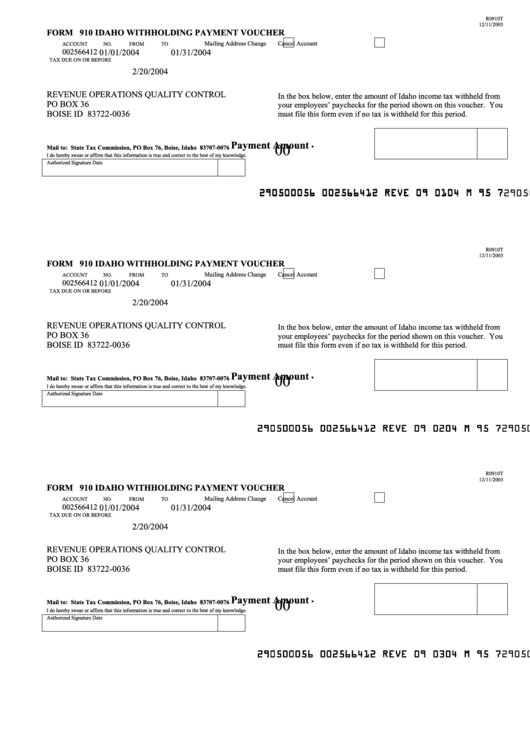

Idaho Form 910

Idaho Form 910 - They also have the option to pay the taxes withheld. Web complete idaho form 910 online with us legal forms. Individual income tax forms (current) individual. Web complete idaho 910 form online with us legal forms. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state payroll tax. Save or instantly send your ready documents. Cookies are required to use this site. Web the idaho state tax commission jan. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other participants via a shareable link. Complete, edit or print tax forms instantly.

