How Do I File Form 990 N

How Do I File Form 990 N - This is may 15 for most nonprofits, which use a calendar year. Discover the answers you need here! Below are solutions to frequently asked questions about entering form 990, form 990. Web why do i need to provide this information? Id.me account creation requires an. Edit, sign and save return org ept income tax form. Enter organization ein, review, and transmit to the irs! Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. The irs requires a login.gov or.

Enter organization ein, review, and transmit to the irs! Sign in/create an account with login.gov or id.me: Web why do i need to provide this information? Edit, sign and save return org ept income tax form. The irs requires a login.gov or. October 24, 2017 | 0 comments. Ad search for answers from across the web with searchresultsquickly.com. Id.me account creation requires an. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web the form 990 allows the irs to check up on a nonprofit in two capacities:

The group return satisfies your reporting requirement. Below are solutions to frequently asked questions about entering form 990, form 990. This is may 15 for most nonprofits, which use a calendar year. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Edit, sign and save return org ept income tax form. Enter organization ein, review, and transmit to the irs! Id.me account creation requires an. Web the form 990 allows the irs to check up on a nonprofit in two capacities: October 24, 2017 | 0 comments. Web why do i need to provide this information?

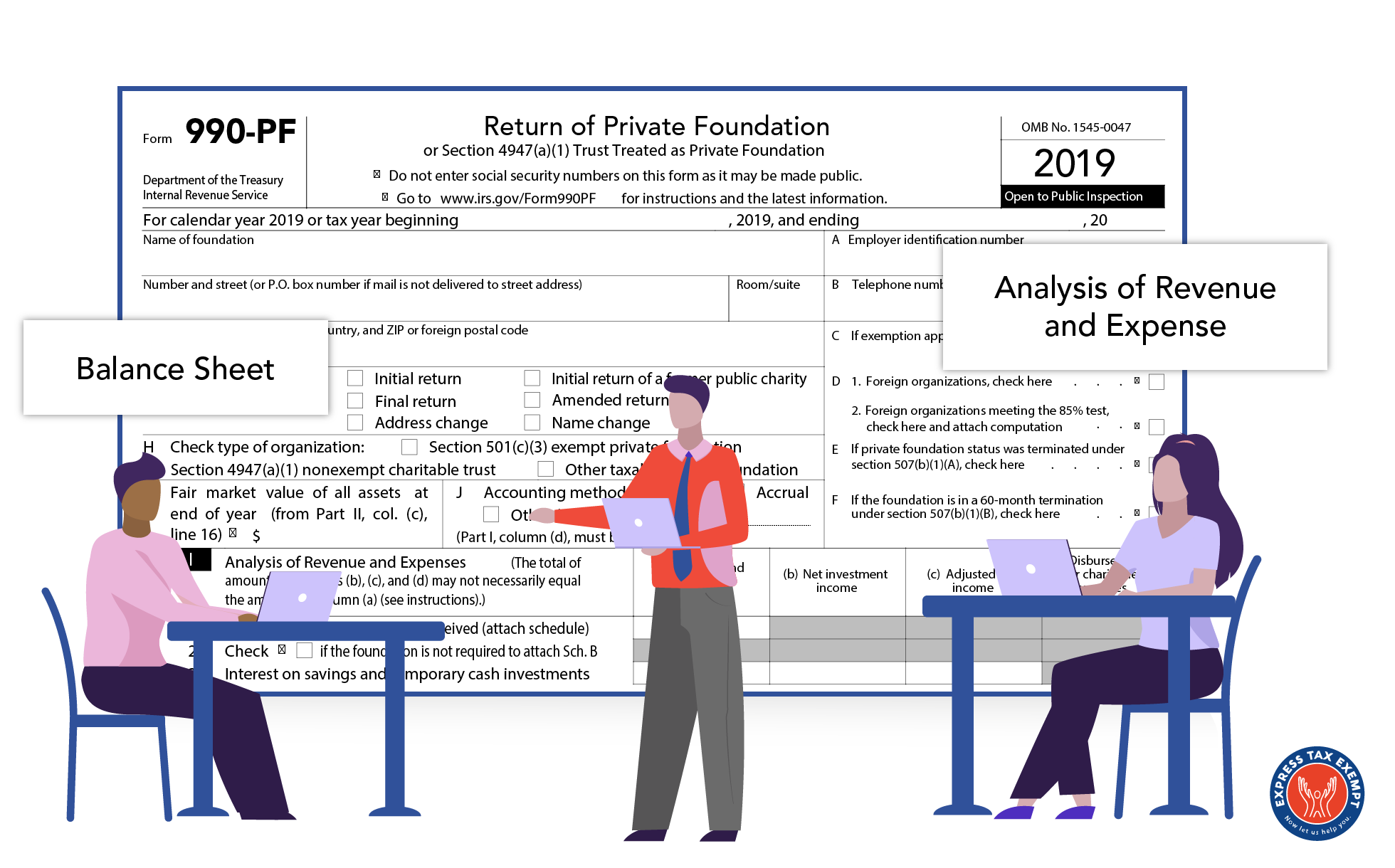

What is Form 990PF?

October 24, 2017 | 0 comments. Sign in/create an account with login.gov or id.me: Below are solutions to frequently asked questions about entering form 990, form 990. Just search for your ein, and our system will automatically import your organization’s data from the irs. When do i need to file?

The Best Form 990 Software for Tax Professionals What You Need to Know

Web the form 990 allows the irs to check up on a nonprofit in two capacities: Uslegalforms allows users to edit, sign, fill & share all type of documents online. Just search for your ein, and our system will automatically import your organization’s data from the irs. Web up to 10% cash back create a new id.me account users without.

FAQ Do I Need to File the IRS Form 990EZ? Secure Nonprofit Tax E

Id.me account creation requires an. Ad search for answers from across the web with searchresultsquickly.com. Just search for your ein, and our system will automatically import your organization’s data from the irs. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web the.

