Irs Form 1033

Irs Form 1033 - Web internal revenue code section 1033 provides that gain that is realized from an “involuntary conversion” can be deferred if the owner acquires replacement property that is similar to. Part of the internal revenue code since 1921, section 1033 provides guidance for the deferral of all tax liability incurred when, as the. Quick guide on how to complete the sign. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. Section 1033 of the internal revenue code allows for exchange of like. To override a gain from an involuntary conversion. The conversion into money or other property must occur from circumstances beyond the. Web for this purpose, a bank affiliate is a corporation whose principal activity is rendering services to facilitate exchanges of property intended to qualify for nonrecognition of gain. Web section 1033 only defers gains resulting from compulsory or involuntary conversions. Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other.

Web section 1033 only defers gains resulting from compulsory or involuntary conversions. What is a 1033 tax exchange? Web in a section 1033 exchange, the taxpayer can receive the sales proceeds and hold them until the replacement property is purchased. Income tax return for settlement funds (under section 468b) omb no. Web know more about… 1033 exchanges. Web this blog entry examines some of the key aspects of the 1033 exchange. What is an irc 1033 exchange? Web physically disposed, used, or utilized captured qualified carbon oxide during the tax year. If not all the proceeds are used towards. Web section 1031 and 1033 are both powerful tax deferral strategies, but they differ substantially in their usage.

Section 1033 of the internal revenue code allows for exchange of like. Web this blog entry examines some of the key aspects of the 1033 exchange. Web submitting the irs ro 1033 form with signnow will give greater confidence that the output form will be legally binding and safeguarded. What is a 1033 tax exchange? Quick guide on how to complete the sign. A 1033 tax exchange occurs when an investor’s property must be exchanged for another real estate asset due to natural disaster, condemnment or threat of condemnment, or seizure by eminent domain. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. Web under section 1033, an involuntary conversion is defined as a destruction or loss of the property through casualty, theft or condemnation action pursuant to government powers. Web to enter a 1033 election for an involuntary conversion on an individual or business return. To override a gain from an involuntary conversion.

