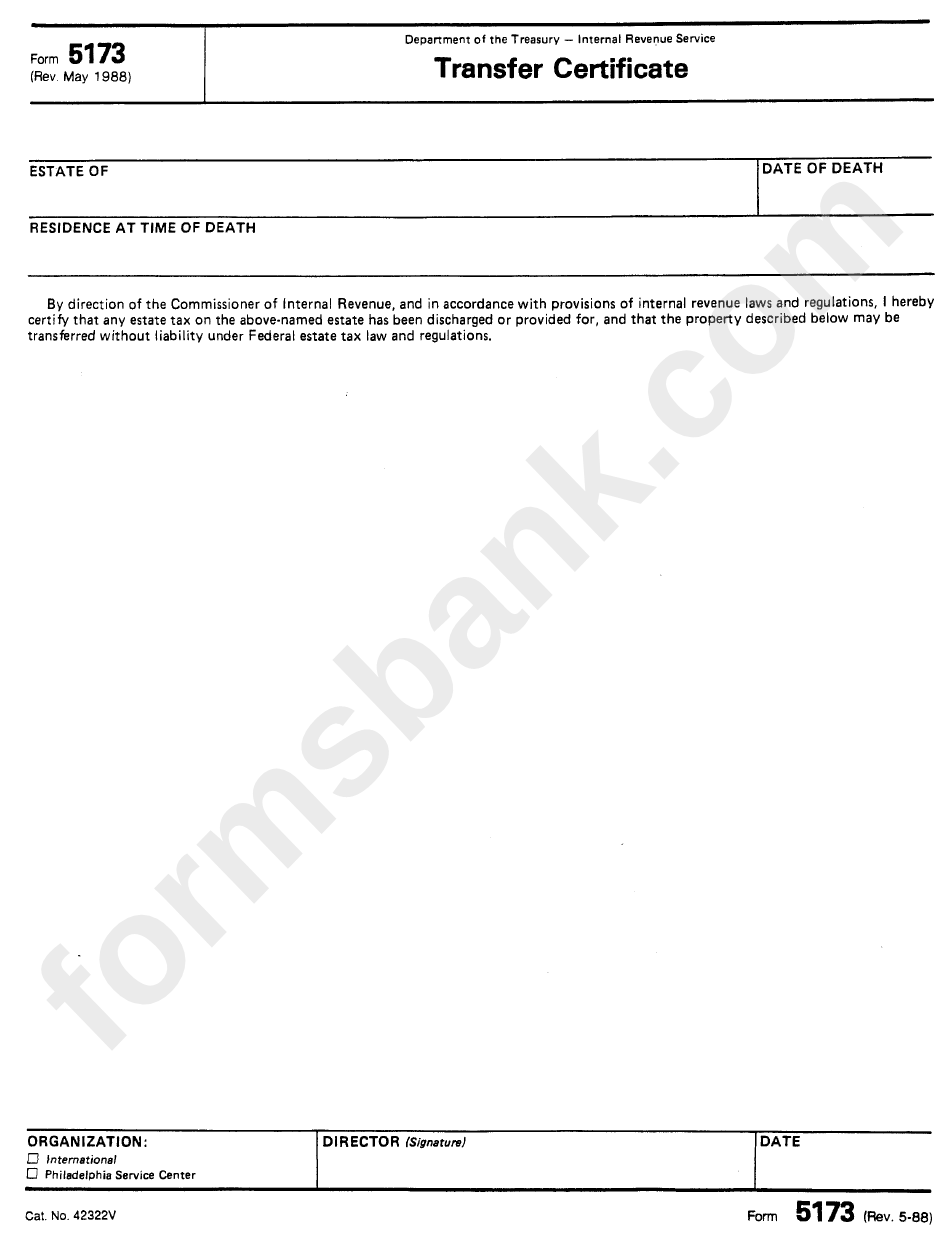

Irs Form 5173

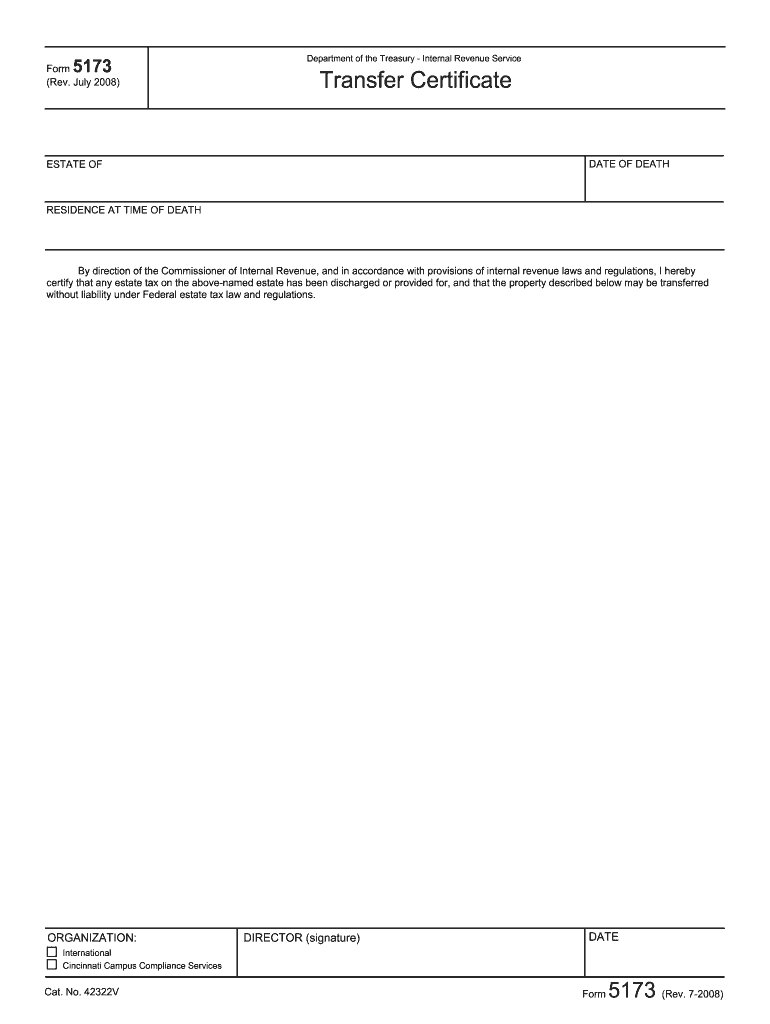

Irs Form 5173 - Web the form will calculate the decedent’s taxable estate, allowable deductions, and any resulting u.s. Web up to $40 cash back related to irs form 5173 transfer certificate 1099 int 2020 9292voidcorrect edpayers name, street address, city or town, state or province,. Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. Sign it in a few clicks draw your signature, type it,. Web citizens of the united states use a different tax form (form 706) for estate tax purposes. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. What accounts require an irs federal tax clearance certificate how do i get a tax clearance certificate from the irs? The executor of the person's estate must provide form 5173 to a u.s. Web what is a form 5173? Executors, surviving joint tenants, trust beneficiaries or other persons legally.

Sign it in a few clicks draw your signature, type it,. Web form 5173 is required when a deceased nonresident has u.s. Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. Web transfer certificate (irs form 5173) is received from the internal revenue service. Web in order for you to obtain form 5173 you will need to file the estata tax return. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Date of death i already filed a form 1041, income tax return for estates and trusts,. Material changes (1) the definition to estate. Web form 5173 is required when a deceased nonresident has u.s. The irs will audit the estate tax return and then you will get form 5173.

Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. Web december 10, 2021 purpose (1) this transmits revised irm 4.25.14, estate and gift tax, miscellaneous procedures. Web the form will calculate the decedent’s taxable estate, allowable deductions, and any resulting u.s. The executor of the person's estate must provide form 5173 to a u.s. Sign it in a few clicks draw your signature, type it,. The executor of the person's estate must provide form 5173 to a u.s. Web read your notice carefully. The irs will audit the estate tax return and then you will get form 5173. Web what is a form 5173? What accounts require an irs federal tax clearance certificate how do i get a tax clearance certificate from the irs?

