Iowa 1040 Tax Form

Iowa 1040 Tax Form - You must fill in your social security number (ssn). Iowa state income tax form ai 1040 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Intended for those who would benefit from a more comprehensive set of instructions. We last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. This form is for income earned in tax year 2022, with tax returns due in. Note that this form will fill in some information automatically and do all the calculations for you. Web go to this site: Form ia 1065 schedule k1. Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony.

Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony. Web go to this site: Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. Form ia 1065 schedule k1. You must fill in your social security number (ssn). Iowa state income tax form ai 1040 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Current mailing address (number and street, apartment, lot, or suite number) or po box: Current mailing address (number and street, apartment, lot, or suite number) or po box: The steps listed below correspond to. Iowa corporation income tax return:

This form is for income earned in tax year 2022, with tax returns due in. Web go to this site: Note that this form will fill in some information automatically and do all the calculations for you. The steps listed below correspond to. Form ia 1065 schedule k1. Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony. Intended for those who would benefit from a more comprehensive set of instructions. You must fill in your social security number (ssn). Iowa corporation income tax return: Iowa state income tax form ai 1040 must be postmarked by may 1, 2023 in order to avoid penalties and late fees.

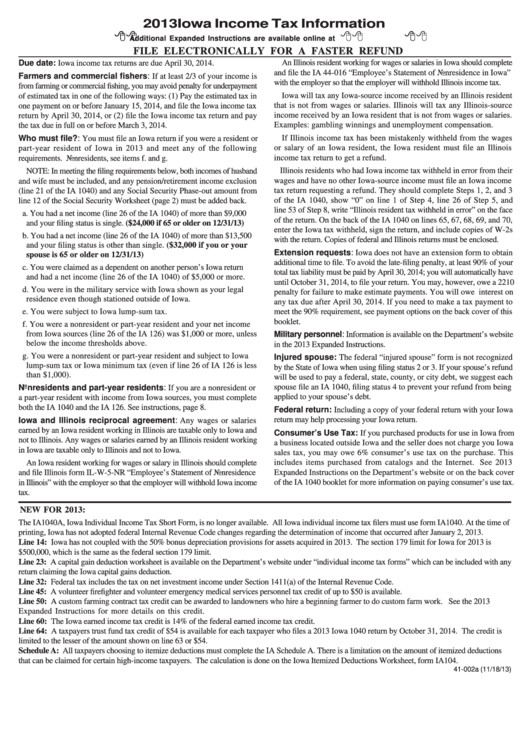

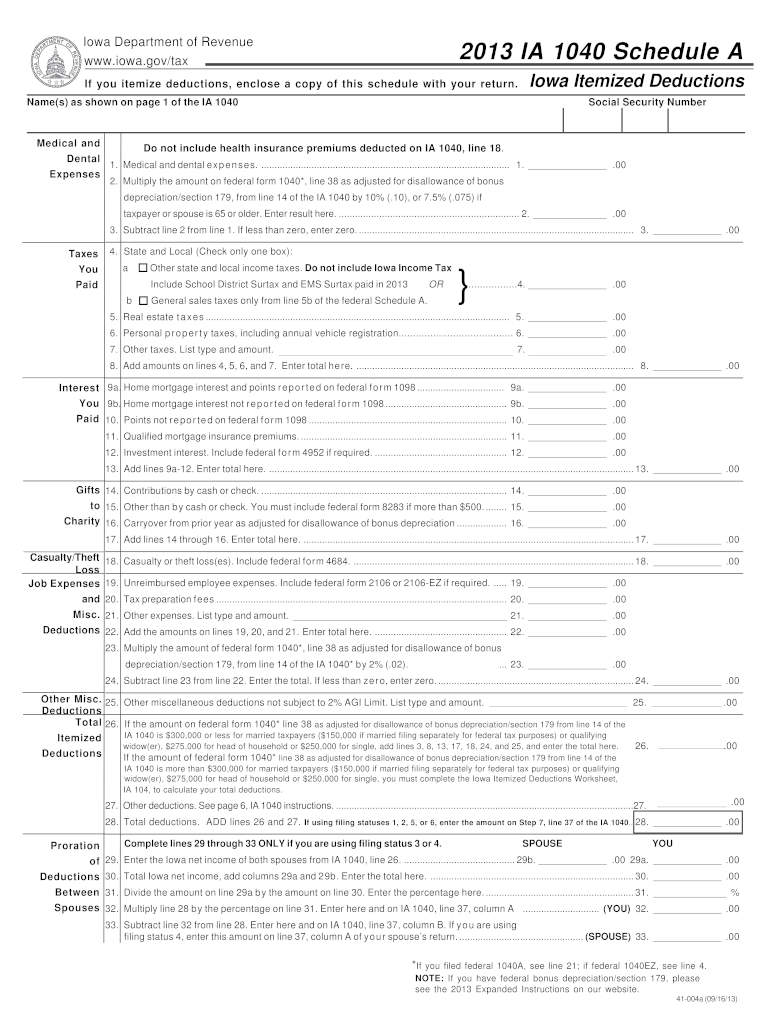

Instructions For Form Ia 1040 Iowa Individual Tax Form 2013

Web go to this site: We last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Stay informed, subscribe to receive updates. Current mailing address (number and street, apartment, lot, or suite number) or po box: Iowa state income tax form ai 1040 must be postmarked by may 1, 2023 in order to avoid penalties.

Iowa 1040 Fill Out and Sign Printable PDF Template signNow

Iowa corporation income tax return: You must fill in your social security number (ssn). You must fill in your social security number (ssn). Current mailing address (number and street, apartment, lot, or suite number) or po box: Stay informed, subscribe to receive updates.

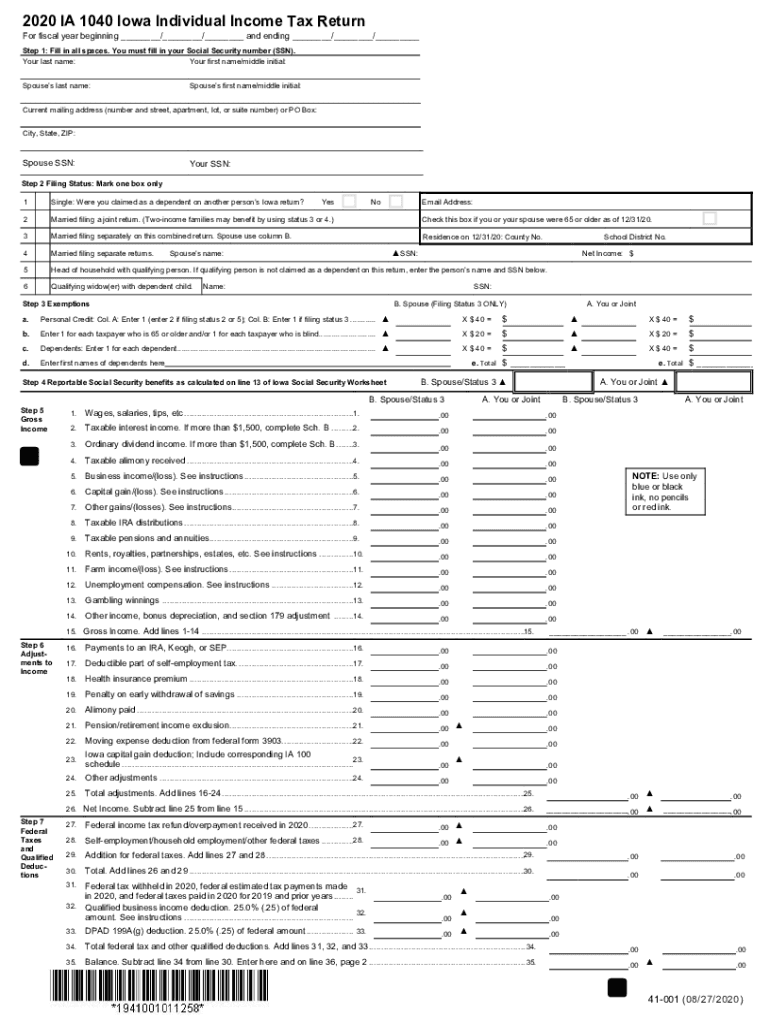

2020 Form IA DoR 1040 Fill Online, Printable, Fillable, Blank pdfFiller

Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. You must fill in your social security number (ssn). Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony..

