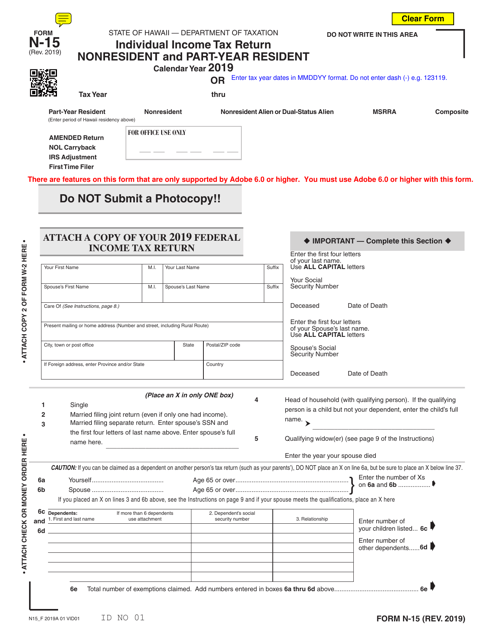

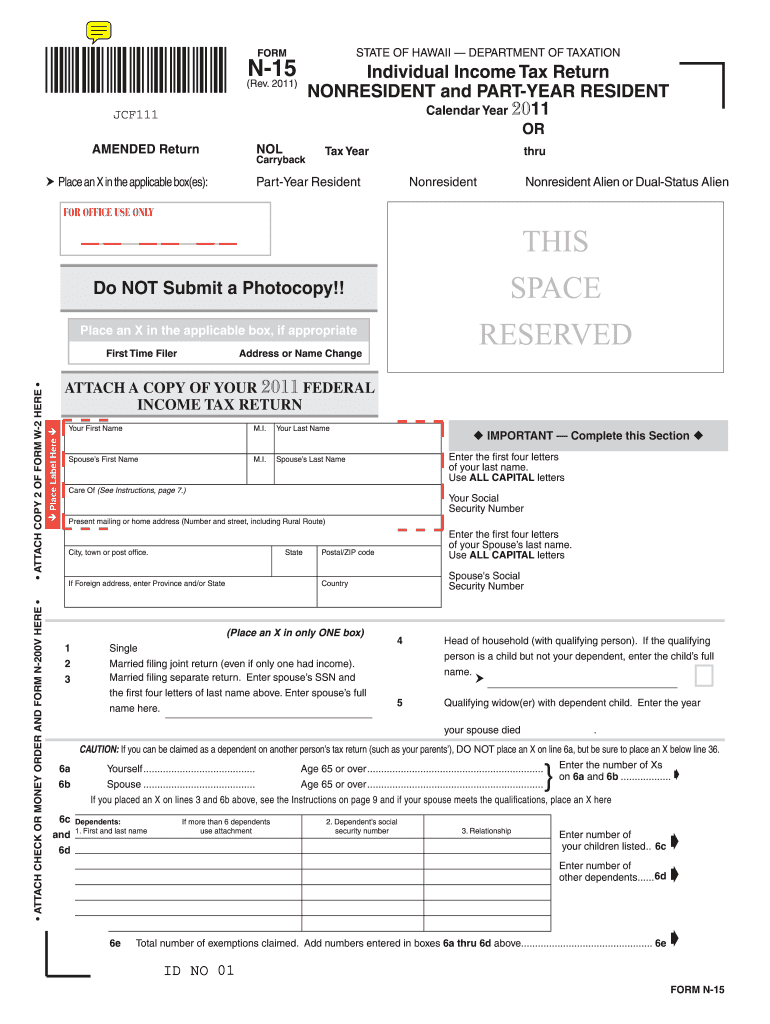

Hawaii Form N-15

Hawaii Form N-15 - This form is for income earned in tax year 2022, with tax returns due in april. For more information about the hawaii income tax, see the hawaii income tax page. Web 123 rows use rev. See this turbotax support faq for state forms. Please explain in detail in item #15 below, the dates, nature. Get ready for tax season deadlines by completing any required tax forms today. Edit your hawaii n 15 online type text, add images, blackout confidential details, add comments, highlights and more. Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. For information and guidance in its preparation, we have. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax.

