Kansas Withholding Form

Kansas Withholding Form - Withholding tax tables single or married; File your state taxes online; Can’t find the form you are looking for? It appears you don't have a pdf plugin for this browser. Get ready for tax season deadlines by completing any required tax forms today. Withholding tax rates single or married: Department of the treasury internal revenue service. Ad edit, sign and print tax forms on any device with pdffiller. Employers engaged in a trade or business who. — employees withholding allowance certificate.

Ad edit, sign and print tax forms on any device with pdffiller. Web to end a current withholding, complete the request to cancel withholdings section in this document and return the form to the unemployment contact center. Web guide to kansas withholding tax: Withholding tax rates single or married: Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. It appears you don't have a pdf plugin for this browser. It must be printed and. Employee's withholding certificate form 941; Get ready for tax season deadlines by completing any required tax forms today. If too little tax is withheld, you will generally owe tax when you.

— employees withholding allowance certificate. However, due to differences between state and. Withholding tax tables single or married; Ad edit, sign and print tax forms on any device with pdffiller. File your state taxes online; Department of the treasury internal revenue service. Can’t find the form you are looking for? It appears you don't have a pdf plugin for this browser. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Withholding tax rates single or married:

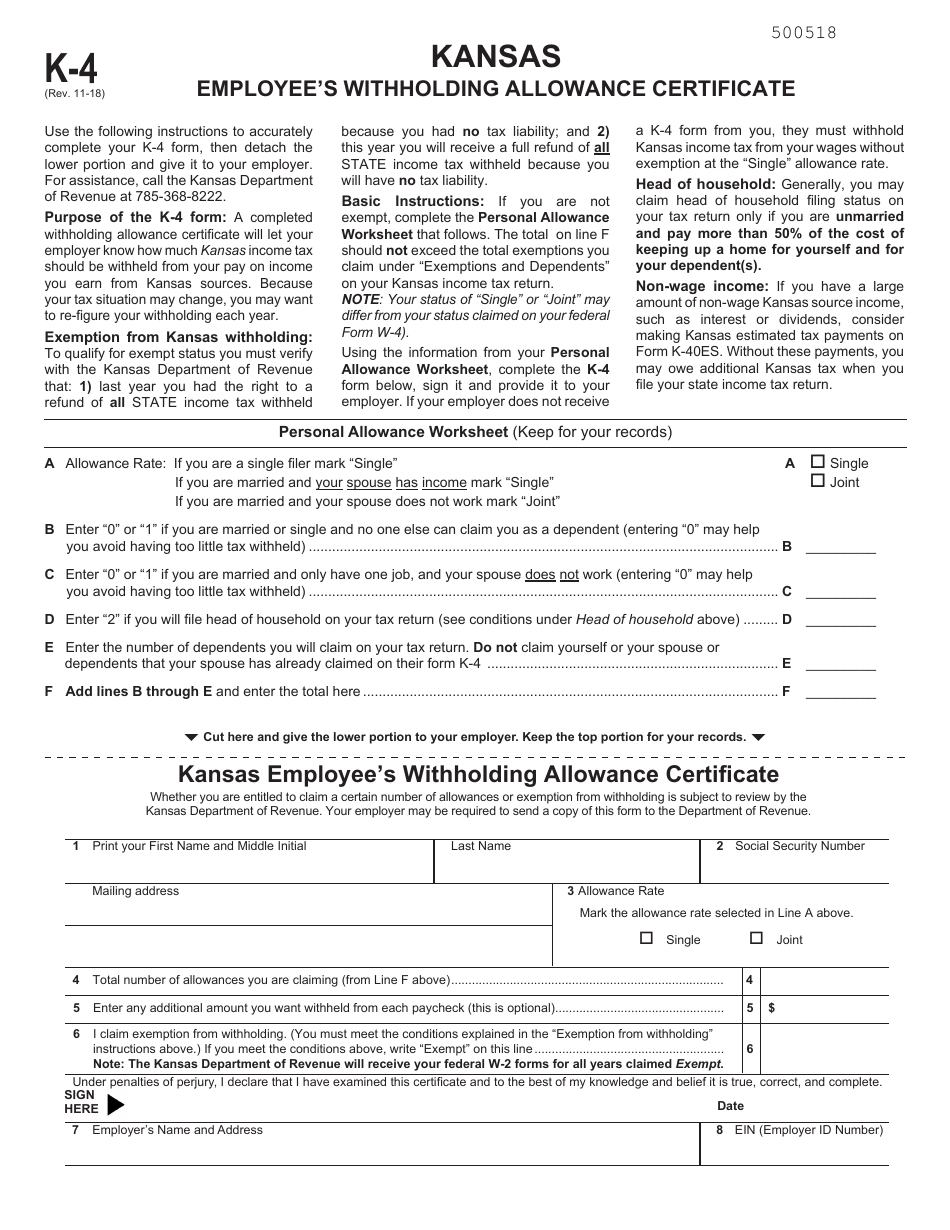

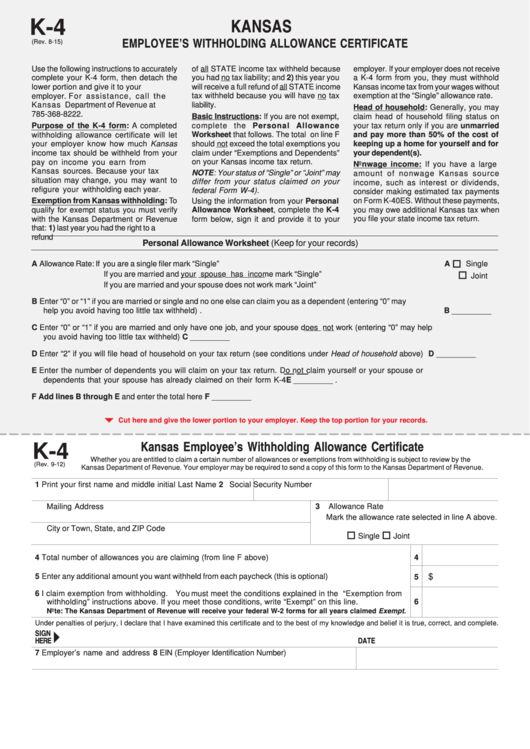

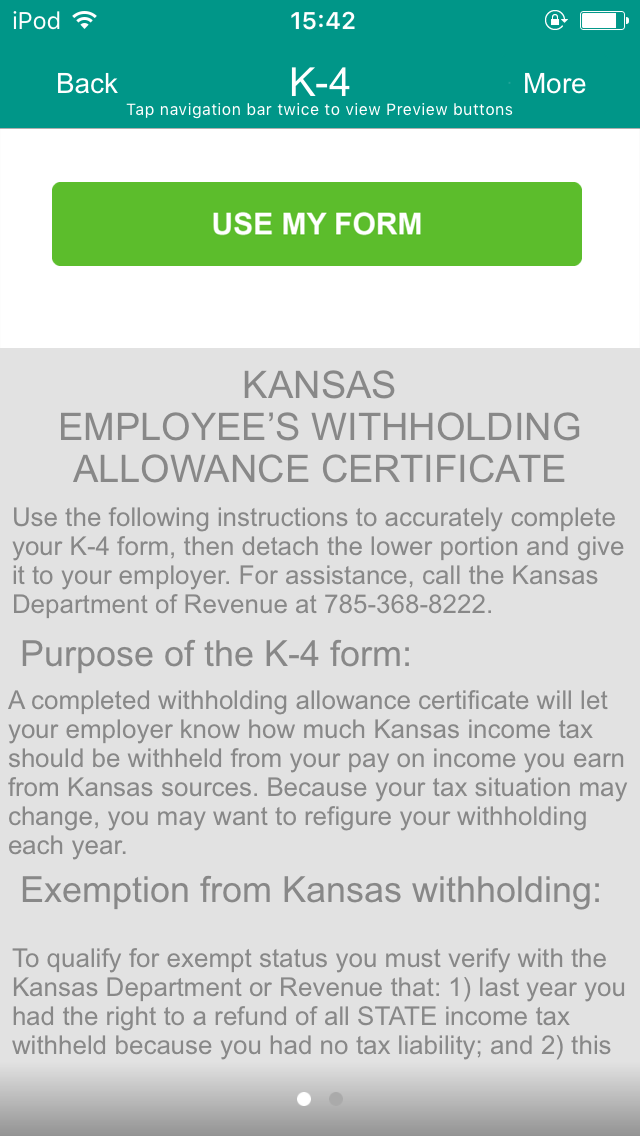

Form K4 Download Fillable PDF or Fill Online Employee's Withholding

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File your state taxes online; — employees withholding allowance certificate. Employee's withholding certificate form 941; It appears you don't have a pdf plugin for this browser.

Withholding Order Form Kansas

However, due to differences between state and. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File your state taxes online; Withholding tax tables single or married; File your state taxes online;

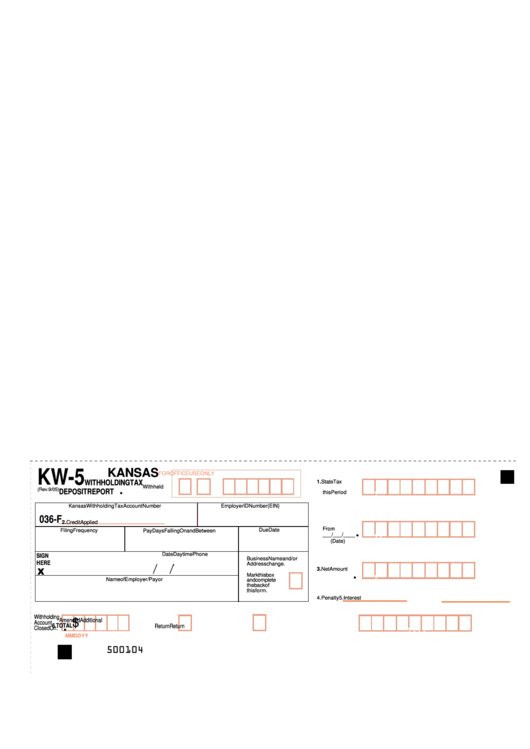

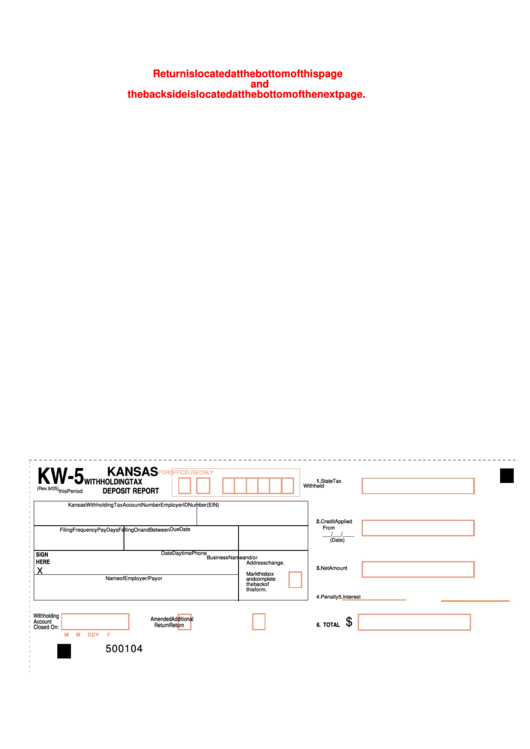

Form Kw5 Kansas Withholding Tax Deposit Report 2005 printable pdf

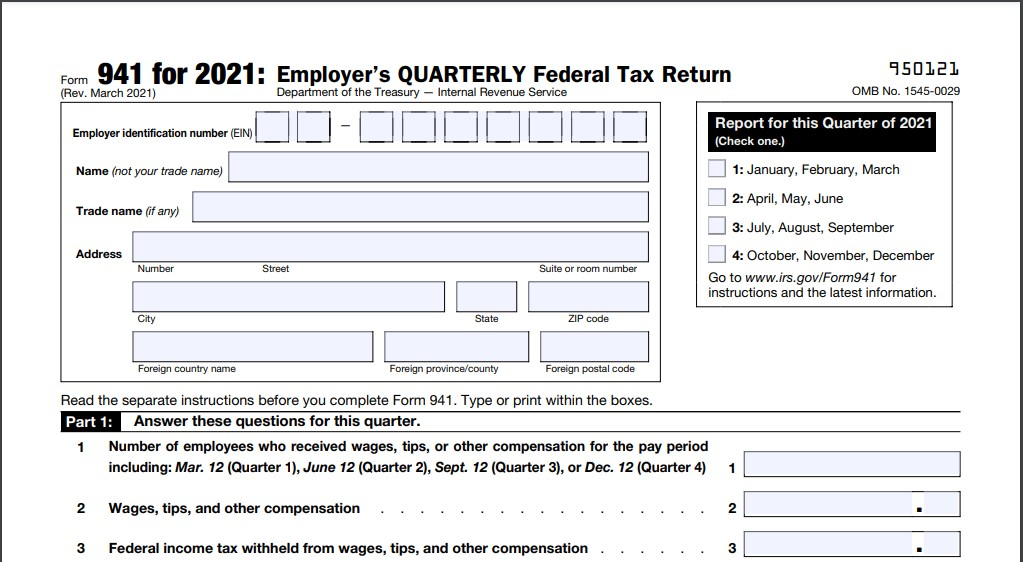

Employee's withholding certificate form 941; — employees withholding allowance certificate. Department of the treasury internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign and print tax forms on any device with pdffiller.

Kw5 Form Fill Online, Printable, Fillable, Blank pdfFiller

It must be printed and. Department of the treasury internal revenue service. Withholding tax rates single or married: Get ready for tax season deadlines by completing any required tax forms today. — employees withholding allowance certificate.

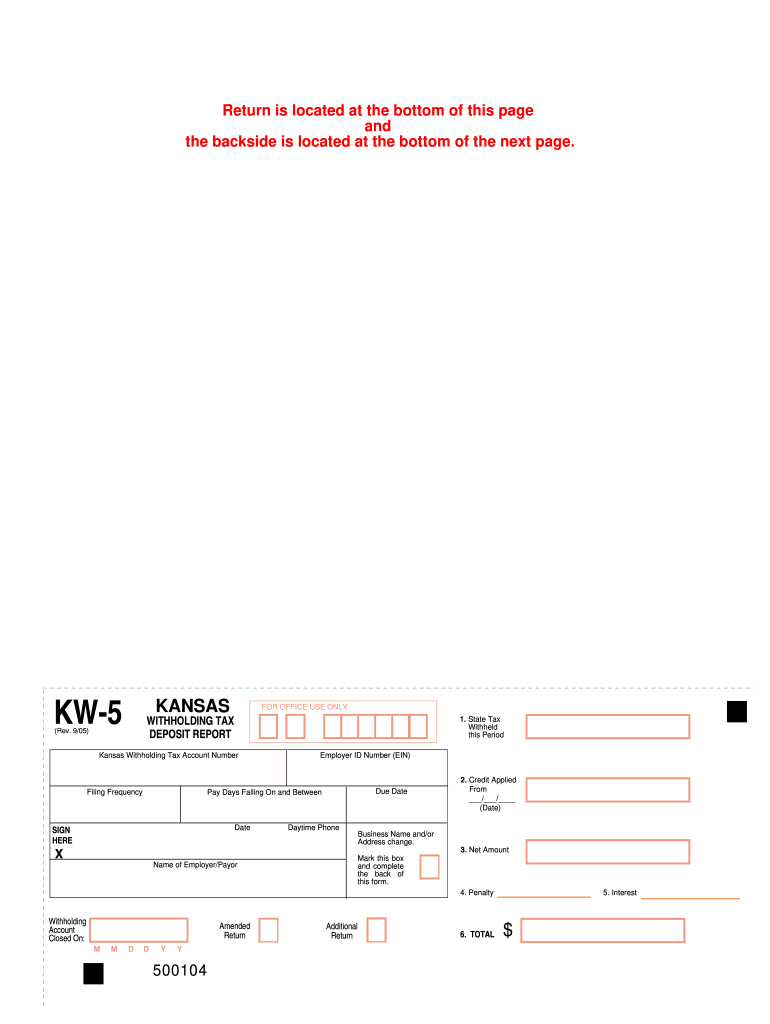

Fillable Form Kw5 Kansas Withholding Tax Deposit Report printable

Withholding tax tables single or married; If too little tax is withheld, you will generally owe tax when you. However, due to differences between state and. Web guide to kansas withholding tax: Employee's withholding certificate form 941;

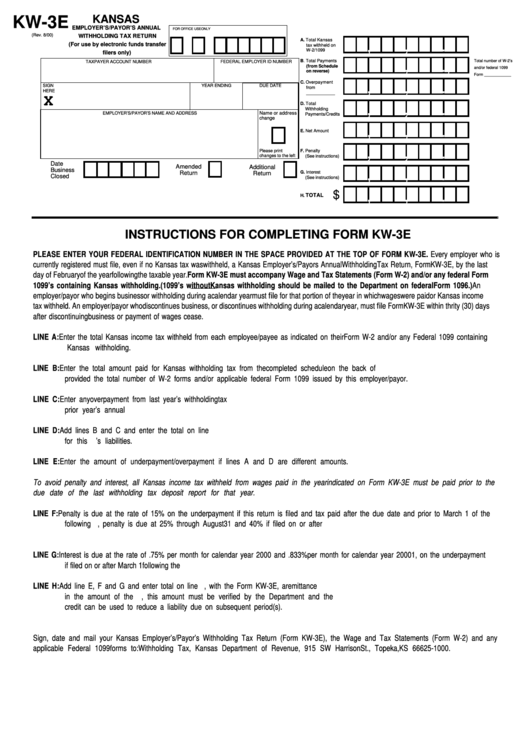

Form Kw3e Kansas Employer'S/payor'S Annual Withholding Tax Return

Withholding tax rates single or married: Withholding tax tables single or married; It appears you don't have a pdf plugin for this browser. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web to end a current withholding, complete the request to cancel withholdings section in this.

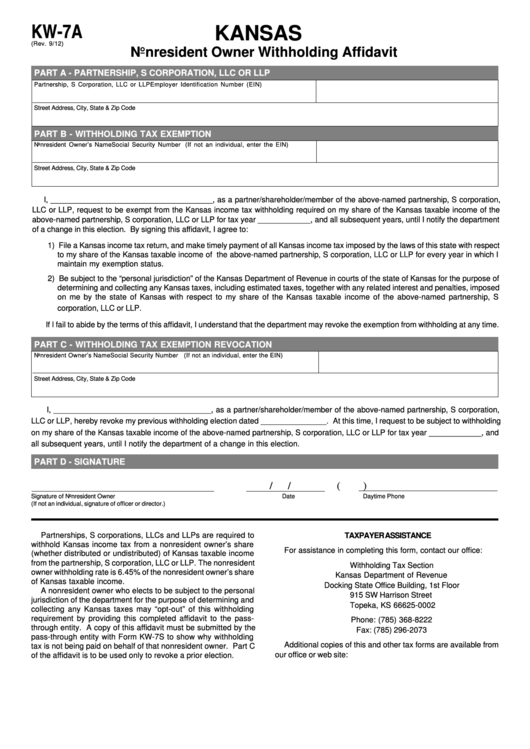

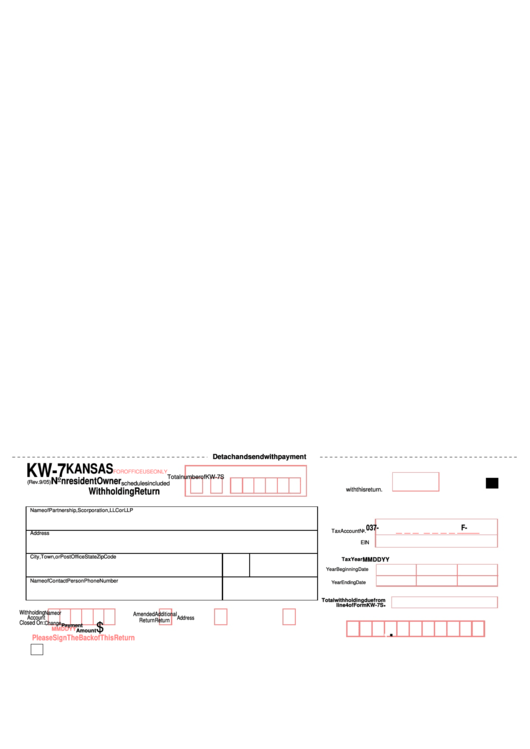

Fillable Form Kw7a Kansas Nonresident Owner Withholding Affidavit

Withholding tax rates single or married: Withholding tax tables single or married; If too little tax is withheld, you will generally owe tax when you. File your state taxes online; Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

File your state taxes online; It must be printed and. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File your state taxes online; Department of the treasury internal revenue service.

Kansas K4 Form For State Withholding

However, due to differences between state and. Ad edit, sign and print tax forms on any device with pdffiller. Web guide to kansas withholding tax: Department of the treasury internal revenue service. Employee's withholding certificate form 941;

Form Kw7 Kansas Nonresidential Owner Withholding Return Form

Web guide to kansas withholding tax: File your state taxes online; Get ready for tax season deadlines by completing any required tax forms today. It appears you don't have a pdf plugin for this browser. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Employee's Withholding Certificate Form 941;

Ad edit, sign and print tax forms on any device with pdffiller. Department of the treasury internal revenue service. However, due to differences between state and. If too little tax is withheld, you will generally owe tax when you.

Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

It appears you don't have a pdf plugin for this browser. Employers engaged in a trade or business who. File your state taxes online; Withholding tax tables single or married;

File Your State Taxes Online;

Can’t find the form you are looking for? Withholding tax rates single or married: Web guide to kansas withholding tax: A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

It must be printed and. Web to end a current withholding, complete the request to cancel withholdings section in this document and return the form to the unemployment contact center. — employees withholding allowance certificate.