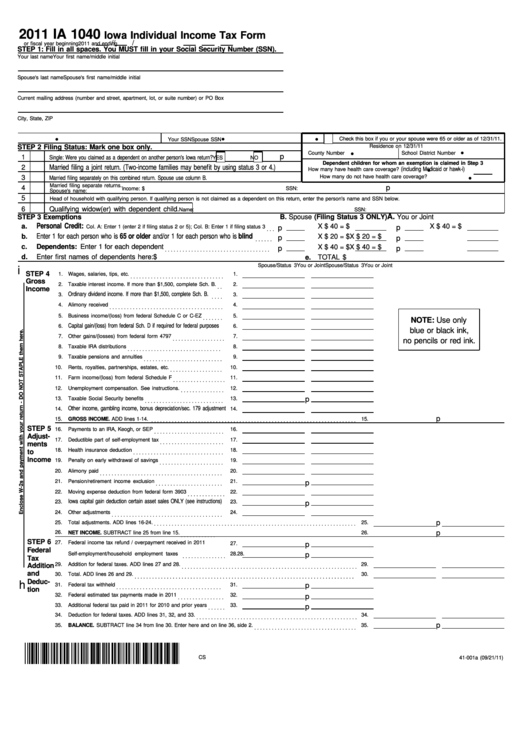

Form Ia 1040 Iowa Individual Tax Form 2011 printable pdf

Iowa corporation income tax return: Iowa state income tax form ai 1040 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony. Stay informed, subscribe to receive updates. Current mailing address (number and street, apartment, lot, or suite.