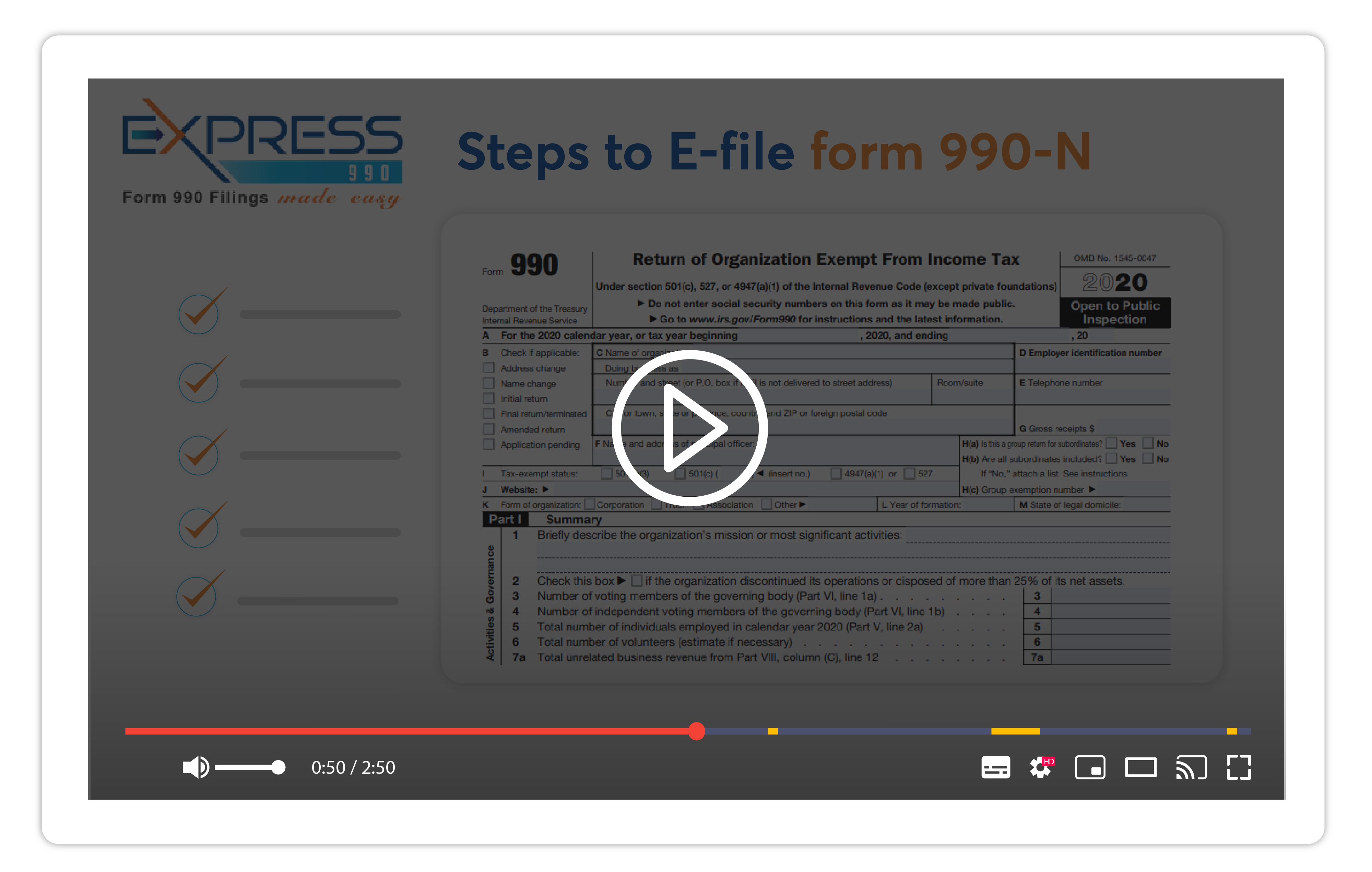

Form 990N ePostcard

Id.me account creation requires an. Web why do i need to provide this information? Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. The irs requires a login.gov or. Just search for your ein, and our system will automatically import your organization’s data from the.

A concrete proposal for a Twin Cities Drupal User Group nonprofit

Id.me account creation requires an. Web the form 990 allows the irs to check up on a nonprofit in two capacities: Web why do i need to provide this information? The group return satisfies your reporting requirement. Below are solutions to frequently asked questions about entering form 990, form 990.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

The irs requires a login.gov or. Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. Enter organization ein, review, and transmit to the irs! Web up to 10% cash back create a new id.me account users without an active irs username credential must register and.

Instructions to file your Form 990PF A Complete Guide

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Discover the answers you need here! Id.me account creation requires an. Web the form 990 allows the irs to check up on a nonprofit in two capacities: When do i need to file?

Efile Form 990N 2020 IRS Form 990N Online Filing

October 24, 2017 | 0 comments. This is may 15 for most nonprofits, which use a calendar year. Just search for your ein, and our system will automatically import your organization’s data from the irs. Id.me account creation requires an. The irs requires a login.gov or.

IRS Form 990 You Can Do This Secure Nonprofit Tax Efiling 990EZ

When do i need to file? This is may 15 for most nonprofits, which use a calendar year. Sign in/create an account with login.gov or id.me: Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. The irs requires a login.gov or.

How To Never Mistake IRS Form 990 and Form 990N Again

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Below are solutions to frequently asked questions about entering form 990, form 990. This is may 15 for most nonprofits, which use a calendar year. Enter organization ein, review, and transmit to the irs!.

Web Once You’ve Determined Your Total Receipts For The Year And They Total Less Than $50,000, You’re Ready To File Your Form 990 N.

The irs requires a login.gov or. Web up to 10% cash back create a new id.me account users without an active irs username credential must register and sign in id.me. This is may 15 for most nonprofits, which use a calendar year. When do i need to file?

October 24, 2017 | 0 Comments.

Just search for your ein, and our system will automatically import your organization’s data from the irs. Id.me account creation requires an. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web the form 990 allows the irs to check up on a nonprofit in two capacities:

Below Are Solutions To Frequently Asked Questions About Entering Form 990, Form 990.

Enter organization ein, review, and transmit to the irs! Ad search for answers from across the web with searchresultsquickly.com. Sign in/create an account with login.gov or id.me: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

Web Why Do I Need To Provide This Information?

Edit, sign and save return org ept income tax form. Discover the answers you need here! The group return satisfies your reporting requirement.