How To Submit Form 941 Online

How To Submit Form 941 Online - Employee wages, income tax withheld from wages, taxable social security wages, taxable social. You can send in your form 941 and payment by mail to the irs. Get ready for tax season deadlines by completing any required tax forms today. When i populated the 941 in payroll, and tried to efile, quickbooks asked for a. Web mail return with payment. Web cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications about the 94x form. Based upon irs sole proprietor data as of 2022, tax year 2021. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax. There may be a fee to file these electronically. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new.

Get ready for tax season deadlines by completing any required tax forms today. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. You can send in your form 941 and payment by mail to the irs. Web form 941 is due by the last day of the month that follows the end of the quarter. If applicable, business owners must also list any advances on earned. Lowest price in the industry. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. I enrolled with eftps.gov, and am set up to efile/epay. Complete, edit or print tax forms instantly.

Web submitting form 941. When i populated the 941 in payroll, and tried to efile, quickbooks asked for a. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 is due by the last day of the month that follows the end of the quarter. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax. Employee wages, income tax withheld from wages, taxable social security wages, taxable social. There may be a fee to file these electronically. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Don't use an earlier revision to report taxes for 2023.

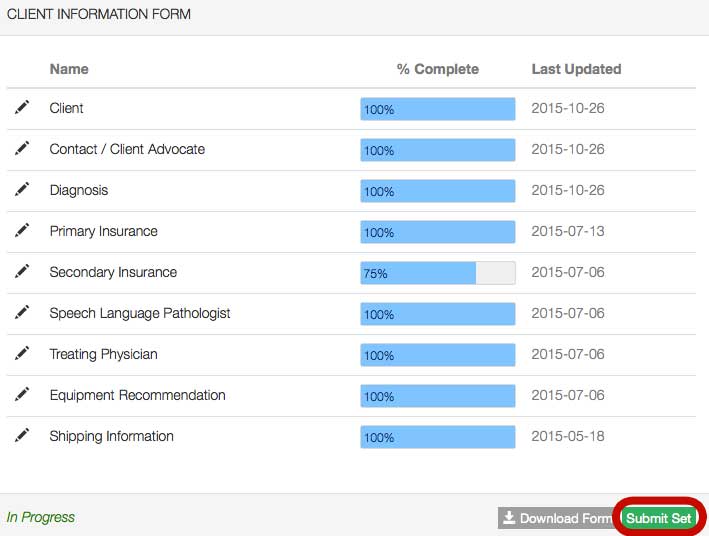

Submit Form Set Tobii Dynavox Funding Support

Web irs form 941 is a quarterly report that cites: Web form 941 is due by the last day of the month that follows the end of the quarter. There may be a fee to file these electronically. Web cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications.

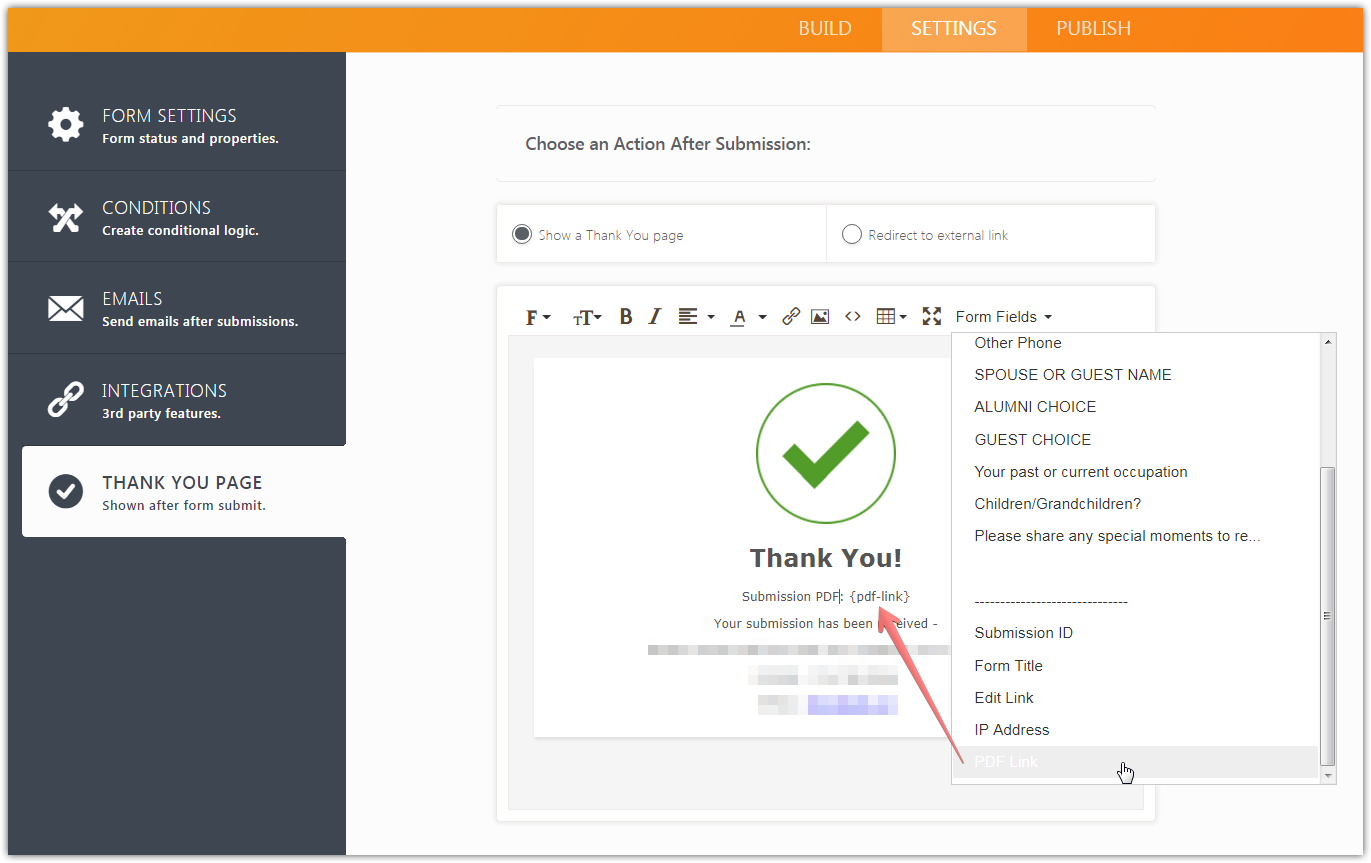

Breanna Image Form Submit

1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax. Web i'm glad to help submit your form 941 online through quickbooks desktop. If any due date for filing shown above falls on a saturday, sunday, or legal holiday, you may. There may be a fee to file these electronically. Employee.

Submit an Online HTML Form to Both MySQL and Email Using PHP YouTube

Get ready for tax season deadlines by completing any required tax forms today. Don't use an earlier revision to report taxes for 2023. If applicable, business owners must also list any advances on earned. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web cheer join the conversation.

Opiniones de 941

Employee wages, income tax withheld from wages, taxable social security wages, taxable social. You can send in your form 941 and payment by mail to the irs. Web cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications about the 94x form. Web how to submit form 941. Form.

2 Ways To Submit HTML Form Without Reloading Page YouTube

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new. Based upon irs sole proprietor data as of 2022, tax year 2021. Employee wages, income tax withheld from wages, taxable social security wages, taxable social. If any due date for filing shown above falls on a saturday, sunday, or legal holiday, you may. I enrolled with.

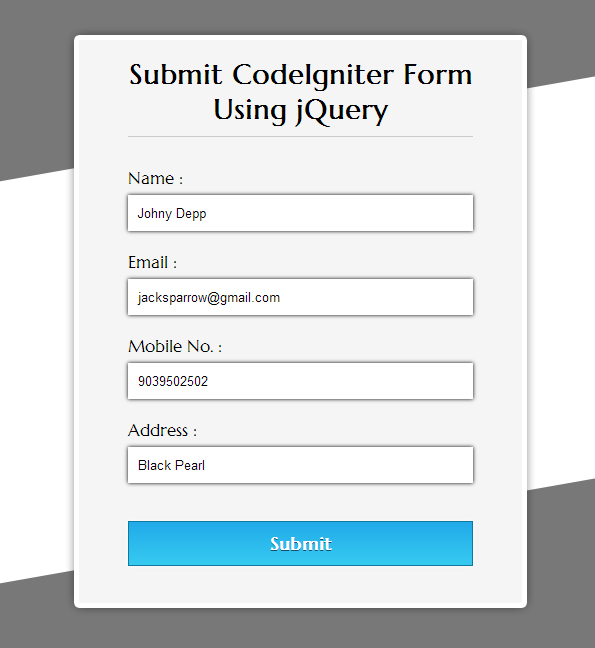

CodeIgniter Form Submission Using jQuery FormGet

Get ready for tax season deadlines by completing any required tax forms today. When i populated the 941 in payroll, and tried to efile, quickbooks asked for a. Lowest price in the industry. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; There may be a fee to file these electronically.

How to submit form YouTube

Web form 941 is due by the last day of the month that follows the end of the quarter. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new. When i populated the 941 in payroll, and tried to efile, quickbooks asked for a. Web an employer that owes employment taxes of $1,000 or less for.

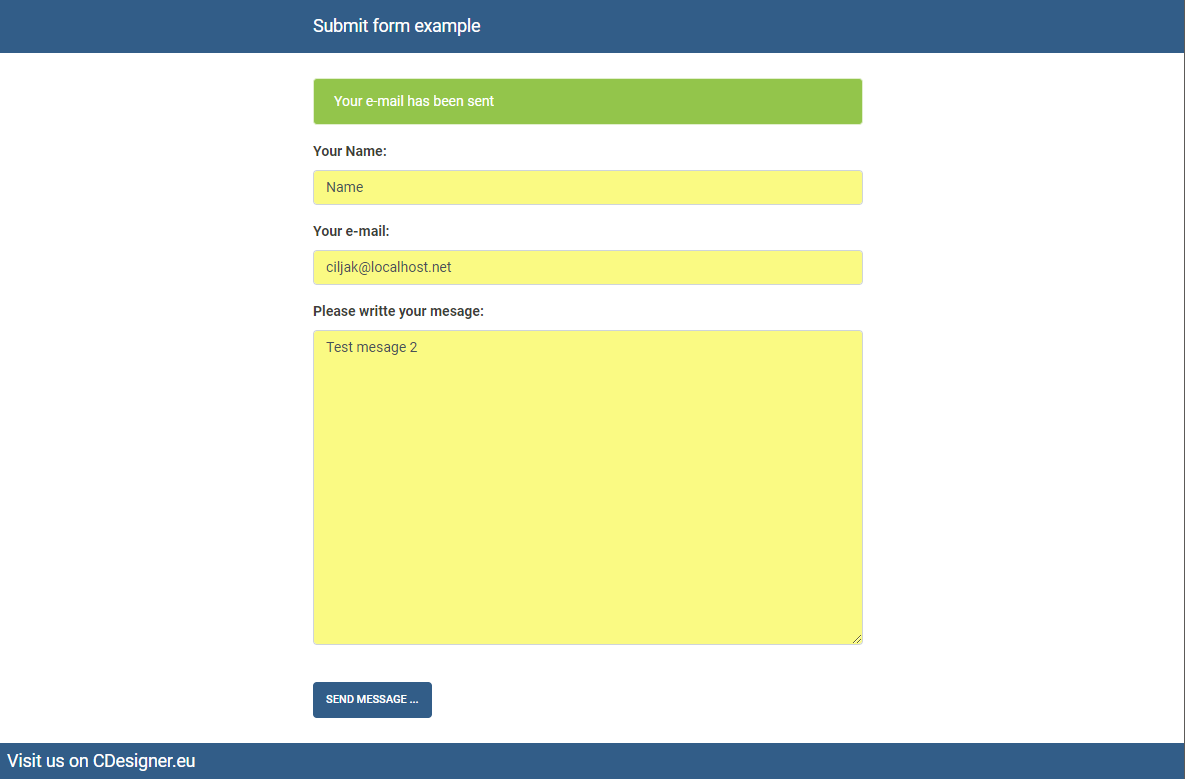

Submit form example php code cdesigner.eu

Web irs form 941 is a quarterly report that cites: Web how to submit form 941. Get ready for tax season deadlines by completing any required tax forms today. Lowest price in the industry. Web submitting form 941.

php HTML file with a submit form Code Review Stack Exchange

Employee wages, income tax withheld from wages, taxable social security wages, taxable social. Web form 941 is due by the last day of the month that follows the end of the quarter. Ad access irs tax forms. I enrolled with eftps.gov, and am set up to efile/epay. Web use the march 2023 revision of form 941 to report taxes for.

Submit Forms Page 2017 YouTube

1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax. Based upon irs sole proprietor data as of 2022, tax year 2021. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do.

Web How To Submit Form 941.

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; 1 choose tax year & quarter 2 enter social security & medicare taxes 3 enter deposit schedule & tax. Web form 941 is due by the last day of the month that follows the end of the quarter. I enrolled with eftps.gov, and am set up to efile/epay.

Don't Use An Earlier Revision To Report Taxes For 2023.

Web mail return with payment. Based upon irs sole proprietor data as of 2022, tax year 2021. Web cheer join the conversation best answers marylandt moderator april 02, 2019 11:43 am good day, @dg11, i'm here for some clarifications about the 94x form. Form 941 is used by employers.

Web Irs Form 941 Is A Quarterly Report That Cites:

Get ready for tax season deadlines by completing any required tax forms today. Web i'm glad to help submit your form 941 online through quickbooks desktop. Lowest price in the industry. There may be a fee to file these electronically.

Web An Employer That Owes Employment Taxes Of $1,000 Or Less For The Year Can File Form 944, Employer’s Annual Federal Tax Return If Given Irs Permission To Do So.

Web submitting form 941. If applicable, business owners must also list any advances on earned. Complete, edit or print tax forms instantly. If any due date for filing shown above falls on a saturday, sunday, or legal holiday, you may.