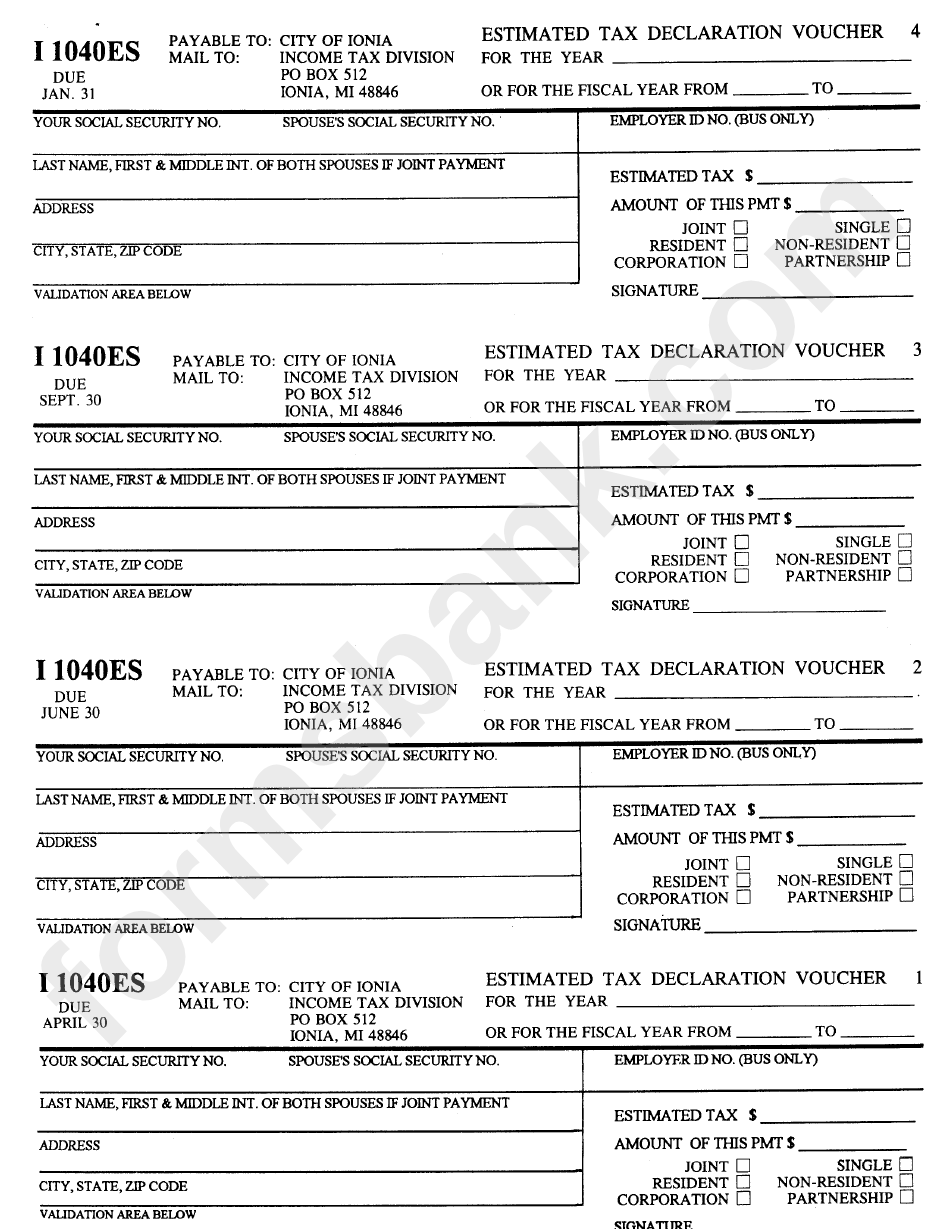

Form I 1040es Estimated Tax Declaration Voucher City Of Ionia

Form ia 1065 schedule k1. The steps listed below correspond to. Current mailing address (number and street, apartment, lot, or suite number) or po box: Stay informed, subscribe to receive updates. Intended for those who would benefit from a more comprehensive set of instructions.

Ia 1040 Iowa Individual Tax Form Edit, Fill, Sign Online

Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. You must fill in your social security number (ssn). Note that this form will fill in some information automatically and do all the calculations for you..

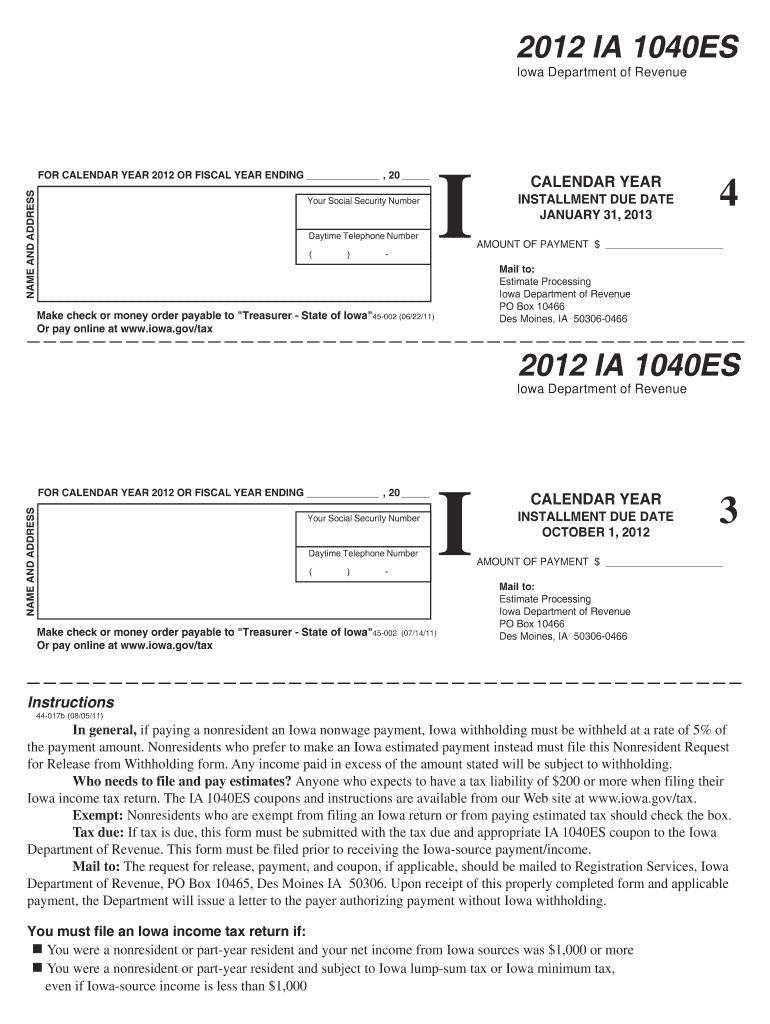

Ia 1040Es Instructions Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in. Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. Current mailing address (number and street, apartment, lot, or suite number).

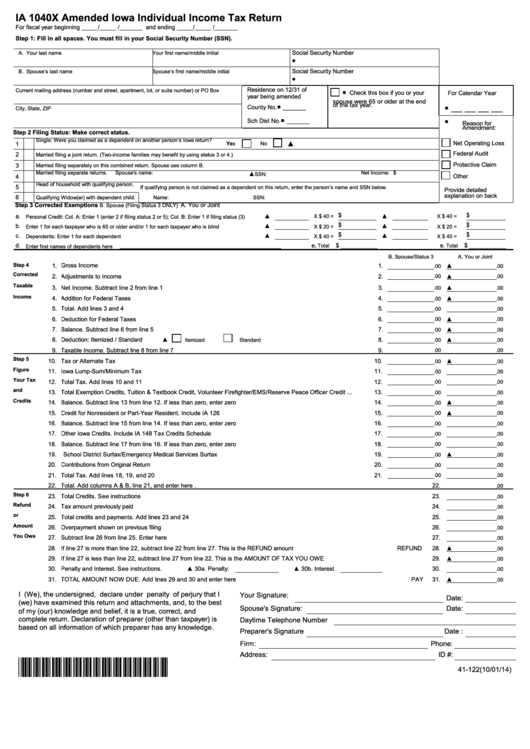

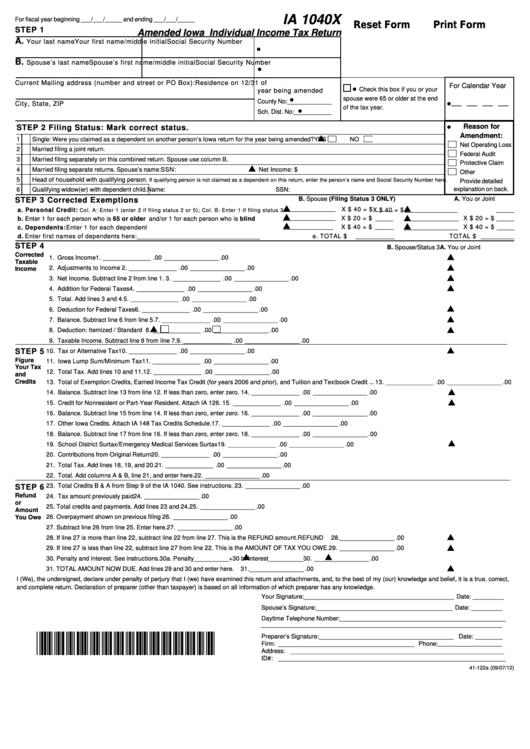

Fillable Form Ia 1040x Amended Iowa Individual Tax Return

Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony. Form ia 1065 schedule k1. Current mailing address (number and street, apartment, lot, or suite number) or po box: Intended for those who would benefit from a more comprehensive set of instructions. The steps listed below correspond to.