Edit your hawaii n 15 online type text, add images, blackout confidential details, add comments, highlights and more. Web f state of hawaii department of taxation n15 i i t (rev. Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax. Taxpayers must file their returns by april 20, 2023. 7/2020) state of hawai‘i department of human resources development. Complete, edit or print tax forms instantly. For information and guidance in its preparation, we have. Complete, edit or print tax forms instantly. Web 123 rows use rev.

Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. Get ready for tax season deadlines by completing any required tax forms today. Web f state of hawaii department of taxation n15 i i t (rev. Save or instantly send your ready documents. For information and guidance in its preparation, we have. Easily fill out pdf blank, edit, and sign them. Schedule cr schedule of tax credits; For information and guidance in. Web 123 rows use rev. 2018 for tax years ending on or before december 31, 2019.

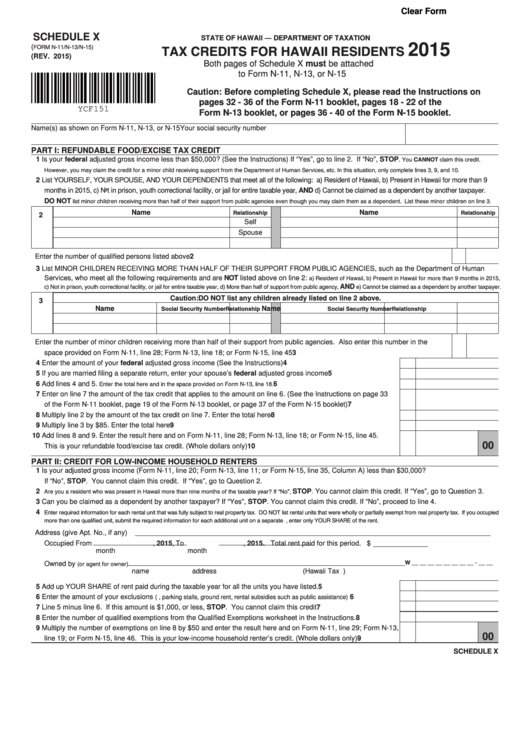

Fillable Schedule X (Form N11/n13/n15) Tax Credits For Hawaii

For information and guidance in. Save or instantly send your ready documents. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax. Edit your hawaii n 15 online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year 2022, with tax.

N15 Instructions Fill Out and Sign Printable PDF Template signNow

Taxpayers must file their returns by april 20, 2023. This form is for income earned in tax year 2022, with tax returns due in april. For information and guidance in. Web form hrd 315 (rev. Sign it in a few clicks draw your signature, type it,.

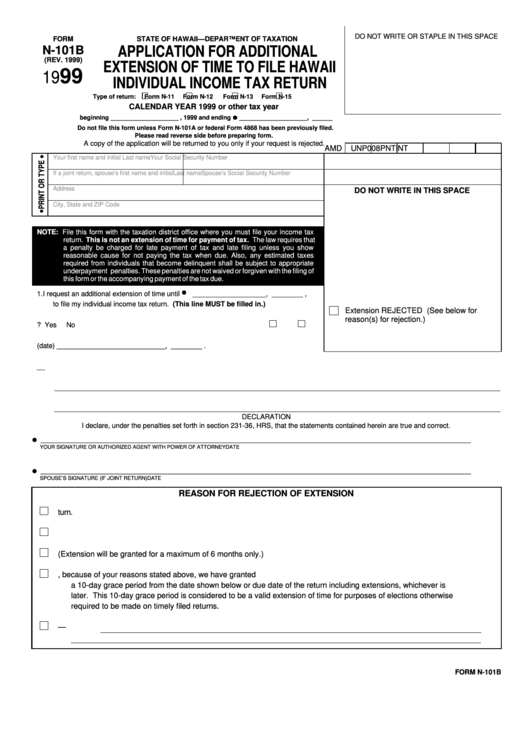

Form N101b Application For Additional Extension Of Time To File

For information and guidance in its preparation, we have. Taxpayers must file their returns by april 20, 2023. Web 123 rows use rev. Complete, edit or print tax forms instantly. For information and guidance in.

