How To Fill Out It-2104 Form 2022 Single

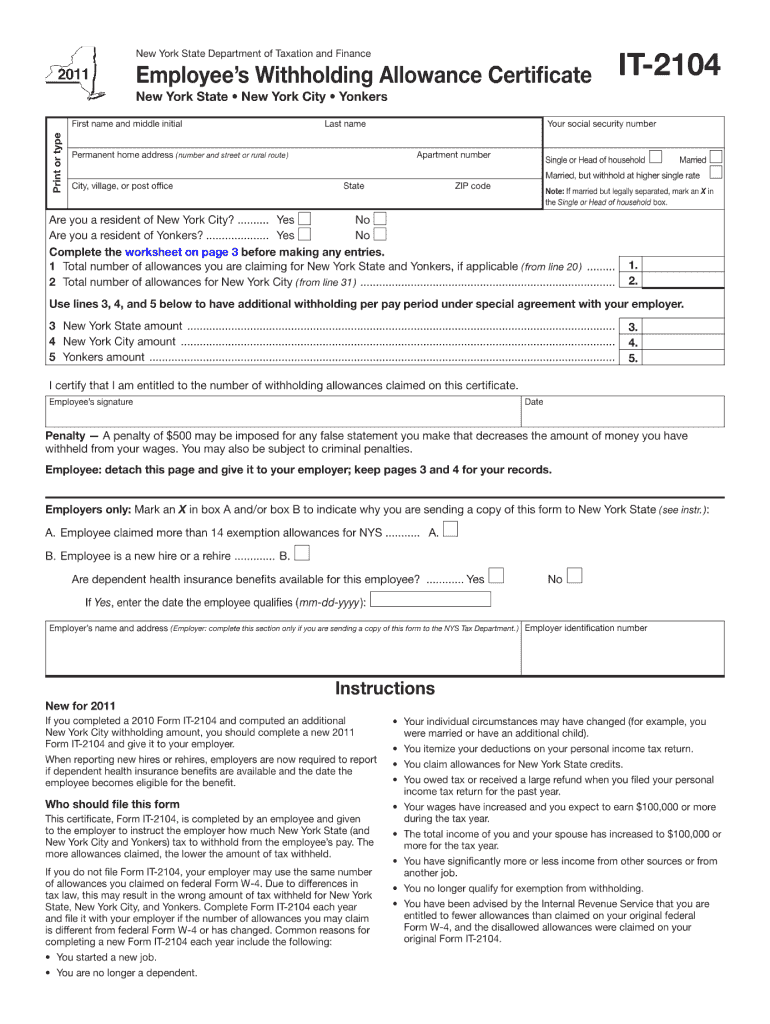

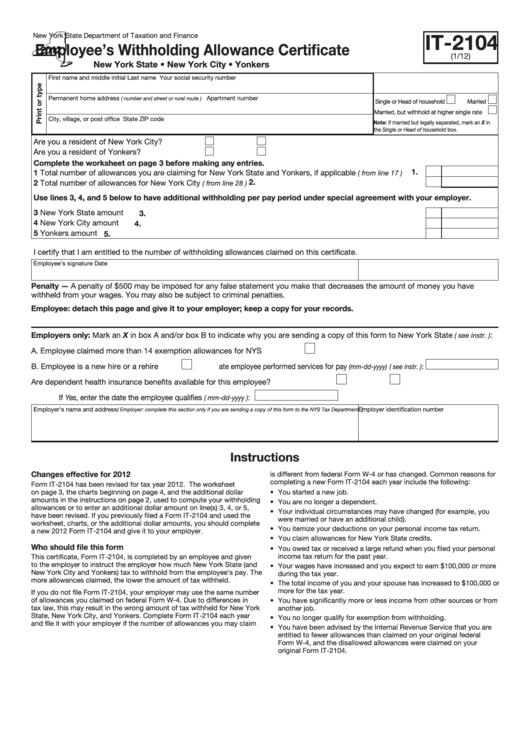

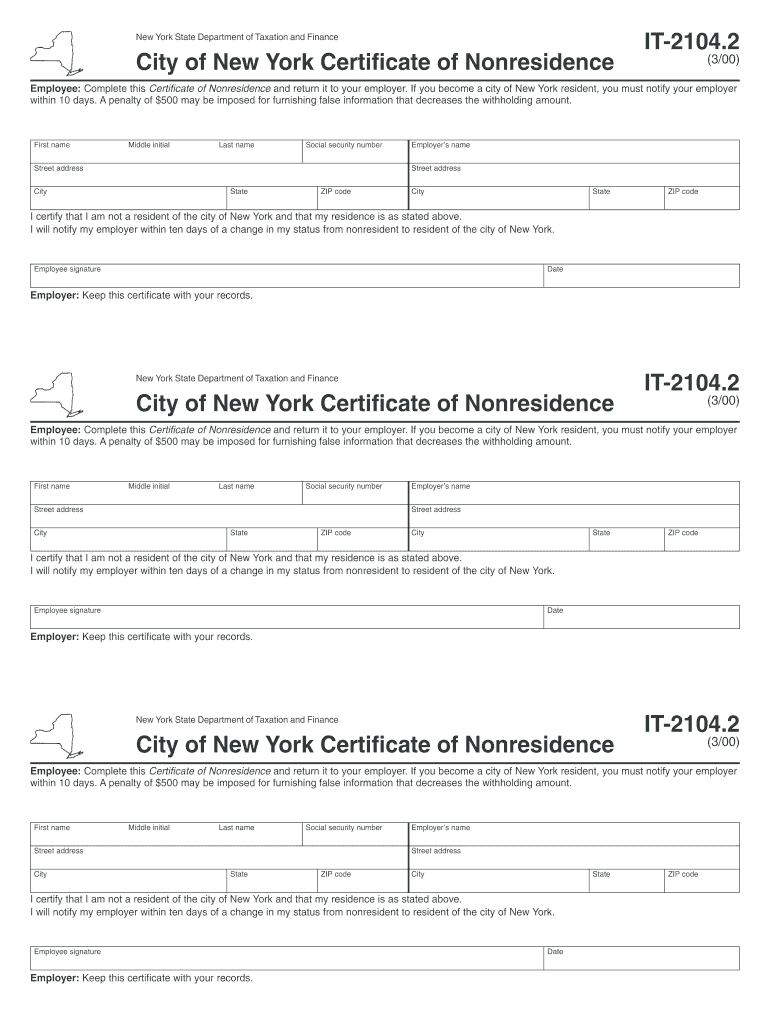

How To Fill Out It-2104 Form 2022 Single - Web this answer was rated: I am single/head of household and have no idea what to put for this: Every employee must complete two withholding forms: For example, if you have a registration. Web • more than $1,077,550, and who are single or married filing separately; Last but not least, renaming your submit button is a small, but important final touch on your form. If you do not, your default ny state status will. Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. Otal number of allowances you are claiming for new york state and yonkers, if ap. First name and middle initial last name your social security number permanent home address (number and street or rural route)apartment number &lw\ yloodjh rusrvwr fh 6wdwh.

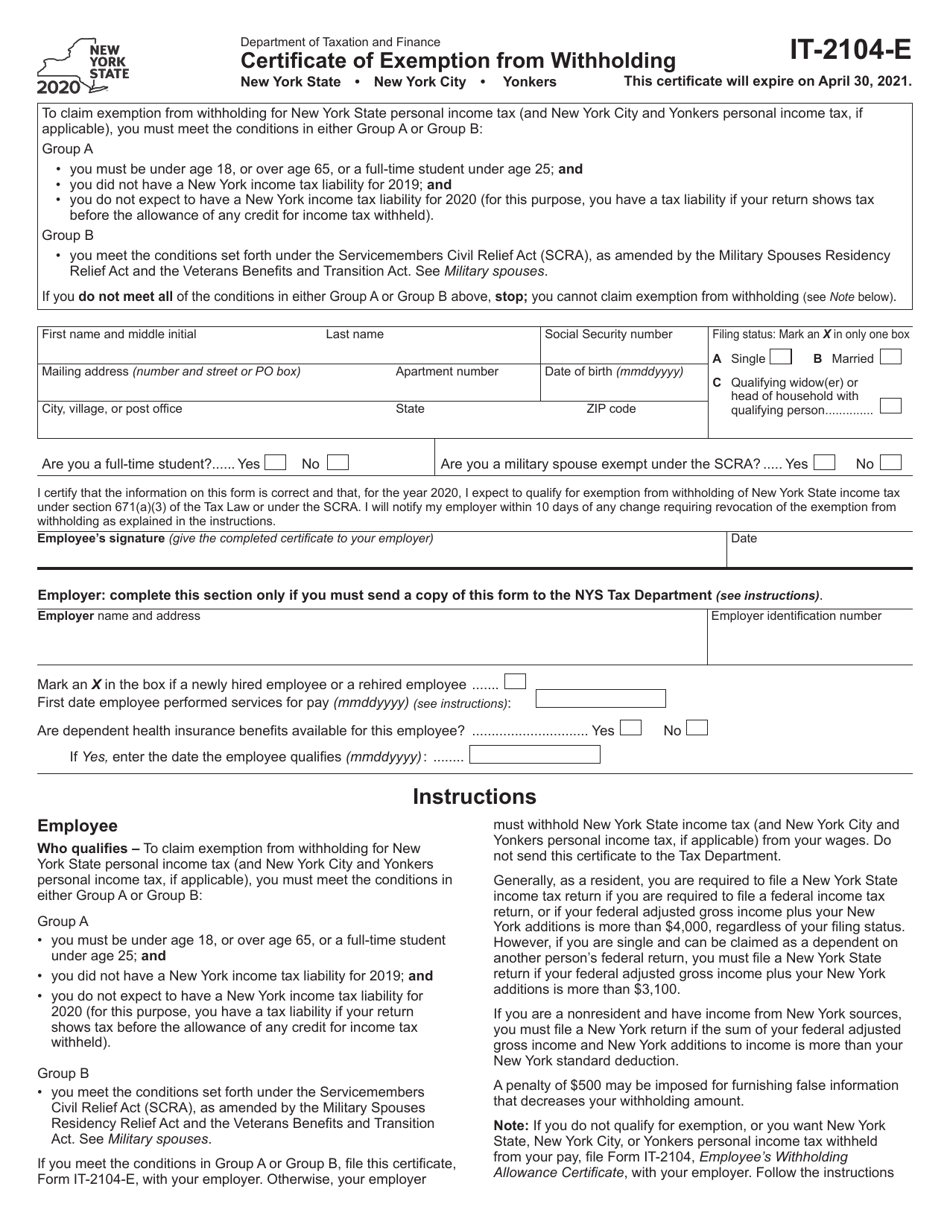

Annuitant's request for income tax withholding: Annuitant's request for income tax withholding: Sign online button or tick the preview image of the document. What is this form for? However, if you claim more than 14 allowances, you must complete the withholding. Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. 1 = less taxes withheld. Every employee must complete two withholding forms: The label on your submit button should make sense with the rest of the content; 12 by the state department of taxation and finance.

First name and middle initial last name your social security number permanent home address (number and street or rural route)apartment number &lw\ yloodjh rusrvwr fh 6wdwh. Annuitant's request for income tax withholding: Or • more than $1,616,450, and who are head of household. If you do not, your default ny state status will. Single taxpayers with one job and zero dependents, enter 1 on lines 1 and 2 (if applicable). The label on your submit button should make sense with the rest of the content; Ask your own tax question. To start the blank, use the fill camp; Annuitant's request for income tax withholding: New york state withholding exemption certificate for military service personnel:

How To Fill Out It 2104 Form WebSelfEdit

Ask your own tax question. The label on your submit button should make sense with the rest of the content; First name and middle initial last name your social security number permanent home address (number and street or rural route)apartment number &lw\ yloodjh rusrvwr fh 6wdwh. Web • more than $1,077,550, and who are single or married filing separately; For.

Cornell Cooperative Extension Required Paperwork for New Employees

Single taxpayers with one job and zero dependents, enter 1 on lines 1 and 2 (if applicable). • you started a new job. What is this form for? New york state withholding exemption certificate for military service personnel: The label on your submit button should make sense with the rest of the content;

Best Answer How To Fill Out It2104 New York Single? [The Right Answer

Web how to fill out the nys form it 2104 2016 on the internet: Web this answer was rated: Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. Answered in 1 minute by: The advanced tools of the editor will guide you through.

