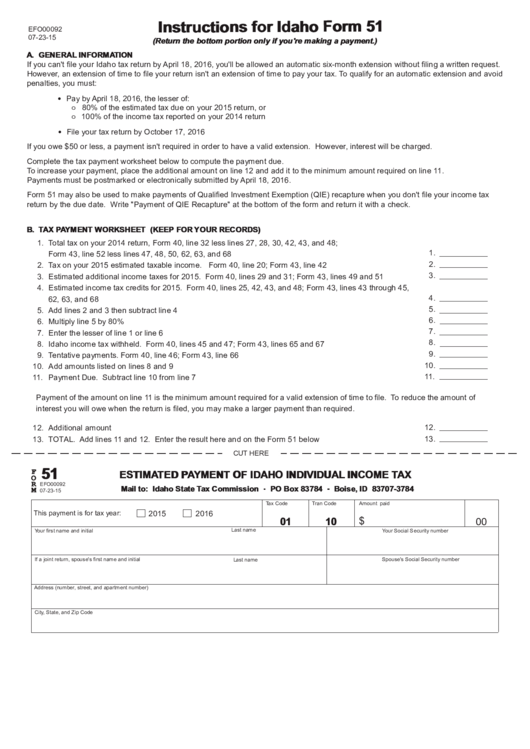

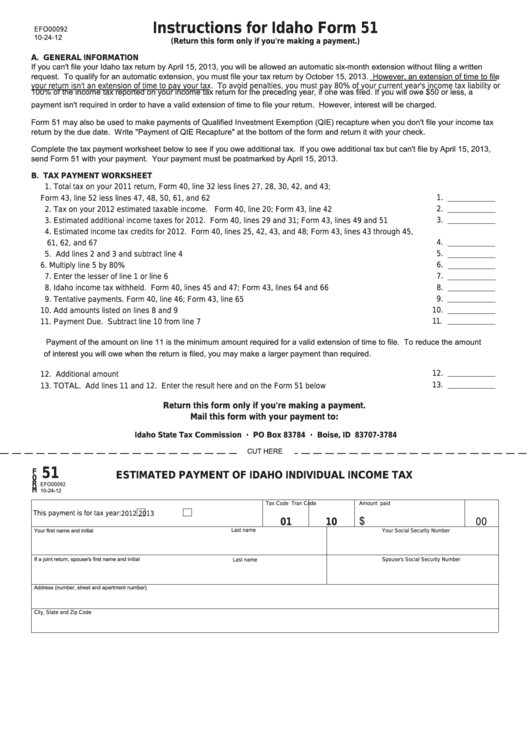

Idaho Form 51

Idaho Form 51 - Web we last updated idaho form 51 in february 2023 from the idaho state tax commission. If you qualify for an extension to file your idaho return,. Web instructions for idaho form 51 a. Instructions for idaho form 51. Business income tax forms (current) business income tax forms. If you’re unsure whether you owe idaho tax or you want to calculate. Web you can find form 51 at tax.idaho.gov. Mail form 51 with your check or money order. Mail form 51 with your check or money order. Web printable idaho income tax form 51.

Instructions for idaho form 51. Web by signing this form, i certify that the statements i made on this form are true and correct. Mail form 51 with your check or money order. Mail form 51 with your check or money order. If a multistate corporation’s only activity. To make a payment and avoid a penalty, do one of the following: Each corporation included in a group return and required to file is subject to the $20 minimum tax. If you’re unsure whether you owe idaho tax or you want to calculate. Idaho, irs late filing, tax payment penalties. Web estimated payment of idaho individual income tax.

Options on how to best pay your id income taxes. Web to avoid a penalty, pay online at tax.idaho.gov/epay or mail your payment with form 51 by april 18, 2022. Mail form 51 with your check or money order. If you qualify for an extension to file your idaho return,. To make a payment and avoid a filing penalty, do one of the following: Web estimated payment of idaho individual income tax. Web you can find form 51 at tax.idaho.gov. Web form 51 — voucher estimated payment of individual income tax general information. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment.

