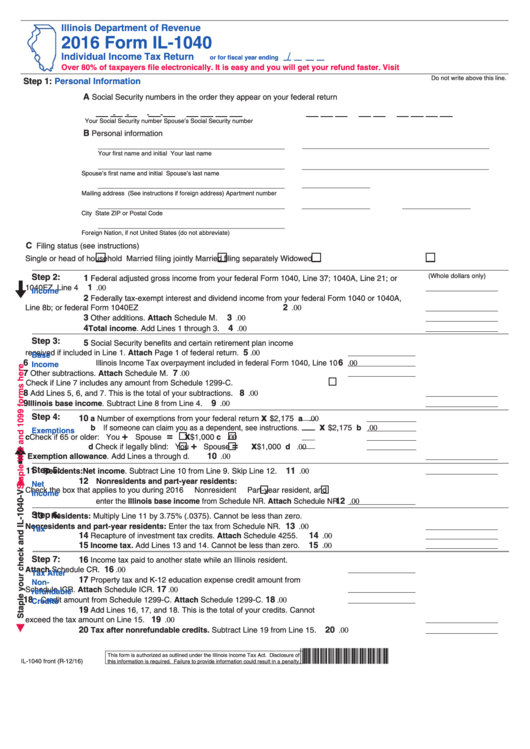

Il 1040 Tax Form

Il 1040 Tax Form - You were required to file a federal income tax return, or. Payment voucher for amended individual income tax. You were not required to file a federal income tax return, but your illinois. Request certain forms from idor. Illinois, irs late filing, tax payment penalties. This form is for income earned in tax year 2022, with tax returns due in april. For more information about the illinois. Complete lines 1 through 10. Income tax rate the illinois income tax rate is 4.95. If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of.

Payment voucher for amended individual income tax. This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. Income tax rate the illinois income tax rate is 4.95. Web illinois department of revenue. 2023 estimated income tax payments for individuals. Illinois, irs late filing, tax payment penalties. Go to service provided by department of revenue go to agency contact. Request certain forms from idor. Complete lines 1 through 10.

2023 estimated income tax payments for individuals. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april. Go to service provided by department of revenue go to agency contact. We last updated the individual income tax return in january 2023, so this is. Request certain forms from idor. Payment voucher for amended individual income tax. You were not required to file a federal income tax return, but your illinois. What if i need help? Income tax rate the illinois income tax rate is 4.95.

Form Il1040 Individual Tax Return 2016 printable pdf download

Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. Complete, edit or print tax forms instantly. Illinois, irs late filing, tax payment penalties. This form is for income earned in tax year 2022, with tax returns due in april..

