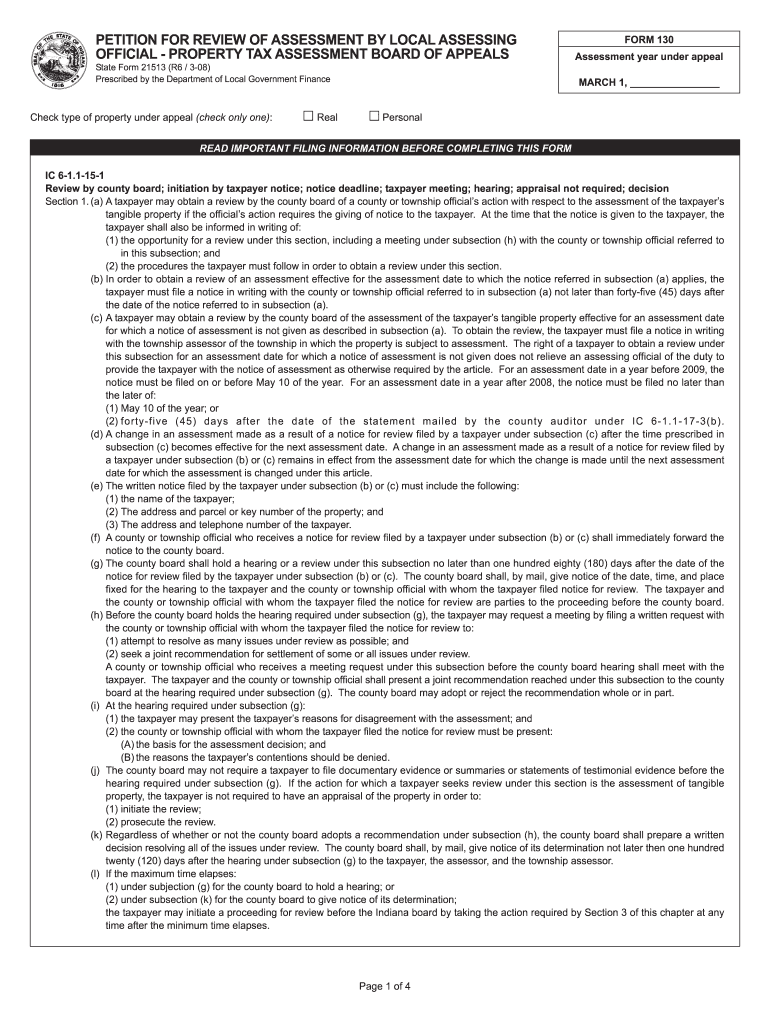

Indiana Property Tax Appeal Form 130

Indiana Property Tax Appeal Form 130 - Ad download or email 2008 130 & more fillable forms, register and subscribe now! Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for. Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Web every spring the county will send all property owners a form 11 notice of assessment. if the tax payer does not agree with the total assessed value as stated on the form, they. Taxpayer's notice to initiate an appeal (pdf) form 131: If you file a form 130, the. Edit, sign and save in dlgf 130 form. Web indiana law does not require a taxpayer to submit an appraisal of the subject property to appeal the assessment. Taxpayer files a property tax appeal with assessing official.

Web taxpayer files a property tax appeal with assessing official. Web there are several different types of appeals available to a taxpayer. If you file a form 130, the. Taxpayer's notice to initiate an appeal (pdf) form 131: Web within 30 days of the ptaboa mailing of its decision, the taxpayer, or township assessor, or a ptaboa member can file a petition to the state board of tax commissioners for. Check the information needed to verify you have included the required. And requires the assessing official to. Ibtr = indiana board of tax review • ibtr is a state. Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the form 11 (notice of assessment) was mailed. Edit, sign and save in dlgf 130 form.

Web there are several different types of appeals available to a taxpayer. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for. Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Edit, sign and save in dlgf 130 form. It appears you don't have a pdf plugin for this browser. And 2) requires the assessing official. And requires the assessing official to. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Check the information needed to verify you have included the required.

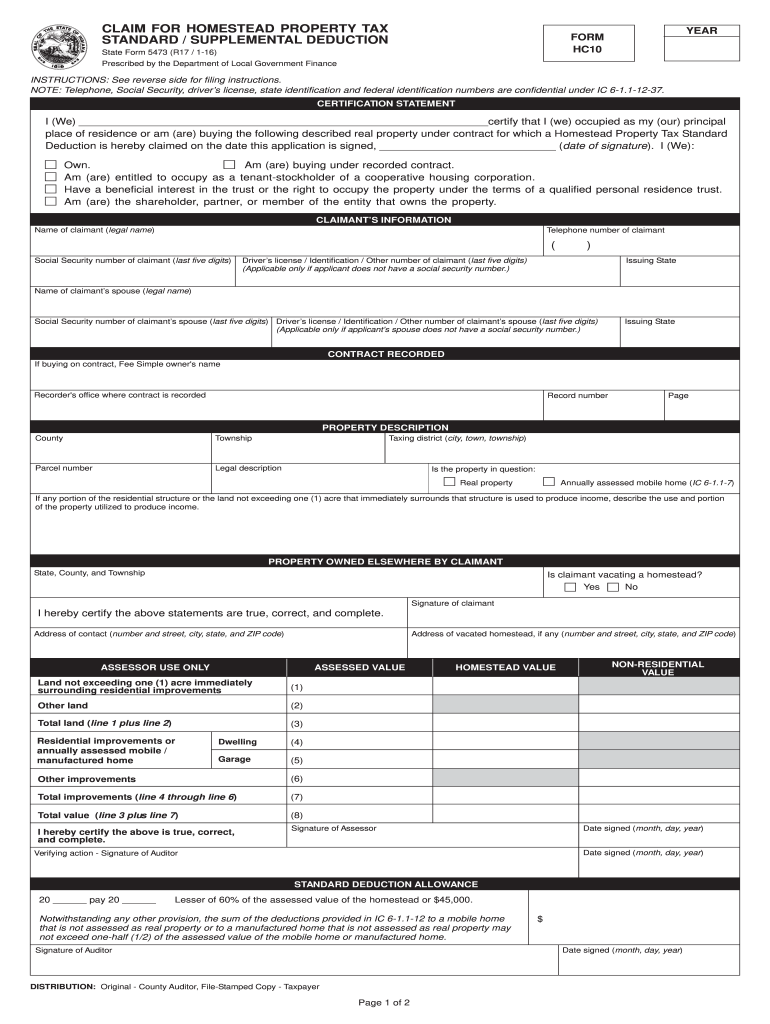

Indiana Homestead Exemption Form Fill Out and Sign Printable PDF

Web within 30 days of the ptaboa mailing of its decision, the taxpayer, or township assessor, or a ptaboa member can file a petition to the state board of tax commissioners for. Ad download or email 2008 130 & more fillable forms, register and subscribe now! The taxpayer must use the form prescribed by the dlgf (form 130) for each.

Form 130 Indiana Fill Out and Sign Printable PDF Template signNow

Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web within 30 days of the ptaboa mailing of its decision, the taxpayer, or township assessor,.

Fill Free fillable forms Jennings County Government

Ad download or email 2008 130 & more fillable forms, register and subscribe now! Ad download or email 2008 130 & more fillable forms, register and subscribe now! The appeal should detail the pertinent facts of why the assessed. Web every spring the county will send all property owners a form 11 notice of assessment. if the tax payer does.

How a Property Database Helps Commercial Property Tax Assessors Thrive

Web to access all department of local government finance forms please visit the state forms online catalog available here. Web taxpayer files a property tax appeal with assessing official. And 2) requires the assessing official. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Edit, sign and save in dlgf 130 form.

Appeal For Property Tax Fill Online, Printable, Fillable, Blank

The taxpayer must file a separate petition for each parcel. Web a taxpayer may appeal an assessment by filing a form (“form 130”) with the assessing official. Taxpayer files a property tax appeal with assessing official. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web the deadline to file an.