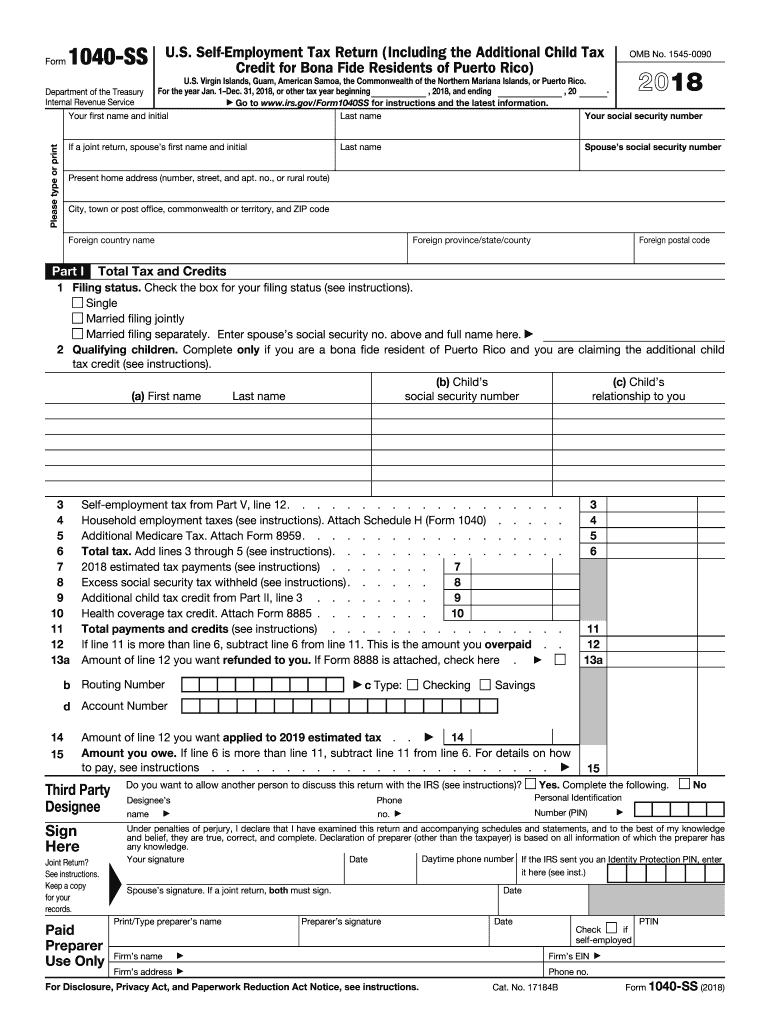

2018 Form IRS 1040SS Fill Online, Printable, Fillable, Blank PDFfiller

This form is for income earned in tax year 2022, with tax returns due in. Current mailing address (number and street, apartment, lot, or suite number) or po box: Intended for those who would benefit from a more comprehensive set of instructions. We last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Form ia.

Fillable Form Ia 1040x Amended Iowa Individual Tax Return

This form is for income earned in tax year 2022, with tax returns due in. You must fill in your social security number (ssn). Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. We last.

Note That This Form Will Fill In Some Information Automatically And Do All The Calculations For You.

Current mailing address (number and street, apartment, lot, or suite number) or po box: Iowa state income tax form ai 1040 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. You must fill in your social security number (ssn). Stay informed, subscribe to receive updates.

Form Ia 1065 Schedule K1.

You must fill in your social security number (ssn). Current mailing address (number and street, apartment, lot, or suite number) or po box: Web free printable and fillable 2022 iowa form 1040 and 2022 iowa form 1040 instructions booklet in pdf format to fill in, print, and mail your state income tax return due may 1, 2023. Form ia 1040 requires you to list multiple forms of income, such as wages, interest, or alimony.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In.

The steps listed below correspond to. We last updated iowa form ia 1040 in february 2023 from the iowa department of revenue. Web go to this site: Intended for those who would benefit from a more comprehensive set of instructions.