How To File Form 4361

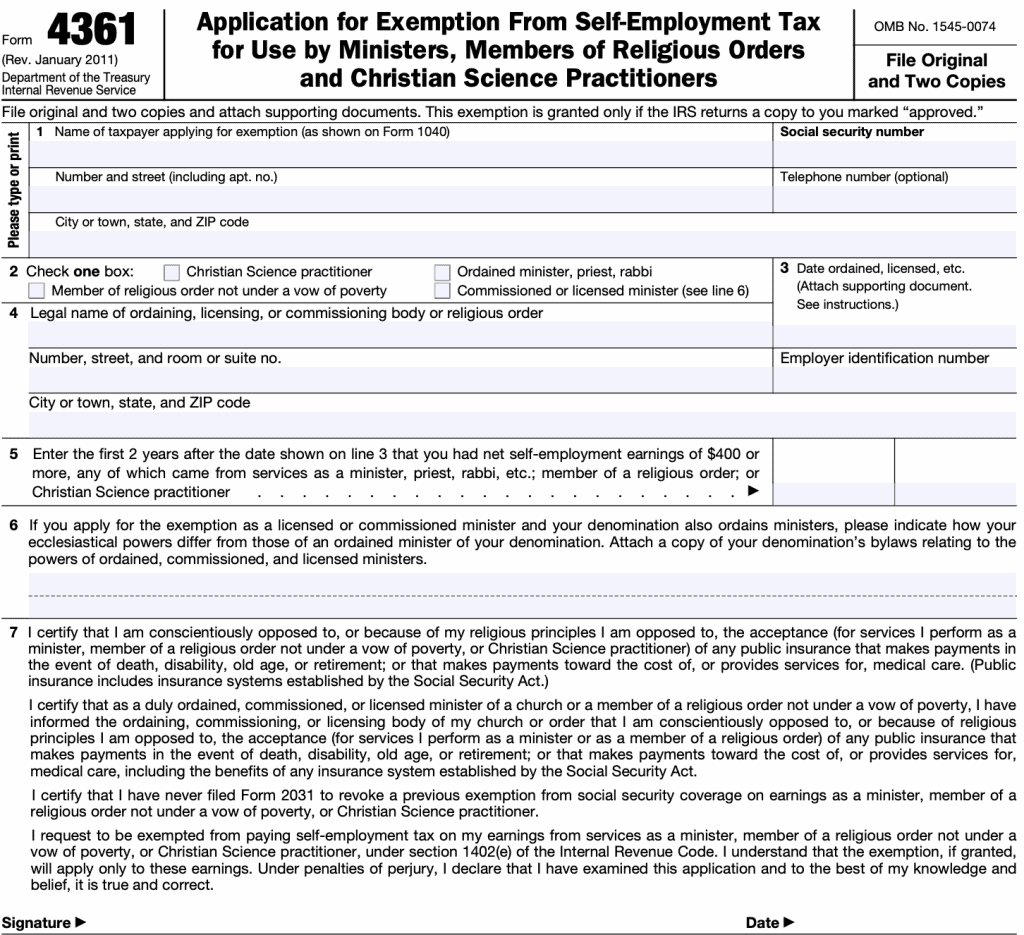

How To File Form 4361 - How to complete this tax form. The minister must be ordained, licensed, or commissioned by a church or religious denomination. Oct 04, 2015 really not a great idea. Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. 3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. You will be asked about your housing allowance and whether or not you have an approved form 4361. Anonymous merely changing churches does not reset the two year window of opportunity. You can view the form itself here. How to file form 4361 to claim your exemption.

3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it. • a member of a religious order who has not taken a vow of poverty; Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. Let’s start with step by step instructions for irs form 4361. Anonymous merely changing churches does not reset the two year window of opportunity. Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. How to complete this tax form. You can view the form itself here. An ordained, commissioned, or licensed minister of a church; Web in this article, we’ll walk through irs form 4361 so you can better understand:

That was april 15, 2019, but you could file an extension until october 15, 2019. 4) must file an irs form 4361. So, you need to submit your form 4361 by october 15, 2019. An ordained, commissioned, or licensed minister of a church; Let’s start with step by step instructions for irs form 4361. Or • a christian science practitioner. Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. You can view the form itself here. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. A member of a religious order who has not taken a vow of.

Fill Free fillable Form 4361 Application for Exemption From Self

A member of a religious order who has not taken a vow of. Anonymous merely changing churches does not reset the two year window of opportunity. Web in this article, we’ll walk through irs form 4361 so you can better understand: 4) must file an irs form 4361. Web form 4361 is an irs document that is used by ministers.

Opt Out of Social Security Form 4361

Web in order to opt out, the minister must file form 4361 no later than the due date (with extensions) for the tax return for the second year in which the minister had net ministerial income of $400 or more. Web in this article, we’ll walk through irs form 4361 so you can better understand: Anonymous merely changing churches does.

Do Amish Pay Taxes? How Taxation Impacts Traditional Communities

A member of a religious order who has not taken a vow of. Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. That was april 15, 2019, but you could file an extension until october 15, 2019. How to file form 4361 to claim your exemption. You will be asked.

고정자산대장 데이터관리 프로그램 엑셀데이터

4) must file an irs form 4361. A member of a religious order who has not taken a vow of. The minister must be ordained, licensed, or commissioned by a church or religious denomination. Oct 04, 2015 really not a great idea. • an ordained, commissioned, or licensed minister of a church;

Form 1065 E File Requirements Universal Network

That was april 15, 2019, but you could file an extension until october 15, 2019. • an ordained, commissioned, or licensed minister of a church; 4) must file an irs form 4361. Oct 04, 2015 really not a great idea. Web in this article, we’ll walk through irs form 4361 so you can better understand:

Form 201 Files

4) must file an irs form 4361. How to complete this tax form. So, you need to submit your form 4361 by october 15, 2019. How to file form 4361 to claim your exemption. That was april 15, 2019, but you could file an extension until october 15, 2019.

IRS Form 4361 Exemption From SelfEmployment Tax

• a member of a religious order who has not taken a vow of poverty; Web 1) must be an ordained, commissioned, or licensed by a church. You can view the form itself here. Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. Let’s start with step by step instructions.

U.S. TREAS Form treasirs43612003

You can view the form itself here. How to complete this tax form. 4) must file an irs form 4361. Web in this article, we’ll walk through irs form 4361 so you can better understand: Before your application can be approved, the irs must verify that you are aware of the grounds for exemption.

Hecht Group Why Churches Don’t Have To Pay Personal Property Taxes

4) must file an irs form 4361. Web 1) must be an ordained, commissioned, or licensed by a church. You can view the form itself here. • a member of a religious order who has not taken a vow of poverty; That was april 15, 2019, but you could file an extension until october 15, 2019.

17 [PDF] FORM 4361 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

You can view the form itself here. 3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it. • a member of a religious order who has not taken a vow of poverty; You will be asked about your housing allowance and whether or not you have.

The Minister Must Be Ordained, Licensed, Or Commissioned By A Church Or Religious Denomination.

Before your application can be approved, the irs must verify that you are aware of the grounds for exemption. Let’s start with step by step instructions for irs form 4361. 3) must be opposed to receiving social security benefits on the basis of their religious principles or because they are conscientiously oppose to it. A member of a religious order who has not taken a vow of.

• An Ordained, Commissioned, Or Licensed Minister Of A Church;

Web 1) must be an ordained, commissioned, or licensed by a church. Anonymous merely changing churches does not reset the two year window of opportunity. Web that means that your first tax year is 2017 and your second tax year is 2018, so you have to file form 4361 by the due date for your 2018 tax return. An ordained, commissioned, or licensed minister of a church;

Web In Order To Opt Out, The Minister Must File Form 4361 No Later Than The Due Date (With Extensions) For The Tax Return For The Second Year In Which The Minister Had Net Ministerial Income Of $400 Or More.

That was april 15, 2019, but you could file an extension until october 15, 2019. Or • a christian science practitioner. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. You can view the form itself here.

Oct 04, 2015 Really Not A Great Idea.

How to complete this tax form. How to file form 4361 to claim your exemption. Web form 4361 is an irs document that is used by ministers to opt out of public insurance programs. You will be asked about your housing allowance and whether or not you have an approved form 4361.

![17 [PDF] FORM 4361 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://3.bp.blogspot.com/-qTJKFRd5GAA/UhiL9mr-pTI/AAAAAAAA6HQ/lxfIrVan3Go/s1600/IMG_4361.jpg)