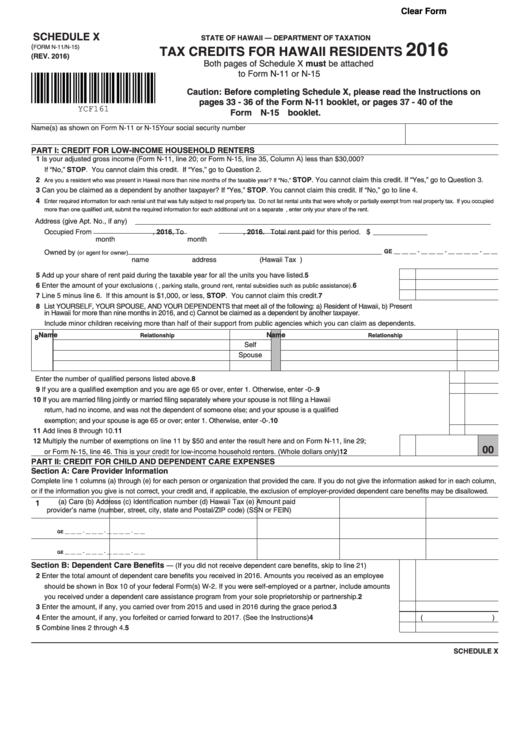

Fillable Form N11/n15 Tax Credits For Hawaii Residents printable

This form is for income earned in tax year 2022, with tax returns due in april. Taxpayers must file their returns by april 20, 2023. Save or instantly send your ready documents. Schedule cr schedule of tax credits; Please explain in detail in item #15 below, the dates, nature.

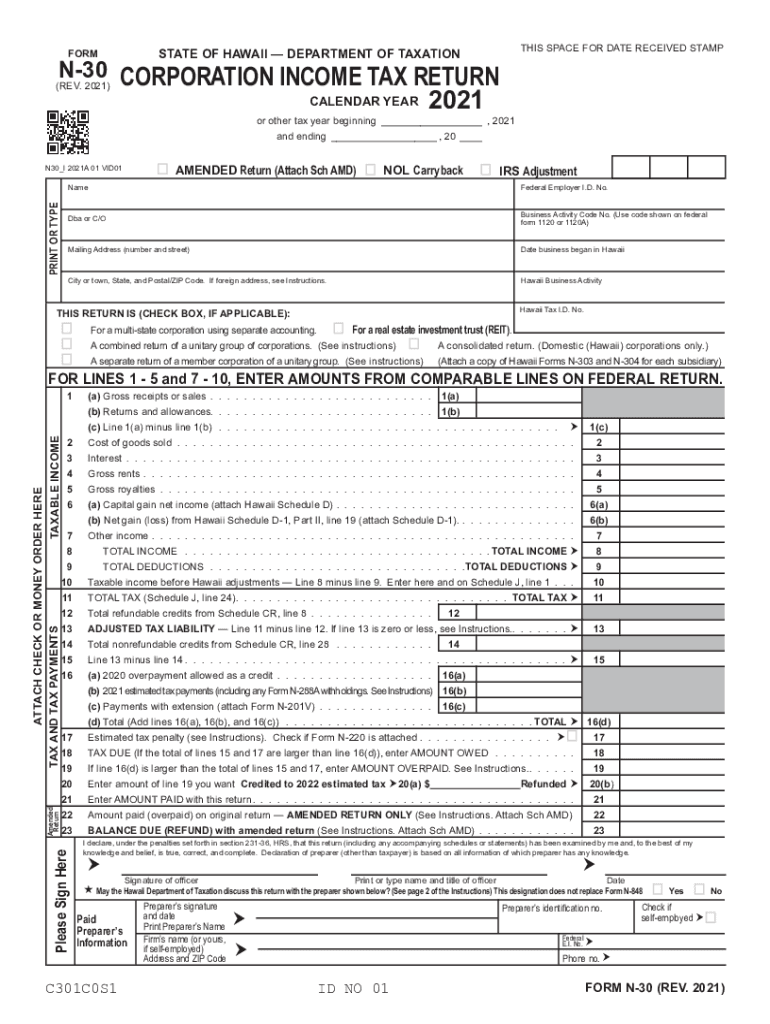

Hawaii form n 30 Fill out & sign online DocHub

Web honolulu, hawaii permit no. Complete, edit or print tax forms instantly. 2018 for tax years ending on or before december 31, 2019. Edit your hawaii n 15 online type text, add images, blackout confidential details, add comments, highlights and more. Web 123 rows use rev.

2019 Form HI DoT N288C Fill Online, Printable, Fillable, Blank PDFfiller

Schedule cr schedule of tax credits; Web 123 rows use rev. For information and guidance in. Web f state of hawaii department of taxation n15 i i t (rev. Easily fill out pdf blank, edit, and sign them.

Form N15 Download Fillable PDF or Fill Online Individual Tax

Taxpayers must file their returns by april 20, 2023. Sign it in a few clicks draw your signature, type it,. 7/2020) state of hawai‘i department of human resources development. For more information about the hawaii income tax, see the hawaii income tax page. Web form hrd 315 (rev.

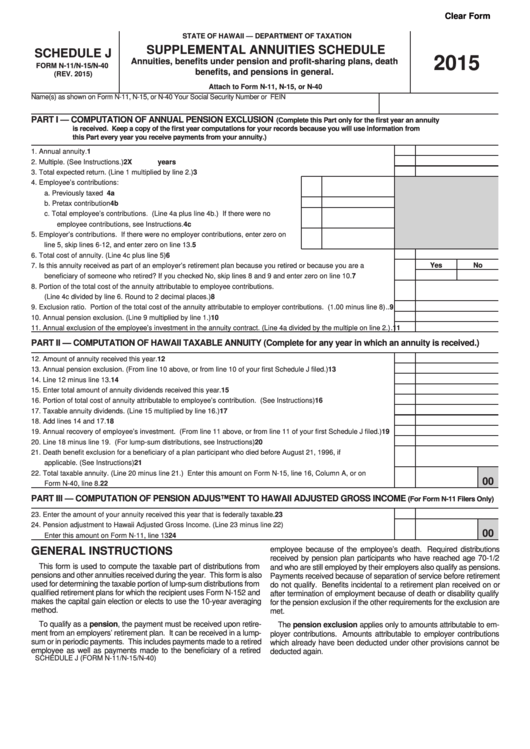

Fillable Schedule J (Form N11/n15/n40) Supplemental Annuities

2018 for tax years ending on or before december 31, 2019. Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. Get ready for tax season deadlines by completing any required tax forms today. 7/2020) state of hawai‘i department of human resources development. Complete, edit or print tax forms instantly.

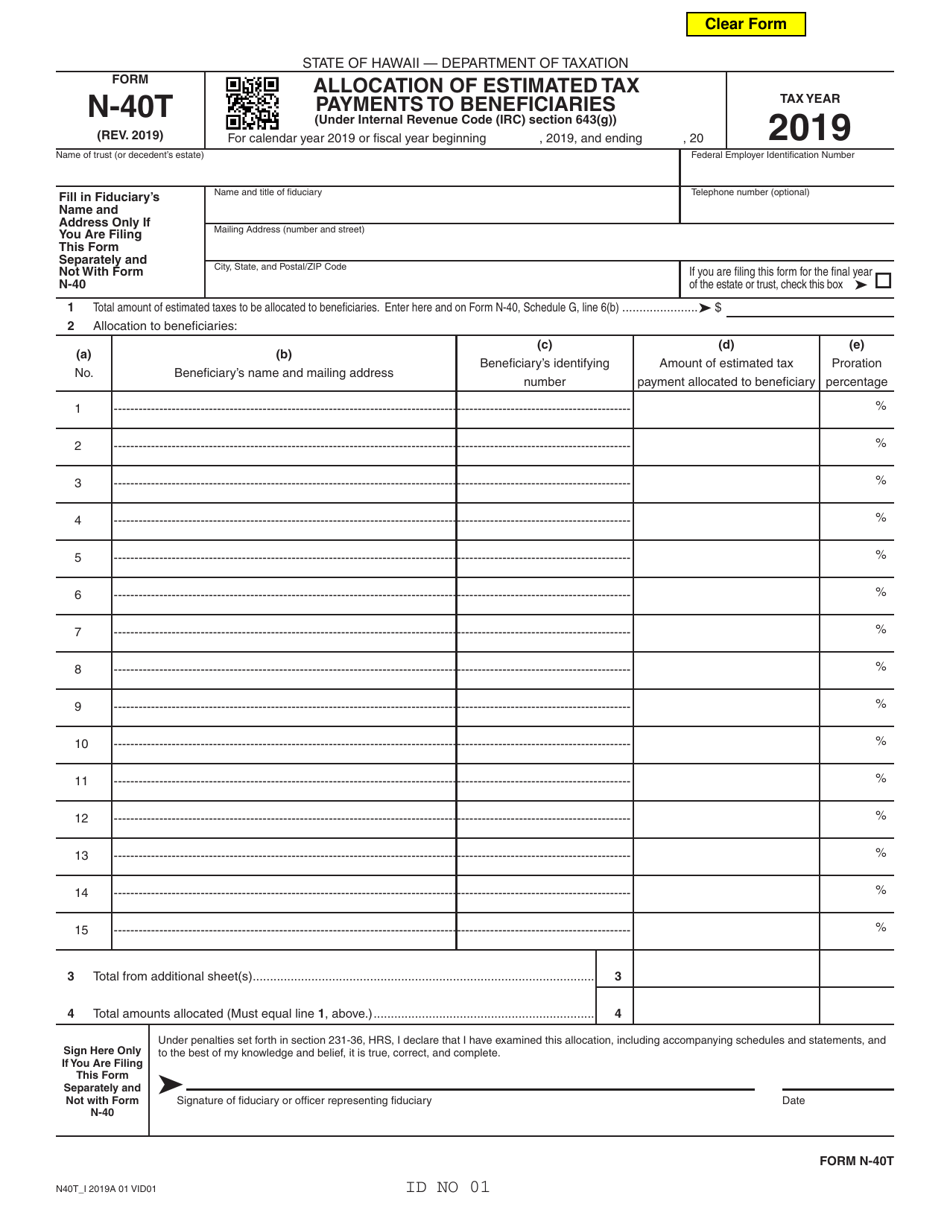

Form N40T Download Fillable PDF or Fill Online Allocation of Estimated

Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. Please explain in detail in item #15 below, the dates, nature. For more information, visit our website at tax.hawaii.gov ovide more effi cient service. Save or instantly send your ready documents. Schedule cr schedule of tax credits;

7/2020) State Of Hawai‘i Department Of Human Resources Development.

Taxpayers must file their returns by april 20, 2023. 2019 form for tax years ending on or after january 1, 2020. Complete, edit or print tax forms instantly. For information and guidance in its preparation, we have.

2018 For Tax Years Ending On Or Before December 31, 2019.

Web the hawaii state department of taxation has not extended the 2022 tax year filing deadline. Save or instantly send your ready documents. Edit your hawaii n 15 online type text, add images, blackout confidential details, add comments, highlights and more. Web 123 rows use rev.

Complete, Edit Or Print Tax Forms Instantly.

Schedule cr schedule of tax credits; Web f state of hawaii department of taxation n15 i i t (rev. For more information about the hawaii income tax, see the hawaii income tax page. For more information, visit our website at tax.hawaii.gov ovide more effi cient service.

2019) Nnidnt Ata Idnt C 2019 Or Tear Thru Attach A Copy Of Your 2019 Federal Income Tax.

Easily fill out pdf blank, edit, and sign them. Web honolulu, hawaii permit no. For information and guidance in. Get ready for tax season deadlines by completing any required tax forms today.