Irs Installment Agreement While In Chapter 7

Irs Installment Agreement While In Chapter 7 - Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. Web dealing with tax debt can be stressful, but there are strategies available to reduce it, including installment agreements with the. The irs offers formal payment plans, also known as. Ad stop irs tax collections. Web understand what a chapter 7 bankruptcy is and how you may discharge some taxes. Web voluntary payments by an individual chapter 7 debtor can be accepted if they are truly voluntary, and are not made from property. Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Ensure the taxpayer is in. Ad new tax relief programs available. Chapter 7 can often help.

Get help from the best irs tax experts in the nation. This chapter provides procedures for processing. The irs sends a cp89 notice each year. Find out the requirements and details to. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored. Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. Say goodbye to tax debt troubles. Web 7 attorney answers. Get the help you need today!

See if you qualify for a fresh start. Web have an upcoming additional new year of taxes to pay? Web for details on what qualifies as a student loan, see chapter 10 in publication 970, tax benefits for. Ad new tax relief programs available. Web voluntary payments by an individual chapter 7 debtor can be accepted if they are truly voluntary, and are not made from property. The irs sends a cp89 notice each year. Ad stop irs tax collections. Web october 07, 2019 purpose (1) this transmits a revision for irm 5.14.9, routine and manually monitored. This chapter provides procedures for processing. Web while the request for installment agreement is pending with the service, for 30 days immediately.

Can You Have Two Installment Agreements With The IRS Polston Tax

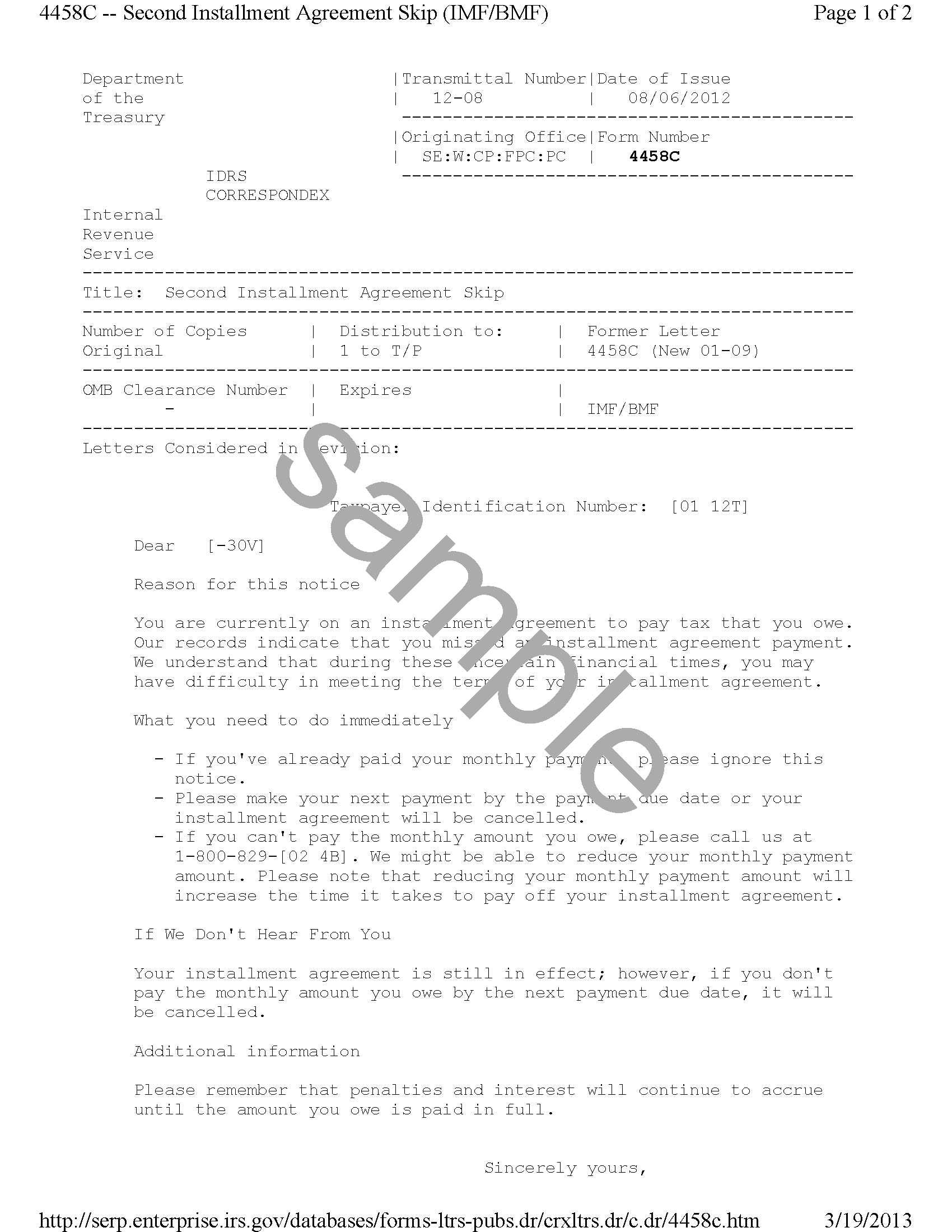

Ensure the taxpayer is in. The irs sends a cp89 notice each year. The irs offers formal payment plans, also known as. This chapter provides procedures for processing. Because of the automatic stay, the irs cannot require you to keep making the payments while.

IRS Installment Agreement Escape Artist

Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. Bankruptcy is a last resort for taxpayers to get out of debts. Web for details on what qualifies as a student loan, see chapter 10 in publication 970, tax benefits for. Ad stop irs tax collections. Web understand what a chapter 7.

