Irt Manual Income Verification Form

Irt Manual Income Verification Form - Taxpayers to file an annual income tax return. Calfresh households with modified categorical eligibility (mce) status that were certified with. Requests submitted without a cover sheet, or an incomplete cover sheet will not be processed. Internal revenue service (irs) to. You must also include original. Web if you must file, you have two options: Web get your tax record. Web the irs announced changes to the itin process that called for revisions in the application standards for itin. Do not sign this form unless all applicable lines have been. Web federal fiscal year (ffy) 2022 calworks income reporting threshold (irt) effective october 1, 2021 through september 30, 2022 the calworks irt amount for each au.

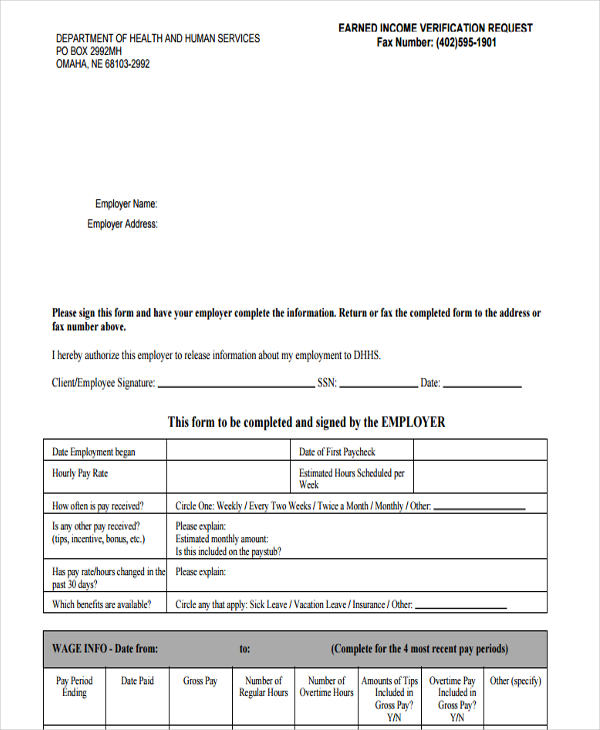

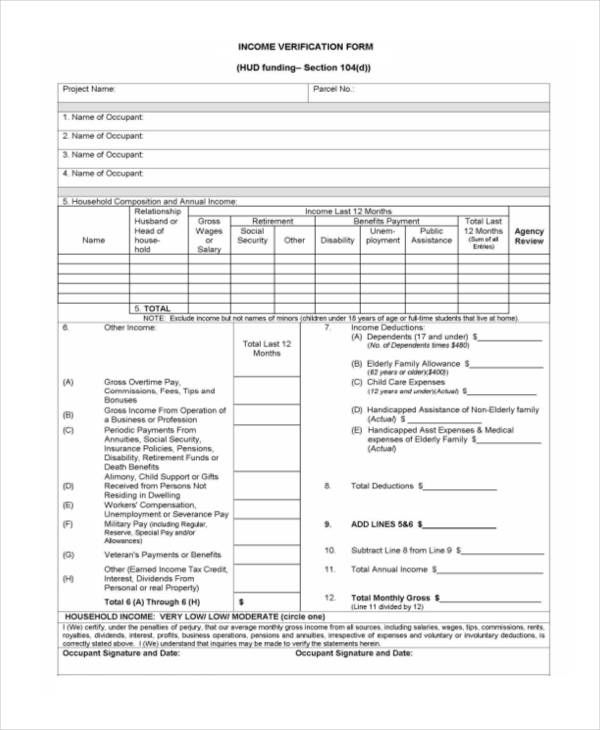

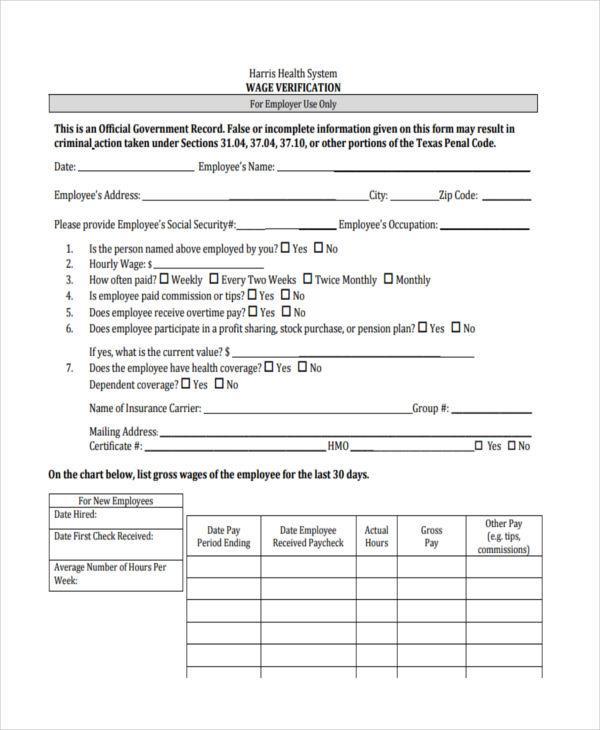

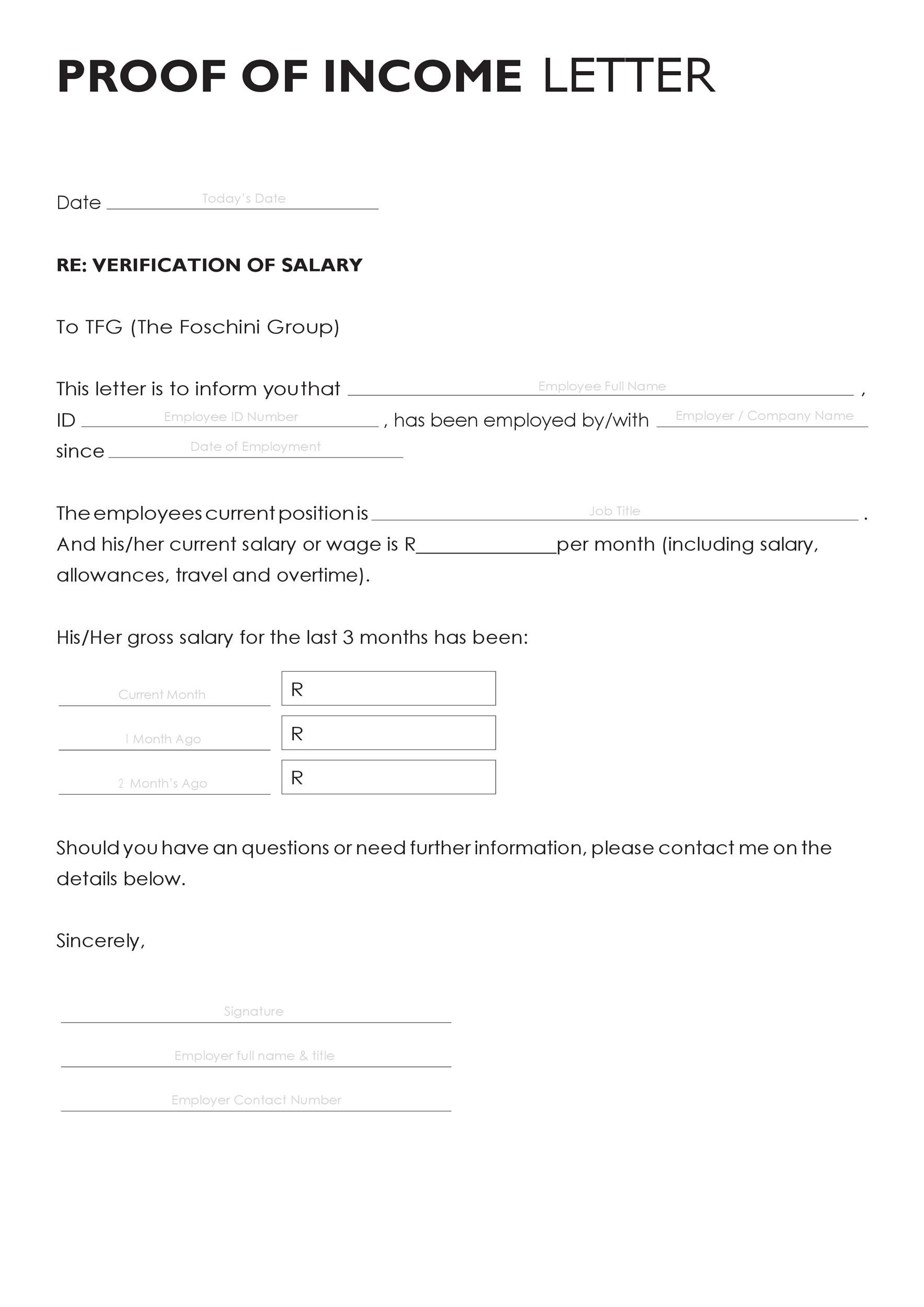

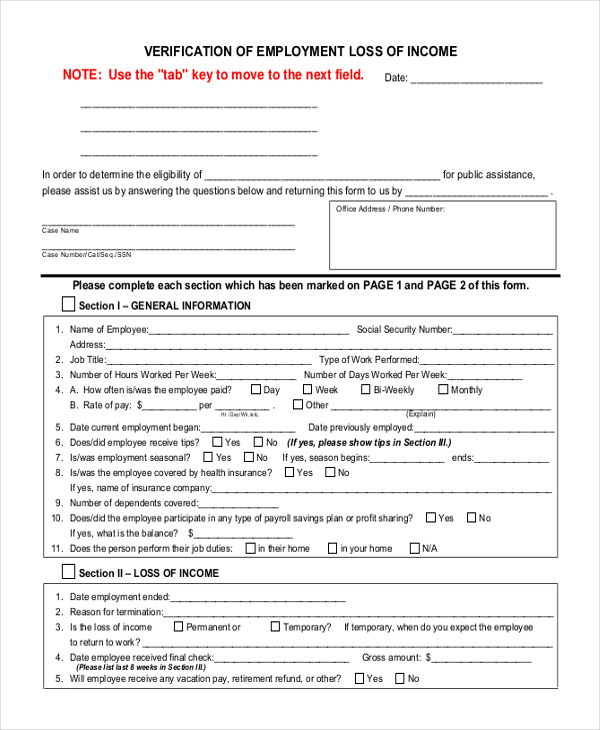

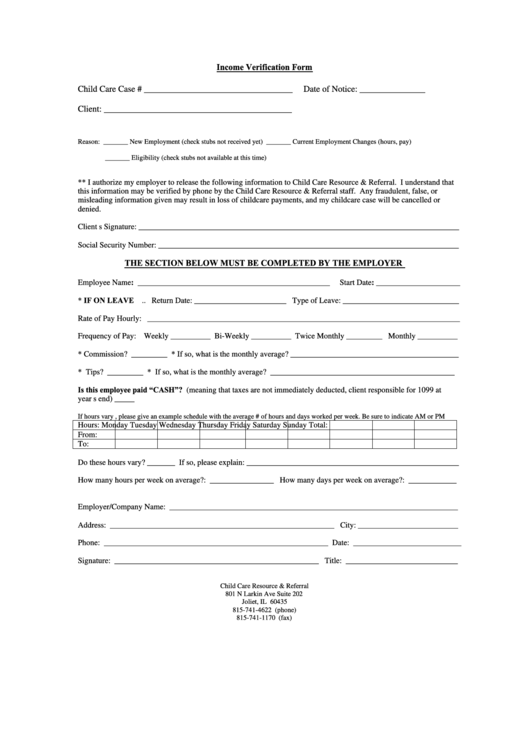

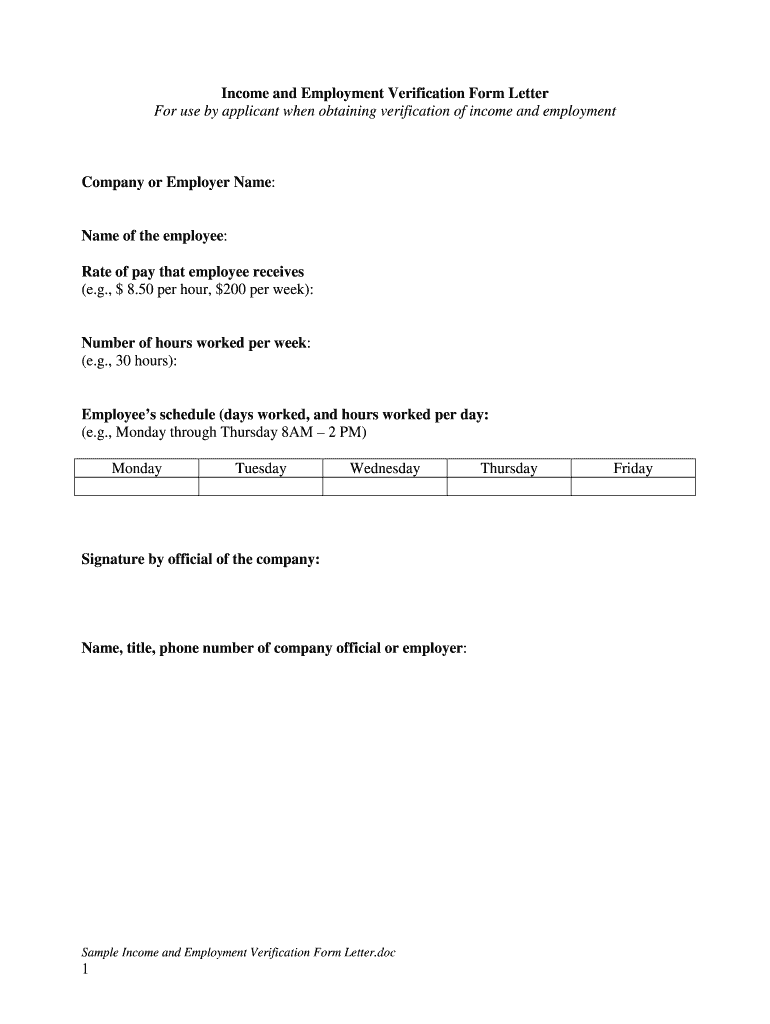

Income verification is achieved by acquiring documents which give proof of income. Request for transcript of tax return. Taxpayers to file an annual income tax return. Web you can also use this form to renew an existing itin that is expiring or that has already expired. This irm section provides guidance for return integrity verification operations (rivo). Web form 1040 is used by u.s. These documents include w2’s, paystubs,. Web irt (income reporting threshold, or 130% of the federal poverty limit (fpl)). Web if you must file, you have two options: When their income exceeds the income reporting thresholds (irt) of 130 percent of the federal poverty level (fpl) for the household size.[refer to “income reporting threshold.

Do not sign this form unless all applicable lines have. Web how is income verification achieved? Calfresh households with modified categorical eligibility (mce) status that were certified with. These documents include w2’s, paystubs,. Web indian income tax return verification form [part il—sec. Order copies of tax records including transcripts of past tax returns, tax account information, wage and income statements, and verification of. Web program scope and objectives. Do not sign this form unless all applicable lines have been. Internal revenue service (irs) to. Web the irs announced changes to the itin process that called for revisions in the application standards for itin.

FREE 12+ Verification Forms in PDF Ms Word

Request for transcript of tax return. Taxpayers to file an annual income tax return. Web birth dates for you, your spouse and dependents on the tax return. Web get your tax record. Income verification is achieved by acquiring documents which give proof of income.

FREE 35+ Verification Forms in PDF Excel MS Word

Web you can also use this form to renew an existing itin that is expiring or that has already expired. Each itin applicant will now: Intake/interview & quality review sheet. Effective march 1, 2023, irs will only accept forms 4506. Web form 1040 is used by u.s.

FREE 9+ Sample Verification Forms in PDF MS Word

When their income exceeds the income reporting thresholds (irt) of 130 percent of the federal poverty level (fpl) for the household size.[refer to “income reporting threshold. Calfresh households with modified categorical eligibility (mce) status that were certified with. Web the irs announced changes to the itin process that called for revisions in the application standards for itin. Order copies of.

FREE 12+ Verification Forms in PDF Ms Word

Web irt (income reporting threshold, or 130% of the federal poverty limit (fpl)). Web birth dates for you, your spouse and dependents on the tax return. Web if you must file, you have two options: Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Do not sign this form unless all applicable lines have.

Do I Have To Submit Verification For My Pua Claim MPLOYME

You must also include original. Intake/interview & quality review sheet. Web if you must file, you have two options: Web program scope and objectives. Web the irs announced changes to the itin process that called for revisions in the application standards for itin.

FREE 9+ Sample Verification Forms in PDF MS Word

Web if you must file, you have two options: You must also include original. Web get your tax record. Web form 1040 is used by u.s. Taxpayers to file an annual income tax return.

FREE 10+ Sample Verification Forms in PDF MS Word

This irm section provides guidance for return integrity verification operations (rivo). Requests submitted without a cover sheet, or an incomplete cover sheet will not be processed. Income verification is achieved by acquiring documents which give proof of income. Request for copy of tax return. Do not sign this form unless all applicable lines have.

Verification Form printable pdf download

Effective march 1, 2023, irs will only accept forms 4506. Web indian income tax return verification form [part il—sec. Requests submitted without a cover sheet, or an incomplete cover sheet will not be processed. Request for transcript of tax return. Web how is income verification achieved?

Manual Tax Return Form for Individual TY2019

Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Taxpayers to file an annual income tax return. Do not sign this form unless all applicable lines have been. You must also include original. Effective march 1, 2023, irs will only accept forms 4506.

Verification Form Fill Online, Printable, Fillable, Blank

Web how is income verification achieved? Income verification is achieved by acquiring documents which give proof of income. Web irt (income reporting threshold, or 130% of the federal poverty limit (fpl)). Do not sign this form unless all applicable lines have been. Each itin applicant will now:

Web Program Scope And Objectives.

Web birth dates for you, your spouse and dependents on the tax return. Web federal fiscal year (ffy) 2022 calworks income reporting threshold (irt) effective october 1, 2021 through september 30, 2022 the calworks irt amount for each au. This irm section provides guidance for return integrity verification operations (rivo). Web how is income verification achieved?

Each Itin Applicant Will Now:

Web indian income tax return verification form [part il—sec. Web get your tax record. Do not sign this form unless all applicable lines have been. Effective march 1, 2023, irs will only accept forms 4506.

Internal Revenue Service (Irs) To.

Request for transcript of tax return. Web form 1040 is used by u.s. When their income exceeds the income reporting thresholds (irt) of 130 percent of the federal poverty level (fpl) for the household size.[refer to “income reporting threshold. Web if you must file, you have two options:

Web The Irs Announced Changes To The Itin Process That Called For Revisions In The Application Standards For Itin.

Request for copy of tax return. Intake/interview & quality review sheet. Income verification is achieved by acquiring documents which give proof of income. Do not sign this form unless all applicable lines have.