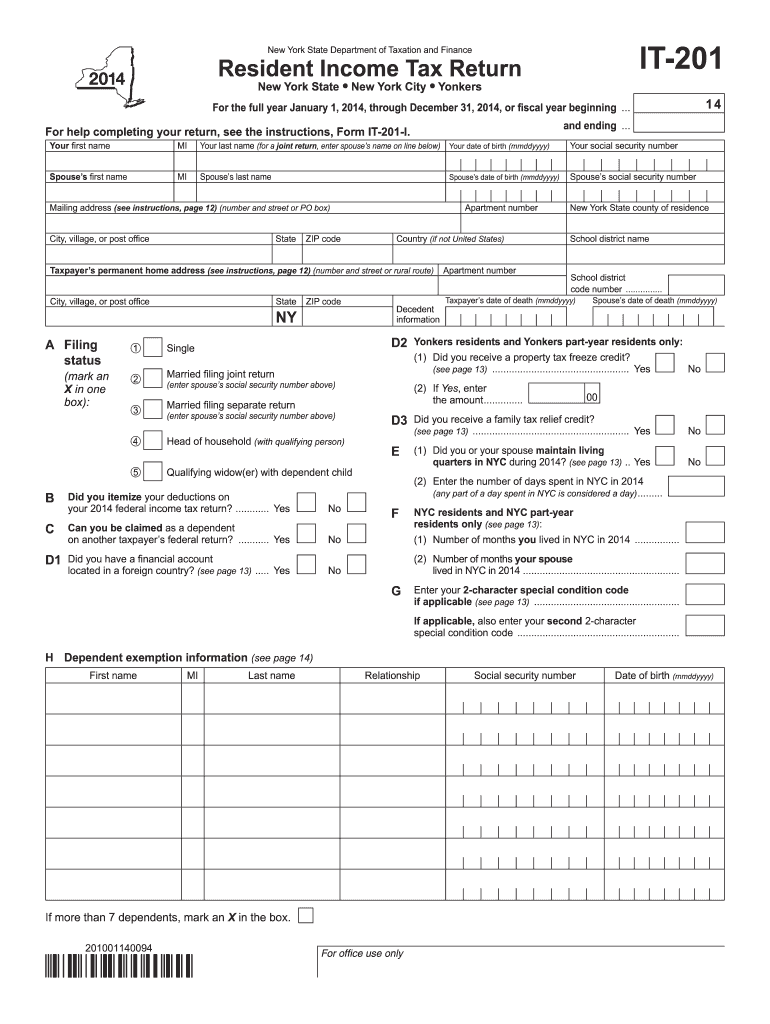

2014 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

Last but not least, renaming your submit button is a small, but important final touch on your form. Ask your own tax question. Every employee must complete two withholding forms: For example, if you have a registration. New york state withholding exemption certificate for military service personnel:

New York City Allowances IT2104 Baron Payroll

New york state withholding exemption certificate for military service personnel: 0 = more taxes withheld; Web • more than $1,077,550, and who are single or married filing separately; Sign online button or tick the preview image of the document. First name and middle initial last name your social security number permanent home address (number and street or rural route)apartment number.

