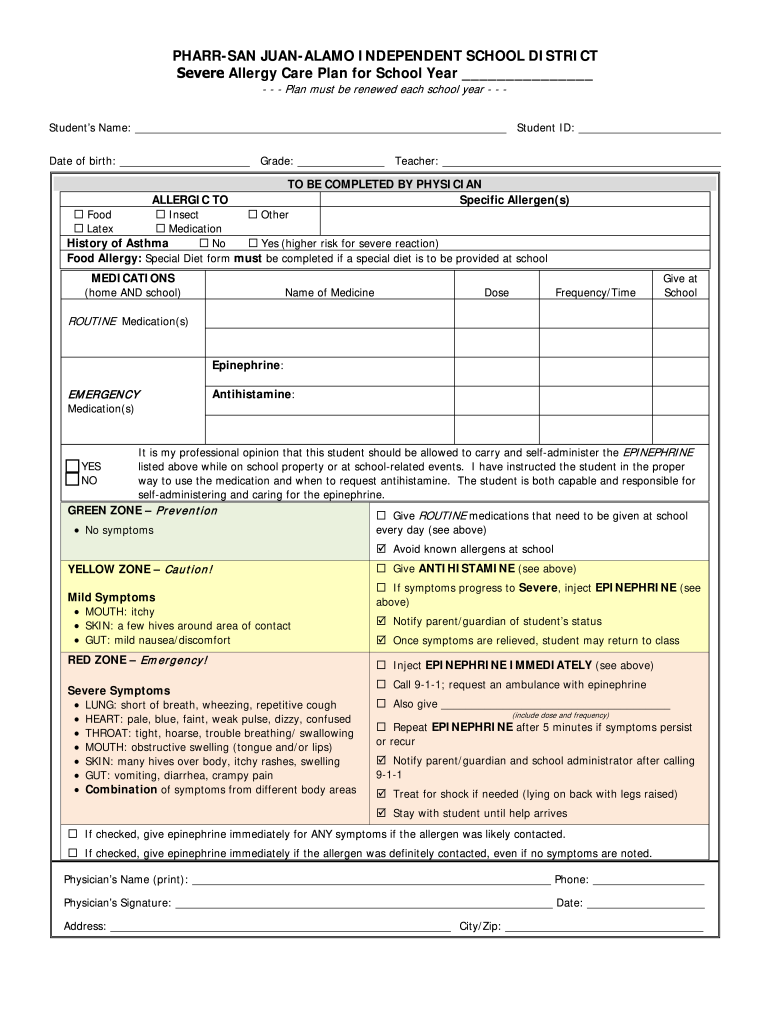

Il Wit Form

Il Wit Form - This form is used by illinois residents who file an individual income tax return. Complete, edit or print tax forms instantly. Start completing the fillable fields and carefully type in required information. Provide your name, address, and social. If there is none nothing needs to be attached. Web up to $40 cash back il form refers to the illinois department of revenue's tax return form. If you have more than five withholding forms, complete multiple copies of this schedule. We will update this page with a new version of the form for 2024 as. The il form is required for individuals and businesses that have a tax liability in illinois. Get ready for tax season deadlines by completing any required tax forms today.