EDGAR Filing Documents for 000119312516456864

Edit your irs form 5173 online type text, add images, blackout confidential details, add comments, highlights and more. Date of death i already filed a form 1041, income tax return for estates and trusts,. Web citizens of the united states use a different tax form (form 706) for estate tax purposes. Web tax return year(s) tax return date(s) if the.

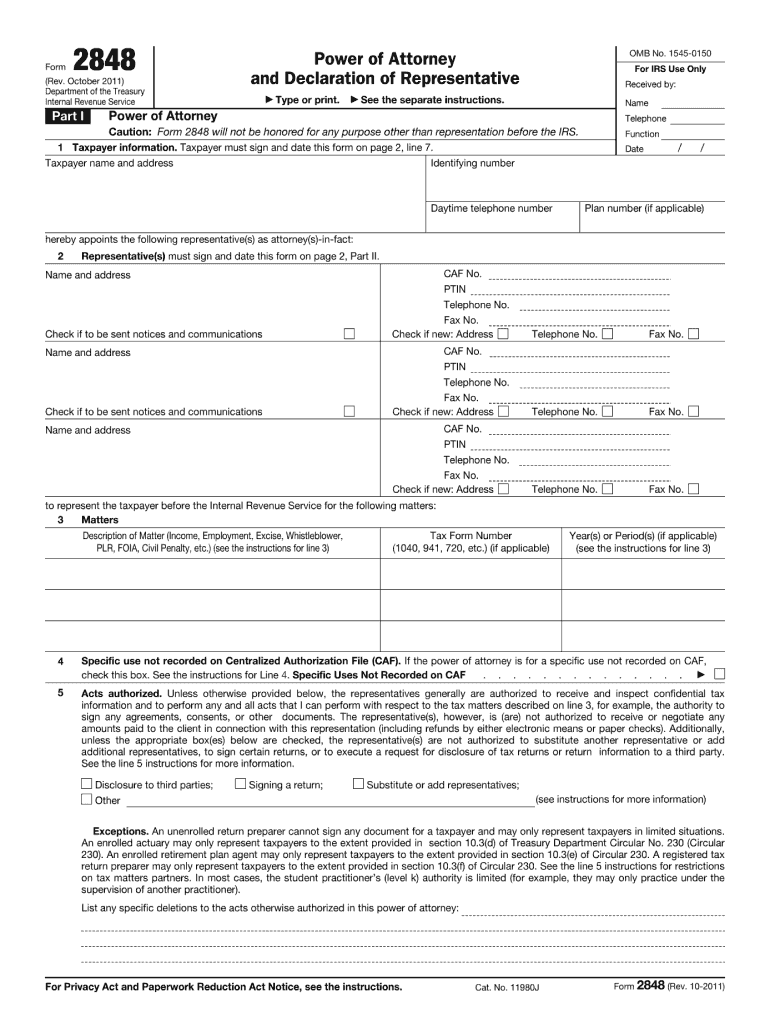

2011 Form IRS 2848 Fill Online, Printable, Fillable, Blank pdfFiller

Form 5713 is used by u.s. The executor of the person's estate must provide form 5173 to a u.s. Date of death i already filed a form 1041, income tax return for estates and trusts,. What accounts require an irs federal tax clearance certificate how do i get a tax clearance certificate from the irs? Web december 10, 2021 purpose.

