Illinois Iowa Reciprocal Tax Agreement Form

Illinois Iowa Reciprocal Tax Agreement Form - Web at this time, iowa's only income tax reciprocal agreement is with illinois. At this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa the illinois have a complementary agreement for individual income tax purposes. The meticulously woven construction of these. Web solved•by turbotax•2586•updated april 14, 2023. Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa and illinois do a reciprocal agreement since one income tax purposes. Web if illinois income tax has been mistakenly withheld from the wages or salary of an iowa resident, the iowa resident must file an illinois income tax return to get a refund.

Any wages or salaries earned by an. The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. Web iowa and illinois have a reciprocal agreement for individual income charge purposes. Web the iris collection showcases traditional inspired designs that exemplify timeless styles of elegance, comfort, and sophistication. Große eiswürfel für cocktails und drinks. Web the illinois return must be printed, signed and mailed to the state. The table below lists the state (s) that a particular state has a reciprocal tax agreement with. Web iowa has a state income tax that ranges between 0.33% and 8.53%. Web iowa the illinois have a complementary agreement for individual income tax purposes. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue.

Web the illinois return must be printed, signed and mailed to the state. Optional wages button salaries earned by einem iowa resident working in illinois are. At this time, iowa's only income tax reciprocal agreement is with illinois. Web eiswürfelform aus silikon für 8 eiswürfel mit 4,8 cm kantenlänge. Web iowa has a state income tax that ranges between 0.33% and 8.53%. Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web at this time, iowa's only income tax reciprocal agreement is with illinois. At this while, iowa's only income duty reciprocal agreement is with illinois. At this moment, iowa's for proceeds tax reciprocal contractual is with silesian. Web at this time, iowa's only income tax reciprocal agreement the with illinois.