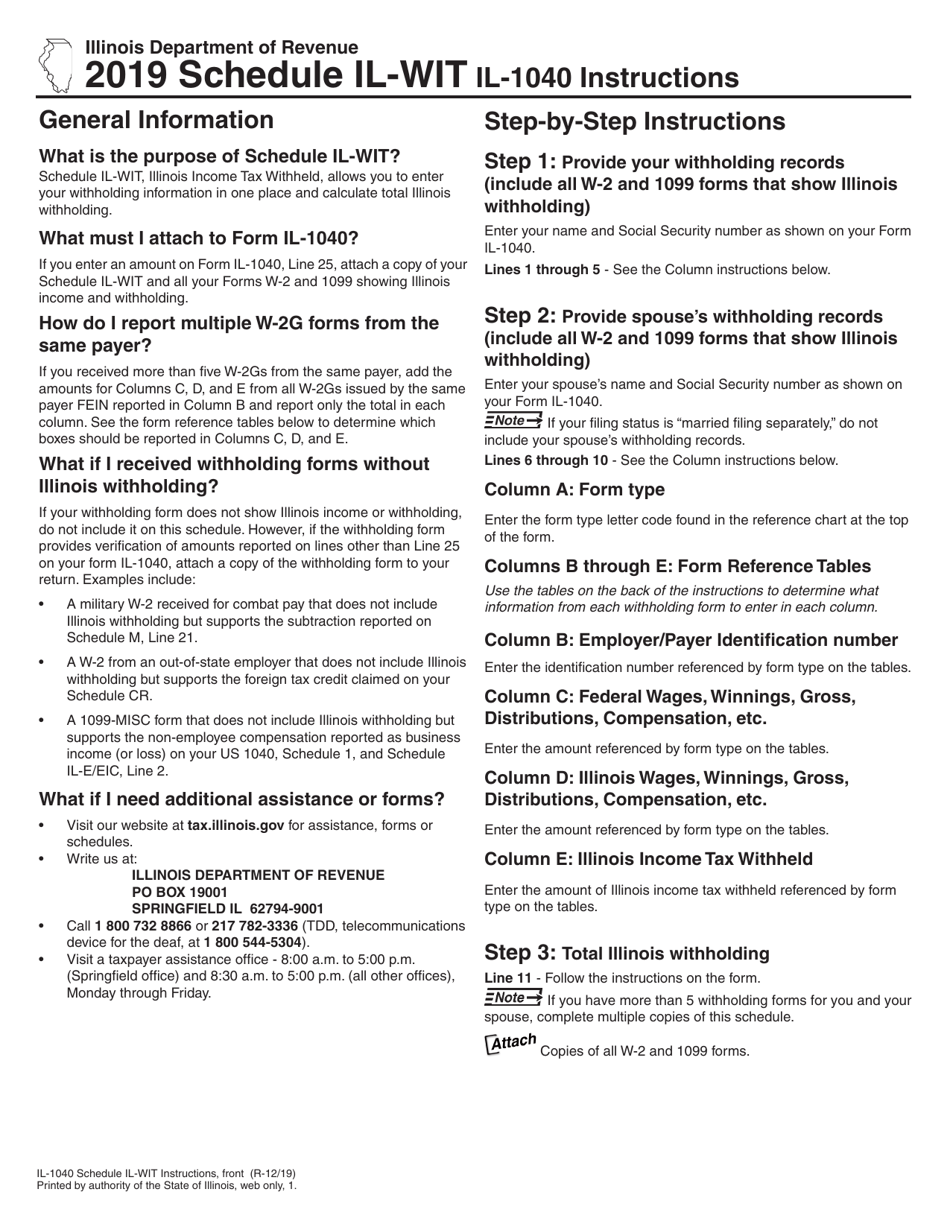

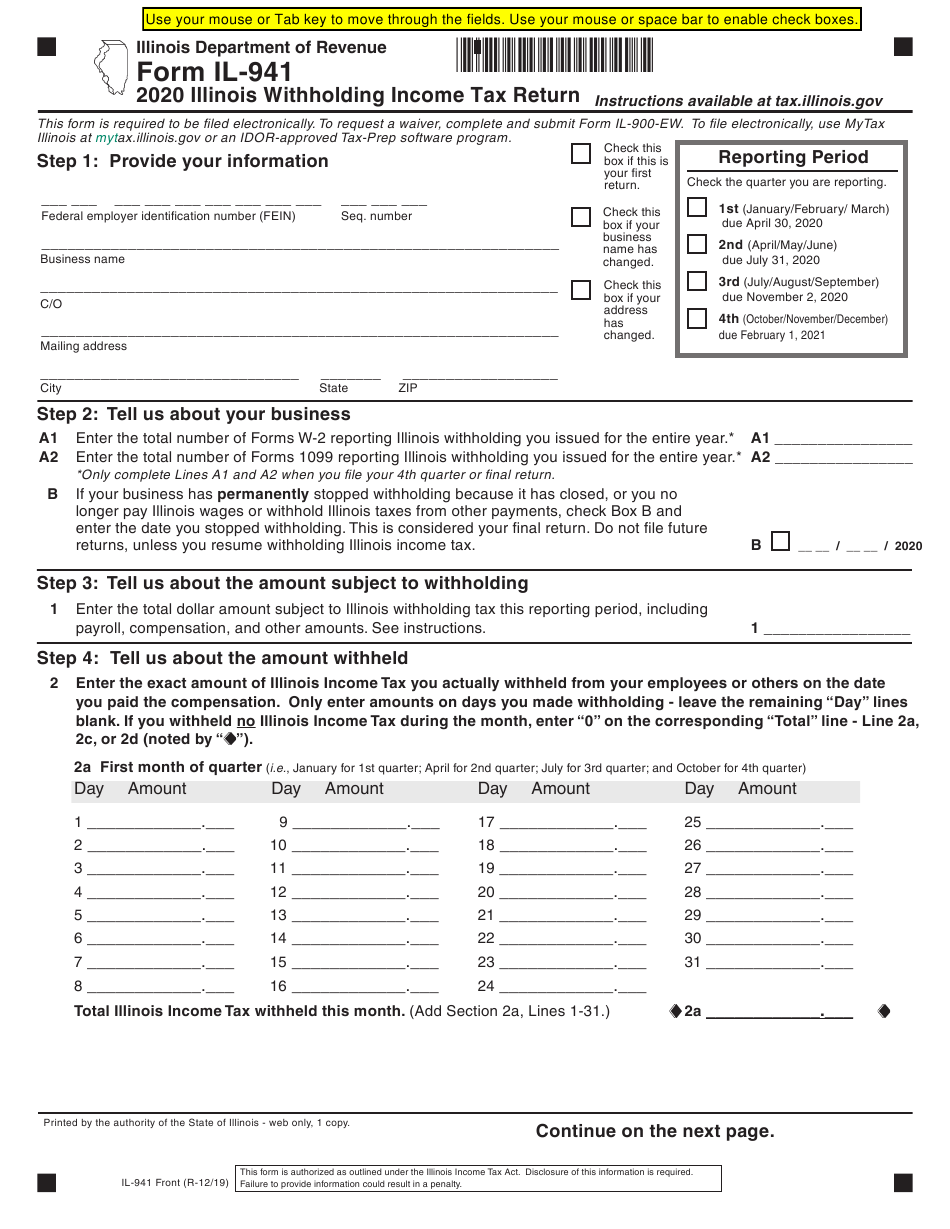

Individual income tax forms (source: This form is for income earned in tax year 2022, with tax returns due in april 2023. Provide your name, address, and social. If you enter an amount on form il. Here is a comprehensive list of illinois tax forms, along with instructions: Use the cross or check marks in the top toolbar to select. Web illinois income tax withheld. Here's how to fill out the il form: If you have more than five withholding forms, complete multiple copies of this schedule. The il form is required for individuals and businesses that have a tax liability in illinois.

Edit your il wit online type text, add images, blackout confidential details, add comments, highlights and more. We will update this page with a new version of the form for 2024 as. Use get form or simply click on the template preview to open it in the editor. If there is none nothing needs to be attached. This form is for income earned in tax year 2022, with tax returns due in april 2023. The il form is required for individuals and businesses that have a tax liability in illinois. 2023 estimated income tax payments for individuals. Web up to $40 cash back il form refers to the illinois department of revenue's tax return form. Provide your name, address, and social. This form is used by illinois residents who file an individual income tax return.

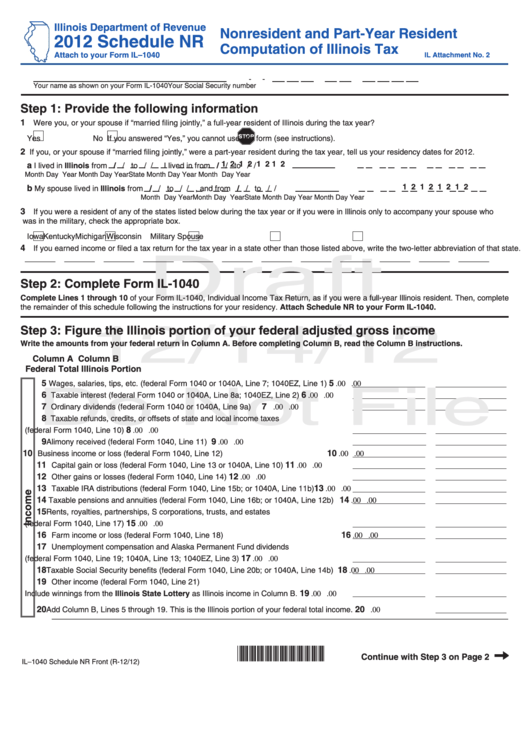

Illinois Tax Form 1040 Schedule Nr 2021 Tax Forms 1040 Printable

If there is none nothing needs to be attached. Complete, edit or print tax forms instantly. Here's how to fill out the il form: Provide your name, address, and social. This form is for income earned in tax year 2022, with tax returns due in april 2023.

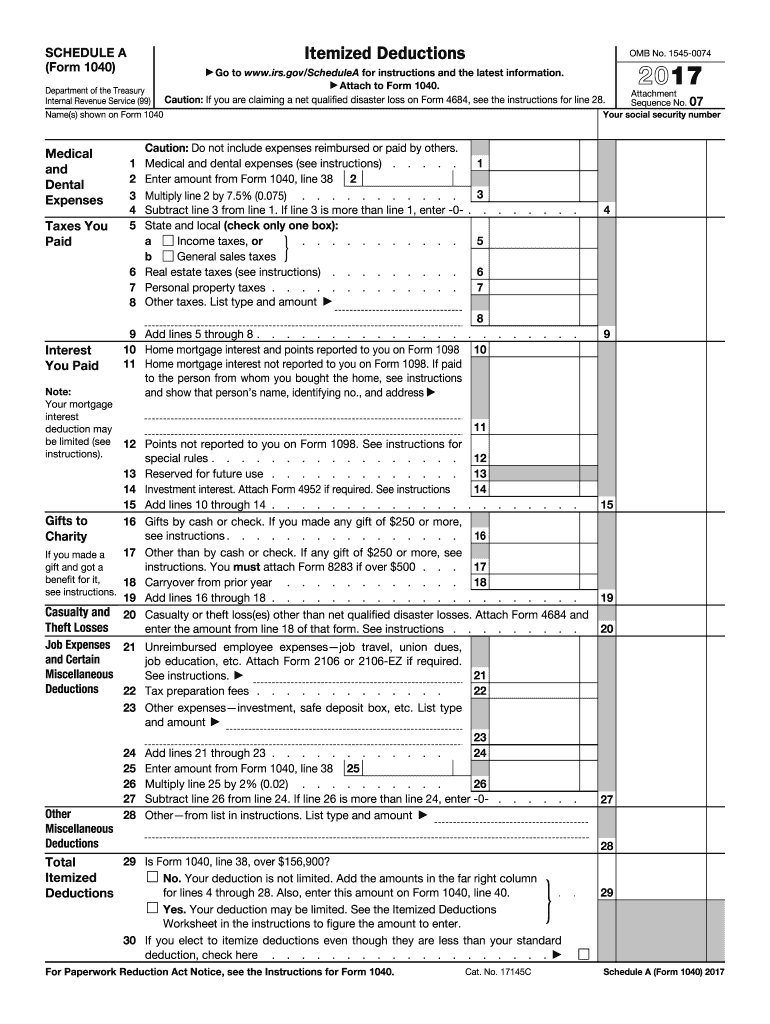

Schedule a Form Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. 2023 estimated income tax payments for individuals. If there is none nothing needs to be attached. Provide your name, address, and social. If you enter an amount on form il.

Schedule Il Wit Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april 2023. Get ready for tax season deadlines by completing any required tax forms today. Estimated income tax payments for individuals: Web the illinois department of revenue (dor) dec. If you enter an amount on form il.

