How To Amend Form 2290

How To Amend Form 2290 - Vin correction increase in taxable gross. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. When the mileage utility limit exceeds. Select 2290 amendment on the dashboard step 3: File form 2290 easily with eform2290.com. Web how to file form 2290 online. Enter your business information step 4: Web certain instances are listed below: Use coupon code get20b & get 20% off. Web the irs will stop mailing package 2290 to you.

Use coupon code get20b & get 20% off. You can go on to your dashboard and efile a 2290 amendment. Web how to make an amendment on 2290 form? On your dashboard, select “start new return”. You must file a paper form to report other changes. How to report changes with form 2290 amendment? Web start filing in any of the following scenarios, you have the option to do amendment for your previously accepted form 2290 returns: When the mileage utility limit exceeds. Changes can be made to the following sections of form 2290: Web you can amend your irs tax form 2290 online at yourtrucktax.com.

If you expect to use your vehicle for 5,000 miles or less during the tax period, your vehicle status will change from taxable vehicle to suspended. On your dashboard, select “start new return”. Web you can amend your irs tax form 2290 online at yourtrucktax.com. File form 2290 easily with eform2290.com. You can go on to your dashboard and efile a 2290 amendment. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web filing an amended 2290 return to report the exceeded mileage will produce an update stamped schedule 1. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Sign up here to create your ez2290 account for free. Use coupon code get20b & get 20% off.

Texas Application to Amend Bylaws (Section 3.01) Community of Interest

When the mileage utility limit exceeds. Choose your tax year & first used month. Web you can amend your irs tax form 2290 online at yourtrucktax.com. Web certain instances are listed below: Easy, fast, secure & free to try.

Motion To Amend Pretrial Order (Sample) PDF Witness Complaint

Web how to make an amendment on 2290 form? Web the irs lets the taxpayer correct the errors made on the irs form 2290 by filing a 2290 amendment. Web create your 2290 amendment form. Irs accepts this 2290 amendment electronically. Filing the amendment will also waive any late.

Amend a Device

When the mileage utility limit exceeds. Choose your tax year & first used month. Web how to make an amendment on 2290 form? Web create your 2290 amendment form. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,.

How to File the Form 2290 Weight Increase Amendment YouTube

July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Enter your business information step 4: File form 2290 easily with eform2290.com. How can i amend irs form 2290? You can go on to your dashboard and efile a 2290 amendment.

Fillable Form Dte 110 Notice To Amend Application For The Valuation

Enter your business information step 4: You can go on to your dashboard and efile a 2290 amendment. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. On your dashboard, select “start new return”. Sign up here to create your ez2290 account for free.

Form DHCS6239 Download Fillable PDF or Fill Online Request to Amend

How can i amend irs form 2290? You must file a paper form to report other changes. If you expect to use your vehicle for 5,000 miles or less during the tax period, your vehicle status will change from taxable vehicle to suspended. File form 2290 easily with eform2290.com. Use coupon code get20b & get 20% off.

Form CDPH6238 Download Fillable PDF or Fill Online Request to Amend

Web log in to your expresstrucktax account. You must file a paper form to report other changes. Vin correction increase in taxable gross. You can go on to your dashboard and efile a 2290 amendment. How to report changes with form 2290 amendment?

Use Form 1040X to Fix and Amend Your JustFiled Tax Return

Easy, fast, secure & free to try. File form 2290 easily with eform2290.com. How to report changes with form 2290 amendment? Web certain instances are listed below: Use coupon code get20b & get 20% off.

Irs amendments 2290

These are the only two reasons to file. Web you can amend your irs tax form 2290 online at yourtrucktax.com. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web when the gross taxable weight of the vehicle increases. When the mileage utility limit.

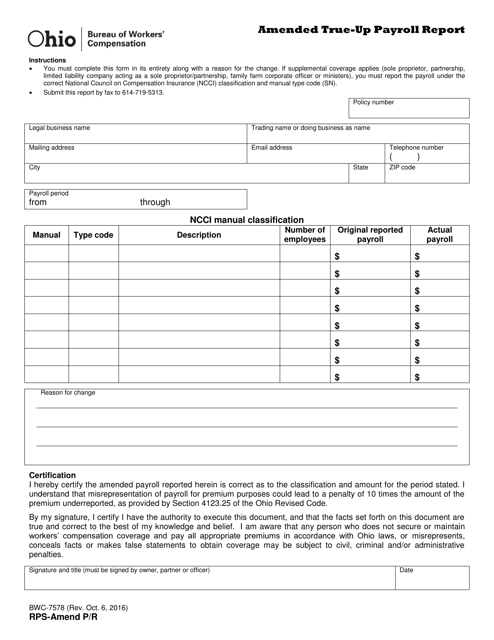

Form RPSAMEND P/R (BWC7578) Download Printable PDF or Fill Online

These are the only two reasons to file. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Changes can be made to the following sections of form 2290: Web the irs will stop mailing package 2290 to you. Web log in to your expresstrucktax account.

Login To Your Eform2290.Com Account Step 2:

Web how to efile form 2290 amendment online? Web start filing in any of the following scenarios, you have the option to do amendment for your previously accepted form 2290 returns: If you expect to use your vehicle for 5,000 miles or less during the tax period, your vehicle status will change from taxable vehicle to suspended. An increase in the gross taxable weight of the vehicle.

Click “Form 2290 Amendments” And Then “Start Form 2290 Amendment”.

Web you can amend your irs tax form 2290 online at yourtrucktax.com. How to report changes with form 2290 amendment? Web the irs will stop mailing package 2290 to you. Vin correction increase in taxable gross.

On Your Dashboard, Select “Start New Return”.

Web how to file form 2290 online. File form 2290 easily with eform2290.com. Irs accepts this 2290 amendment electronically. You can go on to your dashboard and efile a 2290 amendment.

Do Your Truck Tax Online & Have It Efiled To The Irs!

Web create your 2290 amendment form. Filing the amendment will also waive any late. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web certain instances are listed below: