How To Get Onlyfans 1099 Form Online

How To Get Onlyfans 1099 Form Online - Today get free account in. Web gather all necessary documents when it comes to the onlyfans 1099 form, it’s essential to gather all necessary documents required for filing taxes. If you earned more than $600,. Onlyfans premium account generator 2023 ~onlyfans hack. When completing my taxes at the end of the. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Simply follow the provided instructions and. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed.

Web onlyfans will send you a 1099 for your records. This is your gross business income, and you can. Web 22 seconds ago~make money! Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of income as an independent contractor you. When completing my taxes at the end of the. If you earned more than $600,. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Form 8829 business use of home office. Today get free account in.

Today get free account in. Web onlyfans will send you a 1099 for your records. Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Web i made more than $400, but less than $500 so i know i need to pay, i just don't know which forms i need and where to get them since i know you'll only receive. Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year. Simply follow the provided instructions and. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. If you earned more than $600,.

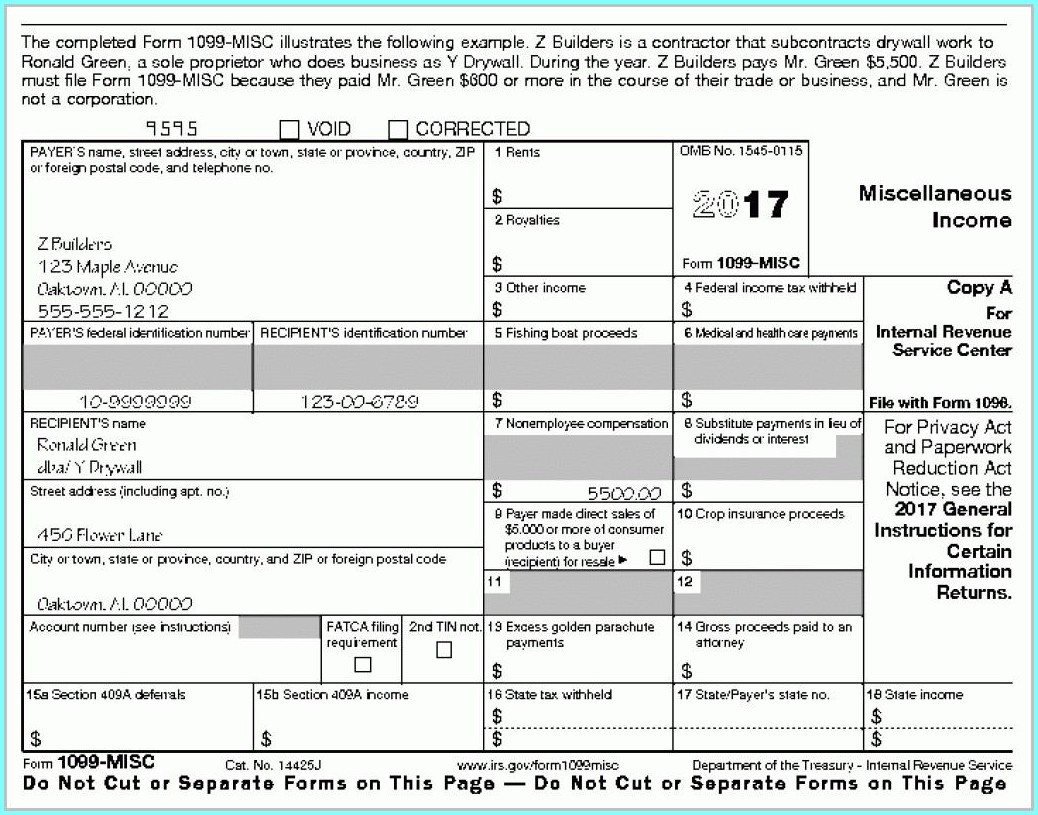

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Today get free account in. Web i made more than $400, but less than $500 so i know i need to pay, i just don't know which forms i need and where to get them since i know you'll only receive. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. The number.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. Today get free account in. Web i made more than $400, but less than $500 so i know i need to pay,.

Form1099NEC

Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. Go to your account settings and check if your address is accurate. Log in to your onlyfans account..

Florida 1099 Form Online Universal Network

You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of income as an independent contractor you. Web you can file your onlyfans 1099 form online through various websites such as.

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

Form 8829 business use of home office. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. Web gather all necessary documents when it comes to the onlyfans.

Free Printable 1099 Misc Forms Free Printable

Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting them in tax filings. In this article, learn the top 15 tax deductions an of creator can take to reduce tax. Simply follow the provided instructions and. You will be required to pay back around 25ish% since 1099/self employment isn’t.

Memo OnlyFans & Myystar Creators Business Set Up and Tax Filing Tips

By filing online, you can. This is your gross business income, and you can. Web onlyfans will send you a 1099 for your records. Web not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of income as an independent contractor you. Web gather all necessary.

Get Form Ssa 1099 Online Form Resume Examples e79QGPmVkQ

Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block. This is your gross business income, and you can. The number listed on the 1099 as your income.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. When completing my taxes at the end of the. Form 8829 business use of home office. Web watch on as an onlyfans independent contractor, you are responsible for keeping track of your earnings and accurately reporting.

Does Llc Partnership Get A 1099 Armando Friend's Template

This is your gross business income, and you can. Web i made more than $400, but less than $500 so i know i need to pay, i just don't know which forms i need and where to get them since i know you'll only receive. Today get free account in. Simply follow the provided instructions and. Web you’ll get a.

Web I Made More Than $400, But Less Than $500 So I Know I Need To Pay, I Just Don't Know Which Forms I Need And Where To Get Them Since I Know You'll Only Receive.

Today get free account in. You will be required to pay back around 25ish% since 1099/self employment isn’t taxed. When completing my taxes at the end of the. Web you can file your onlyfans 1099 form online through various websites such as turbotax or h&r block.

In This Article, Learn The Top 15 Tax Deductions An Of Creator Can Take To Reduce Tax.

Web onlyfans will send you a 1099 for your records. Simply follow the provided instructions and. The number listed on the 1099 as your income from them may not match how much money was deposited into your bank. Go to your account settings and check if your address is accurate.

Web Not Sure That The Standards Are For Onlyfans And Whether They Will Give You A 1099Misc Or Not, But If You Made Over $400 Of Income As An Independent Contractor You.

Web to file your 1099 with the irs, you must file 4 schedules and forms schedule c, form 8829, form 4562, and schedule se. If you earned more than $600,. This is your gross business income, and you can. Web yes, onlyfans does send a 1099 form if a content creator earns $600 or more during the calendar year.

Onlyfans Premium Account Generator 2023 ~Onlyfans Hack.

Log in to your onlyfans account. Form 8829 business use of home office. Web 22 seconds ago~make money! Web you’ll get a 1099 (self employment tax form) if you make more than $600 per year.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)