How To File A Late 1099 Form

How To File A Late 1099 Form - Missing the deadline is not the end of the world, but you will have to pay the following irs penalties for each late. Web the best solution to a late 1099 filing is to avoid penalties altogether. Postal mail recipient copies by mail or online. Web if you are late filing 1099 forms, or submitting them as a gig worker, now’s the time to get them in. Web free electronic filing online portal to file form 1099 series information returns. File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the. Check your refund status, make a payment, get free tax help. Don’t request it, here’s why robert w. Web what happens if you miss the 1099 filing deadline?

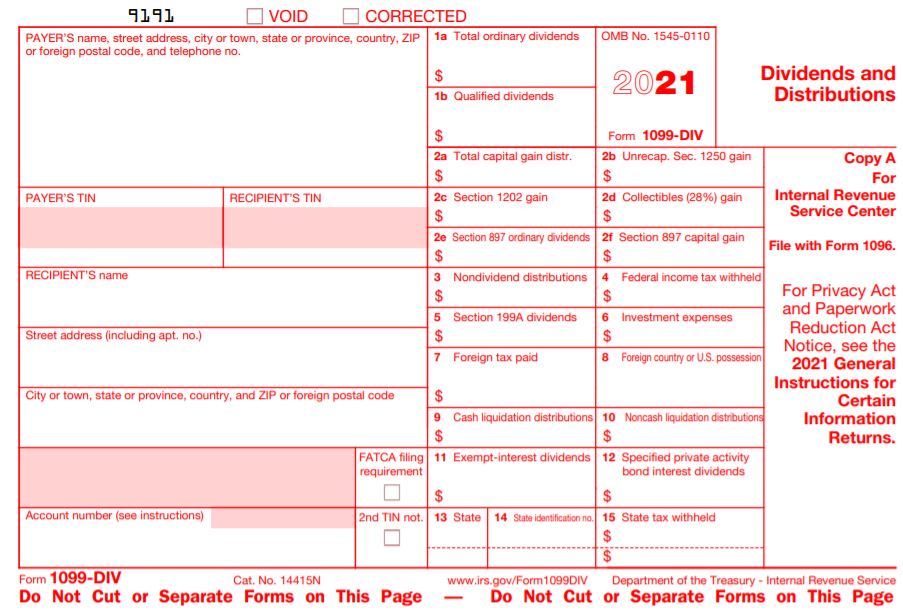

Web be sure to include a copy of the 1099 with the amended return and include a payment for any additional tax that you owe. Volume based pricing for high volume filers. Missing the deadline is not the end of the world, but you will have to pay the following irs penalties for each late. The best way to do that? An integrated accounting software solution, like that offered from ams. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Postal mail recipient copies by mail or online. Jan 27, 2020,09:02am est listen to article. Web the best solution to a late 1099 filing is to avoid penalties altogether. You need forms 1099 that report dividends and stock proceeds that you might not.

Wood senior contributor i focus on taxes and litigation. Web be sure to include a copy of the 1099 with the amended return and include a payment for any additional tax that you owe. Postal mail recipient copies by mail or online. The best way to do that? Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web if you are late filing 1099 forms, or submitting them as a gig worker, now’s the time to get them in. You need forms 1099 that report dividends and stock proceeds that you might not. The irs requires that this form be filed by january 31st for the previous calendar year. We can also print & mail corrected forms to recipients. Don’t request it, here’s why robert w.

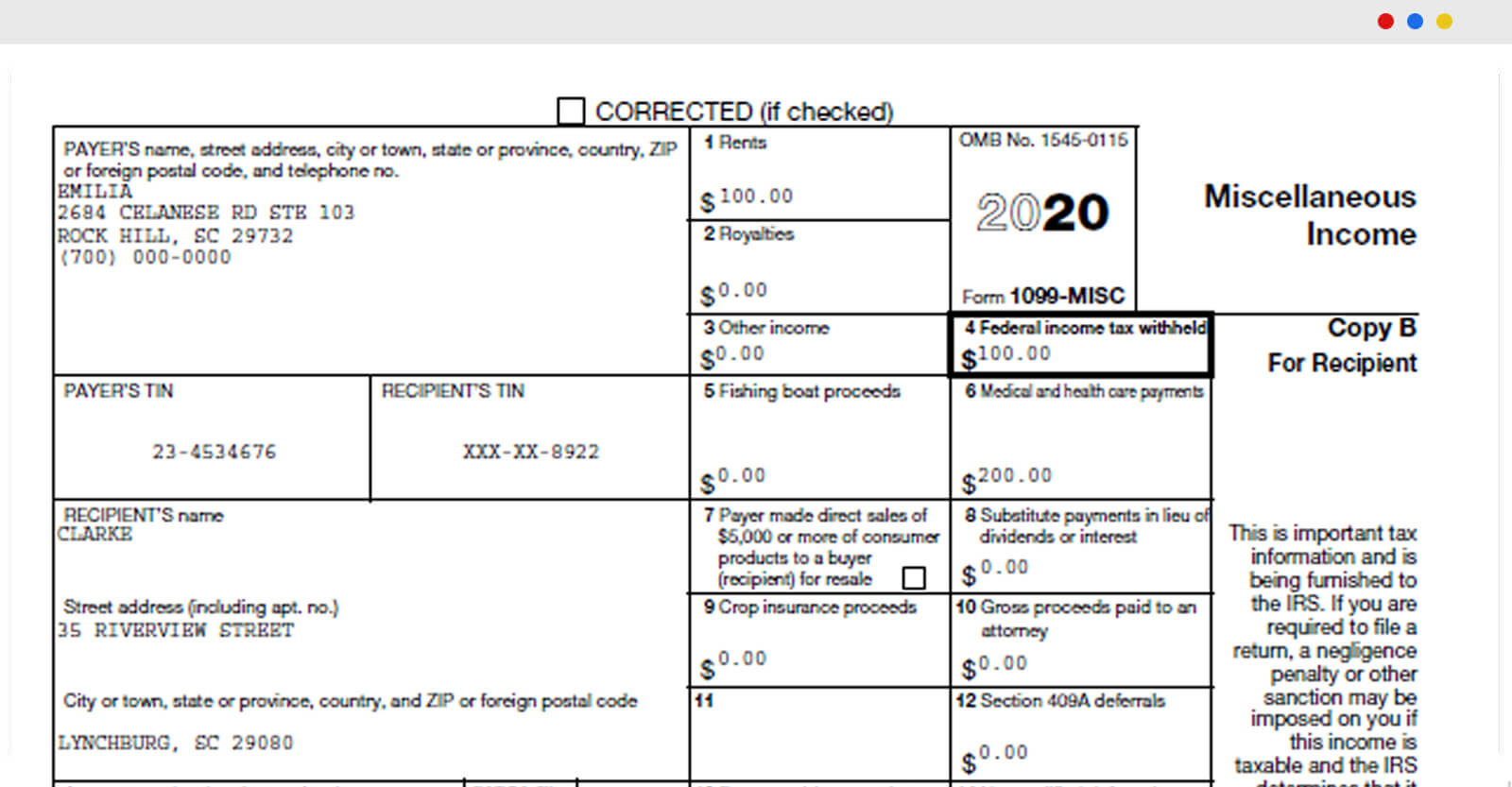

Efile Form 1099 MISC Online How to File 1099 MISC for 2020

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web be sure to include a copy of the 1099 with the amended return and include a payment for any additional tax that you owe. Web what happens if you miss the 1099 filing deadline? You need forms 1099 that report dividends and stock.

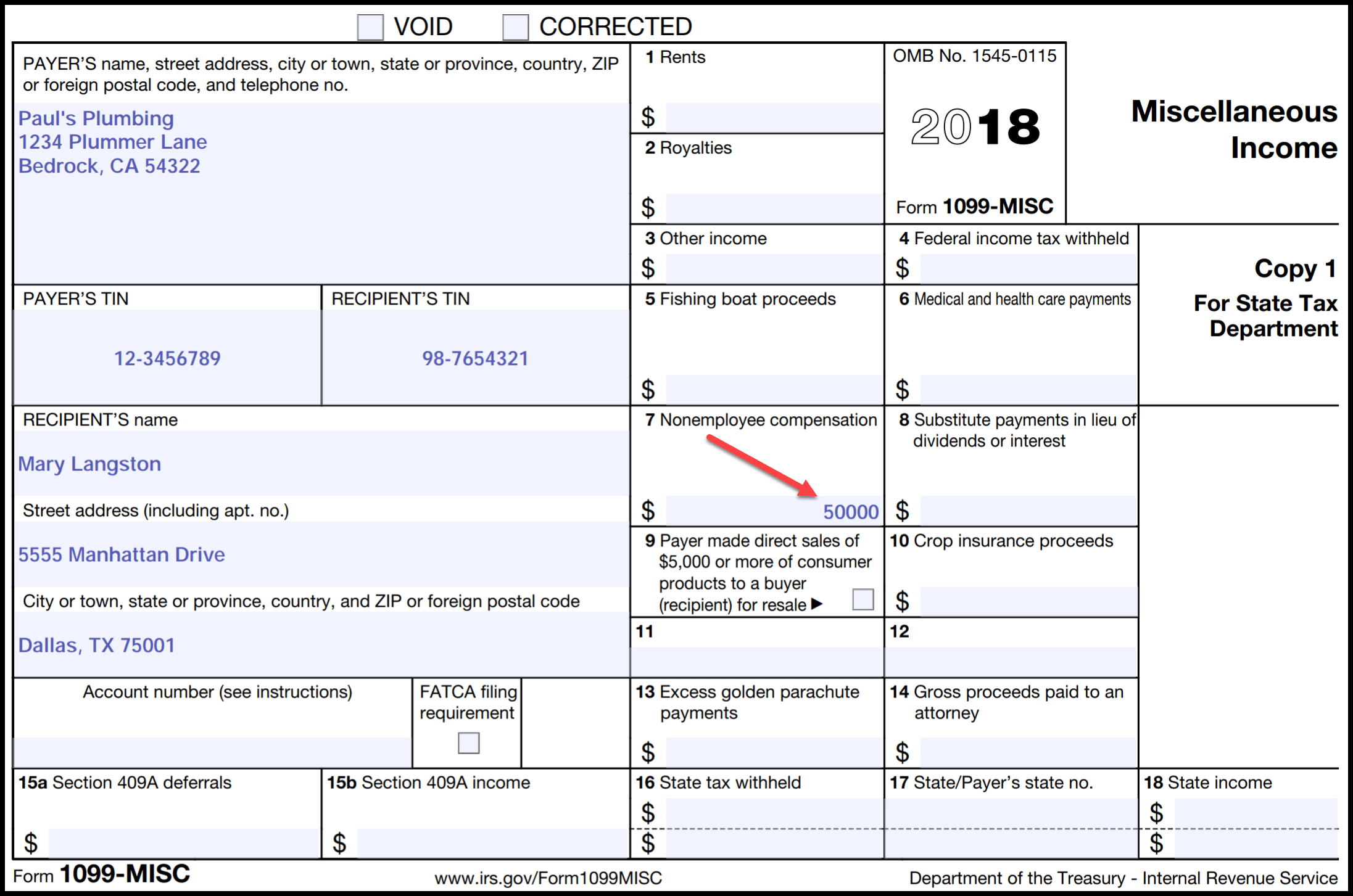

Free Printable 1099 Form Free Printable

You can wait to receive a. Check your refund status, make a payment, get free tax help. Jan 27, 2020,09:02am est listen to article. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Below we’ll cover key deadlines for businesses to send out 1099.

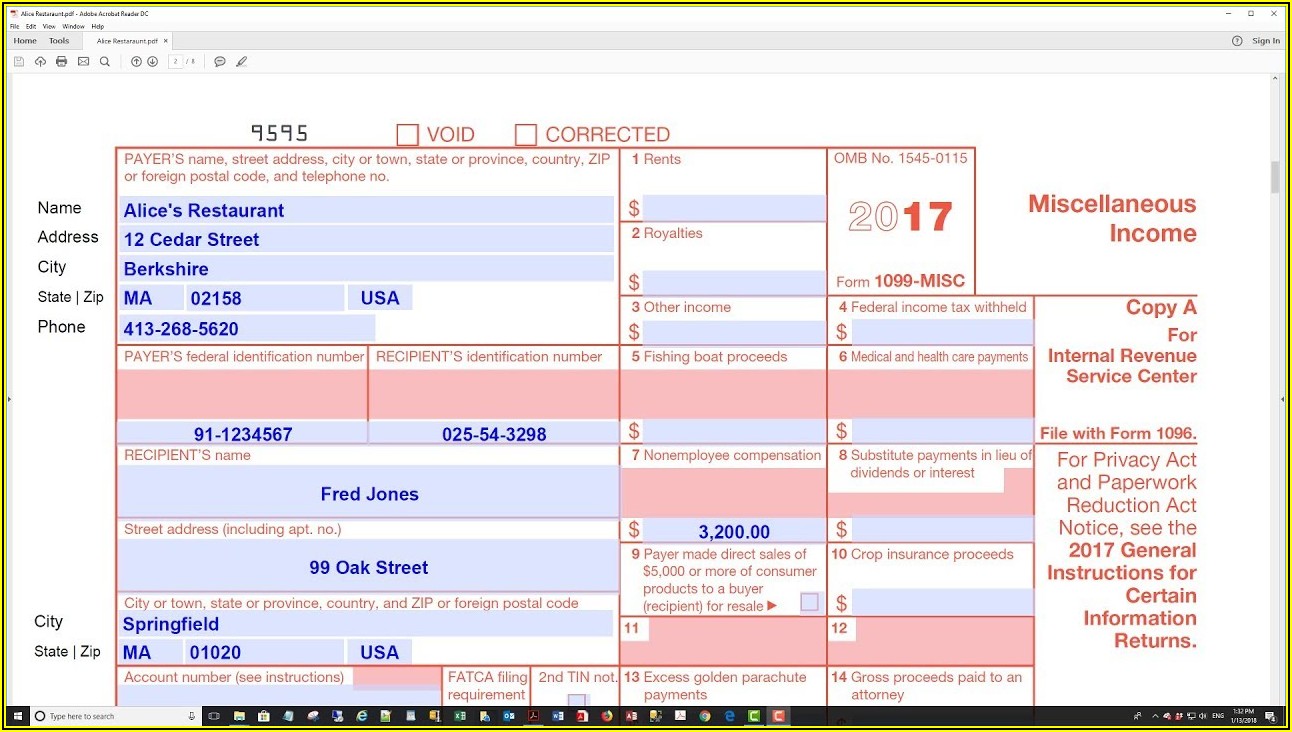

All About Forms 1099MISC and 1099K Brightwater Accounting

Web filing past due tax returns. File your 1099 form corrections in minutes with our online software with any browser You can wait to receive a. File your past due return the same way and to the. Web what happens if you miss the 1099 filing deadline?

Irs Form 1099 Misc Form Resume Examples dP9l7NZW2R

Don’t request it, here’s why robert w. File your 1099 form corrections in minutes with our online software with any browser The irs requires that this form be filed by january 31st for the previous calendar year. An integrated accounting software solution, like that offered from ams. Ap leaders rely on iofm’s expertise to keep them up to date on.

Irs Form 1099 Late Filing Penalty Form Resume Examples

File your past due return the same way and to the. Don’t request it, here’s why robert w. In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Web be sure to include a copy of the 1099 with the amended return and include a payment for any additional tax that.

How To File Form 1099NEC For Contractors You Employ VacationLord

Wood senior contributor i focus on taxes and litigation. The best way to do that? File your past due return the same way and to the. The irs requires that this form be filed by january 31st for the previous calendar year. Volume based pricing for high volume filers.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

In addition to these specific instructions, you should also use the current year general instructions for certain information returns. Don’t request it, here’s why robert w. The irs requires that this form be filed by january 31st for the previous calendar year. Web in other words, much of the time, if you’re filing late, you’re facing two penalties per form—one.

1099 Request Form Letter / How To File 1099 Taxes Online

If the tax filing deadline is near, the representative will let you know how to file. Web filing past due tax returns. File your 1099 form corrections in minutes with our online software with any browser Web free electronic filing online portal to file form 1099 series information returns. An integrated accounting software solution, like that offered from ams.

Form1099NEC

The best way to do that? Web in other words, much of the time, if you’re filing late, you’re facing two penalties per form—one for each copy. Web late irs form 1099? File all tax returns that are due, regardless of whether or not you can pay in full. If you do not file.

EFile 1099 File Form 1099 Online Form 1099 for 2020

File all tax returns that are due, regardless of whether or not you can pay in full. Web if you are late filing 1099 forms, or submitting them as a gig worker, now’s the time to get them in. We can also print & mail corrected forms to recipients. Volume based pricing for high volume filers. We can also print.

Web Filing Past Due Tax Returns.

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Jan 27, 2020,09:02am est listen to article. You need forms 1099 that report dividends and stock proceeds that you might not. In addition to these specific instructions, you should also use the current year general instructions for certain information returns.

But This Also Means That If You Notice The Error Right Away, You.

Check your refund status, make a payment, get free tax help. You can wait to receive a. Missing the deadline is not the end of the world, but you will have to pay the following irs penalties for each late. We can also print & mail corrected forms to recipients.

File Your Past Due Return The Same Way And To The.

File your 1099 form corrections in minutes with our online software with any browser Web what happens if you miss the 1099 filing deadline? Web be sure to include a copy of the 1099 with the amended return and include a payment for any additional tax that you owe. An integrated accounting software solution, like that offered from ams.

The Irs Requires That This Form Be Filed By January 31St For The Previous Calendar Year.

The best way to do that? Volume based pricing for high volume filers. Wood senior contributor i focus on taxes and litigation. We can also print & mail corrected forms to recipients.