Illinois with Holding Tax Return Wikiform Fill Out and Sign

Edit your il wit online type text, add images, blackout confidential details, add comments, highlights and more. This form is used by illinois residents who file an individual income tax return. The il form is required for individuals and businesses that have a tax liability in illinois. Web illinois income tax withheld. If you enter an amount on form il.

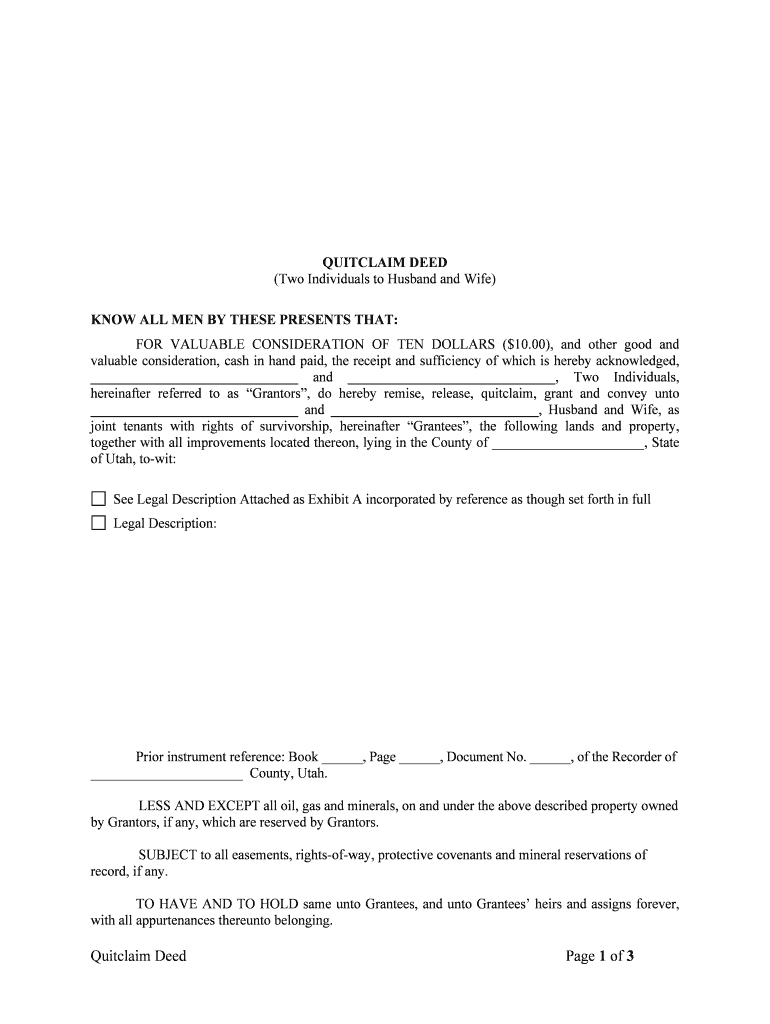

of Utah, to Wit Form Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. If you enter an amount on form il. If you have more than five withholding forms, complete multiple copies of this schedule. Web illinois income tax withheld. Here is a comprehensive list of illinois tax forms, along with instructions:

