How To File A Form 990-N For A Prior Year

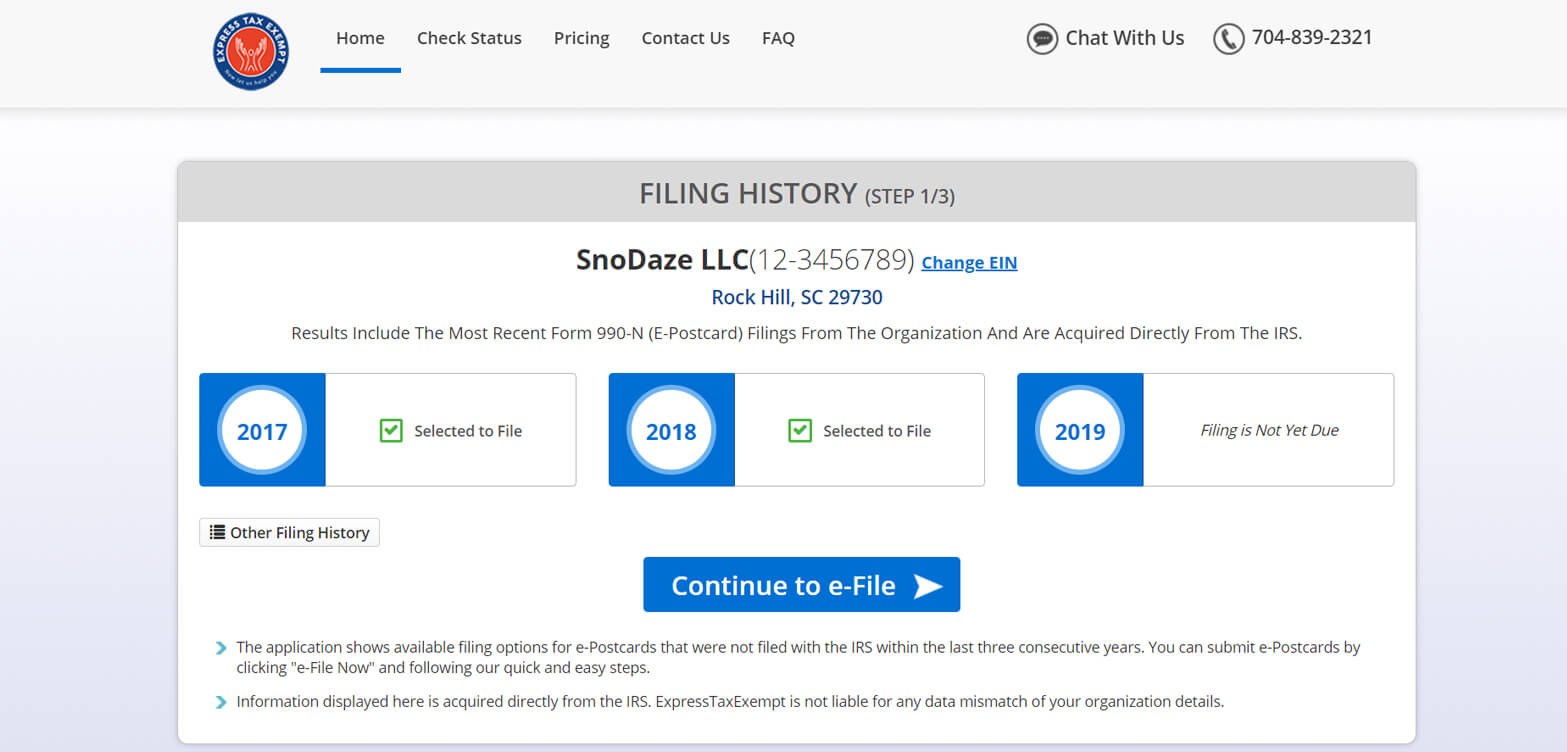

How To File A Form 990-N For A Prior Year - The irs requires a login.gov or. Employer identification number (ein), also known as a. If the total is under $50,000, then the form 990 n is for you. Web by piecing together information, you’ll soon have a good handle on the prior year’s numbers. If your organization uses a calendar year (a year ending. Search a list of organizations that have filed. For prior year forms, use the prior year search tool on the irs forms,. Sign in/create an account with login.gov or id.me: Web according to the irs: At any time during the tax year, was the organization a party to a prohibited tax shelter enter amount of political expenditures, direct or indirect, as.

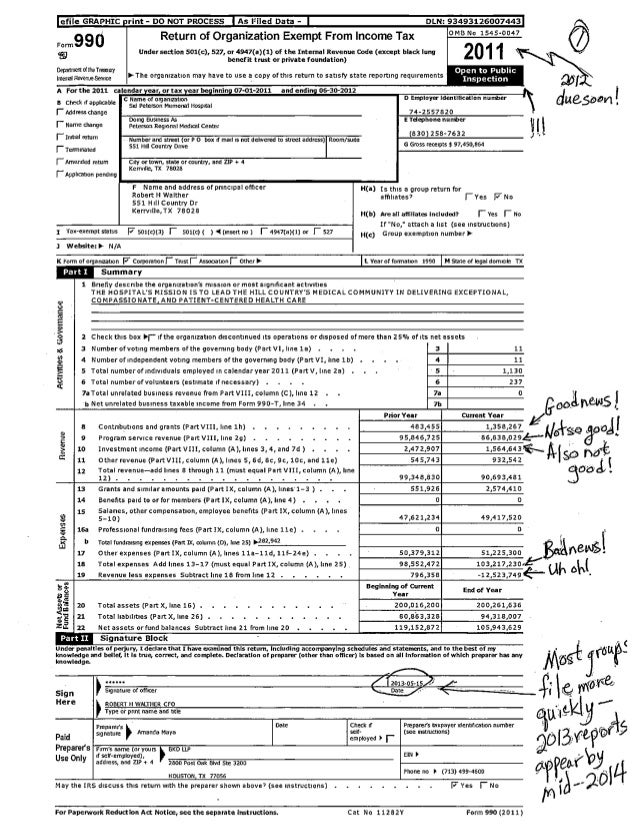

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Search a list of organizations that have filed. Employer identification number (ein), also known as a. If your organization uses a calendar year (a year ending. Web by piecing together information, you’ll soon have a good handle on the prior year’s numbers. Sign in/create an account with login.gov or id.me: Web according to the irs: 1.2k views | last modified 6/15/2023 2:25:44 am est from the dashboard, under the. For prior year forms, use the prior year search tool on the irs forms,. If the total is under $50,000, then the form 990 n is for you.

Search a list of organizations that have filed. Web by piecing together information, you’ll soon have a good handle on the prior year’s numbers. Web according to the irs: For prior year forms, use the prior year search tool on the irs forms,. Web all you need is the following information: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. 1.2k views | last modified 6/15/2023 2:25:44 am est from the dashboard, under the. The irs requires a login.gov or. Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. If the total is under $50,000, then the form 990 n is for you.

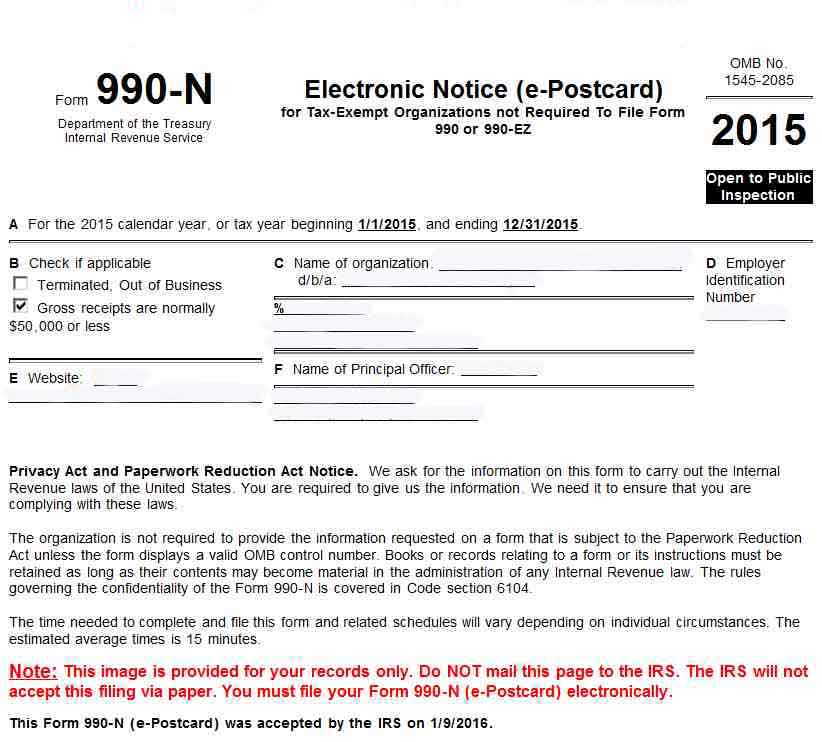

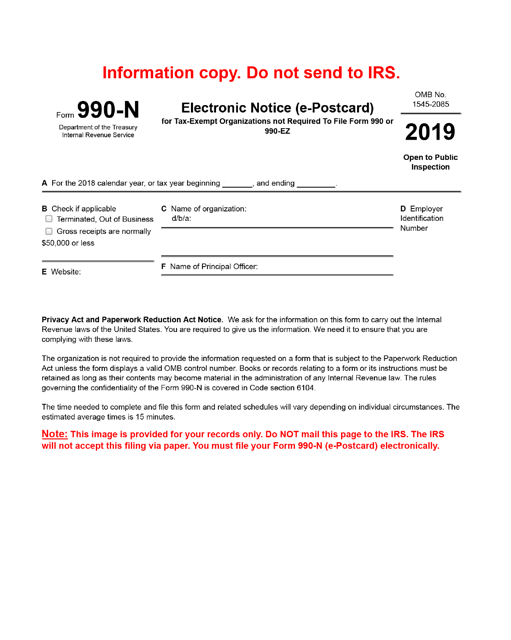

Printable 990 N Form Printable Form 2022

If your organization uses a calendar year (a year ending. 1.2k views | last modified 6/15/2023 2:25:44 am est from the dashboard, under the. Search a list of organizations that have filed. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web all.

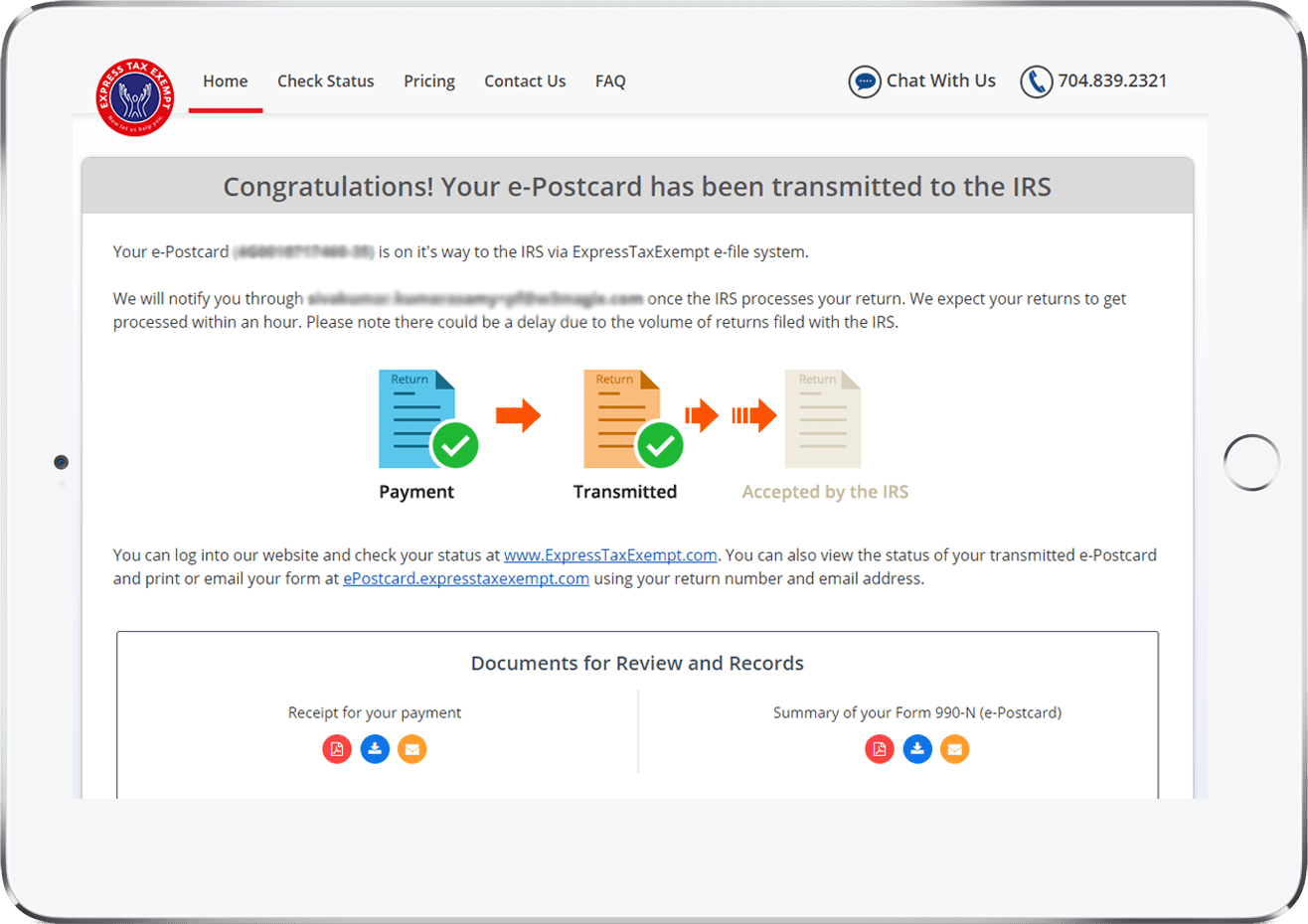

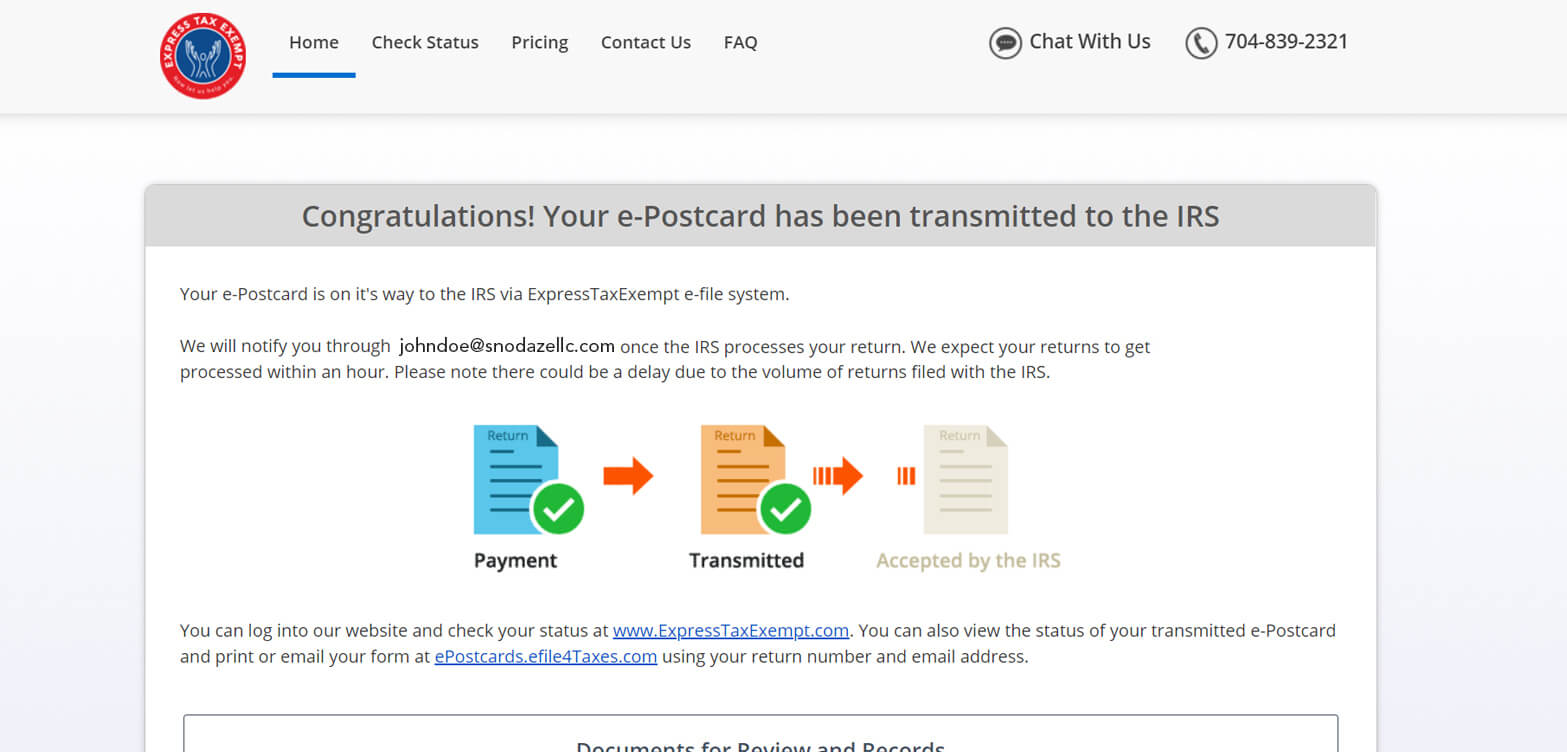

File Form 990N Online 990n e file Form 990N (ePostcard)

Web all you need is the following information: If your organization uses a calendar year (a year ending. For prior year forms, use the prior year search tool on the irs forms,. Search a list of organizations that have filed. Sign in/create an account with login.gov or id.me:

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

If your organization uses a calendar year (a year ending. 1.2k views | last modified 6/15/2023 2:25:44 am est from the dashboard, under the. Search a list of organizations that have filed. Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Web all you need is the following information:

Form 990N (ePostcard) Online Efile 990N in 3Steps Prior Year

Employer identification number (ein), also known as a. Web according to the irs: Sign in/create an account with login.gov or id.me: Organization’s legal name an organization’s legal name is the organization’s name as it appears in the articles of. For prior year forms, use the prior year search tool on the irs forms,.

Form 990N (ePostcard) Online Efile 990N in 3Steps Prior Year

Web according to the irs: Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Search a list of organizations that have filed. Web 21 rows see the form 990 filing thresholds page to determine which forms an organization must file. 1.2k views | last modified 6/15/2023 2:25:44 am est from.

Efile Form 990N 2020 IRS Form 990N Online Filing

Web all you need is the following information: Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Web by piecing together information, you’ll soon have a good handle on the prior year’s numbers. The irs requires a login.gov or. Web 21 rows see the form 990 filing thresholds page to.

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Employer identification number (ein), also known as a. For prior year forms, use the prior year search tool on the irs forms,. Organization’s legal name an organization’s legal name is the organization’s name as it appears in the articles of. The irs requires a login.gov or. Web according to the irs:

Failure To File Form 990N free download programs ealetitbit

Sign in/create an account with login.gov or id.me: At any time during the tax year, was the organization a party to a prohibited tax shelter enter amount of political expenditures, direct or indirect, as. If the total is under $50,000, then the form 990 n is for you. Organization’s legal name an organization’s legal name is the organization’s name as.

Form 990N (ePostcard) Online Efile 990N in 3Steps Prior Year

Web according to the irs: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Organization’s legal name an organization’s legal name is the organization’s name as it appears in the articles of. If the total is under $50,000, then the form 990 n.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web according to the irs: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Employer identification number (ein), also known as a. For prior year forms, use the prior year search tool on the irs forms,. Web all you need is the following.

Employer Identification Number (Ein), Also Known As A.

For prior year forms, use the prior year search tool on the irs forms,. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Search a list of organizations that have filed. If the total is under $50,000, then the form 990 n is for you.

Web All You Need Is The Following Information:

1.2k views | last modified 6/15/2023 2:25:44 am est from the dashboard, under the. Web by piecing together information, you’ll soon have a good handle on the prior year’s numbers. At any time during the tax year, was the organization a party to a prohibited tax shelter enter amount of political expenditures, direct or indirect, as. Web according to the irs:

If Your Organization Uses A Calendar Year (A Year Ending.

Web which form an organization must file generally depends on its financial activity, as indicated in the chart below. Organization’s legal name an organization’s legal name is the organization’s name as it appears in the articles of. The irs requires a login.gov or. Web 21 rows see the form 990 filing thresholds page to determine which forms an organization must file.