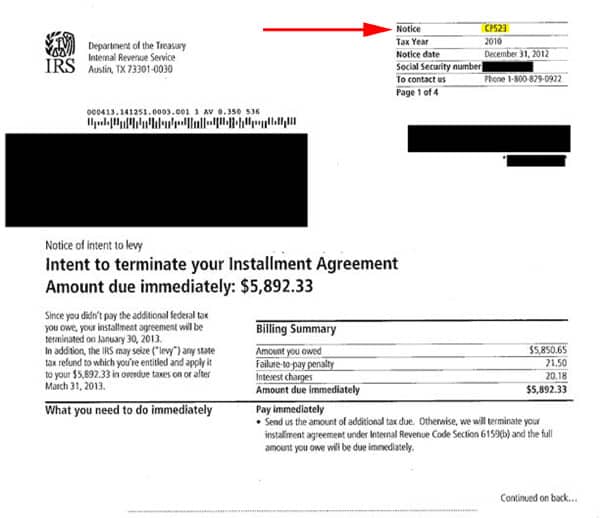

Defaulted IRS Payment Plan Learn What to Do Tax Problem Law Center

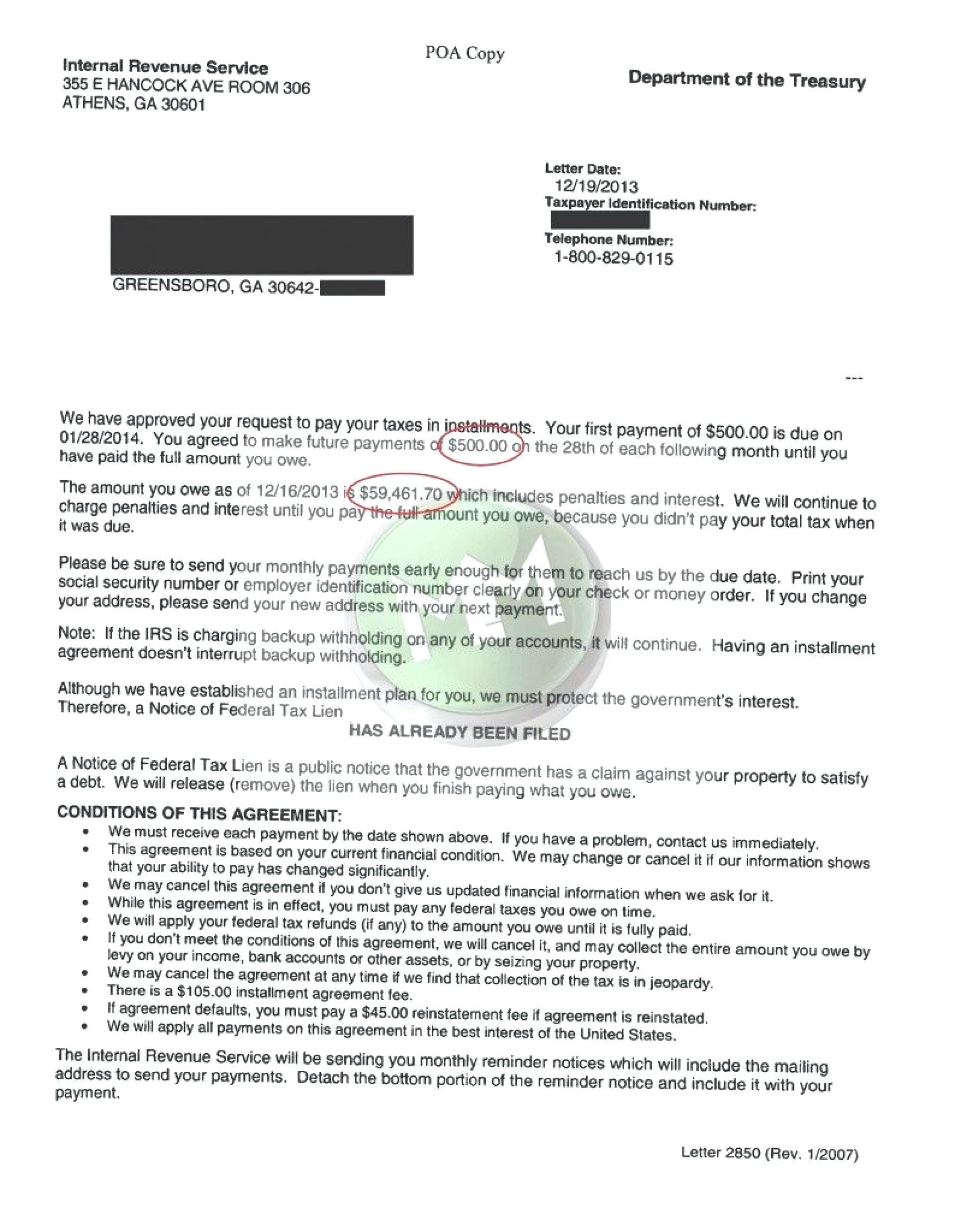

Wait for your annual statement. Find out the requirements and details to. See if you qualify for a fresh start. A partial payment installment agreement (ppia) requires you to make. The irs sends a cp89 notice each year.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Web the internal revenue service (irs) allows taxpayers to pay off tax debt through an installment agreement. Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. The irs offers formal payment plans, also known as. Web while the request for installment agreement is pending with the service, for 30 days immediately..

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Web the necessity of filing or refiling a notice of federal tax lien (nftl) (see irm 5.14.11.6, installment. This chapter provides procedures for processing. See if you qualify for a fresh start. Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Ad new tax relief programs available.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Ad new tax relief programs available. Get the help you need today! Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Web preparing partial payment installment agreements for approval and processing. The irs offers formal payment plans, also known as.