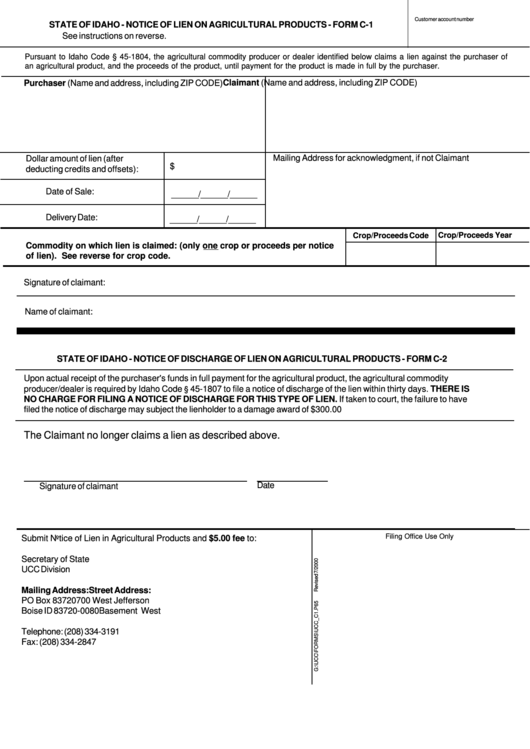

Form C1 Notice Of Lien On Agricultural Products Secretary Of State

Idaho, irs late filing, tax payment penalties. Web printable idaho income tax form 51. I know that submitting false information can result in criminal and civil. Options on how to best pay your id income taxes. Web by signing this form, i certify that the statements i made on this form are true and correct.

1+ Idaho POLST Form Free Download

Instructions for idaho form 51. Mail form 51 with your check or money order. Web printable idaho income tax form 51. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Mail form 51 with your check or money order.

1+ Idaho Offer to Purchase Real Estate Form Free Download

Web estimated payment of idaho individual income tax. Idaho, irs late filing, tax payment penalties. To make a payment and avoid a filing penalty, do one of the following: Web the amount must be a minimum of $20. To make a payment and avoid a filing penalty, do one of the following:

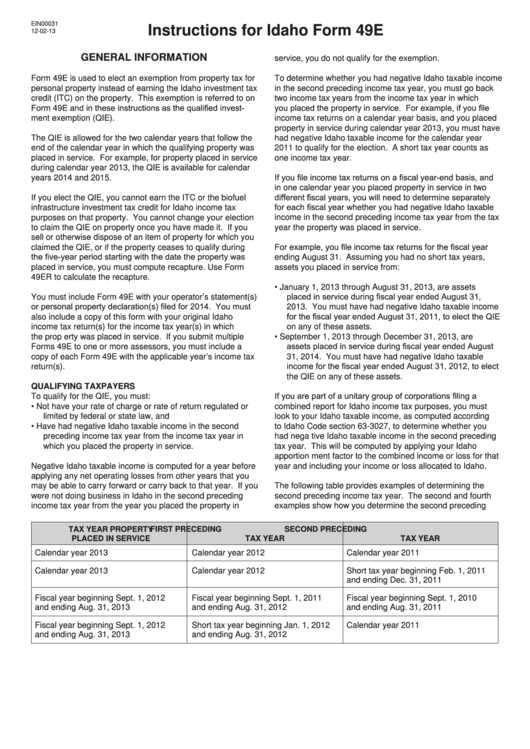

Instructions For Idaho Form 49e Idaho Election To Claim The Qualified

Mail form 51 with your check or money order. Web the amount must be a minimum of $20. If a multistate corporation’s only activity. Web to avoid a penalty, pay online at tax.idaho.gov/epay or mail your payment with form 51 by april 18, 2022. Web estimated payment of idaho individual income tax.

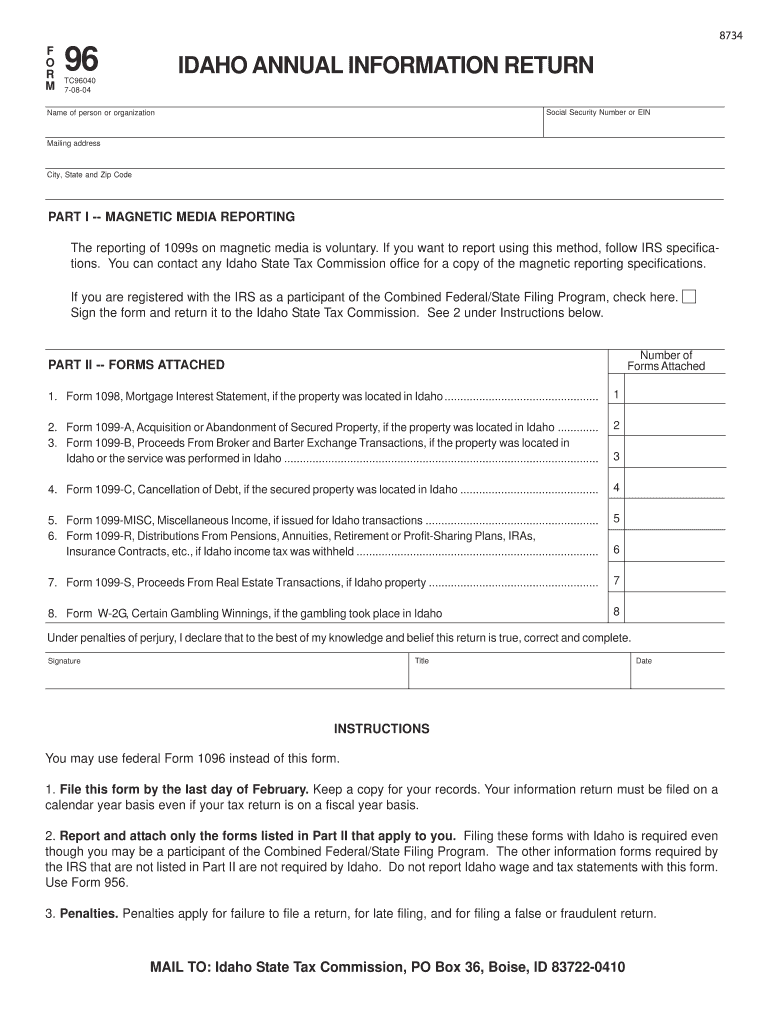

Idaho Form 96 Fill Out and Sign Printable PDF Template signNow

Web we last updated idaho form 51 in february 2023 from the idaho state tax commission. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web form 51 can be used to make payments.