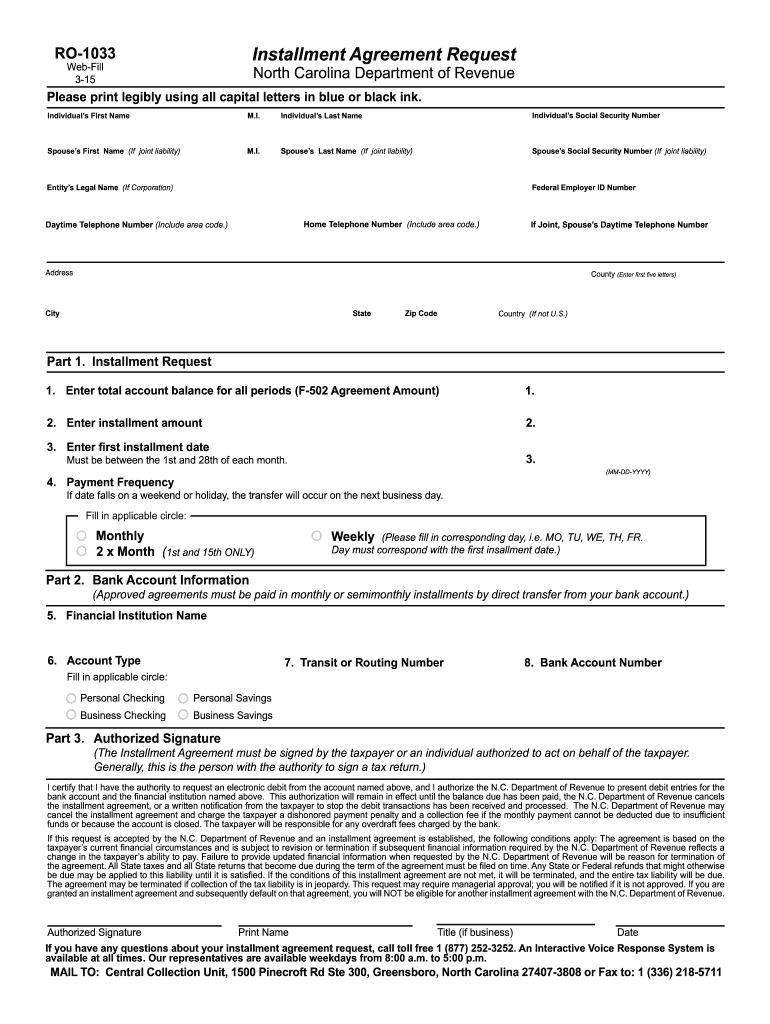

NC DoR RO1033 2011 Fill out Tax Template Online US Legal Forms

Web (a) general rule if property (as a result of its destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) is compulsorily or. Web for this purpose, a bank affiliate is a corporation whose principal activity is rendering services to facilitate exchanges of property intended to qualify for nonrecognition of gain. Web.

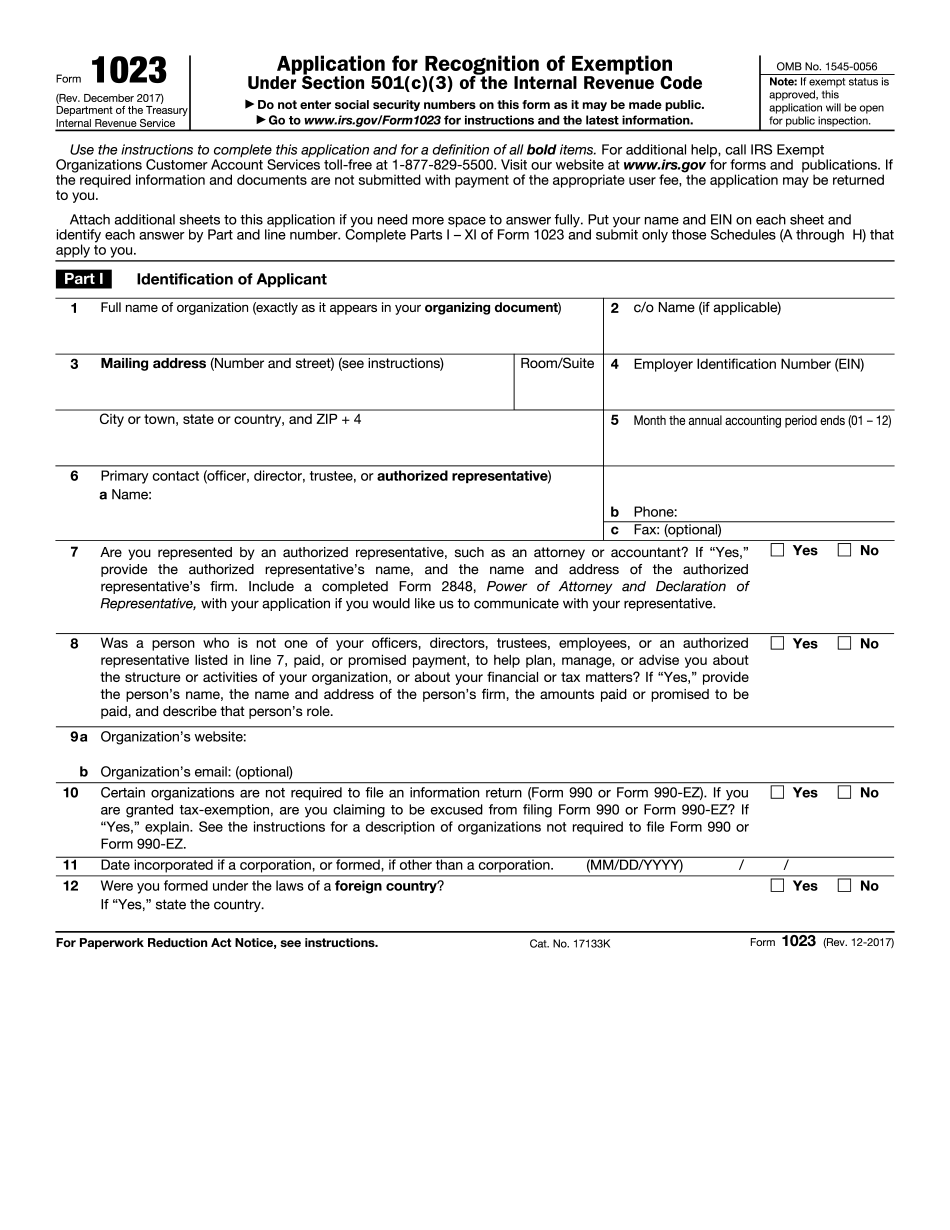

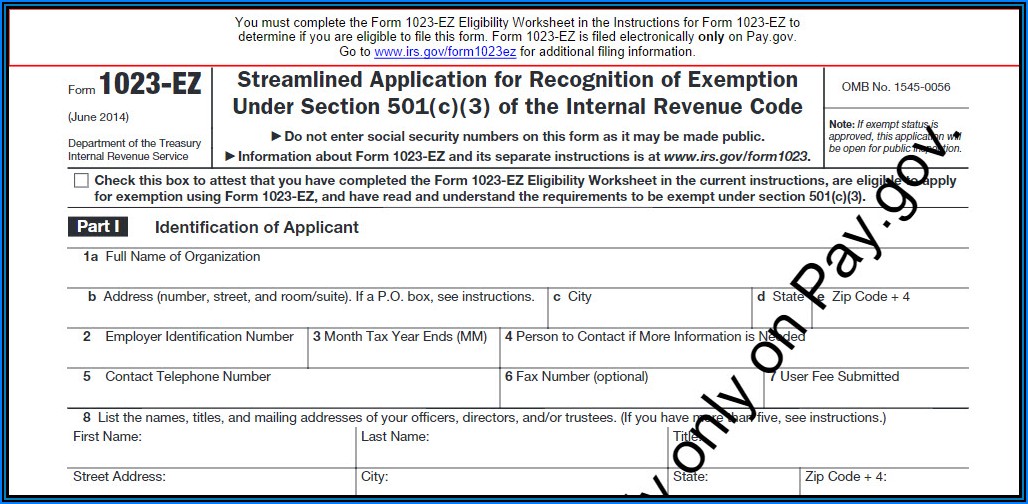

IRS 1023 2022 Form Printable Blank PDF Online

Web section 1033 — involuntary conversions section 1033 of the irs tax code covers various forms of involuntary conversion of taxpayer property. Income tax return for settlement funds (under section 468b) omb no. Web under section 1033, an involuntary conversion is defined as a destruction or loss of the property through casualty, theft or condemnation action pursuant to government powers..

2007 Form NC DoR RO1033 Fill Online, Printable, Fillable, Blank

Web this blog entry examines some of the key aspects of the 1033 exchange. Web to enter a 1033 election for an involuntary conversion on an individual or business return. Web section 1031 and 1033 are both powerful tax deferral strategies, but they differ substantially in their usage. A section 1033 exchange, named for section 1033 of. To override a.

Where do i mail my 2016 tax extension form dentallasopa

Quick guide on how to complete the sign. Web under section 1033, an involuntary conversion is defined as a destruction or loss of the property through casualty, theft or condemnation action pursuant to government powers. Web section 1033 — involuntary conversions section 1033 of the irs tax code covers various forms of involuntary conversion of taxpayer property. Web know more.

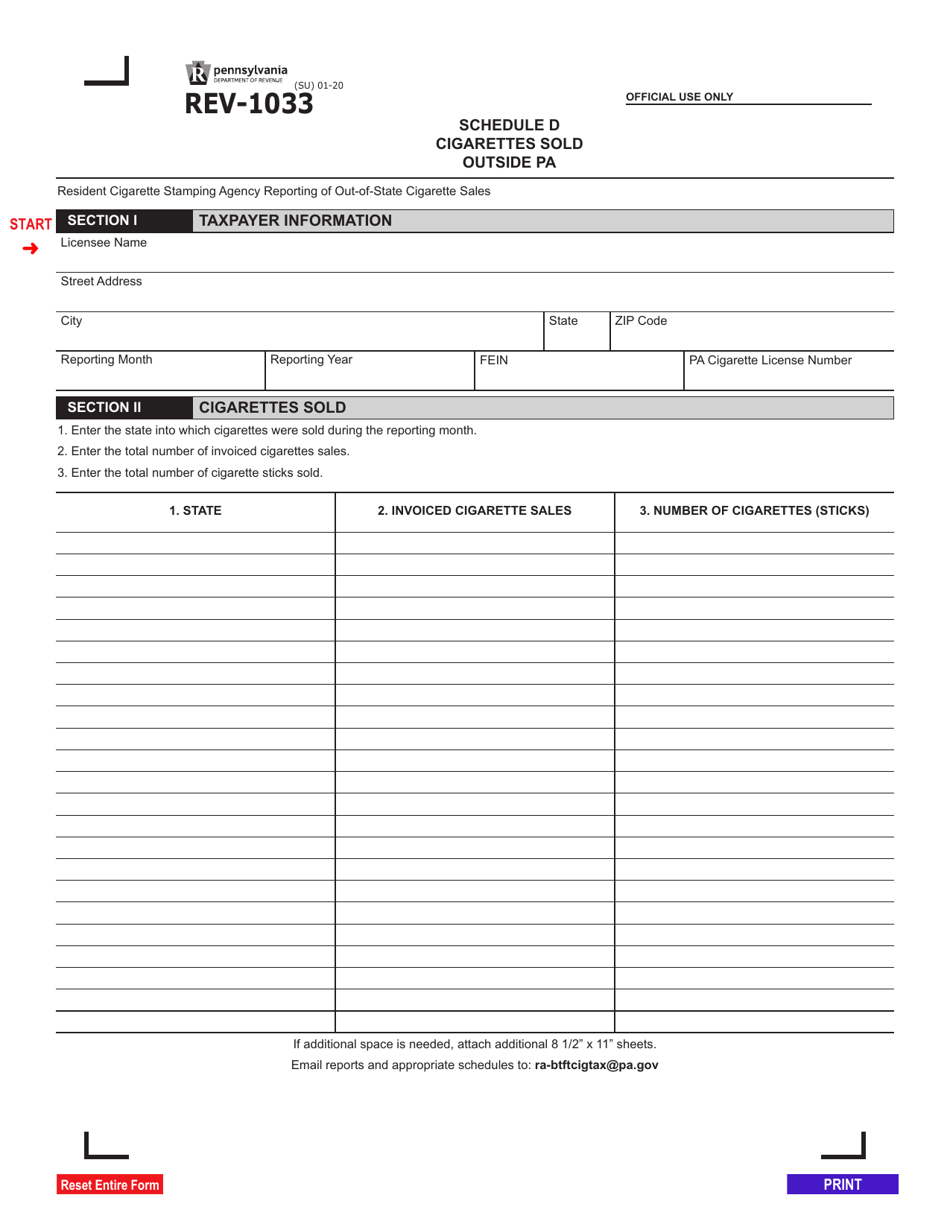

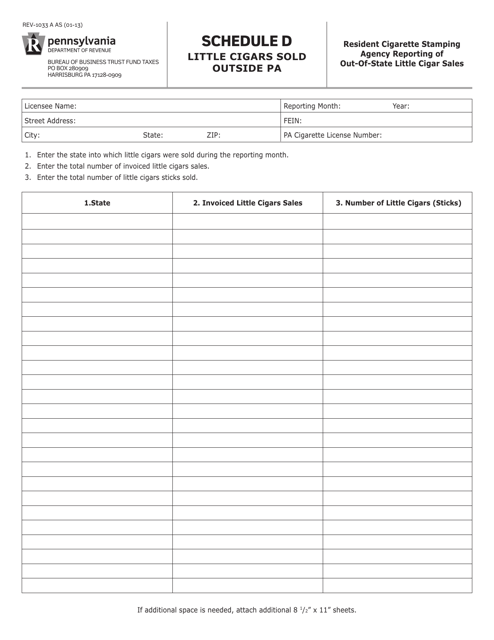

Form REV1033 Schedule D Download Fillable PDF or Fill Online

Web an involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other. What is an irc 1033 exchange? Web (a) general rule if property (as a result of its destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) is compulsorily.

501(c)(3) Form 1023 Form Resume Examples 76YG3pDYoL

3 elected to allow another taxpayer to claim the carbon oxide sequestration. Web section 1031 and 1033 are both powerful tax deferral strategies, but they differ substantially in their usage. Income tax return for settlement funds (under section 468b) omb no. Section 1033 is tax deferral specific to the loss of property by. Part of the internal revenue code since.

Irs Form 1040 Sr From Schedule A Form 1040 Or 1040 Sr 2021 Tax Forms

A section 1033 exchange, named for section 1033 of. Web know more about… 1033 exchanges. The conversion into money or other property must occur from circumstances beyond the. To override a gain from an involuntary conversion. A 1033 tax exchange occurs when an investor’s property must be exchanged for another real estate asset due to natural disaster, condemnment or threat.

Form REV1033 A Schedule D Download Printable PDF or Fill Online Little

What is an irc 1033 exchange? What is a 1033 tax exchange? Web physically disposed, used, or utilized captured qualified carbon oxide during the tax year. Web (a) general rule if property (as a result of its destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) is compulsorily or. Web this blog.

1033 Exchange

Web internal revenue code section 1033 provides that gain that is realized from an “involuntary conversion” can be deferred if the owner acquires replacement property that is similar to. If not all the proceeds are used towards. Part of the internal revenue code since 1921, section 1033 provides guidance for the deferral of all tax liability incurred when, as the..

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

If not all the proceeds are used towards. Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. 3 elected to allow another taxpayer to claim the carbon oxide sequestration. What is an irc 1033 exchange? Quick guide on how to complete the sign.