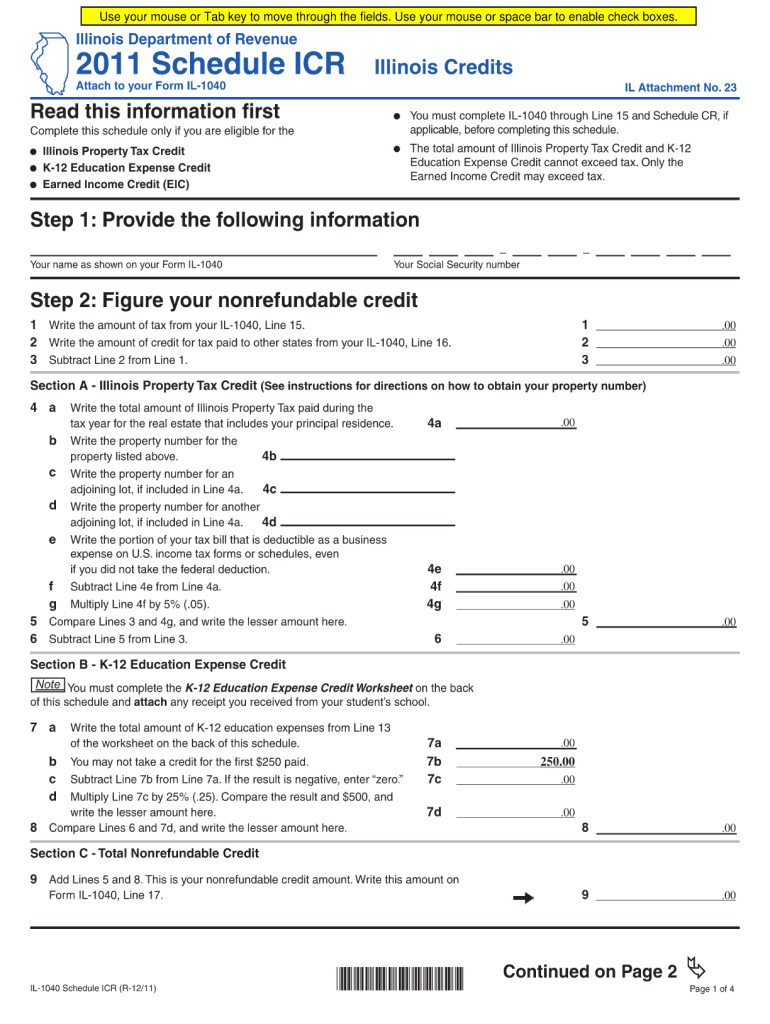

Schedule Icr Illinois 2018 Fill Online, Printable, Fillable, Blank

We will update this page with a new version of the form for 2024 as. Web the illinois department of revenue (dor) dec. Here's how to fill out the il form: If you enter an amount on form il. Individual income tax forms (source:

Eanes Isd Calendar 20222023 2023 Calendar

Use get form or simply click on the template preview to open it in the editor. Estimated income tax payments for individuals: Get ready for tax season deadlines by completing any required tax forms today. Edit your il wit online type text, add images, blackout confidential details, add comments, highlights and more. Use the cross or check marks in the.

Download Instructions for Form IL1040 Schedule ILWIT Illinois

If you have more than five withholding forms, complete multiple copies of this schedule. 2023 estimated income tax payments for individuals. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. This form is used by illinois residents who file an individual income tax return. Use the.

John Oliver Quote “I think puns are not just the lowest form of wit

Web the illinois department of revenue (dor) dec. Edit your il wit online type text, add images, blackout confidential details, add comments, highlights and more. If you have more than five withholding forms, complete multiple copies of this schedule. Use get form or simply click on the template preview to open it in the editor. Provide your name, address, and.

2021 Illinois Withholding Form 2022 W4 Form

If there is none nothing needs to be attached. This form is for income earned in tax year 2022, with tax returns due in april 2023. Here's how to fill out the il form: Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required.

Start Completing The Fillable Fields And Carefully Type In Required Information.

We will update this page with a new version of the form for 2024 as. Get ready for tax season deadlines by completing any required tax forms today. Here is a comprehensive list of illinois tax forms, along with instructions: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad.

Edit Your Il Wit Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Use the cross or check marks in the top toolbar to select. Individual income tax forms (source: Complete, edit or print tax forms instantly. The il form is required for individuals and businesses that have a tax liability in illinois.

If There Is None Nothing Needs To Be Attached.

Web the illinois department of revenue (dor) dec. This form is used by illinois residents who file an individual income tax return. Web illinois income tax withheld. If you enter an amount on form il.

Here's How To Fill Out The Il Form:

If you have more than five withholding forms, complete multiple copies of this schedule. Web up to $40 cash back il form refers to the illinois department of revenue's tax return form. This form is for income earned in tax year 2022, with tax returns due in april 2023. Estimated income tax payments for individuals: