How To Pay Form 2290

How To Pay Form 2290 - You will be redirected to the irs payment page where you can. Web you must pay the tax in full with your form 2290. See credit or debit card under how to pay the tax , later, for more information. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Any company can use this service, be it. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Eftps is the most secure method of the 2290 payment options. Web you’re registering a vehicle in your name; We've been in the trucking business for over 67+ years. We've been in the trucking business for over 67+ years.

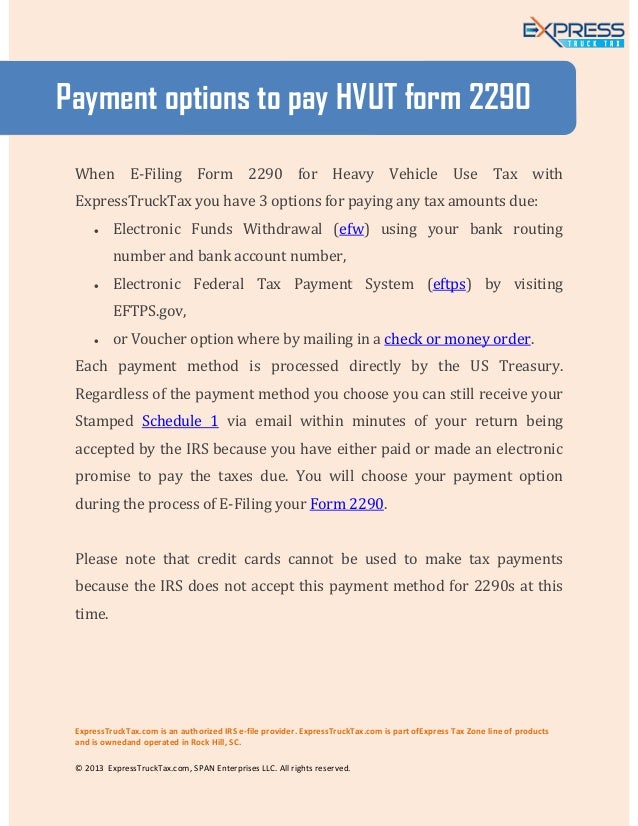

Eftps is the most secure method of the 2290 payment options. Web you can register here.to obtain a copy of your 2290 proof of payment, simply follow these steps: Direct debit or electronic funds withdrawal (efw) credit card or debit card* eftps (electronic federal tax payment system). Web first, you will need the following: Web 1 day agouse form 2290 to file in the following circumstances: Web the 2290 form is due annually between july 1 and august 31. Web you’re registering a vehicle in your name; Web how easy is filing form 2290 with epay2290 you can go to your local irs office, stand in queue for a few hours to handle heavy vehicle use taxes. Web about form 2290, heavy highway vehicle use tax return. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

Get immediate help from our team through chat or phone support automatic tax calculations our smart. Web tax support need tax assistance? Web how easy is filing form 2290 with epay2290 you can go to your local irs office, stand in queue for a few hours to handle heavy vehicle use taxes. Complete the first four pages of form. How to enroll in eftps? Use coupon code get20b & get 20% off. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Ad file form 2290 for vehicles weighing 55,000 pounds or more. Direct debit or electronic funds withdrawal (efw) credit card or debit card* eftps (electronic federal tax payment system).

Irs Form 2290 Payment Universal Network

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web you’re registering a vehicle in your name; Web home how to pay irs form 2290 online how to pay irs form 2290 online last updated on june 23, 2023 by eformblogadmin filing your heavy.

How to pay IRS Form 2290 tax online? Secure IRS 2290 Payment Options

Web how easy is filing form 2290 with epay2290 you can go to your local irs office, stand in queue for a few hours to handle heavy vehicle use taxes. Web for filing form 2290 online, you have various payment methods available, including credit/debit cards, electronic funds transfer (eft), or electronic federal tax payment. Web for vehicles first used on.

Pay Form 2290 Taxes Online

Figure and pay tax due on vehicles used during the reporting period with a taxable gross weight of 55,000 pounds. Make form 2290 payment to the irs; Web for vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web 1 day agouse form.

Pay your form 2290 taxes online through IRSapproved payment systems!

Web for vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web your check or money order must be payable to the united states treasury. Any company can use this service, be it. Web you can register here.to obtain a copy of your.

Simplify Making HVUT Payments Pay Form 2290 Payments Online YouTube

Details required to apply for eftps 3. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Direct debit or electronic funds withdrawal (efw) credit card or debit card* eftps (electronic federal tax payment system). July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july.

Time to renew and pay the Form 2290 and Schedule 1 for 202122

Filers can pay over the internet, by phone, or using their. Direct debit or electronic funds withdrawal (efw) credit card or debit card* eftps (electronic federal tax payment system). Any company can use this service, be it. And you’re using the vehicle on a public roadway. Ad file form 2290 for vehicles weighing 55,000 pounds or more.

Payment options to pay hvut tax form 2290

Ad file form 2290 easily with eform2290.com. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Complete the first four pages of form. Web you must pay the tax in full with your form 2290. Filers can pay over the internet, by phone, or using their.

Form 2290 HVUT for the vehicles first used in April 2022 is due today!

Complete the first four pages of form. Web you must pay the tax in full with your form 2290. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Do your truck tax online & have it efiled to the irs! Web you can pay your hvut 2290 using a credit/debit card after completing your.

Pay Form 2290 Taxes Online

Get immediate help from our team through chat or phone support automatic tax calculations our smart. Irs.gov/transcripts log into your account and visit the. Web for vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Figure and pay tax due on vehicles used.

Pay Form 2290 Taxes Online

Direct debit or electronic funds withdrawal (efw) credit card or debit card* eftps (electronic federal tax payment system). How to enroll in eftps? Any company can use this service, be it. Web first, you will need the following: Eftps is the most secure method of the 2290 payment options.

Eftps Pay By Phone 7.

Direct debit or electronic funds withdrawal (efw) credit card or debit card* eftps (electronic federal tax payment system). Web your check or money order must be payable to the united states treasury. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Irs.gov/transcripts log into your account and visit the.

Web The 2290 Form Is Due Annually Between July 1 And August 31.

We've been in the trucking business for over 67+ years. Eftps is the most secure method of the 2290 payment options. Any company can use this service, be it. We've been in the trucking business for over 67+ years.

Do Your Truck Tax Online & Have It Efiled To The Irs!

Figure and pay the tax due on highway motor vehicles used during the period with a. Details required to apply for eftps 3. Web for filing form 2290 online, you have various payment methods available, including credit/debit cards, electronic funds transfer (eft), or electronic federal tax payment. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties.

Ad File Form 2290 For Vehicles Weighing 55,000 Pounds Or More.

Web you must pay the tax in full with your form 2290. Get immediate help from our team through chat or phone support automatic tax calculations our smart. Efiles did not go through successfully? When you’re paying 2290 truck taxes using.