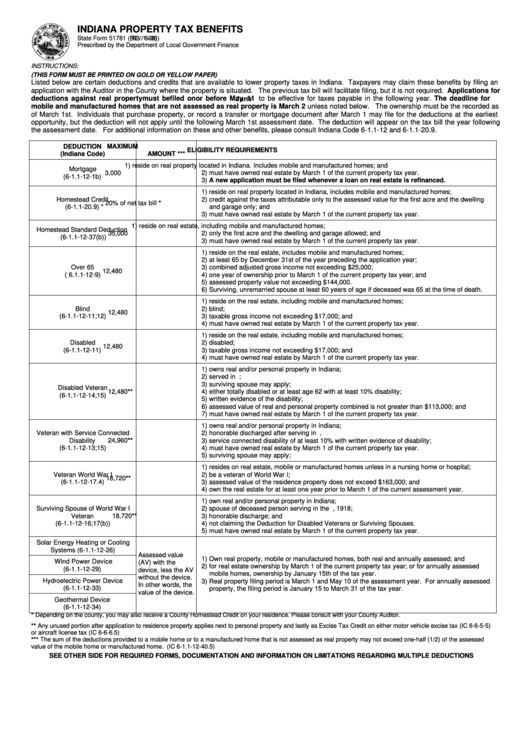

Indiana Property Tax Benefits Form printable pdf download

Web the indiana department of revenue (dor) accepts written appeals up to 60 days from the date the proposed assessment or refund denial is issued. Taxpayer's notice to initiate an appeal (pdf) form 131: Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for. Web to access all department of local government finance.

Morris County NJ Property Tax Appeal Form YouTube

Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web taxpayer files a property tax appeal with assessing official. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. Web to.

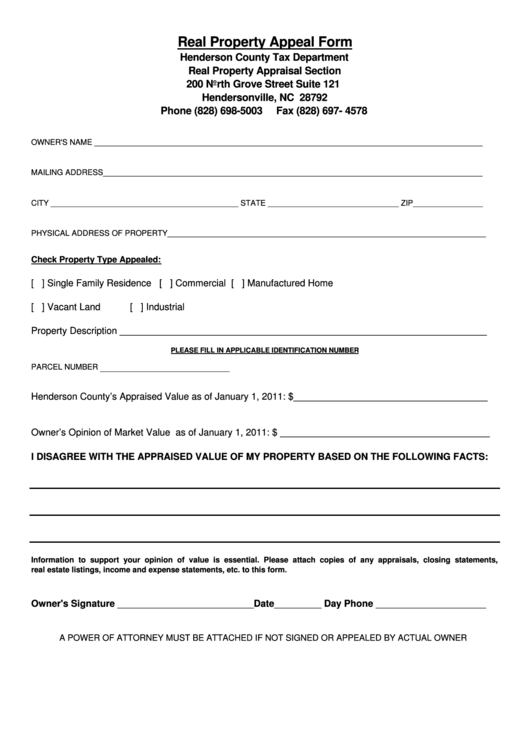

Real Property Appeal Form Henderson County Tax Department printable

Web indiana law does not require a taxpayer to submit an appraisal of the subject property to appeal the assessment. And 2) requires the assessing official. The taxpayer must file a separate petition for each parcel. Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the.

How to Appeal Your Property Tax Assessment Clark Howard

Web to access all department of local government finance forms please visit the state forms online catalog available here. Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the form 11 (notice of assessment) was mailed. Check the information needed to verify you have included the.

Understanding Indiana Property Tax Prorations

Web every spring the county will send all property owners a form 11 notice of assessment. if the tax payer does not agree with the total assessed value as stated on the form, they. It appears you don't have a pdf plugin for this browser. Web within 30 days of the ptaboa mailing of its decision, the taxpayer, or township.

The Appeal Should Detail The Pertinent Facts Of Why The Assessed.

Web a taxpayer may appeal an assessment by filing a form 130 with the assessing official. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web there are several different types of appeals available to a taxpayer. Check the information needed to verify you have included the required.

Web Taxpayer Files A Property Tax Appeal With Assessing Official.

Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Ibtr = indiana board of tax review • ibtr is a state. Web the deadline to file an appeal is june 15th, 2023. Web taxpayer files a property tax appeal with assessing official.

The Taxpayer Must File A Separate Petition For Each Parcel.

It appears you don't have a pdf plugin for this browser. And 2) requires the assessing official. Web to appeal an assessment notice, the taxpayer must file a form 130 with the county assessor within 45 days of the date the form 11 (notice of assessment) was mailed. Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for.

If A Property Owner Chooses To File An Assessment.

If you file a form 130, the. Taxpayer's notice to initiate an appeal (pdf) form 131: Web a taxpayer may appeal an assessment by filing a form (“form 130”) with the assessing official. The taxpayer must file a separate petition for each parcel.