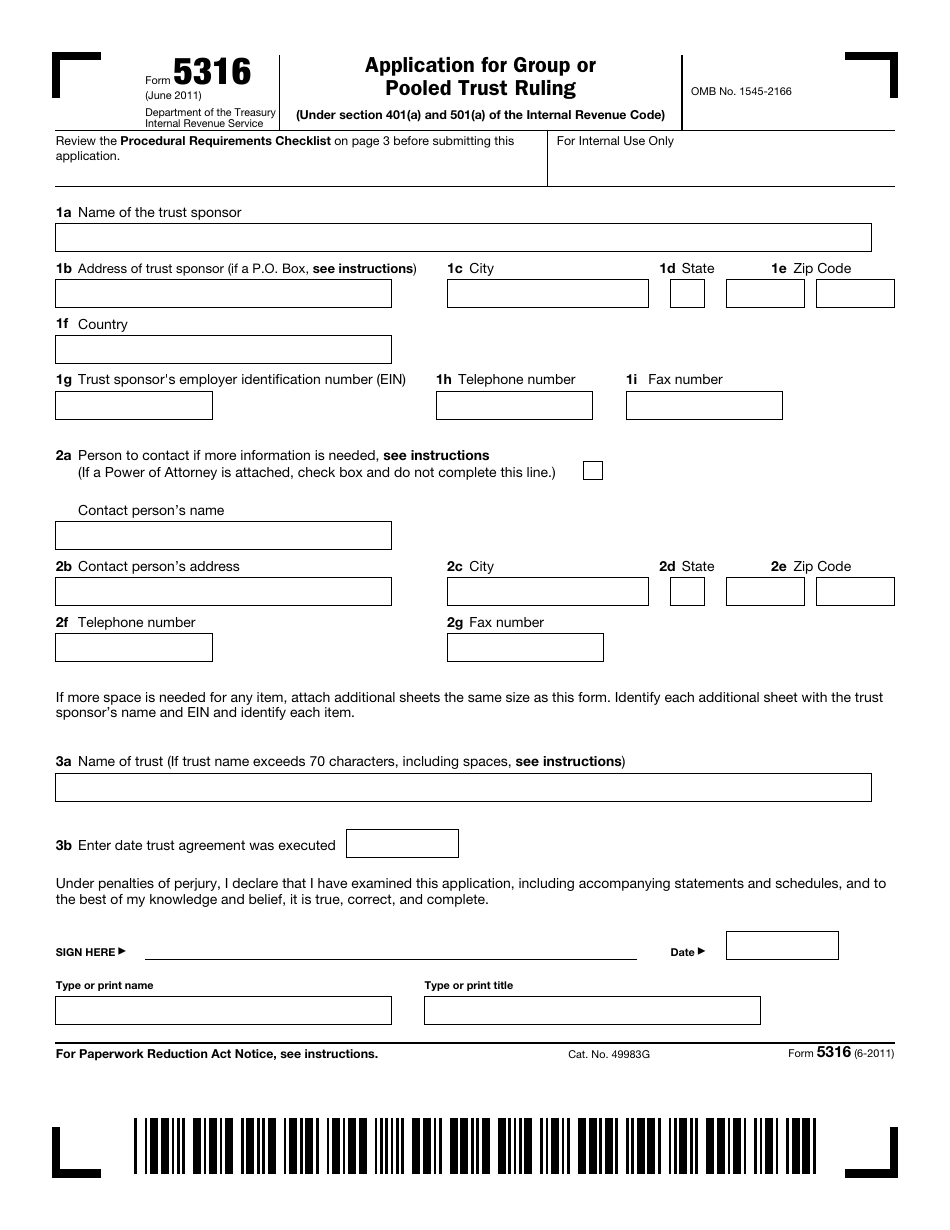

IRS Form 5316 Download Fillable PDF or Fill Online Application for

Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Web up to $40 cash back related to irs form 5173 transfer certificate 1099 int 2020 9292voidcorrect edpayers name, street address, city or town, state or province,. Web the form will calculate the decedent’s taxable estate, allowable deductions, and any resulting.

Form 5173 Fill Out and Sign Printable PDF Template signNow

Web read your notice carefully. Web in order for you to obtain form 5173 you will need to file the estata tax return. Web transfer certificate (irs form 5173) is received from the internal revenue service. Sign it in a few clicks draw your signature, type it,. Web what is a form 5173?

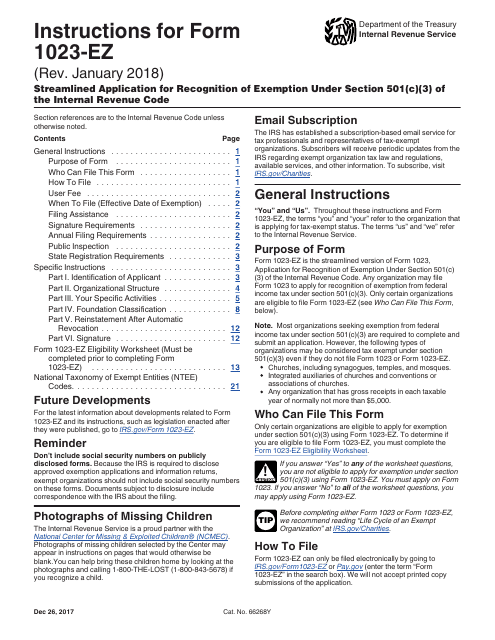

Download Instructions for IRS Form 1023EZ Streamlined Application for

Web the form will calculate the decedent’s taxable estate, allowable deductions, and any resulting u.s. The following transfer certificate filing requirements apply to the. Web what is a form 5173? The executor of the person's estate must provide form 5173 to a u.s. Edit your irs form 5173 online type text, add images, blackout confidential details, add comments, highlights and.

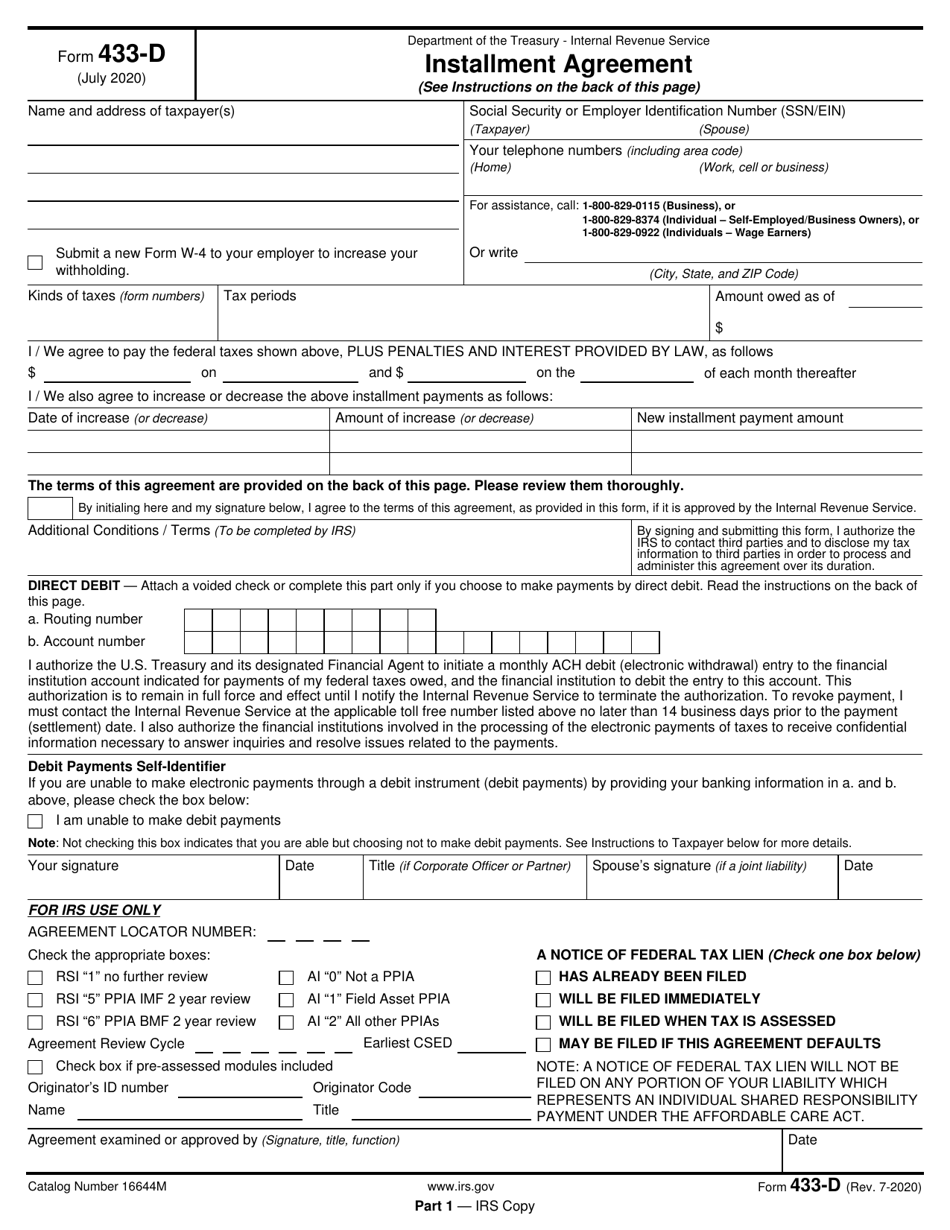

IRS Form 433D Download Fillable PDF or Fill Online Installment

The executor of the person's estate must provide form 5173 to a u.s. Web form 5173 is required when a deceased nonresident has u.s. Web transfer certificate (irs form 5173) is received from the internal revenue service. The executor of the person's estate must provide form 5173 to a u.s. Web up to $40 cash back related to irs form.

IRS Tax Forms 836 Free Templates in PDF, Word, Excel Download

Web form 5173 is required when a deceased nonresident has u.s. Web form 5173 is required when a deceased nonresident has u.s. The irs will audit the estate tax return and then you will get form 5173. Web citizens of the united states use a different tax form (form 706) for estate tax purposes. Form 5713 is used by u.s.

IRS 8275 20132021 Fill and Sign Printable Template Online US Legal

Material changes (1) the definition to estate. The irs will audit the estate tax return and then you will get form 5173. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. What accounts require an irs federal tax clearance certificate how do i get a tax clearance certificate from the irs? Web read.

Form 5173 Transfer Certificate Form Inernal Revenue Service

The executor of the person's estate must provide form 5173 to a u.s. Web the form will calculate the decedent’s taxable estate, allowable deductions, and any resulting u.s. What accounts require an irs federal tax clearance certificate how do i get a tax clearance certificate from the irs? Date of death i already filed a form 1041, income tax return.

IRS Form 8038GC Download Fillable PDF or Fill Online Information

Sign it in a few clicks draw your signature, type it,. Web transfer certificate (irs form 5173) is received from the internal revenue service. Web what is a form 5173? Web december 10, 2021 purpose (1) this transmits revised irm 4.25.14, estate and gift tax, miscellaneous procedures. Web in order for you to obtain form 5173 you will need to.

Web Tax Return Year(S) Tax Return Date(S) If The Person Addressed On This Notice Is Deceased.

It will explain how much you owe and how to pay it. Web read your notice carefully. Web citizens of the united states use a different tax form (form 706) for estate tax purposes. Pay the amount you owe by the due date on the notice.

Custodian In Order For Them To.

Web federal transfer certificates, also sometimes referred to as form 5173, prove that inheritance tax clearance has already been obtained in the uk and therefore the assets. Web the form will calculate the decedent’s taxable estate, allowable deductions, and any resulting u.s. Citizens or residents who have brokerage accounts in the united states should be aware that certain investments may. The executor of the person's estate must provide form 5173 to a u.s.

Date Of Death I Already Filed A Form 1041, Income Tax Return For Estates And Trusts,.

The following transfer certificate filing requirements apply to the. Web up to $40 cash back related to irs form 5173 transfer certificate 1099 int 2020 9292voidcorrect edpayers name, street address, city or town, state or province,. Material changes (1) the definition to estate. Web transfer certificate (irs form 5173) is received from the internal revenue service.

Sign It In A Few Clicks Draw Your Signature, Type It,.

Executors, surviving joint tenants, trust beneficiaries or other persons legally. The irs will audit the estate tax return and then you will get form 5173. Web form 5173 is required when a deceased nonresident has u.s. Web december 10, 2021 purpose (1) this transmits revised irm 4.25.14, estate and gift tax, miscellaneous procedures.