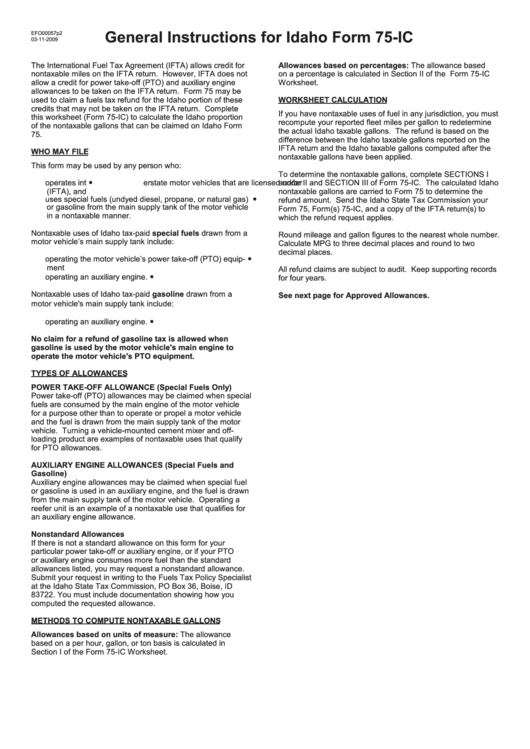

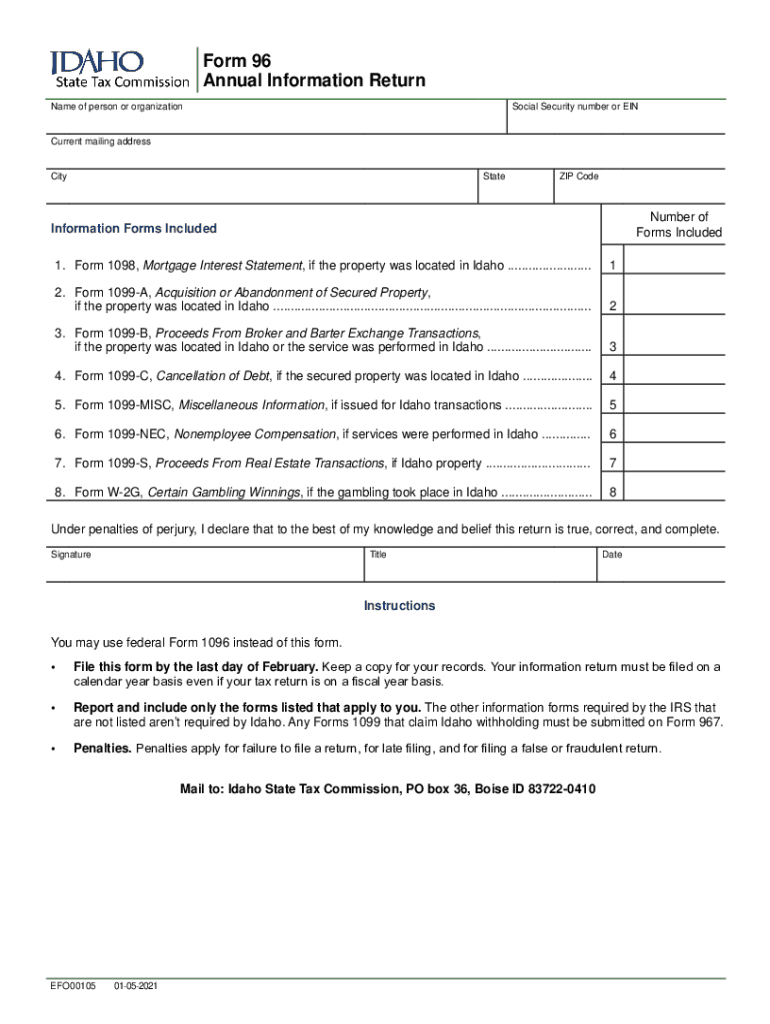

Individual income tax forms (current) individual. Cookies are required to use this site. If you’re an employee, your employer probably withholds. Download or email id form 96 & more fillable forms, register and subscribe now! Fuels taxes and fees forms. Employers are required by idaho law to withhold income tax from their employees’ wages. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web farmers not required to file with the idaho department of labor can pay the taxes withheld on a yearly basis using form 910. Easily fill out pdf blank, edit, and sign them.

If you’re an employee, your employer probably withholds. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or with a form. Download or email id form 96 & more fillable forms, register and subscribe now! Web complete idaho 910 form online with us legal forms. Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Be sure to verify that the form you are. Web edit your form 910 idaho online. Withholdi ng form 910 (semimonthly filers) read more about withholding. Web complete idaho form 910 online with us legal forms.

Form 910 Idaho Withholding Payment Voucher 2004 printable pdf download

Web farmers not required to file with the idaho department of labor can pay the taxes withheld on a yearly basis using form 910. Get ready for tax season deadlines by completing any required tax forms today. Web the idaho state tax commission jan. If you’re an employee, your employer probably withholds. Web complete idaho form 910 online with us.

General Instructions For Idaho Form 75Ic printable pdf download

Use get form or simply click on the template preview to open it in the editor. Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks. In the amount field on form 910*, enter the amount of idaho income tax you withheld for this period. Employers are required by idaho law to withhold income tax.

Form I910 Edit, Fill, Sign Online Handypdf

If you’re an employee, your employer probably withholds. Save or instantly send your ready documents. Cookies are required to use this site. Web idaho tax forms for 2022 and 2023. Web you may obtain the following forms at unemployment insurance tax.

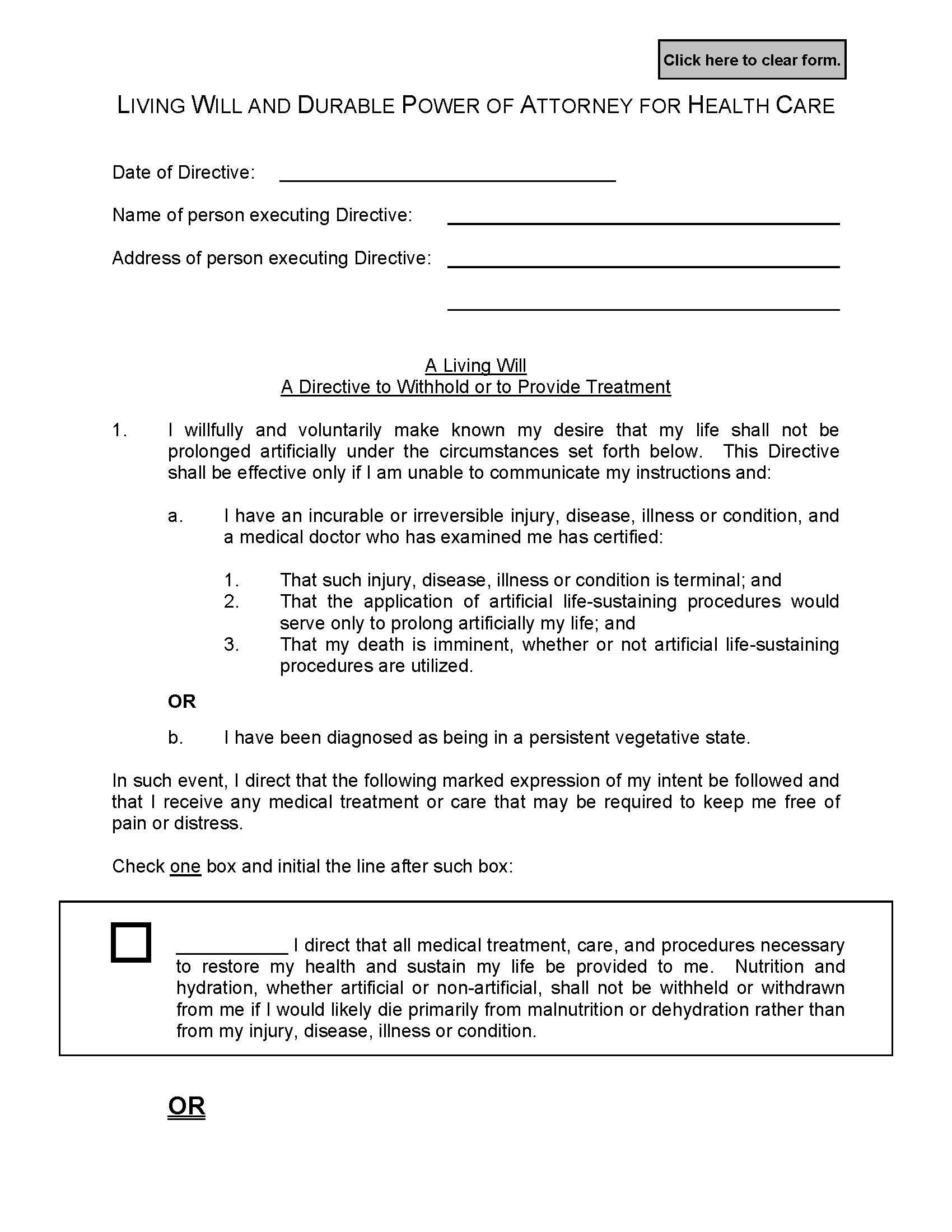

Idaho Living Will Form Fillable PDF Free Printable Legal Forms

Complete, edit or print tax forms instantly. Web complete idaho 910 form online with us legal forms. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other participants via a shareable link. Easily fill out pdf blank, edit, and sign them. Be sure to verify that the form you are.

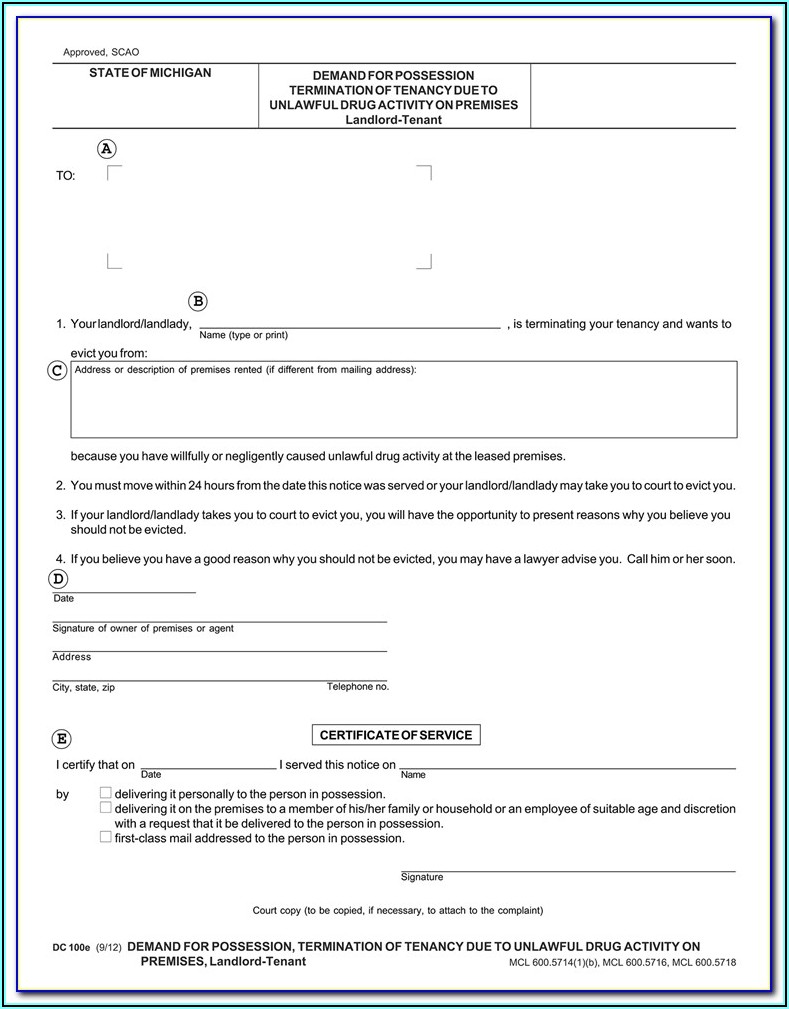

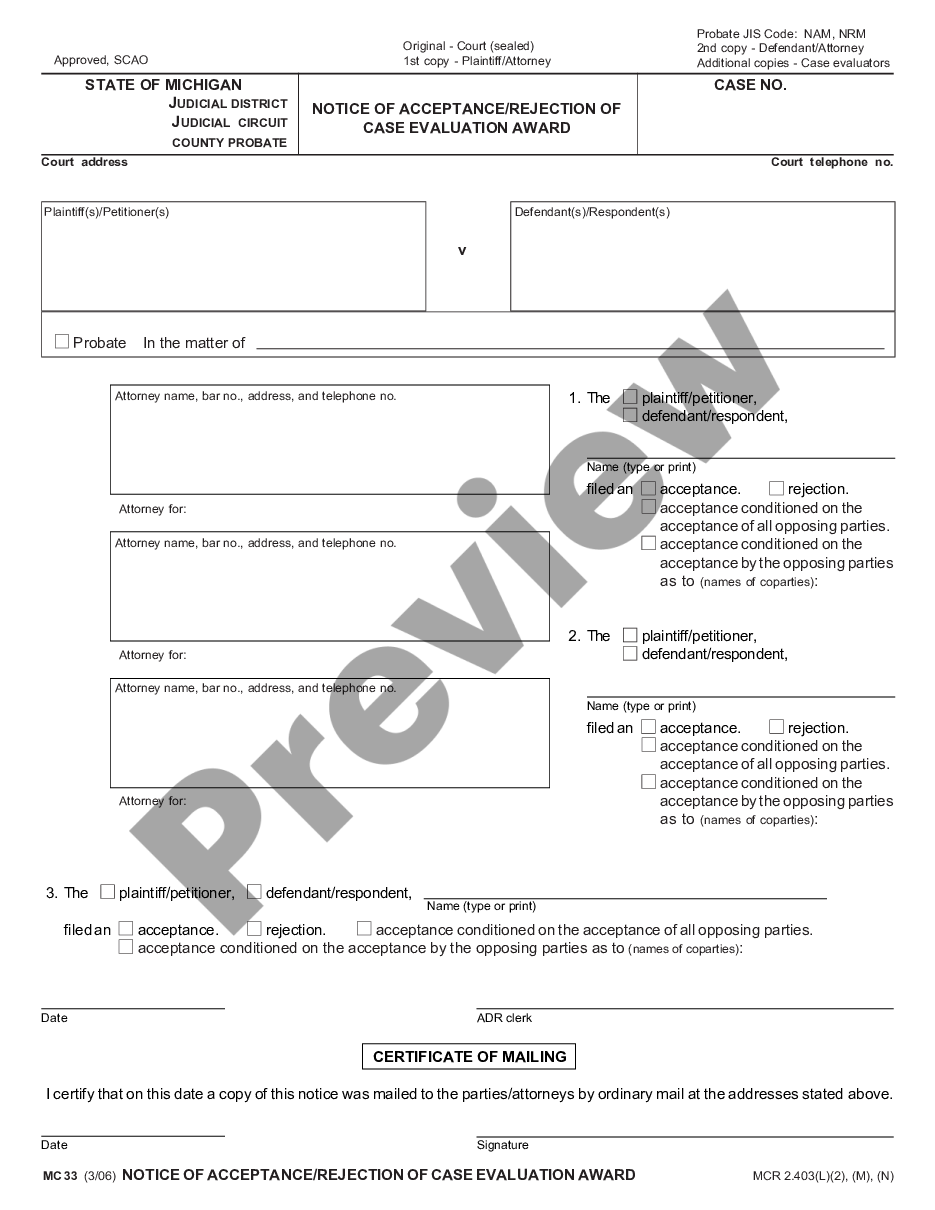

Idaho Probate Forms Form Resume Examples l6YN7yy5V3

Web you may obtain the following forms at unemployment insurance tax. Form 910, withholding payment voucher state income withholdings and is filed with payment based on the filing. Download or email id form 96 & more fillable forms, register and subscribe now! Web complete idaho 910 form online with us legal forms. Easily fill out pdf blank, edit, and sign.

Name Change Idaho Withholding Form US Legal Forms

Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web the idaho state tax commission jan. Web edit your form 910 idaho online. Cookies are required to use this site.

Idaho Incorporation & Registered Agent IncParadise

If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or with a form. Sign it in a few clicks. Type text, add images, blackout confidential details, add comments, highlights and more. Web business income tax forms (archive) cigarette taxes forms. Individual income tax forms (current) individual.

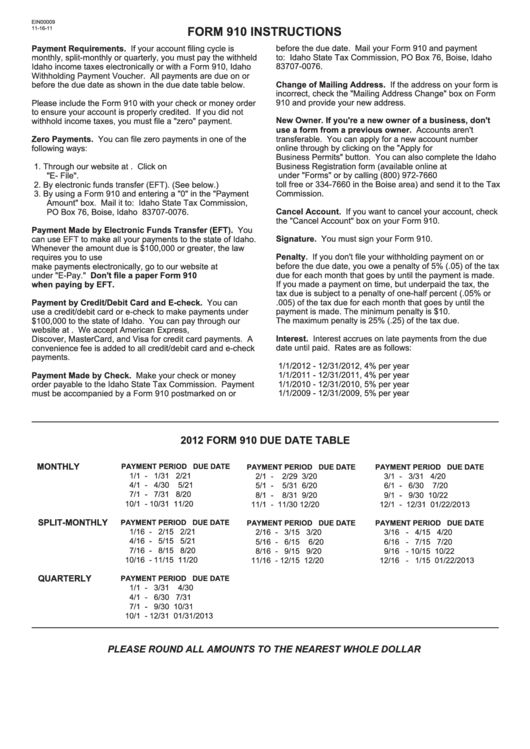

Instructions For Form 910 Idaho Withholding Payment Voucher 2012

Get ready for tax season deadlines by completing any required tax forms today. Download or email id form 96 & more fillable forms, register and subscribe now! Web you may obtain the following forms at unemployment insurance tax. Web what you need to know about reporting and paying unemployment insurance tax. Withholdi ng form 910 (semimonthly filers) read more about.

Idaho form 910 Fill out & sign online DocHub

Enter “0” in the amount field if you have no. Download or email id form 96 & more fillable forms, register and subscribe now! Employers are required by idaho law to withhold income tax from their employees’ wages. Individual income tax forms (current) individual. Sign it in a few clicks.

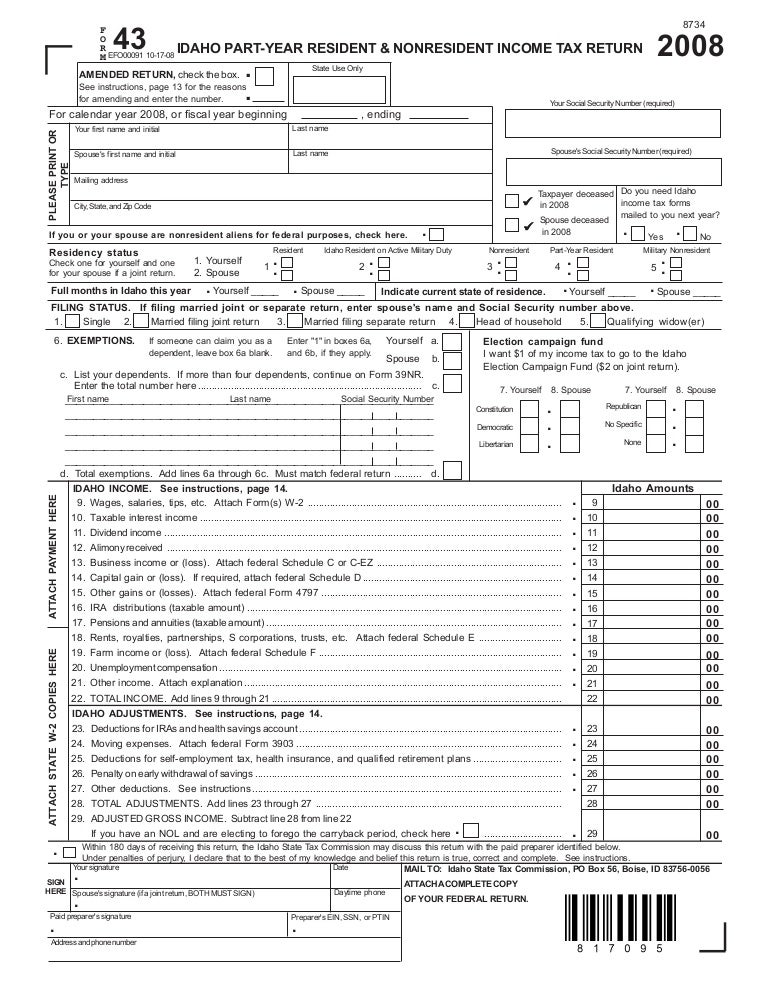

tax.idaho.gov EFO00091_10172008

Information you need to file a quarterly unemployment insurance tax report. Complete, edit or print tax forms instantly. Web you may obtain the following forms at unemployment insurance tax. If you’re an employee, your employer probably withholds. Draw your signature, type it,.

Download Or Email Id Form 96 & More Fillable Forms, Register And Subscribe Now!

In the amount field on form 910*, enter the amount of idaho income tax you withheld for this period. Form 910, withholding payment voucher state income withholdings and is filed with payment based on the filing. Save or instantly send your ready documents. Web you may obtain the following forms at unemployment insurance tax.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web business income tax forms (archive) cigarette taxes forms. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state payroll tax. Withholdi ng form 910 (semimonthly filers) read more about withholding. If you’re an employee, your employer probably withholds.

They Also Have The Option To Pay The Taxes Withheld.

Type text, add images, blackout confidential details, add comments, highlights and more. Information you need to file a quarterly unemployment insurance tax report. Individual income tax forms (current) individual. Fuels taxes and fees forms.

Download Your Adjusted Document, Export It To The Cloud, Print It From The Editor, Or Share It With Other Participants Via A Shareable Link.

Use get form or simply click on the template preview to open it in the editor. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or with a form. Web what you need to know about reporting and paying unemployment insurance tax. Enter “0” in the amount field if you have no.