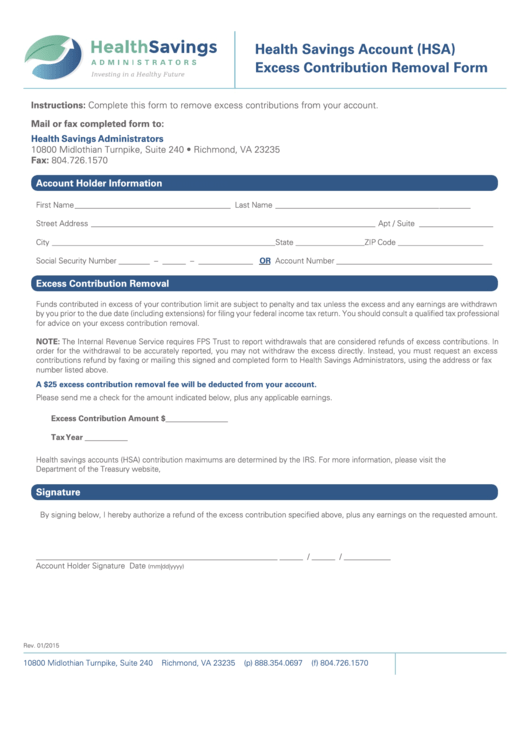

Hsa Excess Contribution Removal Form

Hsa Excess Contribution Removal Form - Web if you go over hsa contribution limits for the year, that money is considered an excess contribution — we break down how to handle them. This form is required by the irs to properly report an excess contribution removal. (refund of money that was deposited in. The form is located under the tools & support section and can be. Distributions of excess hsa or archer msa contributions. Web funds will be returned via check to the address on file for your hsa. Web health savings account excess contribution removal form. Web all you have to do is fill out the excess contribution form found on the hsa central consumer portal. Web apply my excess contribution as my current year’s contribution. Web download the hsa contribution form from the member website:

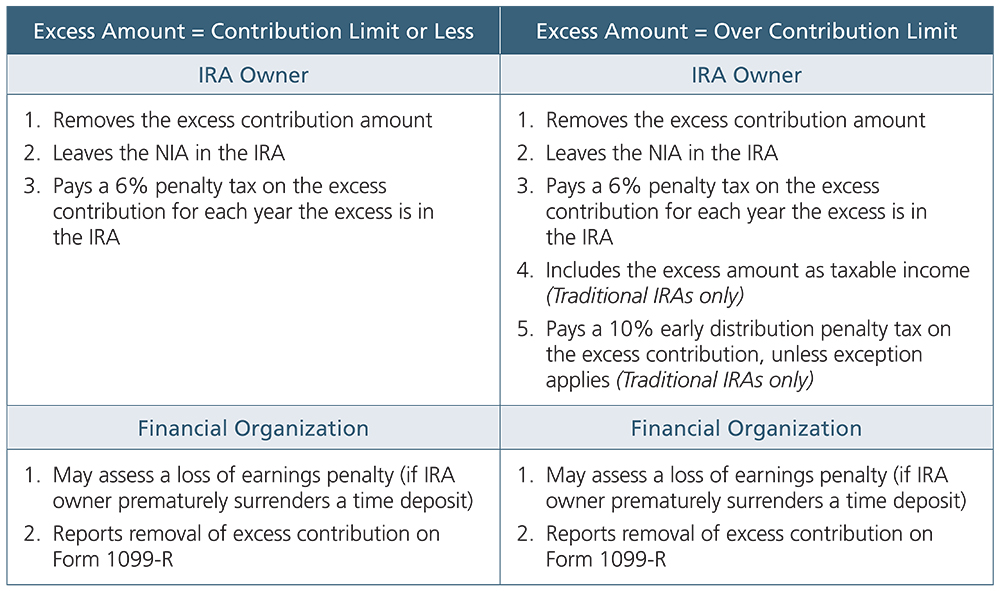

Web up to 8% cash back sign in to your account online to download the health savings account (hsa) excess contribution removal form to request an excess contribution refund or a. Web up to 8% cash back excess excess contribution contribution and and deposit deposit correction correction request request form form be sure to consult a tax advisor before. Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Web use form 8889 to: Web up to 8% cash back health savings account (hsa) excess contribution removal form form instructions: Generally, you must pay a 6% excise tax on excess. Web apply my excess contribution as my current year’s contribution. Distributions of excess hsa or archer msa contributions. Select “tools & support” > “account support & forms.” complete and mail the form along with a check. Complete this form to request.

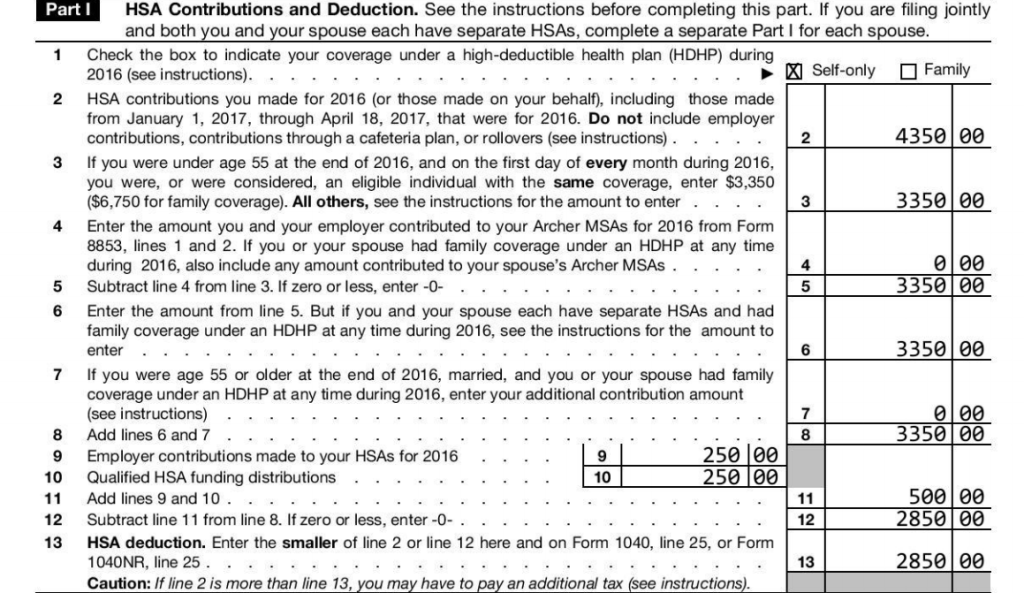

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Distributions of excess hsa or archer msa contributions. Web funds will be returned via check to the address on file for your hsa. Web health savings account excess contribution removal form. Web up to 8% cash back excess excess contribution contribution and and deposit deposit correction correction request request form form be sure to consult a tax advisor before. Web treasury regulations provide the requirements for calculating nia, but an excess removal form, such as the ascensus® ira or hsa excess removal. Web all you have to do is fill out the excess contribution form found on the hsa central consumer portal. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web apply my excess contribution as my current year’s contribution.

Health Savings Account (Hsa) Excess Contribution Removal Form printable

Please choose one of the following: Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web excess removal form remove funds that exceed your annual contribution limit. Web treasury regulations provide the requirements for calculating nia, but an excess removal form,.

The Deadline For Correcting IRA Excesses Has Passed—Now What? — Ascensus

Return of excess contribution — fidelity health savings account (hsa) use this form to request a return of an excess contribution. Complete this form to request. Web to remove excess contributions, complete the hsa distribution request form, indicating excess contribution removal as the reason for the distribution request. Hsa contribution maximums are determined by the irs and are no longer.

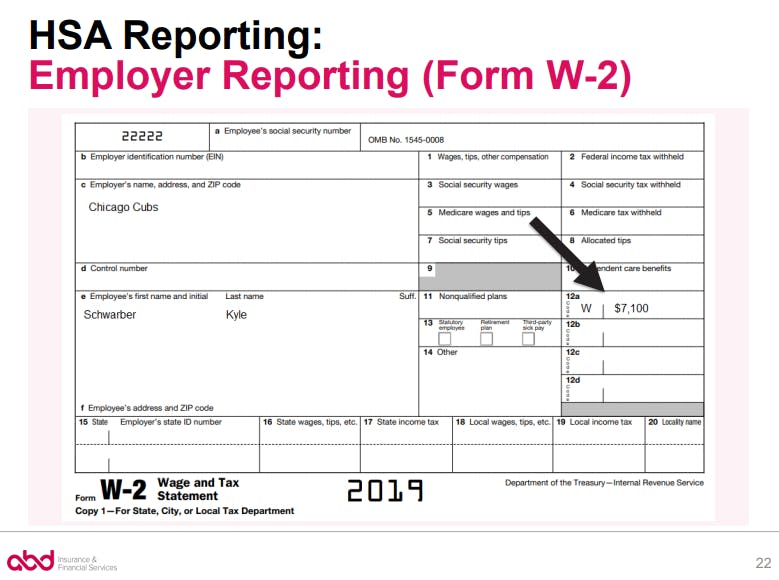

HSA Form W2 Reporting

Distributions of excess hsa or archer msa contributions. Web if you go over hsa contribution limits for the year, that money is considered an excess contribution — we break down how to handle them. Web however, if you want to avoid the unnecessary expenditure, mail your completed excess contribution removal form to your hsa plan administrator. Web to remove excess.

HSA Excess Contributions? We have the answers Lively

Complete this form to request. Distributions of excess hsa or archer msa contributions. Web to remove excess contributions, complete the hsa distribution request form, indicating excess contribution removal as the reason for the distribution request. Generally, you must pay a 6% excise tax on excess. The form is located under the tools & support section and can be.

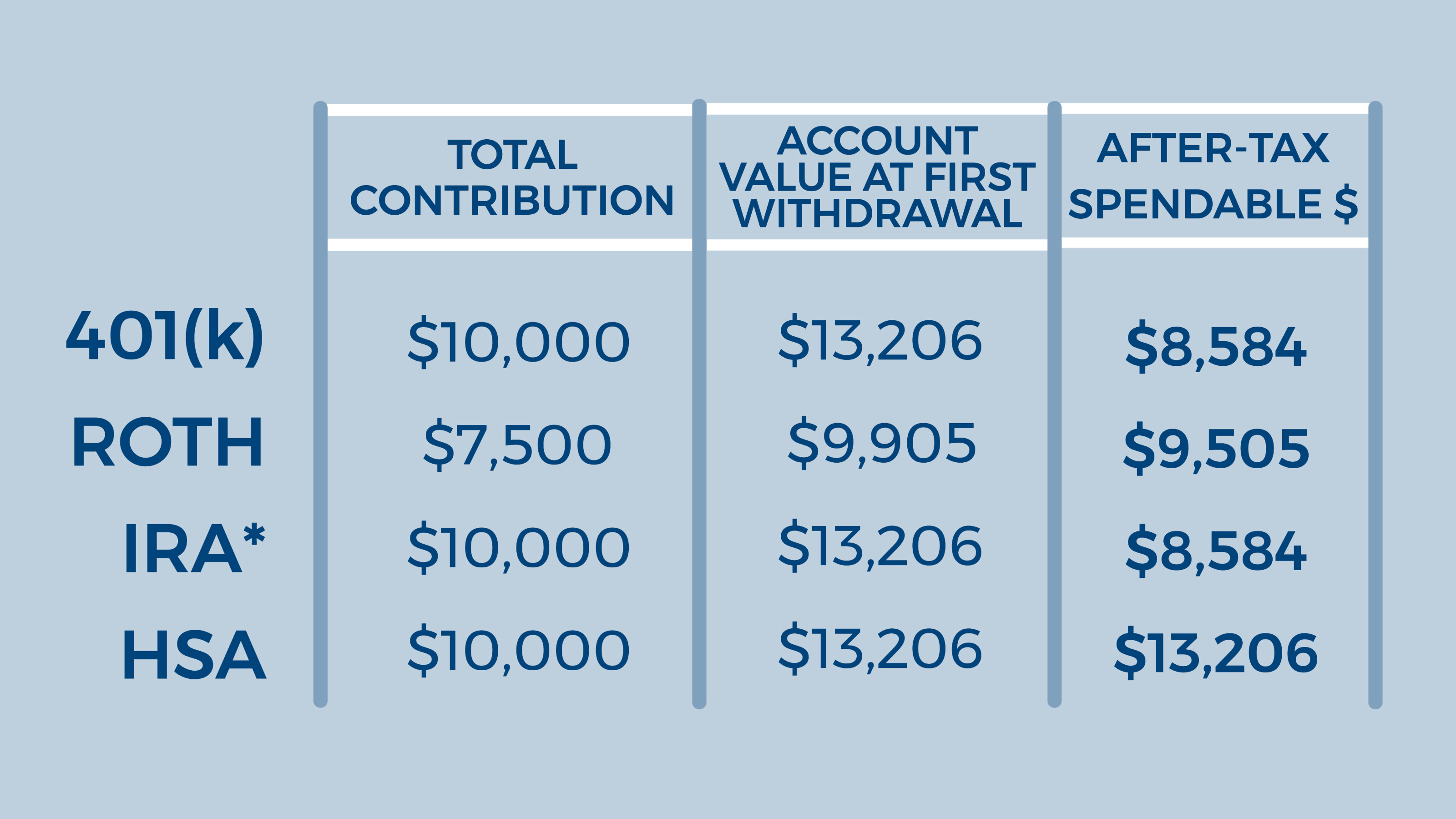

Using an HSA As a Retirement Account AOPA

Web use form 8889 to: This form is required by the irs to properly report an excess contribution removal. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Generally, you must pay a 6% excise tax on excess. Web up to 8% cash back health savings account (hsa) excess.

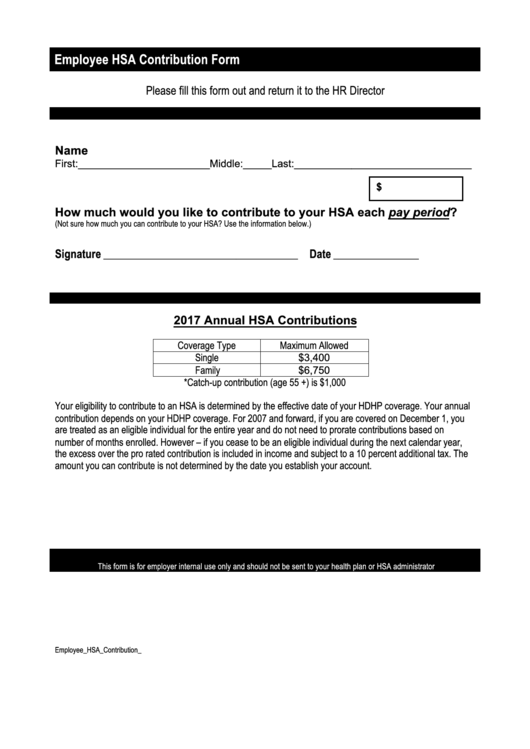

Employee Hsa Contribution Form printable pdf download

Please use this form to report any excess contribution(s) to hsa cash. Web excess removal form remove funds that exceed your annual contribution limit. Web all you have to do is fill out the excess contribution form found on the hsa central consumer portal. Web health savings account excess contribution removal form. Web if you go over hsa contribution limits.

HSA Excess Contribution—What Is the Penalty and How to Avoid it

(refund of money that was deposited in. Web however, if you want to avoid the unnecessary expenditure, mail your completed excess contribution removal form to your hsa plan administrator. Generally, you must pay a 6% excise tax on excess. Distributions made after you were disabled. Web funds will be returned via check to the address on file for your hsa.

How to Handle Excess Contributions on Form 8889 HSA Edge

Web funds will be returned via check to the address on file for your hsa. Generally, you must pay a 6% excise tax on excess. Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Web use form 8889 to: Return of excess contribution — fidelity health savings account (hsa) use this form to.

2020 HSA Contribution Limits and Rules

Select “tools & support” > “account support & forms.” complete and mail the form along with a check. This form is required by the irs to properly report an excess contribution removal. Web excess removal form remove funds that exceed your annual contribution limit. Generally, you must pay a 6% excise tax on excess. Web download the hsa contribution form.

The Deadline For Correcting IRA Excesses Has Passed—Now What? — Ascensus

Return of excess contribution — fidelity health savings account (hsa) use this form to request a return of an excess contribution. Web health savings account excess contribution removal form. Distributions made after you were disabled. Web up to 8% cash back health savings account (hsa) excess contribution removal form form instructions: Web funds will be returned via check to the.

Web Use Form 8889 To:

Web instead, you must request an excess contributions refund by faxing or mailing this signed and completed form to hsa bank, using the address or fax number listed above. This form is required by the irs to properly report an excess contribution removal. Please use this form to report any excess contribution(s) to hsa cash. Web up to 8% cash back sign in to your account online to download the health savings account (hsa) excess contribution removal form to request an excess contribution refund or a.

Web Up To 8% Cash Back Health Savings Account (Hsa) Excess Contribution Removal Form Form Instructions:

Web excess removal form remove funds that exceed your annual contribution limit. Web all you have to do is fill out the excess contribution form found on the hsa central consumer portal. Web the contributions for 2022 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Web up to 8% cash back excess excess contribution contribution and and deposit deposit correction correction request request form form be sure to consult a tax advisor before.

Web Download The Hsa Contribution Form From The Member Website:

Select “tools & support” > “account support & forms.” complete and mail the form along with a check. Hsa contribution maximums are determined by the irs and are no longer based on your deductible. Web apply my excess contribution as my current year’s contribution. Distributions of excess hsa or archer msa contributions.

Generally, You Must Pay A 6% Excise Tax On Excess.

Distributions made after you were disabled. Complete this form to request. Web treasury regulations provide the requirements for calculating nia, but an excess removal form, such as the ascensus® ira or hsa excess removal. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report.