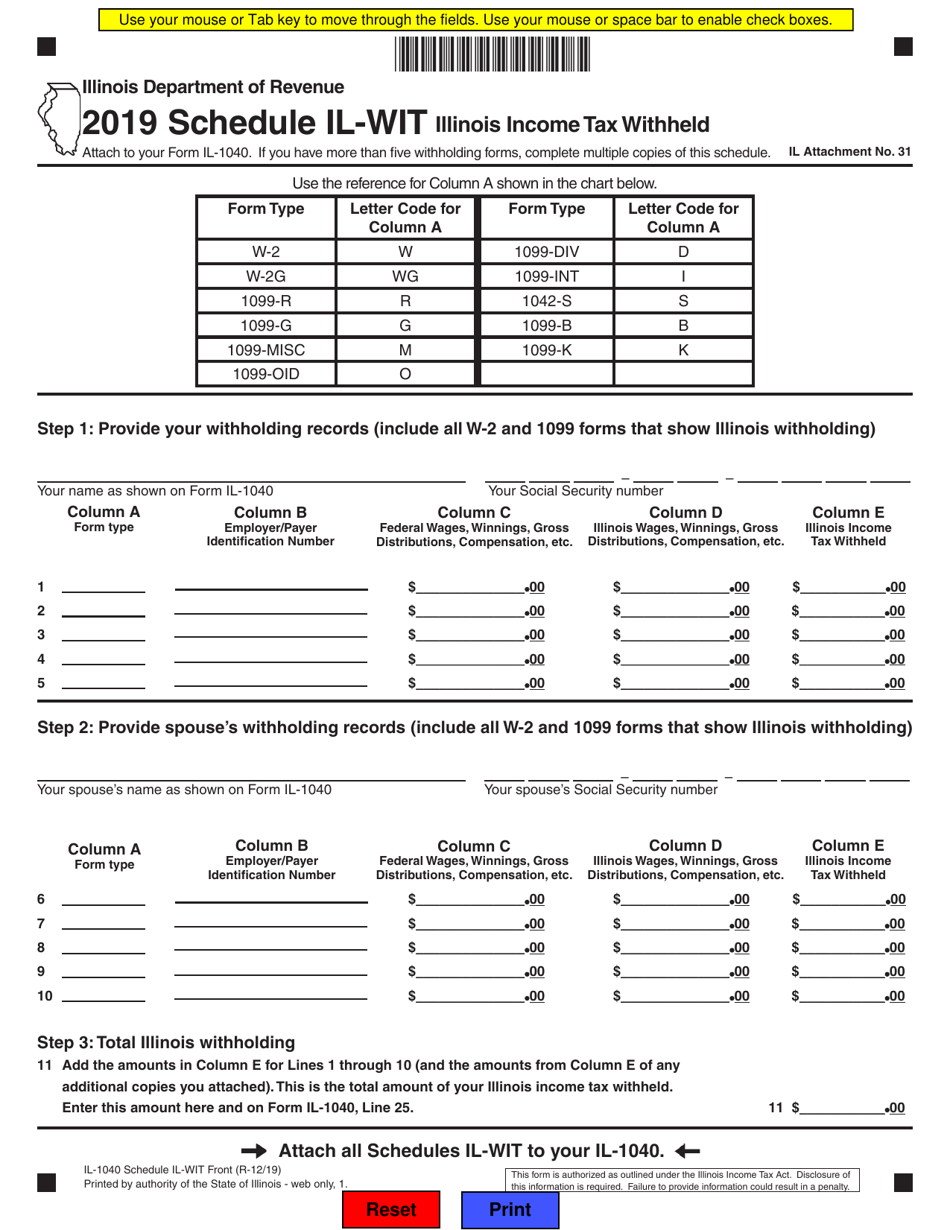

Form IL1040 Schedule ILWIT Download Fillable PDF or Fill Online

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. This form is for income earned in tax year 2022, with tax returns due in april. Income tax rate the illinois income tax rate is 4.95. You were not required to file a federal income tax return, but your illinois. For.

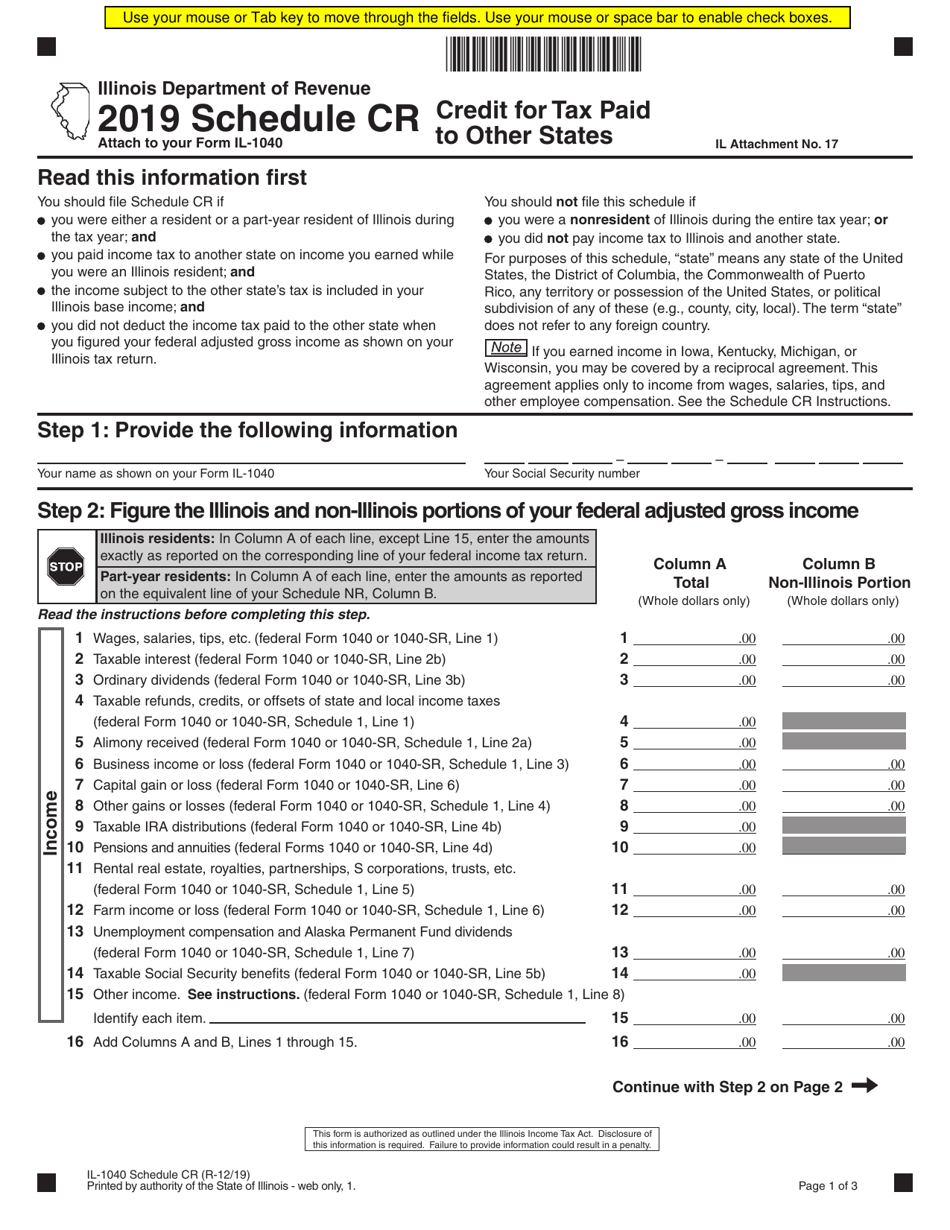

Form IL1040 Schedule CR Download Fillable PDF or Fill Online Credit

If you need help, call the illinois department of revenue at 1 800. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2023 estimated income tax payments for individuals. Complete, edit or print tax forms instantly. You were required to file a federal income tax return, or.

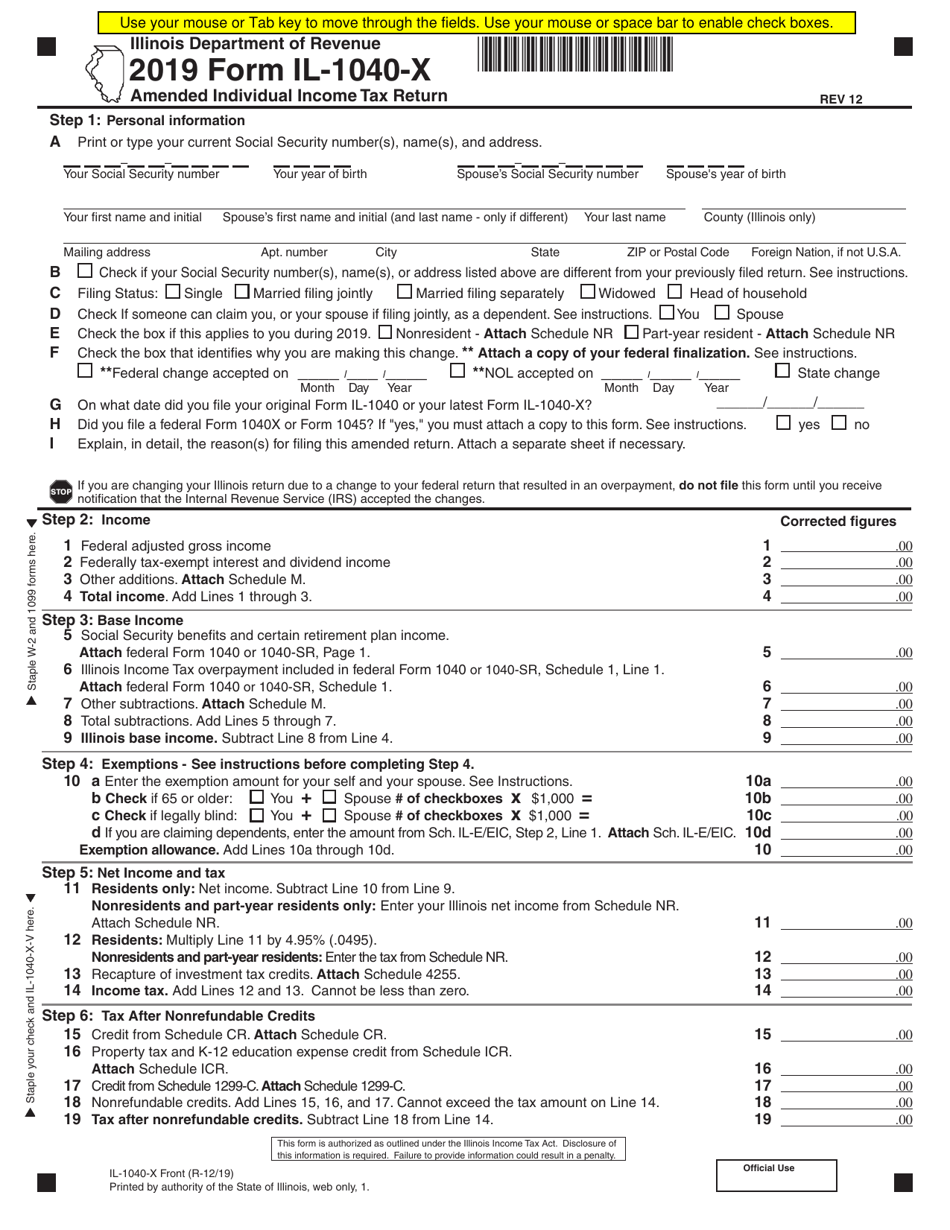

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

Complete, edit or print tax forms instantly. Payment voucher for amended individual income tax. Request certain forms from idor. Web illinois department of revenue. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and.

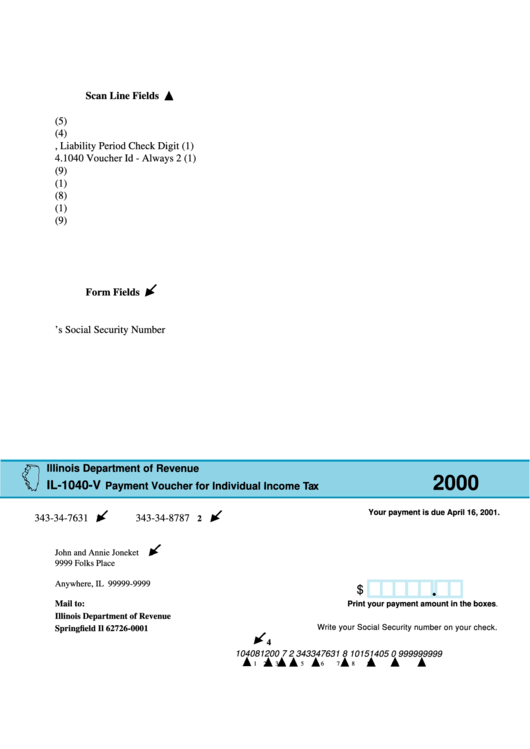

Form Il1040V Payment Voucher For Individual Tax Illinois

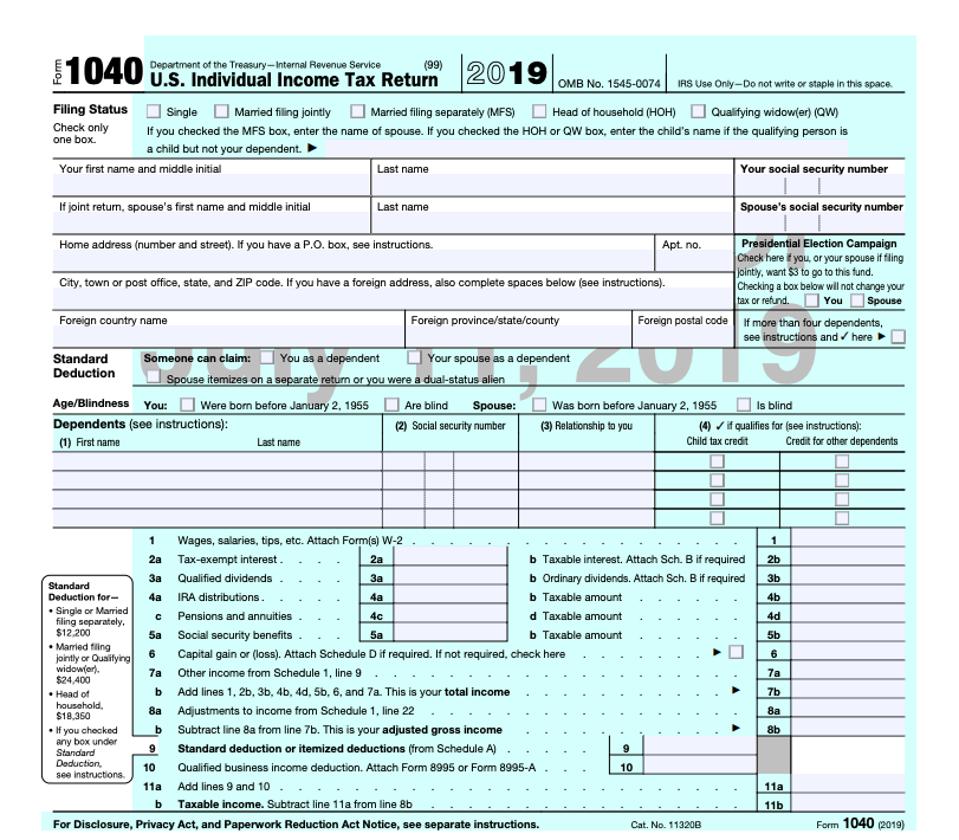

Complete lines 1 through 10. Income tax rate the illinois income tax rate is 4.95. Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving.

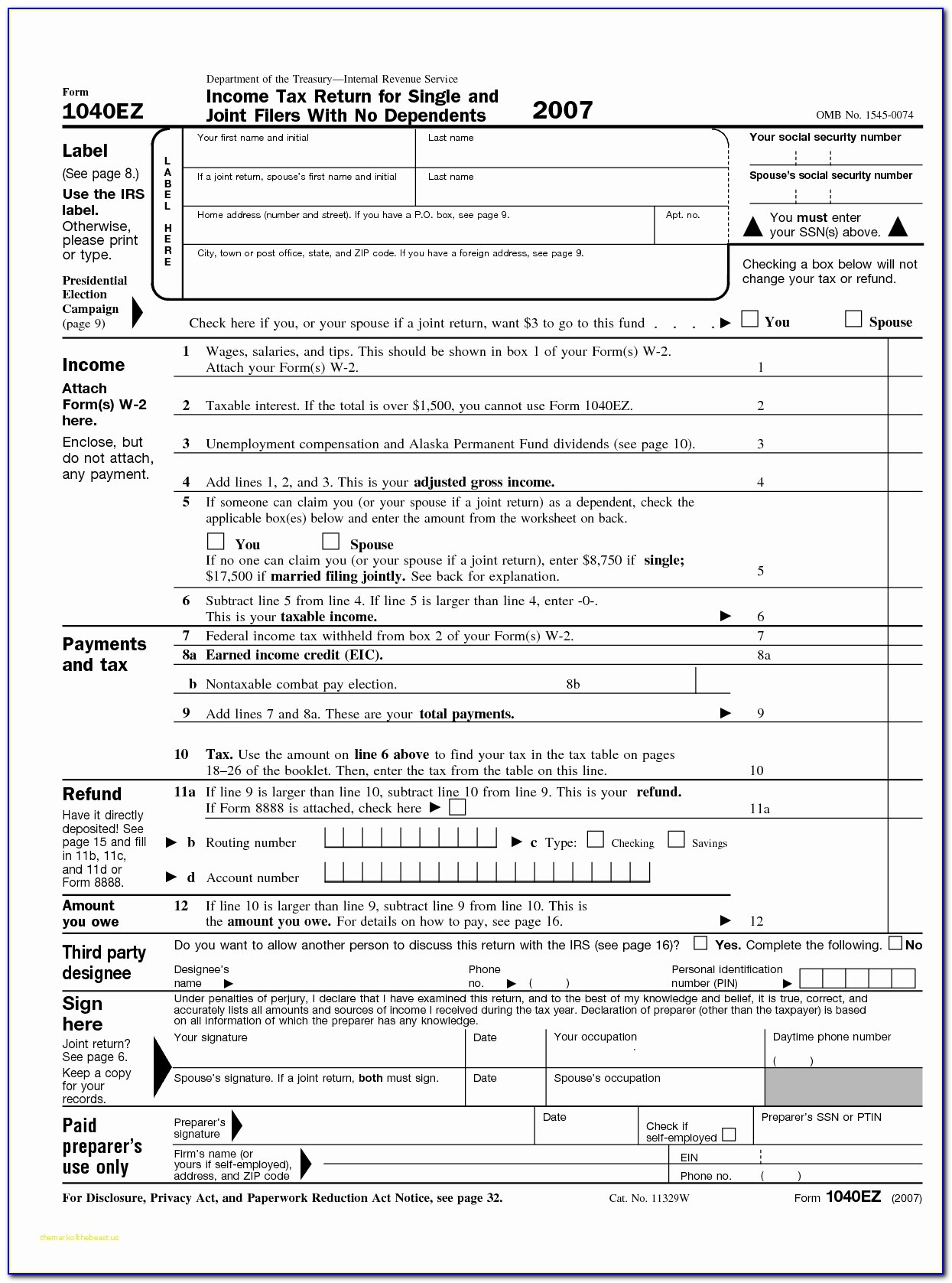

How Do You Get A 1040 Tax Form Tax Walls

This form is for income earned in tax year 2022, with tax returns due in april. Complete, edit or print tax forms instantly. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. Payment voucher for amended individual income tax. Illinois, irs.

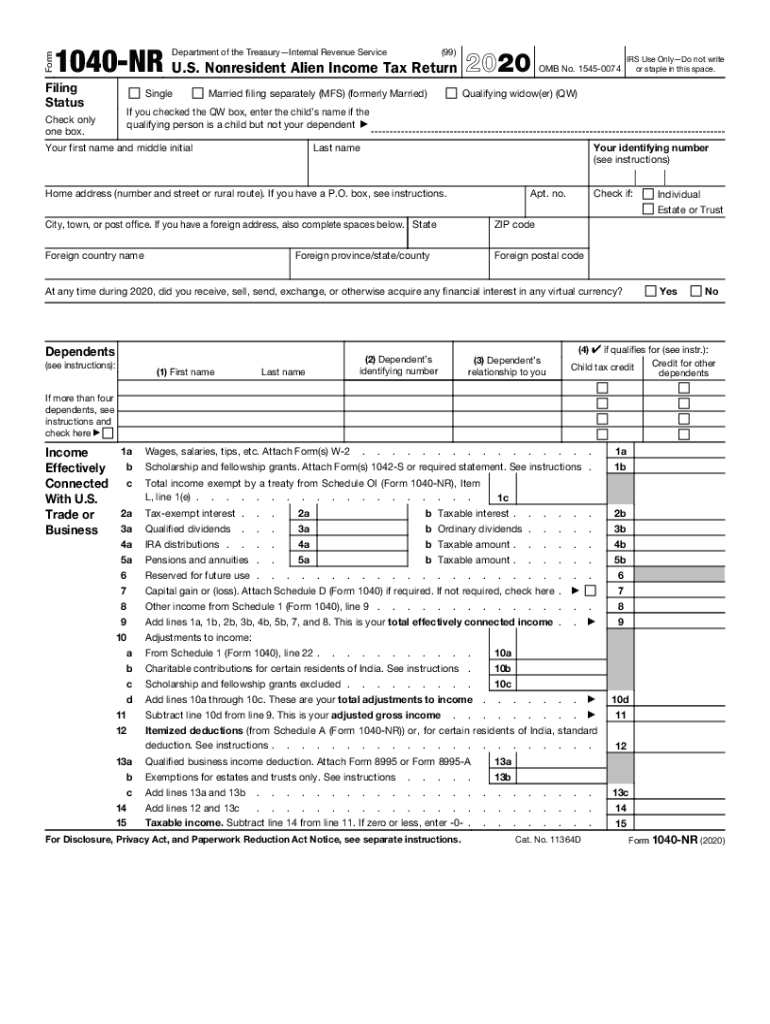

1040Nr Fill Out and Sign Printable PDF Template signNow

Payment voucher for amended individual income tax. Request certain forms from idor. Go to service provided by department of revenue go to agency contact. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your. You were not required to file a federal.

Free Printable Irs Tax Forms Printable Form 2022

If you need help, call the illinois department of revenue at 1 800. Go to service provided by department of revenue go to agency contact. We last updated the individual income tax return in january 2023, so this is. Payment voucher for amended individual income tax. Use this form for payments that are due on april 18, 2023, june 15,.

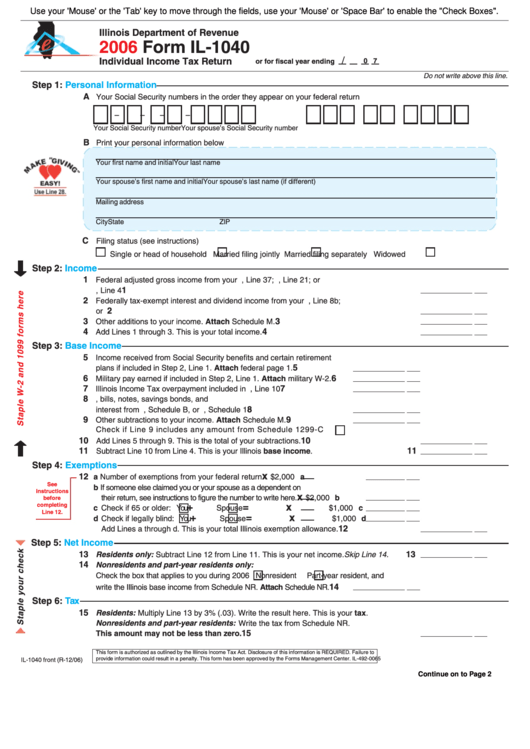

Fillable Form Il1040 Individual Tax Return 2006 printable

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. You were not required to file a federal income tax return, but your illinois. Request certain forms from idor. You were required to file a federal income tax return, or. We last updated the individual income tax return in january 2023,.

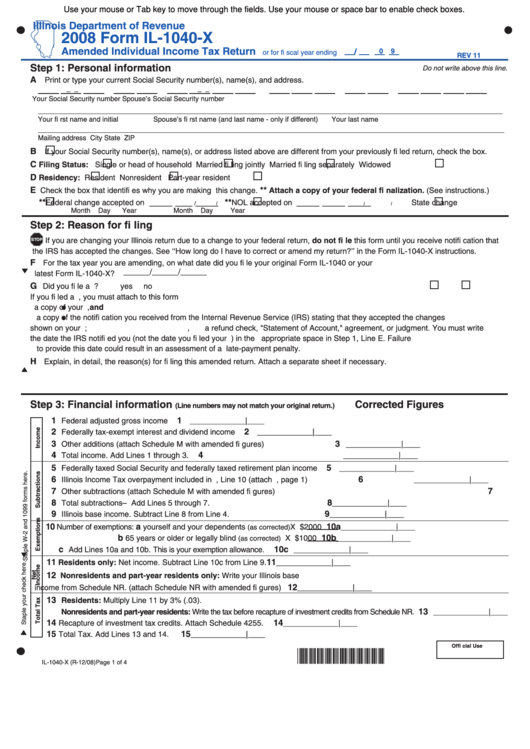

Fillable Form Il1040X Amended Individual Tax Return 2008

Complete lines 1 through 10. You were not required to file a federal income tax return, but your illinois. Payment voucher for amended individual income tax. You were required to file a federal income tax return, or. 2023 estimated income tax payments for individuals.

Use This Form For Payments That Are Due On April 18, 2023, June 15, 2023, September 15, 2023, And.

Options on how to best pay your il income taxes. Illinois, irs late filing, tax payment penalties. If you need help, call the illinois department of revenue at 1 800. You were required to file a federal income tax return, or.

What If I Need Help?

Web illinois income tax forms illinois printable income tax forms 76 pdfs illinois has a flat state income tax of 4.95% , which is administered by the illinois department of. Complete lines 1 through 10. Income tax rate the illinois income tax rate is 4.95. Payment voucher for amended individual income tax.

Web Illinois Department Of Revenue.

For more information about the illinois. Complete, edit or print tax forms instantly. 2023 estimated income tax payments for individuals. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

You were not required to file a federal income tax return, but your illinois. If you filed a joint federal income tax return and are filing a separate illinois return, include in column a only your share of. Request certain forms from idor. Go to service provided by department of revenue go to agency contact.