Ifta 2290 Form

Ifta 2290 Form - Guaranteed stamped schedule 1 or money back Web schedule 1 (form 2290) heavy vehicle use tax international fuel tax agreement (ifta) you can open a new ifta account, renew your account, and gain access as a third party. Have a total gross weight of more than 55,000 pounds operate on public. Report california ifta fuel tax online with expressifta. We help you file form 2290 quick. #1 irs 2290 efile provider. Figure and pay the tax due on highway motor vehicles used during the period with a. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach. Do your truck tax online & have it efiled to the irs! Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period.

It is a fee that the irs requires all. Web schedule 1 (form 2290) heavy vehicle use tax international fuel tax agreement (ifta) you can open a new ifta account, renew your account, and gain access as a third party. Ad get your schedule 1 now. The federal excise tax form 2290 also known as heavy vehicle use tax (hvut) is due for new vehicles that were first used or began operations in june. Web the irs form 2290 or heavy vehicle use tax is a federal tax on commercial vehicles that: Web why efile 2290 with ez2290. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. Ifta renewal instructions registration for 2023 is now open get instructions for. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022, through june 30, 2023, were not subject to the tax for that period except for any.

Ifta renewal instructions registration for 2023 is now open get instructions for. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022, through june 30, 2023, were not subject to the tax for that period except for any. Web about form 2290, heavy highway vehicle use tax return. #1 choice for fleets & drivers. File your hvut 2290 with 2290heavytax.com. Figure and pay the tax due on highway motor vehicles used during the period with a. File your 2290 online & get schedule 1 in minutes. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach. Do your truck tax online & have it efiled to the irs! Easy, fast, secure & free to try.

We Need To Talk About 4th Quarter IFTA Rate Changes Blog

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Receive your stamped schedule 1 in just. The federal excise tax form 2290 also known as heavy vehicle use tax (hvut) is due for new vehicles that were first used or began operations in june. #1 choice for.

Prioritize efiling for tax forms 2290, 720 & IFTA, due January 31

Guaranteed stamped schedule 1 or money back Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins july 1, 2023, and ends june 30,. Web schedule 1 (form 2290) heavy vehicle use tax international fuel tax agreement (ifta) you can open a new ifta.

All You Need To Know About The 4th Quarter IFTA Deadline Blog

Ifta renewal instructions registration for 2023 is now open get instructions for. File your 2290 online & get schedule 1 in minutes. Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. #1 choice for fleets & drivers. Have a total gross weight of more than 55,000 pounds operate on public.

Form 2290 / 720 / IFTA filings are Due TODAY, July 31. Efile Now

Web about form 2290, heavy highway vehicle use tax return. #1 irs 2290 efile provider. Web heavy vehicle use tac 2290 (hvut) unified carrier registration (ucr) contact us international registration plan (irp) The current period begins july 1, 2023, and ends june 30,. Guaranteed stamped schedule 1 or money back

EFile Now as the Deadline is around the corner for Form 2290, Q4 Form

Report california ifta fuel tax online with expressifta. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web the form 2290 or hvut (heavy vehicle use tax) is an annual tax that is filed with the irs to report, figure and pay taxes due (if applicable) on.

Form 2290 & IFTA Are Due By July 31st! Log onto

Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. Web the form 2290 or hvut (heavy vehicle use tax) is an annual tax that is filed with the irs to report, figure and pay taxes due (if applicable) on vehicles with a taxable gross weight. #1 choice for fleets & drivers. The current period.

Form 2290 Renewal for TY 2020 & IFTA for Q2 of 2020 Due Now!! Tax

#1 irs 2290 efile provider. It is a fee that the irs requires all. Web heavy vehicle use tac 2290 (hvut) unified carrier registration (ucr) contact us international registration plan (irp) Ad stop wasting 3 days every quarter gathering your receipts and filing your ifta reports. Web irs form 2290 is what is used by the government to collect what.

1st Quarter 2022 IFTA Reporting Everything You Need to Know! Blog

Ifta renewal instructions registration for 2023 is now open get instructions for. Receive your stamped schedule 1 in just. Web the irs form 2290 or heavy vehicle use tax is a federal tax on commercial vehicles that: Easy, fast, secure & free to try. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99).

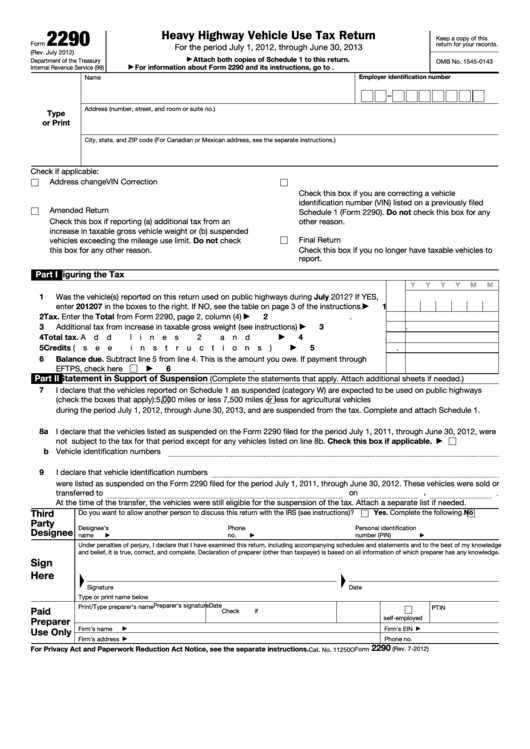

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Web why efile 2290 with ez2290. Web about form 2290, heavy highway vehicle use tax return. The current period begins july 1, 2023, and ends june 30,. Web irs form 2290 is what is used by the government to collect what is referred to as the heavy vehicle use tax or hvut tax. We help you file form 2290 quick.

HVUT Form 2290 and 1st Qtr IFTA are due April 30, 2021 Tax 2290 Blog

The federal excise tax form 2290 also known as heavy vehicle use tax (hvut) is due for new vehicles that were first used or began operations in june. We help you file form 2290 quick. It is a fee that the irs requires all. Web the irs form 2290 or heavy vehicle use tax is a federal tax on commercial.

#1 Irs 2290 Efile Provider.

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Web about form 2290, heavy highway vehicle use tax return. Ad get your schedule 1 now. Ifta renewal instructions registration for 2023 is now open get instructions for.

Web Schedule An Appointment Due To Staffing Limitations Your Transactions May Take Longer Than Normal.

Web schedule 1 (form 2290) heavy vehicle use tax international fuel tax agreement (ifta) you can open a new ifta account, renew your account, and gain access as a third party. Web the irs form 2290 or heavy vehicle use tax is a federal tax on commercial vehicles that: Easy, fast, secure & free to try. It is a fee that the irs requires all.

Web I Declare That The Vehicles Listed As Suspended On The Form 2290 Filed For The Period July 1, 2022, Through June 30, 2023, Were Not Subject To The Tax For That Period Except For Any.

Web irs form 2290 is what is used by the government to collect what is referred to as the heavy vehicle use tax or hvut tax. Have a total gross weight of more than 55,000 pounds operate on public. The federal excise tax form 2290 also known as heavy vehicle use tax (hvut) is due for new vehicles that were first used or began operations in june. Receive your stamped schedule 1 in just.

Ad Stop Wasting 3 Days Every Quarter Gathering Your Receipts And Filing Your Ifta Reports.

Web the form 2290 or hvut (heavy vehicle use tax) is an annual tax that is filed with the irs to report, figure and pay taxes due (if applicable) on vehicles with a taxable gross weight. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach. Figure and pay the tax due on highway motor vehicles used during the period with a. Do your truck tax online & have it efiled to the irs!