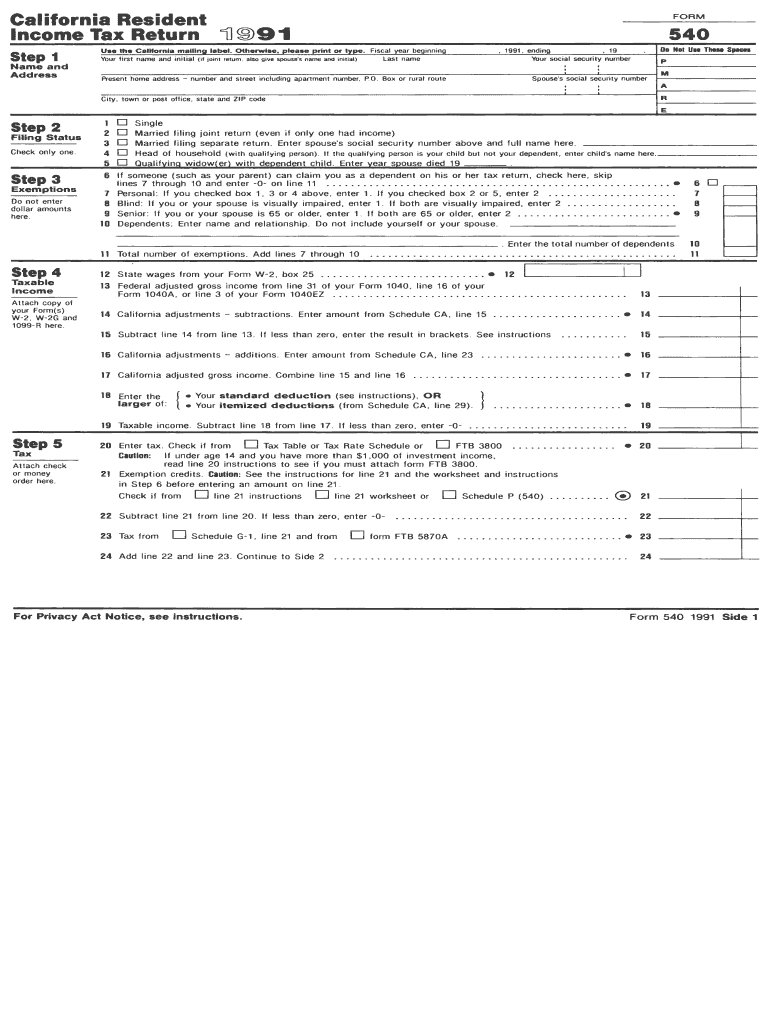

It-540 Form

It-540 Form - Individual tax return form 1040 instructions; Web “form 940,” and “2015” on your check or money order. Web form 1040a may be best for you if: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Resident taxpayers are allowed a credit for income tax paid to. Web popular forms & instructions; This form is for income earned in tax year 2022, with tax returns due in april. Enter the appropriate number in the ling. If you are married and both you and your spouse are residents of the state. There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and.

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and. Individual tax return form 1040 instructions; Web “form 940,” and “2015” on your check or money order. You have capital gain distributions. • go to ftb.ca.gov and login or register for myftb to check tax return records. If you are married and both you and your spouse are residents of the state. File your louisiana and federal tax returns online with turbotax in minutes. Your taxable income is less than $100,000. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web efile your louisiana tax return now efiling is easier, faster, and safer than filling out paper tax forms.

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and. Web efile your louisiana tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web form 1040a may be best for you if: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web popular forms & instructions; Individual tax return form 1040 instructions; Claiming refund or payments made on an original return when amending your tax return: Web find irs tax forms, instructions and publications. Web “form 940,” and “2015” on your check or money order. Resident taxpayers are allowed a credit for income tax paid to.

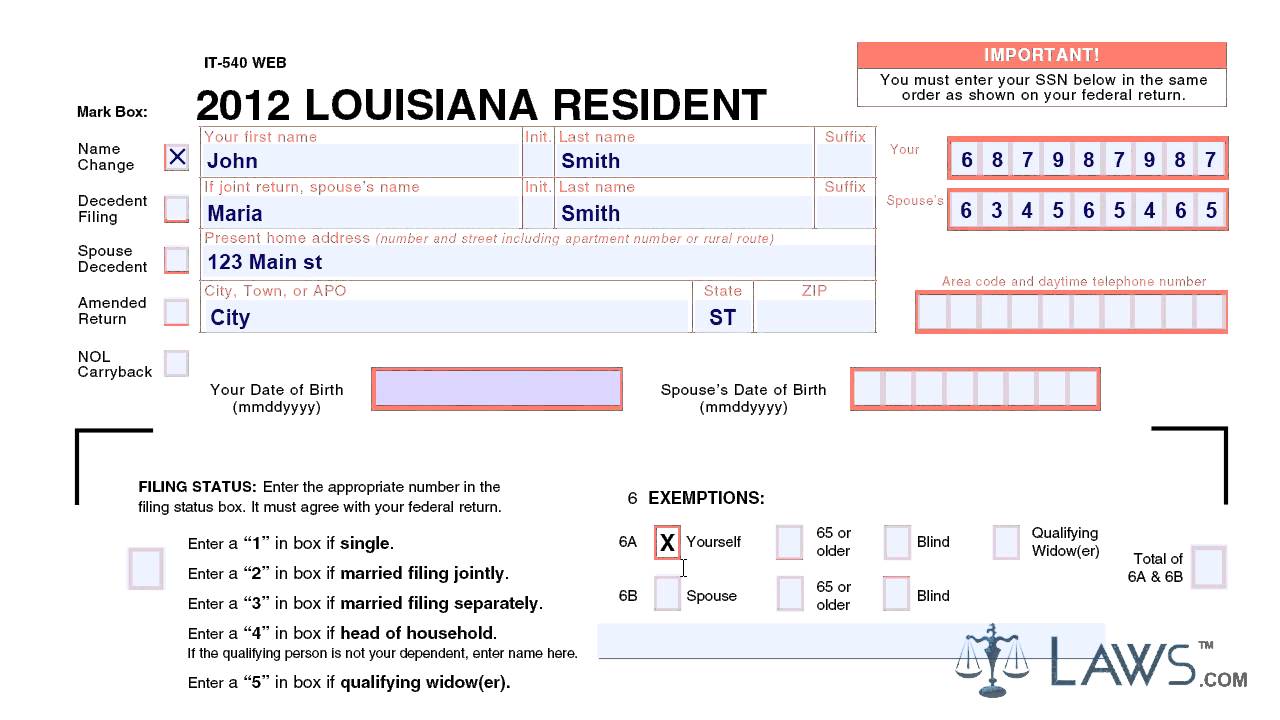

Louisiana state 2012 it 540 form online 2017 Fill out & sign online

Resident taxpayers are allowed a credit for income tax paid to. Web “form 940,” and “2015” on your check or money order. Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. This form is for income earned in tax year 2022, with tax returns due in april. Enter.

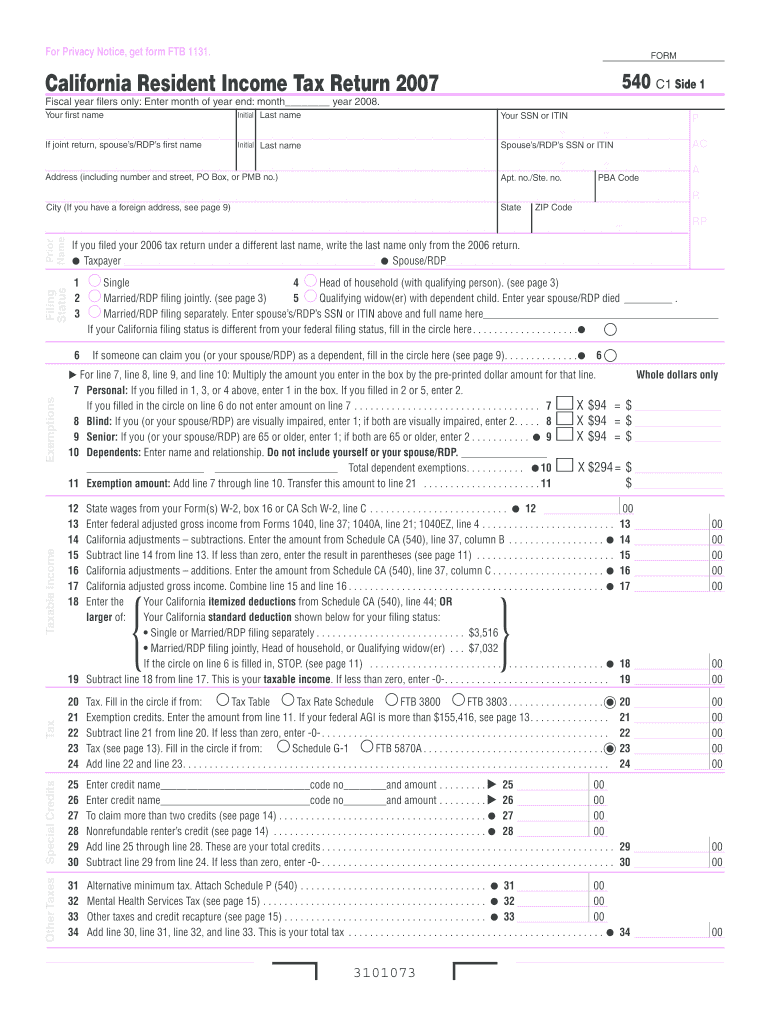

2007 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Web what is form it 540? Enter the appropriate number in the ling. File your louisiana and federal tax returns online with turbotax in minutes. • go to ftb.ca.gov and login or register for myftb to check tax return records. If you are married and both you and your spouse are residents of the state.

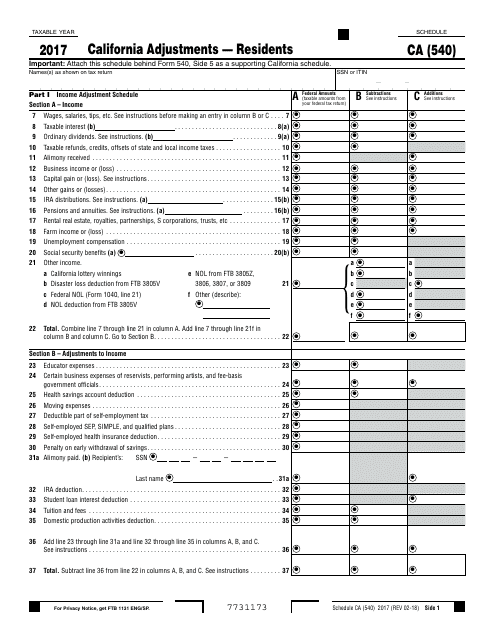

California CA 540 Instructions 2016

If you are married and both you and your. Web popular forms & instructions; This form is for income earned in tax year 2022, with tax returns due in april. Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. Web what is form it 540?

Form 540 Es 20202022 20202022 Fill and Sign Printable Template

Web “form 940,” and “2015” on your check or money order. Web find irs tax forms, instructions and publications. Claiming refund or payments made on an original return when amending your tax return: Web efile your louisiana tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web what is form it 540?

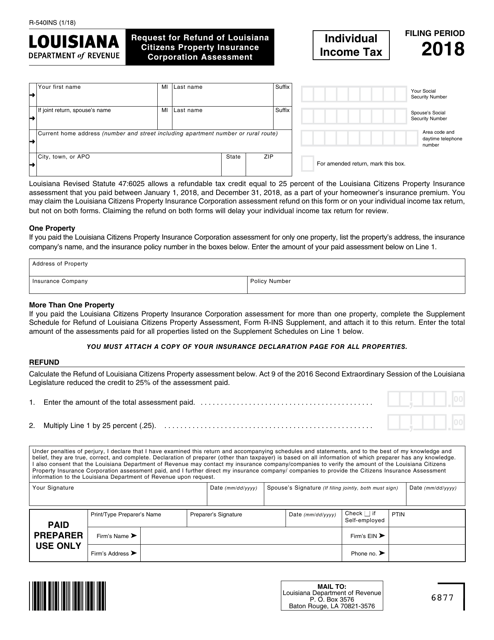

Form R540INS Download Fillable PDF or Fill Online Request for Refund

You have capital gain distributions. File your louisiana and federal tax returns online with turbotax in minutes. Web 2020 instructions for form 540 personal income tax booklet revised: Individual tax return form 1040 instructions; Web form 1040a may be best for you if:

2020 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

If you are married and both you and your. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Click here to see a copy: File your louisiana and federal tax returns online with turbotax in minutes. There are a number of.

Form 540 Download Fillable PDF 2017, Schedule Ca California

This form is for income earned in tax year 2022, with tax returns due in april. Claiming refund or payments made on an original return when amending your tax return: Your taxable income is less than $100,000. Web 2020 instructions for form 540 personal income tax booklet revised: Enter the appropriate number in the ling.

Form IT 540 Individual Return Resident YouTube

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and. If you are married and both you and your. Web find irs tax forms, instructions and publications. File your louisiana and federal tax returns online with turbotax in minutes. Resident taxpayers are allowed a credit for income tax paid to.

540 Form Fill Out and Sign Printable PDF Template signNow

If you are married and both you and your. Web efile your louisiana tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web find irs tax forms, instructions and publications. You claim certain tax credits; Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search.

2014 Form 540 2Ez California Resident Tax Return Edit, Fill

Web efile your louisiana tax return now efiling is easier, faster, and safer than filling out paper tax forms. Web “form 940,” and “2015” on your check or money order. Web find irs tax forms, instructions and publications. If you are married and both you and your. There are a number of excellent sources available for taxpayers to obtain tax.

Web Efile Your Louisiana Tax Return Now Efiling Is Easier, Faster, And Safer Than Filling Out Paper Tax Forms.

Resident taxpayers are allowed a credit for income tax paid to. Web popular forms & instructions; If you are married and both you and your. If you are married and both you and your spouse are residents of the state.

Individual Tax Return Form 1040 Instructions;

Your taxable income is less than $100,000. This form is for income earned in tax year 2022, with tax returns due in april. Enter the appropriate number in the ling. You claim certain tax credits;

Web The 1040 Form Is The Official Tax Return That Taxpayers Have To File With The Irs Each Year To Report Taxable Income And Calculate Their Taxes Due.

Click here to see a copy: Web form 1040a may be best for you if: Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. File your louisiana and federal tax returns online with turbotax in minutes.

Web Find Irs Tax Forms, Instructions And Publications.

Web “form 940,” and “2015” on your check or money order. You have capital gain distributions. Claiming refund or payments made on an original return when amending your tax return: Web what is form it 540?