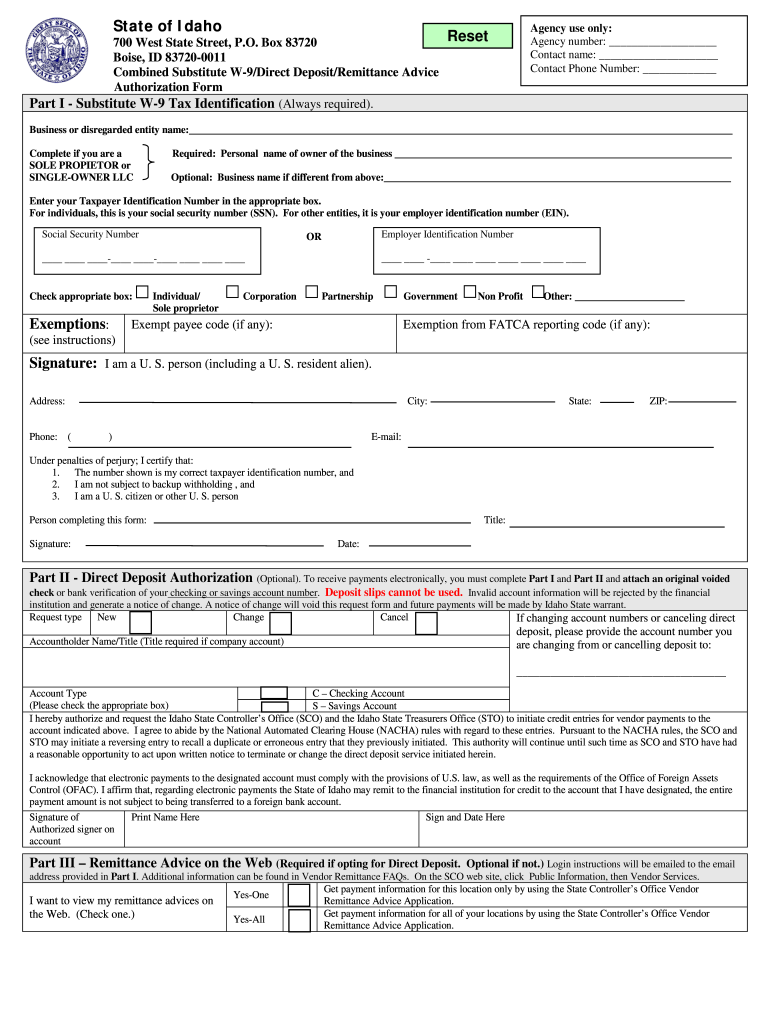

Idaho W9 Form Fill Out and Sign Printable PDF Template signNow

Web form 51 can be used to make payments of qualified investment exemption (qie) recapture when you don't file your income tax return by the due date. This form is for income earned in tax year 2022, with tax returns due in april 2023. Mail form 51 with your check or money order. I know that submitting false information can.

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

To make a payment and avoid a filing penalty, do one of the following: Web you can find form 51 at tax.idaho.gov. Web we last updated idaho form 51 in february 2023 from the idaho state tax commission. Web instructions for idaho form 51. Go to billing > bills & payments > payment methods.

Fillable Form 51 Estimated Payment Of Idaho Individual Tax

Mail form 51 with your check or money order. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Go to billing > bills & payments > payment methods. If you can’t file your idaho tax return by april 15, 2020, you’ll be allowed an automatic six..

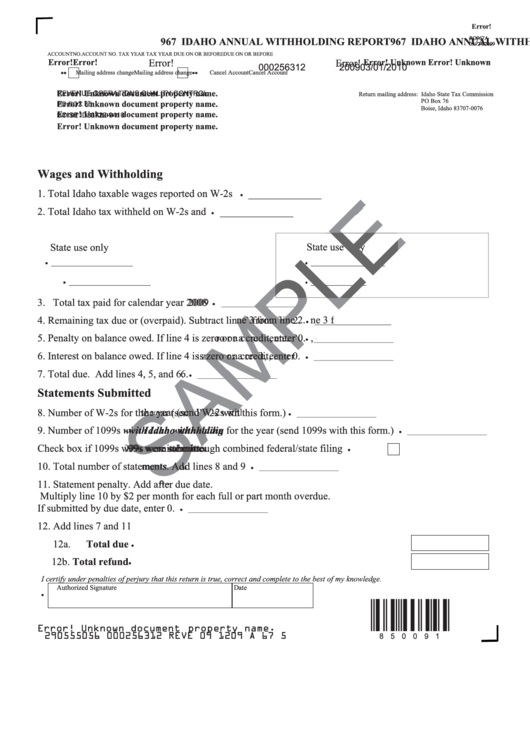

Form Ro967a 967 Idaho Annual Withholding Report 2009 printable pdf

Instructions for idaho form 51. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year on. Web printable idaho income tax form 51. Web you.

Web By Signing This Form, I Certify That The Statements I Made On This Form Are True And Correct.

Web to avoid a penalty, pay online at tax.idaho.gov/epay or mail your payment with form 51 by april 18, 2022. Web you can find form 51 at tax.idaho.gov. To make a payment and avoid a filing penalty, do one of the following: If a multistate corporation’s only activity.

Idaho, Irs Late Filing, Tax Payment Penalties.

To make a payment and avoid a filing penalty, do one of the following: Web form 51 can be used to make payments of qualified investment exemption (qie) recapture when you don't file your income tax return by the due date. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. To make a payment and avoid a penalty, do one of the following:

Web Use Idaho Form 51 (Estimated Payment Of Idaho Individual Income Tax) To Make A State Extension Payment.

Web instructions for idaho form 51. Web how to pay income taxes. If you are self employed and do not have tax withholding deducted from your salary you can file an estimated income tax. Mail form 51 with your check or money order.

Go To Billing > Bills & Payments > Payment Methods.

Web estimated payment of idaho individual income tax. If you’re unsure whether you owe idaho tax or you want to calculate. Each corporation included in a group return and required to file is subject to the $20 minimum tax. Select add a payment method.