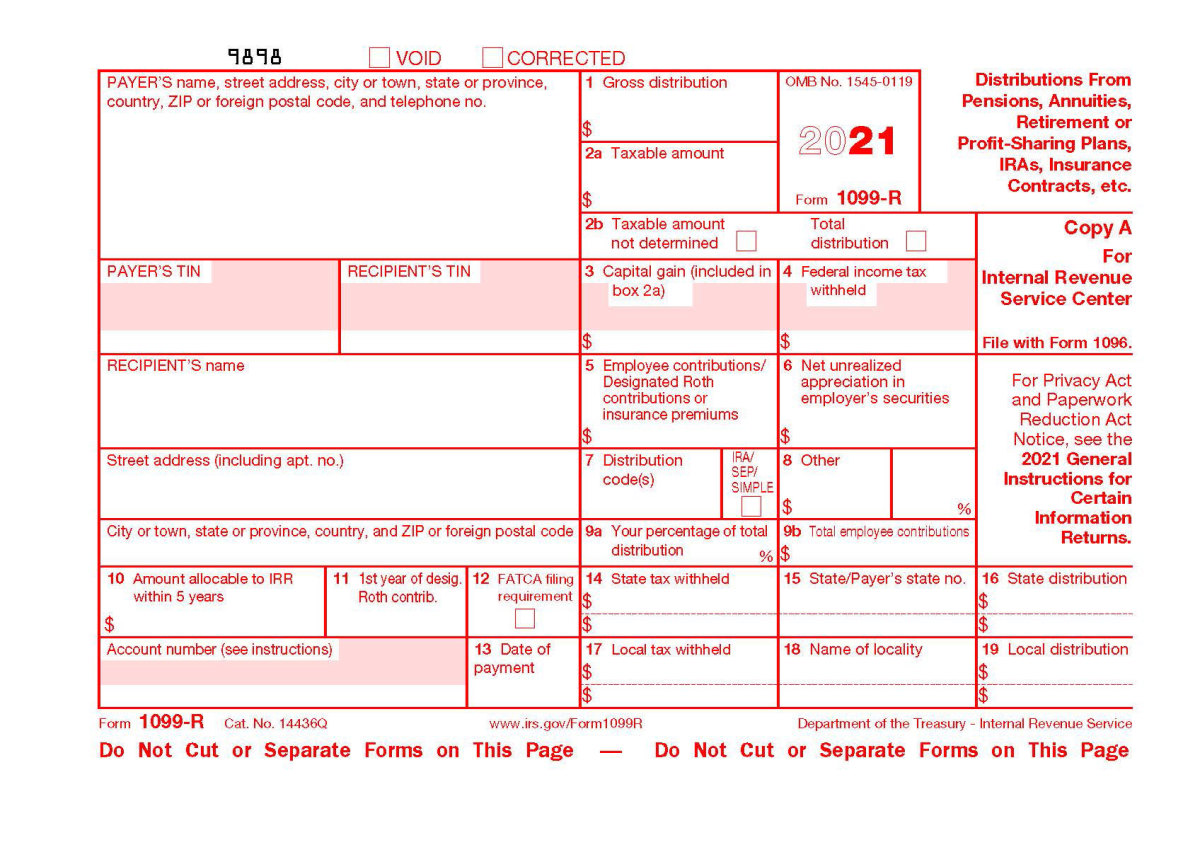

How Are Qualified Charitable Distributions Reported On Form 1099-R

How Are Qualified Charitable Distributions Reported On Form 1099-R - Indicate the return includes a qcd. In early 2023, the ira owner. They are aggregated with other taxable distributions and reported on lines. Scroll down to the other. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. Web qualified charitable distributions (qcd): It won’t distinguish between qcds and other. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Generally, do not report payments subject to withholding of social security and medicare taxes on this form. For inherited iras or inherited roth iras, the qcd will be reported.

Scroll down to the other. When an amount is entered in this box, the. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. Indicate the return includes a qcd. It won’t distinguish between qcds and other. To report a qcd on your form 1040 tax return,. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. For inherited iras or inherited roth iras, the qcd will be reported. In early 2023, the ira owner. They are aggregated with other taxable distributions and reported on lines.

It won’t distinguish between qcds and other. Scroll down to the other. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. Indicate the return includes a qcd. Web qualified charitable distributions (qcd): To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: For inherited iras or inherited roth iras, the qcd will be reported. Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. To report a qcd on your form 1040 tax return,.

IRA Qualified Charitable Distributions Tax Diversification

For inherited iras or inherited roth iras, the qcd will be reported. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. Scroll down to the other. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. It won’t distinguish between qcds.

Qualified Charitable Distributions A Choice for IRA owners to reduce

Generally, do not report payments subject to withholding of social security and medicare taxes on this form. Indicate the return includes a qcd. For inherited iras or inherited roth iras, the qcd will be reported. They are aggregated with other taxable distributions and reported on lines. When an amount is entered in this box, the.

What Are Qualified Charitable Distributions?

For inherited iras or inherited roth iras, the qcd will be reported. When an amount is entered in this box, the. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Scroll down to the other. Indicate the return includes a qcd.

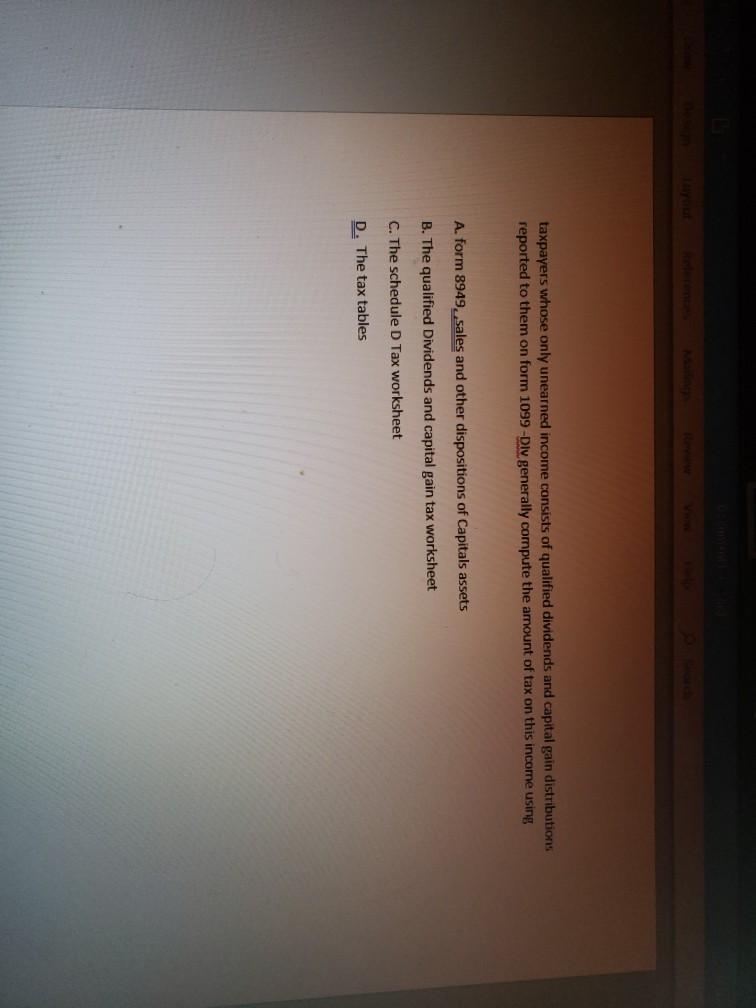

Solved taxpayers whose only unearned consists of

Scroll down to the other. It won’t distinguish between qcds and other. For inherited iras or inherited roth iras, the qcd will be reported. To report a qcd on your form 1040 tax return,. In early 2023, the ira owner.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution),.

Make Qualified Charitable Distributions Keystone Financial Partners

It won’t distinguish between qcds and other. Scroll down to the other. To report a qcd on your form 1040 tax return,. Web qualified charitable distributions (qcd): To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select:

Qualified charitable distributions Everything you need to know

Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. Scroll down to the other. In early 2023, the ira owner. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. To enter a qcd in taxslayer.

qualified charitable distributions Meadows Urquhart Acree and Cook, LLP

Scroll down to the other. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. When an amount is entered in this box, the. It won’t distinguish between qcds and other.

Qualified Charitable Distributions [Video] Financial Design Studio, Inc.

Indicate the return includes a qcd. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. Web qualified charitable distributions (qcd): In early 2023, the ira owner. When an amount is entered in this box, the.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

For inherited iras or inherited roth iras, the qcd will be reported. Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. Web qualified charitable distributions (qcd): They are aggregated with other taxable distributions and reported on lines. To enter a qcd.

Web Qualified Charitable Distributions (Qcd):

Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. For inherited iras or inherited roth iras, the qcd will be reported. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select:

Enter The Qualified Charitable Distribution Portion Of The Total Distributions From An Ira, If Applicable.

To report a qcd on your form 1040 tax return,. Scroll down to the other. When an amount is entered in this box, the. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season.

Indicate The Return Includes A Qcd.

They are aggregated with other taxable distributions and reported on lines. It won’t distinguish between qcds and other. In early 2023, the ira owner.

![Qualified Charitable Distributions [Video] Financial Design Studio, Inc.](https://financialdesignstudio.com/wp-content/uploads/2017/12/FDS-Qualified-Charitable-Distribution.png)