Housing Deduction From Form 2555

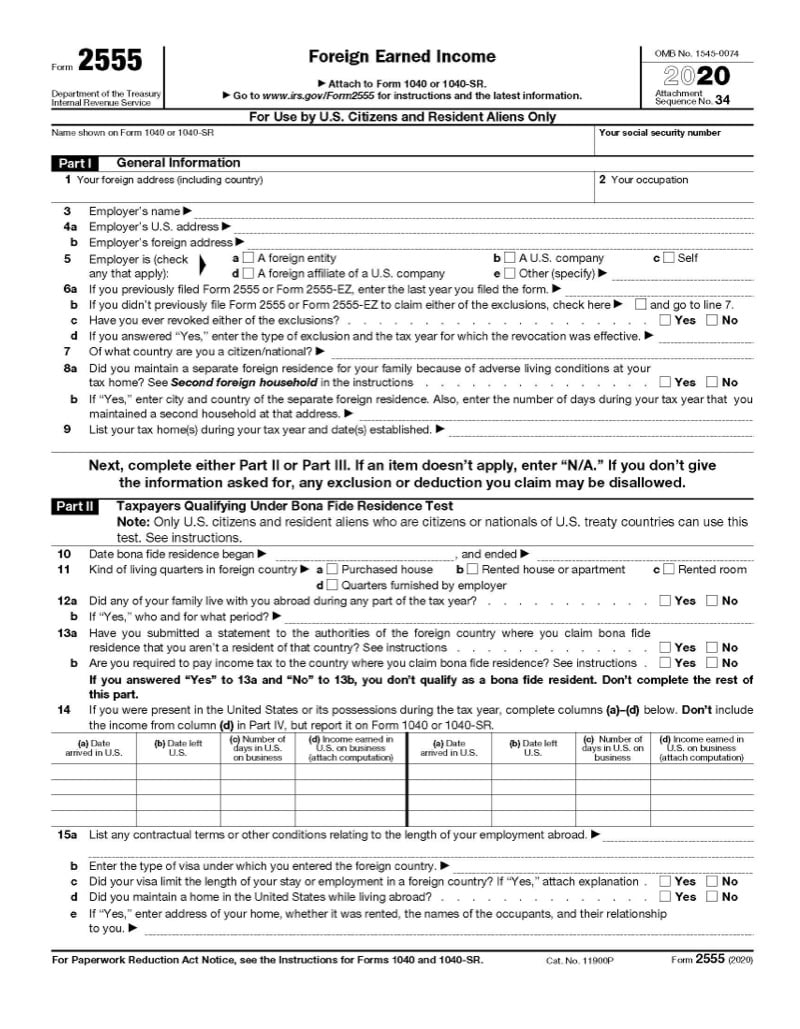

Housing Deduction From Form 2555 - Web foreign housing exclusion and deduction. Go to www.irs.gov/form2555 for instructions and the. Web the housing deduction is figured in part ix. The foreign housing deduction is reported on form 2555 part vi and ix. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. The exclusion is available only for wages or self. Web yes no are you required to pay income tax to the country where you claim bona fide residence? Web the foreign housing deduction is reported on form 2555 part vi and ix. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. If you are married and you and your spouse each qualifies under one of the tests, see.

Go to www.irs.gov/form2555 for instructions and the. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. These two exclusions help us taxpayers abroad capitalize on. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555, which should be attached to the taxpayer’s form 1040. This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your. The exclusion is available only for wages or self.

In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your. Yes no if you answered “yes” to 13a and “no” to 13b,. Web the housing deduction is figured in part ix. If you are married and you and your spouse each qualifies under one of the tests, see. If you qualify, you can use form. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. Web yes no are you required to pay income tax to the country where you claim bona fide residence? Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction.

Housing Recovery All of a Sudden Looks Strong

Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. If you qualify, you can use form. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. Web if you qualify, you can use form 2555 to figure.

IRS Form 2555 and the Foreign Earned Exclusion A Practical

If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. These two exclusions help us taxpayers abroad capitalize on. In addition to the foreign earned income exclusion, you can also claim an exclusion or a.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. Web the housing deduction is figured in part ix. If you choose to claim.

Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad

You cannot exclude or deduct more than the. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web foreign housing exclusion and deduction. The exclusion is available only for wages or self. If you qualify, you can use form.

Instructions for form 2555 2013

Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. Web foreign housing exclusion and deduction. Web the foreign housing deduction is reported on form 2555 part vi and ix. If you are married and you and your spouse each qualifies under one of the tests, see. Review that the entity number for.

Housing Allowance Back Pay 2020 Fill Online, Printable, Fillable

Web the housing deduction is figured in part ix. In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. Web if eligible, you can also use form 2555 to request.

Form 2555 Claiming Foreign Earned Exclusion Jackson Hewitt

Go to www.irs.gov/form2555 for instructions and the. Web the housing deduction is figured in part ix. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. If you qualify, you can use form. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix.

3.21.3 Individual Tax Returns Internal Revenue Service

The exclusion is available only for wages or self. The foreign housing deduction is reported on form 2555 part vi and ix. Web foreign housing exclusion and deduction. You cannot exclude or deduct more than the. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix.

Foreign Housing Deductions & Exclusions US Expats Tax Form 2555

These two exclusions help us taxpayers abroad capitalize on. Web the housing deduction is figured in part ix. This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. Go to www.irs.gov/form2555 for instructions and the. Web the foreign earned income exclusion and the foreign housing exclusion or deduction are claimed using form 2555,.

US Tax Abroad Expatriate Form 2555

Web foreign housing exclusion and deduction. This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. Web the housing deduction is figured in part ix. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. The exclusion is available only for wages or self.

Web The Foreign Earned Income Exclusion And The Foreign Housing Exclusion Or Deduction Are Claimed Using Form 2555, Which Should Be Attached To The Taxpayer’s Form 1040.

Go to www.irs.gov/form2555 for instructions and the. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web the simplified form 2555 ez cannot be used for the housing exclusion or the deduction. The foreign housing deduction is reported on form 2555 part vi and ix.

Web Yes No Are You Required To Pay Income Tax To The Country Where You Claim Bona Fide Residence?

If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix. You cannot exclude or deduct more than the. Web in addition, the taxpayer may exclude housing expenses in excess of 16% of this maximum ($52.60 per day in 2023) but with limits. The exclusion is available only for wages or self.

Web Foreign Housing Exclusion And Deduction.

If you are married and you and your spouse each qualifies under one of the tests, see. Web the housing deduction is figured in part ix. This deduction amount is then reported on form 1040 line 36, indicating form 2555 in the space. If you choose to claim the foreign earned income exclusion, complete parts vii and viii before part ix.

Web Information About Form 2555, Foreign Earned Income, Including Recent Updates, Related Forms, And Instructions On How To File.

In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your. Web if eligible, you can also use form 2555 to request the foreign housing exclusion or deduction. Web the foreign housing deduction is reported on form 2555 part vi and ix. Yes no if you answered “yes” to 13a and “no” to 13b,.