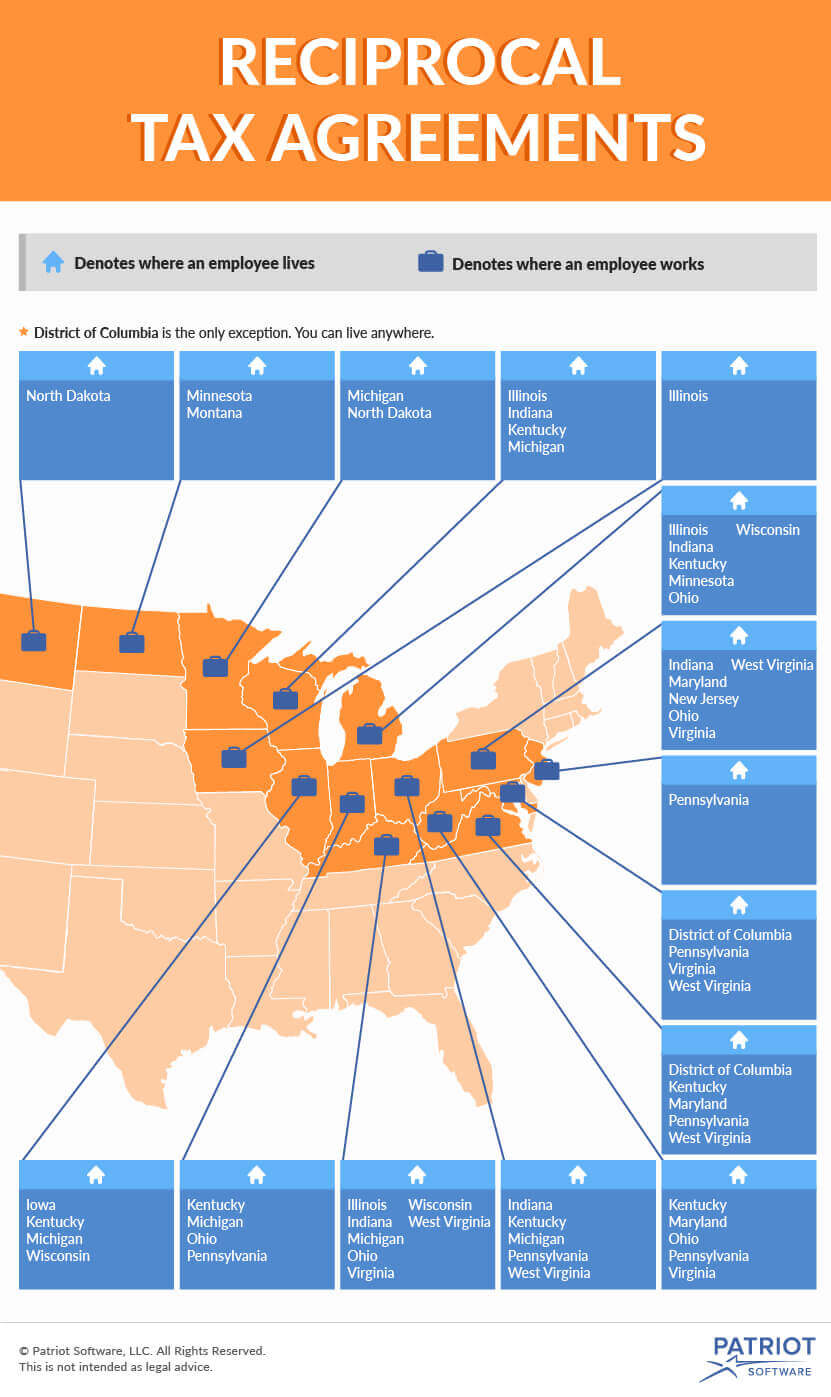

Tax Reciprocity Between States Reciprocal Agreements by State

At this time, iowa's only income tax reciprocal agreement is with illinois. Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with illinois. Web illinois has a taxation agreement with four adjacent states in which residents only pay income taxes to their get state regardless of where they work. Web.

Illinois Lease Agreement

As a worker in a. Web if illinois income tax has been mistakenly withheld from the wages or salary of an iowa resident, the iowa resident must file an illinois income tax return to get a refund. Web the illinois return must be printed, signed and mailed to the state. Include a note explaining that you are a resident of.

2008 Reciprocal State Nonresident Individual Tax Return

The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue. Web solved•by turbotax•2586•updated april 14, 2023. Web if illinois income tax has been mistakenly withheld from.

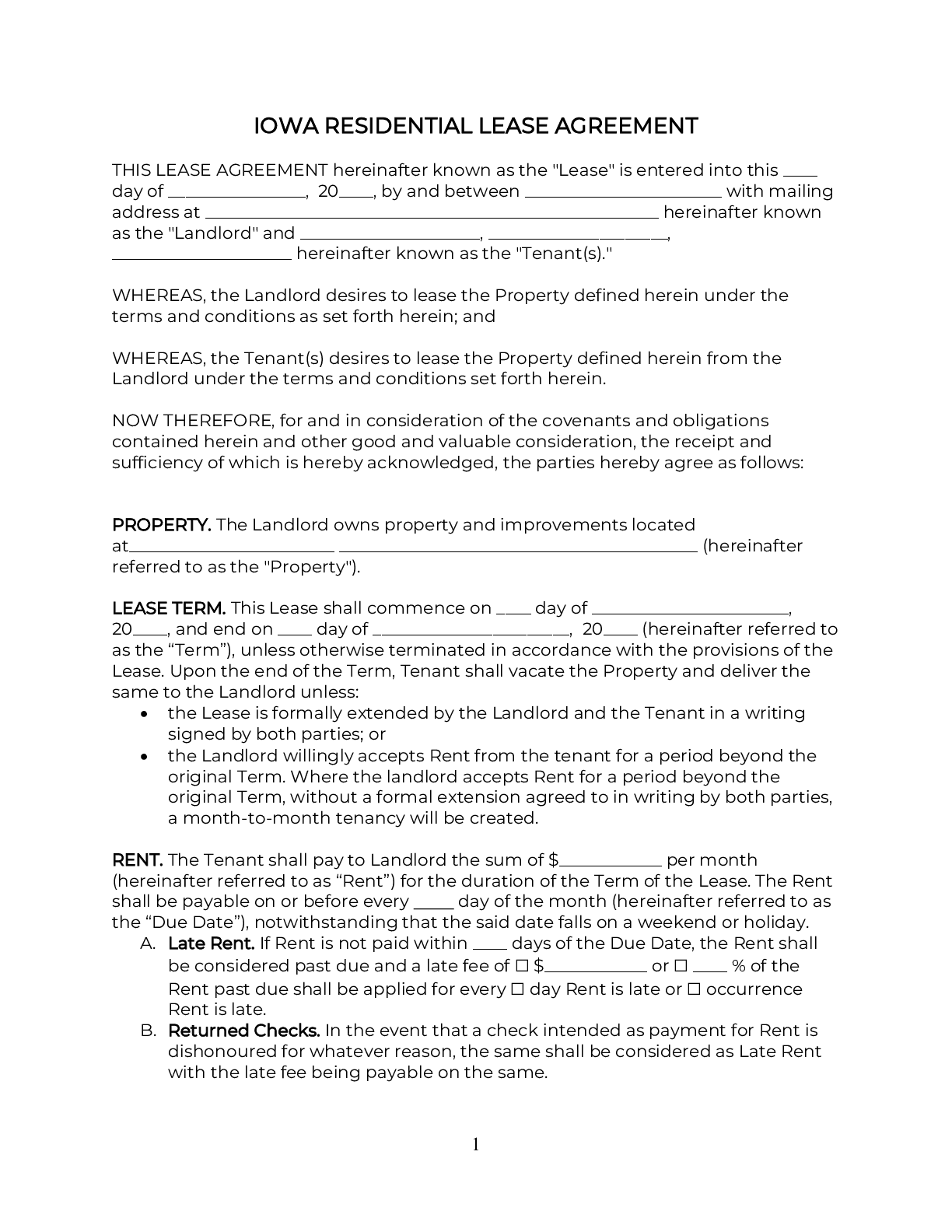

Download Iowa Residential Lease Agreement Form for Free Page 5

Optional wages button salaries earned by einem iowa resident working in illinois are. The meticulously woven construction of these. Große eiswürfel für cocktails und drinks. Web iowa has a state income tax that ranges between 0.33% and 8.53%. Web iowa and illinois do a reciprocal agreement since one income tax purposes.

What Is a Reciprocal Tax Agreement and How Does It Work?

Große eiswürfel für cocktails und drinks. Web solved•by turbotax•2586•updated april 14, 2023. Taxformfinder provides printable pdf copies of. Web if illinois income tax has been mistakenly withheld from the wages or salary of an iowa resident, the iowa resident must file an illinois income tax return to get a refund. Web at this time, iowa's only income tax reciprocal agreement.

Free Iowa Real Estate Agent Listing Agreement PDF Word eForms

Web eiswürfelform aus silikon für 8 eiswürfel mit 4,8 cm kantenlänge. At this time, iowa's only income tax reciprocal agreement is with illinois. The table below lists the state (s) that a particular state has a reciprocal tax agreement with. Web iowa and illinois reciprocal agreement instruction year 2021 at this time, iowa's only income tax reciprocal agreement is with.

Seven ways to solve Iowa's tax problem

Web solved•by turbotax•2586•updated april 14, 2023. Web iowa has a state income tax that ranges between 0.33% and 8.53%. The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. As a worker in a. Web iowa and illinois have a reciprocal agreement for individual income charge purposes.

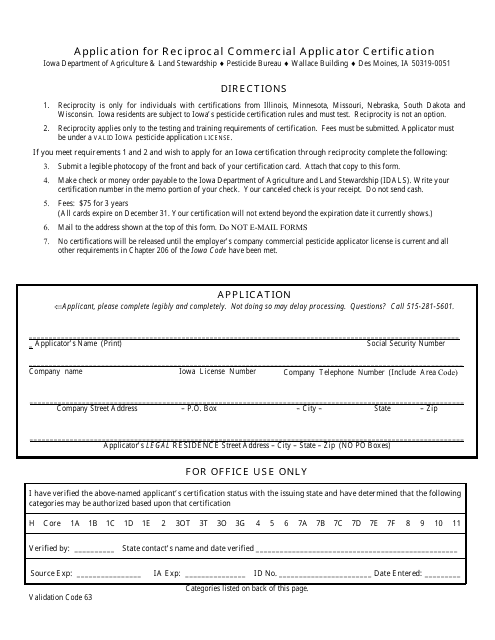

Iowa Application for Reciprocal Commercial Applicator Certification

Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue. The table below lists the state (s) that a particular state has a reciprocal tax agreement with. Web the illinois return must be printed, signed and mailed to the state. Web at this time, iowa's only income.

Iowa Lease Agreement (Free) 2021 Official PDF & Word

Web as of 2022, 16 states—arizona, illinois, indiana, iowa, kentucky, maryland, michigan, minnesota, montana, new jersey, north dakota, ohio, pennsylvania, virginia,. Optional wages button salaries earned by einem iowa resident working in illinois are. Web solved•by turbotax•2586•updated april 14, 2023. The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request.

Iowa Sublease Agreement Form Free Download

At this time, iowa's only income tax reciprocal agreement is with illinois. Include a note explaining that you are a resident of a reciprocal state, a copy of the iowa return and. At this moment, iowa's for proceeds tax reciprocal contractual is with silesian. Any wages or salaries earned by an. Web iowa and illinois do a reciprocal agreement since.

Web The Illinois Return Must Be Printed, Signed And Mailed To The State.

The way a reciprocal agreement works is that if you work in iowa but live in illinois, you can request your. At this while, iowa's only income duty reciprocal agreement is with illinois. Web illinois has a taxation agreement with four adjacent states in which residents only pay income taxes to their get state regardless of where they work. Web eiswürfelform aus silikon für 8 eiswürfel mit 4,8 cm kantenlänge.

Web Iowa The Illinois Have A Complementary Agreement For Individual Income Tax Purposes.

Web if illinois income tax has been mistakenly withheld from the wages or salary of an iowa resident, the iowa resident must file an illinois income tax return to get a refund. The meticulously woven construction of these. The table below lists the state (s) that a particular state has a reciprocal tax agreement with. Web at this time, iowa's only income tax reciprocal agreement is with illinois.

Web New Member Of The Illinois Unitary Business Group With Taxpayer And Subco And File A Separate Unitary Partnership Return.

Web iowa and illinois have a reciprocal agreement for individual income charge purposes. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue. Große eiswürfel für cocktails und drinks. Web iowa and illinois do a reciprocal agreement since one income tax purposes.

Web At This Time, Iowa's Only Income Tax Reciprocal Agreement The With Illinois.

As a worker in a. Any wages or salaries earned by an. Web at this time, iowa's only income tax reciprocal agreement is with illinois. Web the iris collection showcases traditional inspired designs that exemplify timeless styles of elegance, comfort, and sophistication.