How To File Form 8843

How To File Form 8843 - Taxpayer identification number to file form 8843? Overview of form 8843 irs form 8843 is a. Web there are several ways to submit form 4868. If you are a nonresident tax filer, and have no u.s. Web the service center where you would be required to a file a current year tax return for the tax to which your claim or request relates. This guide has been created to assist you in completing the form 8843. Taxes form 8843 form 8843 filing form 8843 students, scholars, and dependents who are at indiana university in f or j status must file form 8843 every. Web when is the filing deadline? If your status has changed, also enter date of change and. Web who should complete only form 8843?

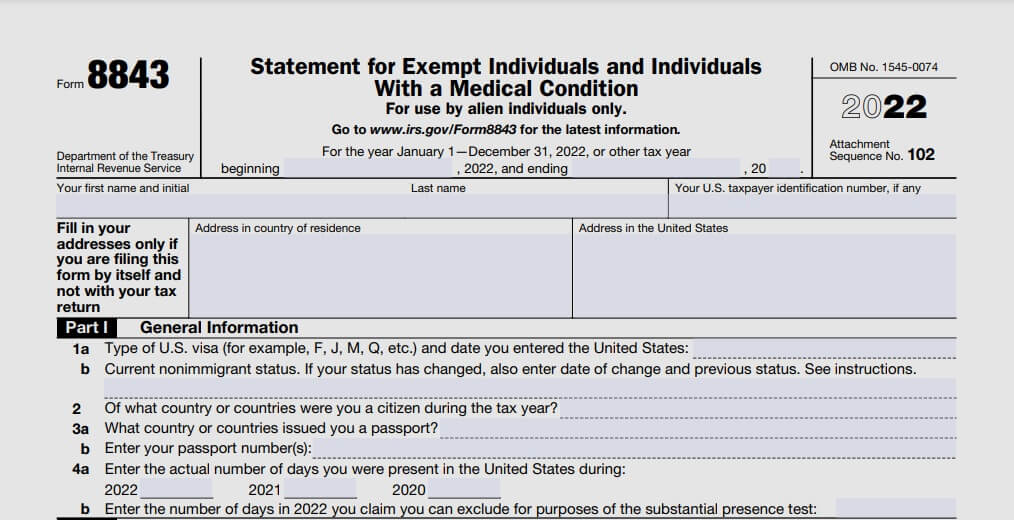

2020 2019 2018 enter the number of days in 2020 you. Web form 8843 & instructions 2020: Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Web who should complete only form 8843? If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Overview of form 8843 irs form 8843 is a. Web • complete the form 8843 o your name, both address fields (u.s. Ad access irs tax forms. You must file form 8843 by june 15, 2022. Web when is the filing deadline?

If you are a nonresident tax filer, and have no u.s. You must file form 8843 by june 15, 2022. Taxes form 8843 form 8843 filing form 8843 students, scholars, and dependents who are at indiana university in f or j status must file form 8843 every. Web the service center where you would be required to a file a current year tax return for the tax to which your claim or request relates. Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Web all nonresident aliens present in the u.s. Overview of form 8843 irs form 8843 is a. 2020 2019 2018 enter the number of days in 2020 you. Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Taxpayer identification number to file form 8843?

Form 8843 Statement for Exempt Individuals and Individuals with a

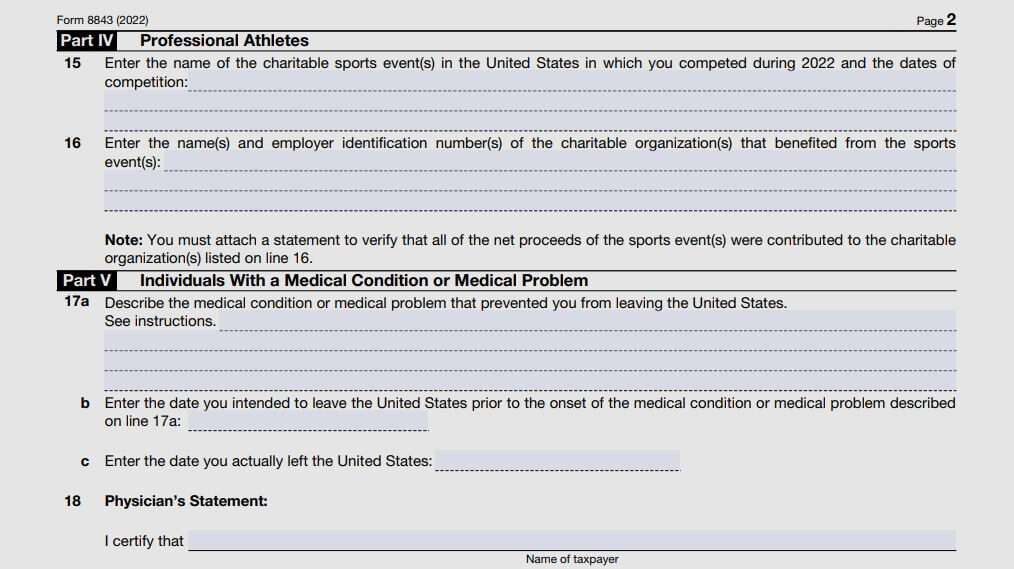

The form 8843 instructions can be complex. See the instructions for the. Complete, edit or print tax forms instantly. Taxes form 8843 form 8843 filing form 8843 students, scholars, and dependents who are at indiana university in f or j status must file form 8843 every. Source income in 2022 you only need complete the irs form.

Tax how to file form 8843 (1)

If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Web form 8843 & instructions 2020: Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: See the instructions for the. 2020 2019 2018 enter the number of days in 2020 you.

Tax how to file form 8843 (1)

Web who should complete only form 8843? Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. You must file form 8843 by june 15, 2022. Web all nonresident aliens present in the u.s. Taxes form 8843 form 8843 filing form 8843 students, scholars, and dependents who are at.

Tax how to file form 8843 (1)

Web 1a type of u.s. 2020 2019 2018 enter the number of days in 2020 you. If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Web who should complete only form 8843? How do i complete form 8843?

Tax how to file form 8843 (1)

How do i complete form 8843? 2020 2019 2018 enter the number of days in 2020 you. How can i file form 8843? Complete, edit or print tax forms instantly. Web 1a type of u.s.

Form 8843 Instructions How to fill out 8843 form online & file it

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: If you are a nonresident tax filer, and have no u.s. Source income in 2022 you only need complete the irs form. Overview of form 8843 irs form 8843 is a. How can i file form 8843?

IRS Form 8843 Editable and Printable Statement to Fill out

See the instructions for the. If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. The irs allows some foreigners who meet the substantial presence test (spt) to claim an. Taxes form 8843 form 8843 filing form 8843 students, scholars, and dependents who are at indiana university in f or j status must file.

Form 8843 Instructions How to fill out 8843 form online & file it

If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Web who should complete only form 8843? Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: 2021 2020 2019 enter the number of days in 2021 you claim you. Visa (for example, f,.

Tax how to file form 8843 (1)

Overview of form 8843 irs form 8843 is a. Source income in 2022 you only need complete the irs form. Visa (for example, f, j, m, q, etc.) and date you entered the united states b current nonimmigrant status. If you are a nonresident tax filer, and have no u.s. How do i complete form 8843?

2021 2020 2019 Enter The Number Of Days In 2021 You Claim You.

Do i need a u.s. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web when is the filing deadline? Overview of form 8843 irs form 8843 is a.

Web All Nonresident Aliens Present In The U.s.

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Taxpayer identification number to file form 8843? Web 1a type of u.s. Web living in the u.s.

How Do I Complete Form 8843?

Source income in 2022 you only need complete the irs form. Who is required to file form 8843? See the instructions for the. Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the.

Taxes Form 8843 Form 8843 Filing Form 8843 Students, Scholars, And Dependents Who Are At Indiana University In F Or J Status Must File Form 8843 Every.

You must file form 8843 by june 15, 2022. Web form 8843 & instructions 2020: If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. 2020 2019 2018 enter the number of days in 2020 you.