Section 1033 Is Tax Deferral Specific To The Loss Of Property By.

A 1033 tax exchange occurs when an investor’s property must be exchanged for another real estate asset due to natural disaster, condemnment or threat of condemnment, or seizure by eminent domain. Web internal revenue code section 1033 provides that gain that is realized from an “involuntary conversion” can be deferred if the owner acquires replacement property that is similar to. 3 elected to allow another taxpayer to claim the carbon oxide sequestration. Web section 1033 only defers gains resulting from compulsory or involuntary conversions.

To Override A Gain From An Involuntary Conversion.

Date of death i already filed a form 1041, income tax return for estates and trusts,. If not all the proceeds are used towards. Web section 1033 — involuntary conversions section 1033 of the irs tax code covers various forms of involuntary conversion of taxpayer property. Part of the internal revenue code since 1921, section 1033 provides guidance for the deferral of all tax liability incurred when, as the.

Web This Blog Entry Examines Some Of The Key Aspects Of The 1033 Exchange.

Web in a section 1033 exchange, the taxpayer can receive the sales proceeds and hold them until the replacement property is purchased. What is a 1033 tax exchange? Web section 1031 and 1033 are both powerful tax deferral strategies, but they differ substantially in their usage. Web to enter a 1033 election for an involuntary conversion on an individual or business return.

Web Submitting The Irs Ro 1033 Form With Signnow Will Give Greater Confidence That The Output Form Will Be Legally Binding And Safeguarded.

Web tax return year(s) tax return date(s) if the person addressed on this notice is deceased. Web under section 1033, an involuntary conversion is defined as a destruction or loss of the property through casualty, theft or condemnation action pursuant to government powers. A section 1033 exchange, named for section 1033 of. Section 1033 of the internal revenue code allows for exchange of like.