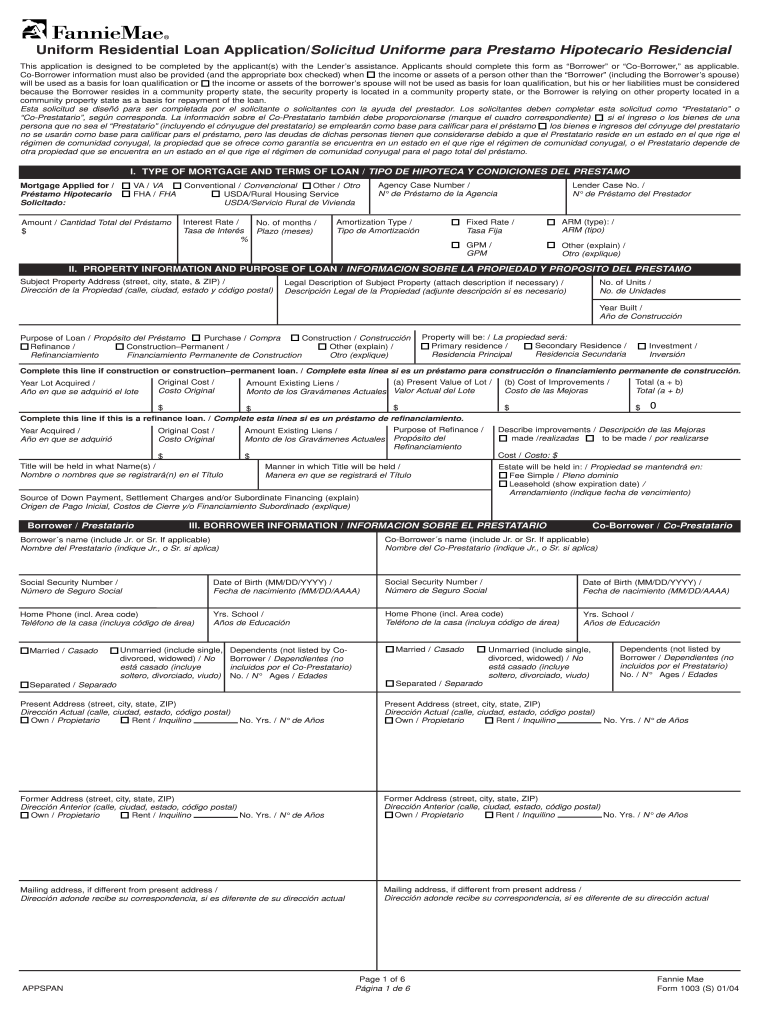

Form 1003 in spanish Fill out & sign online DocHub

Annuitant's request for income tax withholding: Annuitant's request for income tax withholding: The label on your submit button should make sense with the rest of the content; Single taxpayers with one job and zero dependents, enter 1 on lines 1 and 2 (if applicable). 0 = more taxes withheld;

Fillable Form It2104 Employee'S Withholding Allowance Certificate

New york state withholding exemption certificate for military service personnel: The label on your submit button should make sense with the rest of the content; Annuitant's request for income tax withholding: Answered in 1 minute by: Or • more than $1,616,450, and who are head of household.

Employee's Withholding Allowance Certificate Form 2022 2023

Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. Sign online button or tick the preview image of the document. Web new york’s 2022 withholding certificate was released jan. However, if you claim more than 14 allowances, you must complete the withholding. Every.

Form IT2104E Download Fillable PDF or Fill Online Certificate of

Web how to fill out the nys form it 2104 2016 on the internet: Every employee must complete two withholding forms: For example, if you have a registration. I am single/head of household and have no idea what to put for this: Single taxpayers with one job and zero dependents, enter 1 on lines 1 and 2 (if applicable).

It 2104 Fill Out and Sign Printable PDF Template signNow

I am single/head of household and have no idea what to put for this: Last but not least, renaming your submit button is a small, but important final touch on your form. 12 by the state department of taxation and finance. Web • more than $1,077,550, and who are single or married filing separately; Or • more than $1,616,450, and.

What Is This Form For?

Married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in. 0 = more taxes withheld; Every employee must complete two withholding forms: Web this answer was rated:

Annuitant's Request For Income Tax Withholding:

Or • more than $1,616,450, and who are head of household. For example, if you have a registration. 1 = less taxes withheld. If you do not, your default ny state status will.

The Label On Your Submit Button Should Make Sense With The Rest Of The Content;

However, if you claim more than 14 allowances, you must complete the withholding. Ask your own tax question. Web • more than $1,077,550, and who are single or married filing separately; She should fill it out by accurately answering the questions on the worksheet, similar to the process she used for the w4.

Otal Number Of Allowances You Are Claiming For New York State And Yonkers, If Ap.

The advanced tools of the editor will guide you through the editable pdf template. 12 by the state department of taxation and finance. New york state withholding exemption certificate for military service personnel: Annuitant's request for income tax withholding: