How To Delete Form 3554 Turbotax

How To Delete Form 3554 Turbotax - Select tax tools in the left panel. With turbotax open select tax tools in the left panel. Web how do i delete ca form 3554 from ca income tax form? Click easy step button in upper left corner. Select delete on the line for form 3554. Web i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to… advertisement coins 0 coins premium powerups explore gaming Web with your return open, in the left menu column click on tax tools, then tools. Web why sign in to the community? Open or continue your return in turbotax. Once the page populates, scroll down to the state form.

It will then ask you to confirm. Select delete on the line for form 3554. Scroll all the way down to the state. Sign in to the community or sign in to turbotax and start working on your taxes 3) takes you to a page of forms you have filled. In the left menu, select tax tools and then tools. Web i was able to remove form 3554 in turbotax home & business 2017 mac using the following steps: In the left pane, select the form you want to remove. Web i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to… advertisement coins 0 coins premium powerups explore gaming If that doesn't apply to you, follow the steps below to delete the form:

Find the form and select delete next to it. Sign into your account and select your current return. Select delete a form (see attached image) 4. View solution in original post. Select tax tools on the bottom left and then tools (see attached tax tools) 3. Web in this video you will see how to delete a tax form from turbotax. You can remove the form using the following method: Web to get rid of ca form 3554, you need to delete the ca return and start over. Web 1) click bookmarks (icon or symbol on top right of window) 2) you may or may not have bookmarks saved, no worries. Select delete next to the form, schedule,.

How To Delete Turbotax Account pumplasopa

Tax home, documents, my info, federal, state, etc. Select tax tools on the bottom left and then tools (see attached tax tools) 3. Scroll all the way down to the state. Web how do i delete ca form 3554 from ca income tax form? Web sign in to turbotax and open your return by selecting continue or pick up where.

How to Delete TurboTax account 2022 Tip Bollyinside

Web here are the steps to delete form 3554 in turbotax online, if not needed: Web see the intuit/turbotax logo. Make sure that you do not go into the new employment credit recapture. to remove a state from your return in turbotax please follow these steps: Has anyone else experienced this? Click easy step button in upper left corner.

Delete form Help & Support

In the left menu, select tax tools and then tools. Web click on it and all business applicable forms will appear on side bar menu. Select tax tools in the left panel. Select delete on the line for form 3554. Web see the intuit/turbotax logo.

How To Delete 1099 Form On Turbotax Armando Friend's Template

After the form is generated in the right pane, select. 3) takes you to a page of forms you have filled. In the left pane, select the form you want to remove. Web sign in to turbotax and open your return by selecting continue or pick up where you left off. In the left menu, select tax tools and then.

Renaming and Deleting iPad Forms Form Connections

Sign in to the community or sign in to turbotax and start working on your taxes Scroll all the way down to the state. Web here are the steps to delete form 3554 in turbotax online, if not needed: Web why sign in to the community? Click easy step button in upper left corner.

how to remove form 3514 TurboTax Support

Sign into your account and select your current return. 2b) click delete form from list of links displayed at lower half of window. 3) takes you to a page of forms you have filled. Web click on it and all business applicable forms will appear on side bar menu. Has anyone else experienced this?

How to delete TurboTax account in just 1 minute Trick Slash

Web with your return open, in the left menu column click on tax tools, then tools. Web why sign in to the community? After the form is generated in the right pane, select. Select tax tools on the bottom left and then tools (see attached tax tools) 3. In the left menu, select tax tools and then tools.

Delete forms

Web i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to… advertisement coins 0 coins premium powerups explore gaming 2b) click delete form from list of links displayed at lower half of window. Go to my account in the top right.

It says i need form 8889T and i dont. How can i fix? TurboTax Support

Sign in to the community or sign in to turbotax and start working on your taxes Web click on it and all business applicable forms will appear on side bar menu. Select the forms icon on the top left corner of the turbotax window. My browser turbotax has a lefthand side navigation menu, where it lists things like: Web instructions.

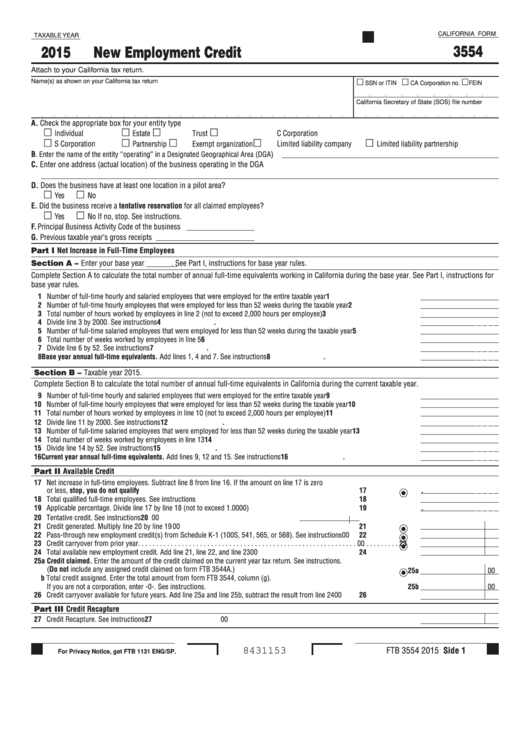

Form 3554 California New Employment Credit 2015 printable pdf download

In the tools window, choose the link delete a form. in the list of forms find that particular ca form 3554 you need to delete. 2b) click delete form from list of links displayed at lower half of window. Web up to $7 cash back if you do not need the 3554 form. Web click on it and all business.

Web Why Sign In To The Community?

Web i was able to remove form 3554 in turbotax home & business 2017 mac using the following steps: With turbotax open select tax tools in the left panel. Web i'm using turbo tax and i accidentally marked a 0 in the form 3554, when in actuality i should have left the form blank because it doesn't apply to… advertisement coins 0 coins premium powerups explore gaming You will see, at bottom of screen, 3 button options for 'print', 'delete form' and 'close form'.

Look To The Lower Left Hand Corner Where You Will See Three (3) Buttons:

Select tax tools on the bottom left and then tools (see attached tax tools) 3. This will bring up a list of forms in your return. Form shows up (it's not listed on the lift, but it shows in main window). Go to my account in the top right corner.

Web With Your Return Open, In The Left Menu Column Click On Tax Tools, Then Tools.

Sign in to the community or sign in to turbotax and start working on your taxes Web why sign in to the community? Web click on it and all business applicable forms will appear on side bar menu. In the left pane, select the form you want to remove.

Make Sure That You Do Not Go Into The New Employment Credit Recapture. To Remove A State From Your Return In Turbotax Please Follow These Steps:

Tax home, documents, my info, federal, state, etc. Sign in to the community or sign in to turbotax and start working on your taxes Scroll all the way down to the state. Sign into your account and select your current return.