Irs Form 147C Letter

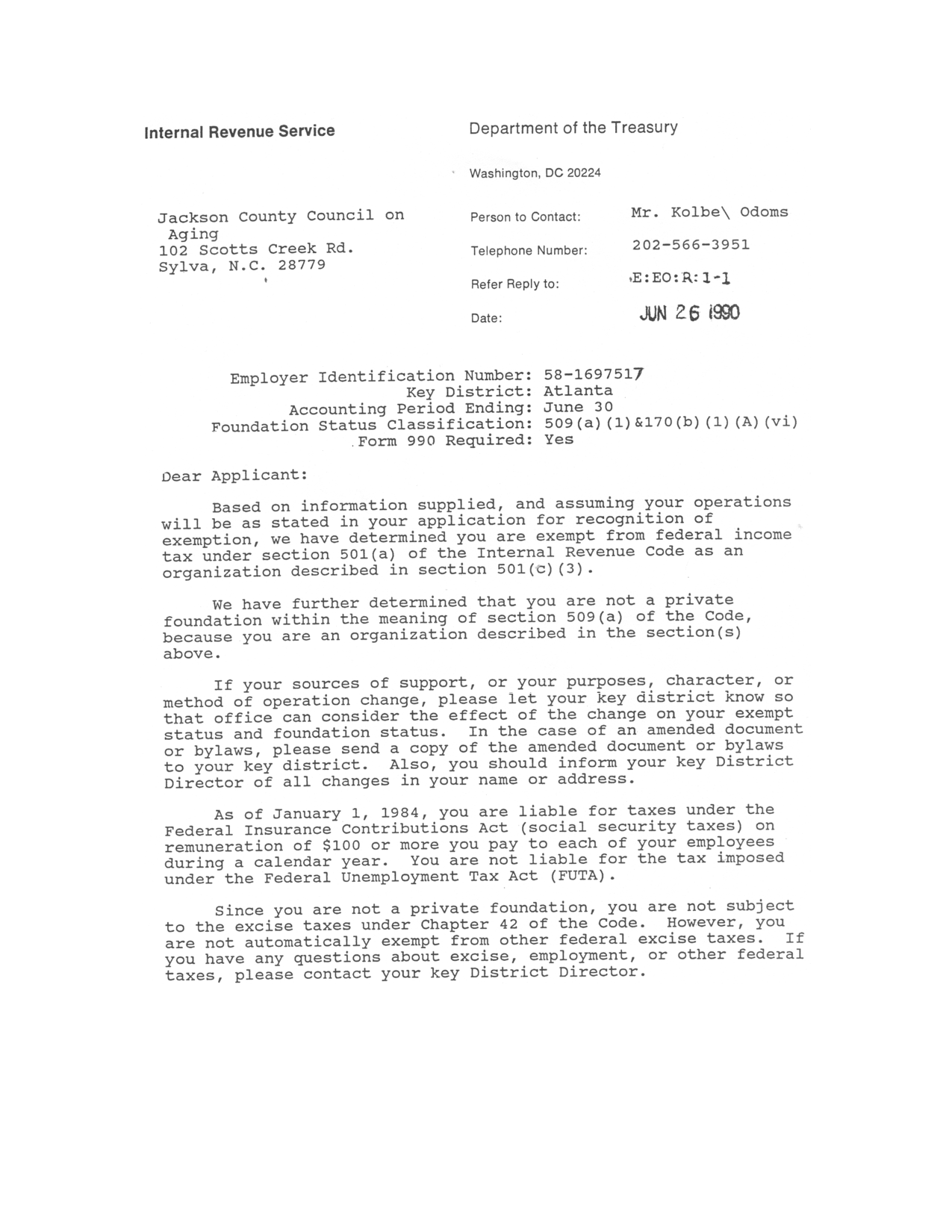

Irs Form 147C Letter - A 147c letter refers to an ein verification letter which is a document issued by the irs in replacement of an ein confirmation letter (cp 575). Your previously filed return should be notated with your ein. Web a letter 147c is a document sent by a company to the irs to request their ein. We need to verify your identity. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission. Press option 3 for “if you already have an ein, but you can’t remember it, etc.”. Web you have a balance due. Web only an owner or a power of attorney (poa) can request a 147c letter. You are due a larger or smaller refund. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an additional part of that amount to your estimated tax.

Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. This document is often required for businesses to verify their ein for employment tax purposes. If you would like a poa to request your ein verification letter (147c), both you and your poa will need to complete the irs form 2848 and have it ready to send to the irs via fax during the phone call with the irs. Press option 1 for english. We have a question about your tax return. What you need to do read your notice carefully. Web what is a 147c letter? The letter is not sent to request a new ein, but for an already existing number. Press option 1 for employer identification numbers. Web you have a balance due.

Press option 1 for employer identification numbers. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. Web here’s how to call the irs and get a 147c letter. Your previously filed return should be notated with your ein. We need to notify you of delays in processing your return. What you need to do read your notice carefully. Web what is a 147c letter? It may be asked for by a third party as a form of verification, or it may be requested if. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission. Press option 3 for “if you already have an ein, but you can’t remember it, etc.”.

Irs Letter 147c Sample Letter Resume Template Collections NLzn2jOz2Q

We need to verify your identity. What you need to do read your notice carefully. As of 2021, the irs no longer provides form 147c to. Web here’s how to call the irs and get a 147c letter. Press option 1 for employer identification numbers.

Printable 147c Form 20202022 Fill and Sign Printable Template Online

Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Press option 1 for english. The letter is not sent to request a new ein, but for an already existing number. Web only an owner or a power of attorney (poa) can request a.

IRS FORM 147C PDF

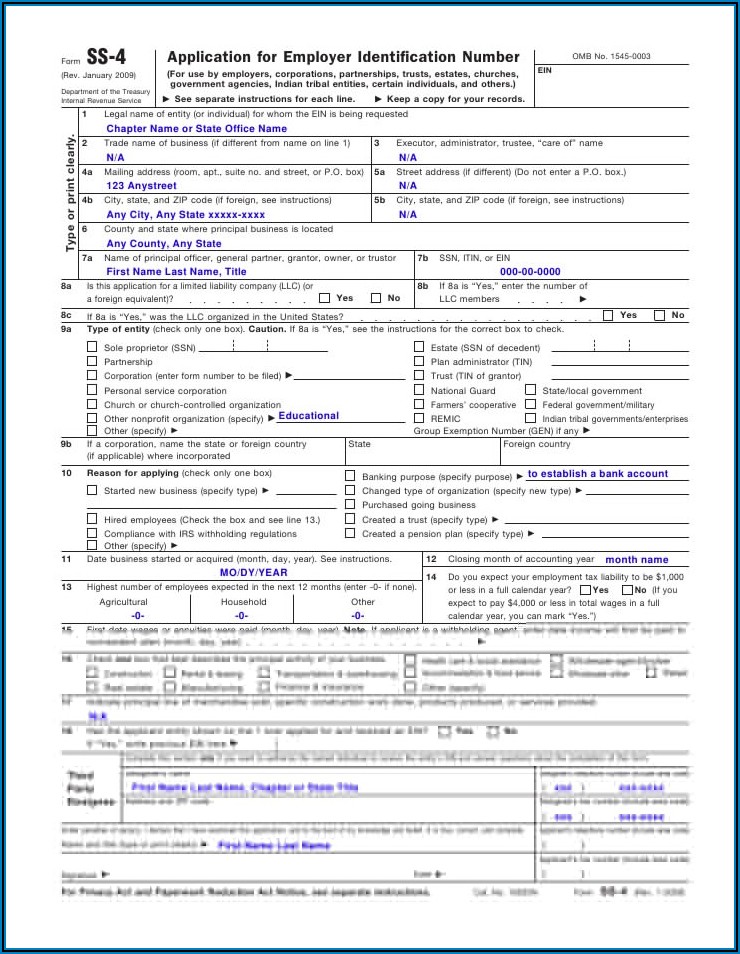

Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press “1” for ein. A 147c letter refers to an ein verification letter which is a document issued by the irs in replacement of an ein confirmation.

Irs Name Change Letter Sample Lovely Irs Ein Name Change Form Models

Web a letter 147c is a document sent by a company to the irs to request their ein. We have a question about your tax return. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press.

Irs Letter 147c Sample

Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. You are due a larger or smaller refund. As of 2021, the irs no longer provides form 147c to. Web a 147c letter, also known as an ein verification letter, is a form sent.

Ein Verification Letter 147c certify letter

Web what is a 147c letter? We need to notify you of delays in processing your return. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an additional part of that amount to your estimated.

XYZReptiles Federal Tax ID Sample And Explanation For Wholesalers

Your previously filed return should be notated with your ein. We have a question about your tax return. Press option 3 for “if you already have an ein, but you can’t remember it, etc.”. It may be asked for by a third party as a form of verification, or it may be requested if. Press option 1 for employer identification.

How can I get a copy of my EIN Verification Letter (147C) from the IRS

Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission. Web you have a balance due. Your previously filed return should.

Irs Audit Letter Example Free Printable Documents

It may be asked for by a third party as a form of verification, or it may be requested if. The letter is not sent to request a new ein, but for an already existing number. Web you have a balance due. As of 2021, the irs no longer provides form 147c to. Web find a previously filed tax return.

How Long Does It Take To Get A Ein

Press option 3 for “if you already have an ein, but you can’t remember it, etc.”. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press “1” for ein. What you need to do read your.

A 147C Letter Refers To An Ein Verification Letter Which Is A Document Issued By The Irs In Replacement Of An Ein Confirmation Letter (Cp 575).

Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's taxes, we are now able to apply an additional part of that amount to your estimated tax. Web you have a balance due. Press option 1 for english. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press “1” for ein.

We Need To Notify You Of Delays In Processing Your Return.

We need to verify your identity. What you need to do read your notice carefully. Press option 3 for “if you already have an ein, but you can’t remember it, etc.”. If you would like a poa to request your ein verification letter (147c), both you and your poa will need to complete the irs form 2848 and have it ready to send to the irs via fax during the phone call with the irs.

Web Find A Previously Filed Tax Return For Your Existing Entity (If You Have Filed A Return) For Which You Have Your Lost Or Misplaced Ein.

Your previously filed return should be notated with your ein. We have a question about your tax return. Web here’s how to call the irs and get a 147c letter. This document is often required for businesses to verify their ein for employment tax purposes.

Web A Letter 147C Is A Document Sent By A Company To The Irs To Request Their Ein.

Press option 1 for employer identification numbers. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. You are due a larger or smaller refund.