How To Add To Existing Irs Installment Agreement Armando Friend's

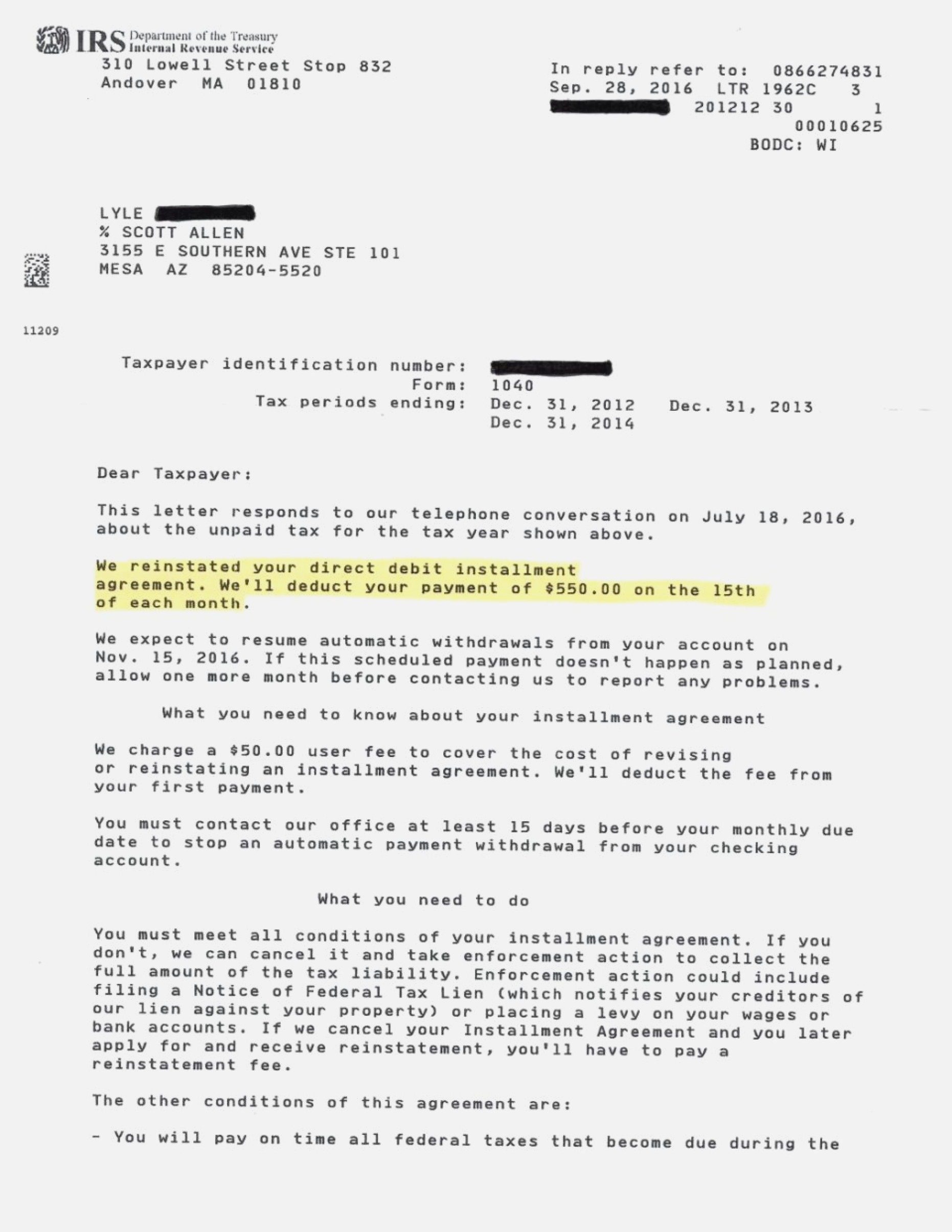

Wait for your annual statement. Because of the automatic stay, the irs cannot require you to keep making the payments while. The irs sends a cp89 notice each year. Ad new tax relief programs available. Ensure the taxpayer is in.

32+ Exclusive Image of Irs Installment Agreement Online letterify.info

Get help from the best irs tax experts in the nation. The irs sends a cp89 notice each year. The irs offers formal payment plans, also known as. Web voluntary payments by an individual chapter 7 debtor can be accepted if they are truly voluntary, and are not made from property. This chapter provides procedures for processing.

The Tax Times IRS' Collection Upheld Even Though Taxpayer Issued Check

Web partnerships and corporations file bankruptcy under chapter 7 or chapter 11 of the bankruptcy code. Web for details on what qualifies as a student loan, see chapter 10 in publication 970, tax benefits for. Web understand what a chapter 7 bankruptcy is and how you may discharge some taxes. Don't let the irs intimidate you. A partial payment installment.

The Three Types of IRS Installment Agreement Law Offices of Darrin T

Web voluntary payments by an individual chapter 7 debtor can be accepted if they are truly voluntary, and are not made from property. Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Web as such, an installment agreement combined with a chapter 7 bankruptcy will simultaneously allow the taxpayer to. See.

Web October 07, 2019 Purpose (1) This Transmits A Revision For Irm 5.14.9, Routine And Manually Monitored.

Say goodbye to tax debt troubles. The irs sends a cp89 notice each year. Wait for your annual statement. Ad new tax relief programs available.

Get Help From The Best Irs Tax Experts In The Nation.

The irs offers formal payment plans, also known as. A partial payment installment agreement (ppia) requires you to make. Web while the request for installment agreement is pending with the service, for 30 days immediately. Get the help you need today!

Ad Stop Irs Tax Collections.

Web installment agreements are payment plans with the irs that let you pay off your tax debt over a set timeframe. Web the internal revenue service (irs) allows taxpayers to pay off tax debt through an installment agreement. This chapter provides procedures for processing. Ensure the taxpayer is in.

Ad New Tax Relief Programs Available.

Web 1.) the irs will not consider an installment agreement until you’ve filed all your tax returns. Web a chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Bankruptcy is a last resort for taxpayers to get out of debts. Get the help you need today!