General Business Credit Form 3800

General Business Credit Form 3800 - Web most of these small business tax credits are reported on a variety of tax forms, then consolidated on irs form 3800, general business credit. Web what is the general business credit’s form 3800? Web what is form 3800? Web must be removed before printing. Future developments for the latest information. Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web file form 3800 to claim any of the general business credits. Web you must file form 3800 if you have business tax credits to claim.

Ad compare cash back, travel rewards and no annual fee business credit cards. Future developments for the latest information. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. Web must be removed before printing. The form has two main. Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Carryback and carryforward of unused credit Web you must file form 3800 to claim any of the general business credits. Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form.

Web must be removed before printing. Ad compare cash back, travel rewards and no annual fee business credit cards. Web you must file form 3800 if you have business tax credits to claim. From general business credits no longer covered on form 3800 due to, and not limited to, expiration of a tax provision. In this guide, we’ll show. Carryback and carryforward of unused credit Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. Web what is the general business credit, form 3800?

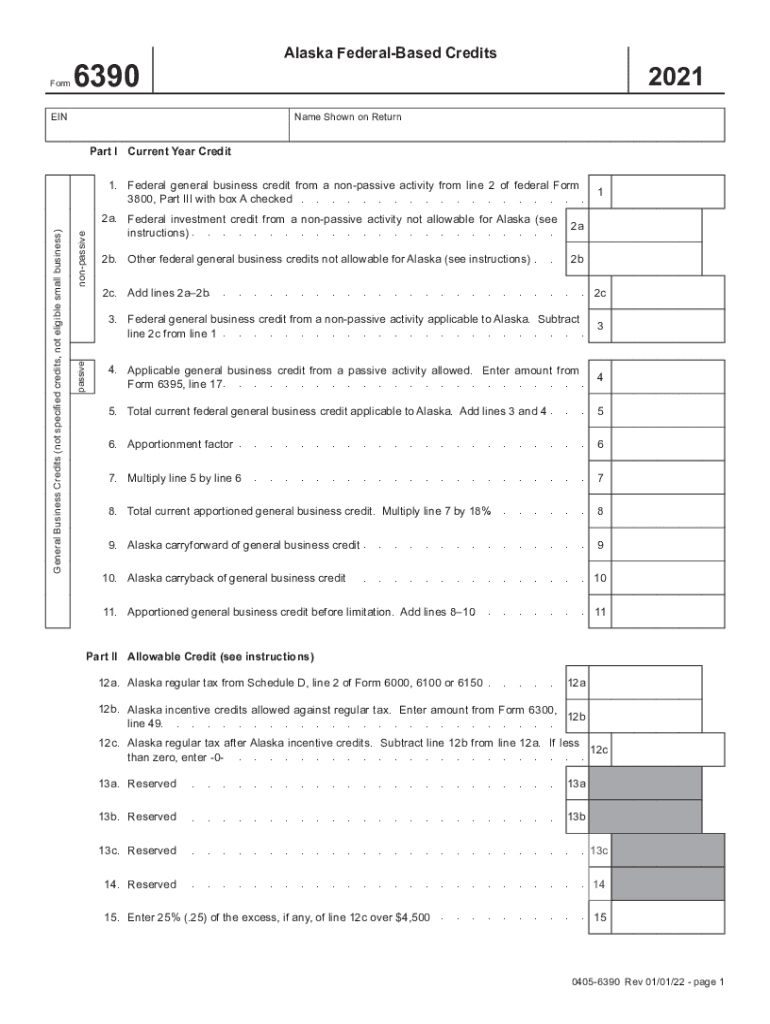

Alaska Form 6390 Fill Out and Sign Printable PDF Template signNow

Future developments for the latest information. Web form 3800 is used to summarize the credits that make up the general business credit, or to claim a carryback or carryforward of any of the credits. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. Web if you’re claiming more than one.

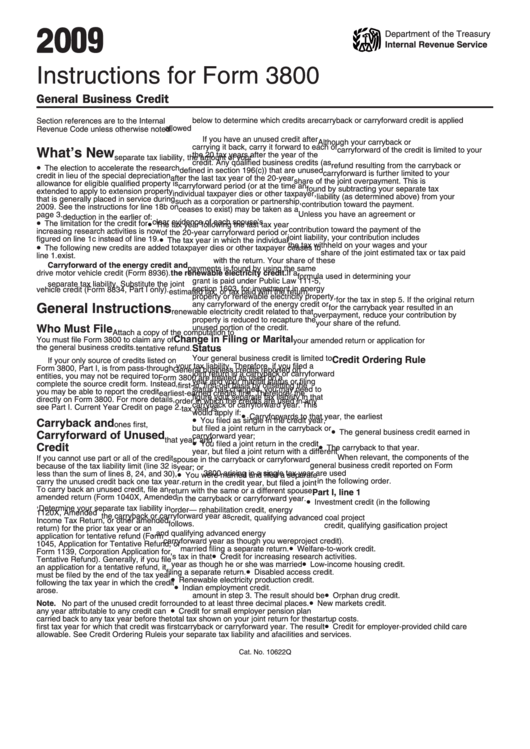

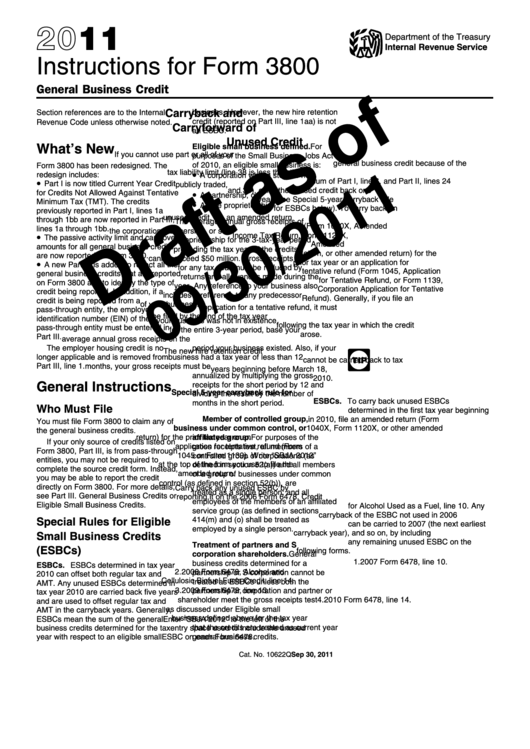

Instructions For Form 3800 General Business Credit Internal Revenue

If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Future developments for the latest information. #didyouknow you can use tax credits. In this guide, we’ll show.

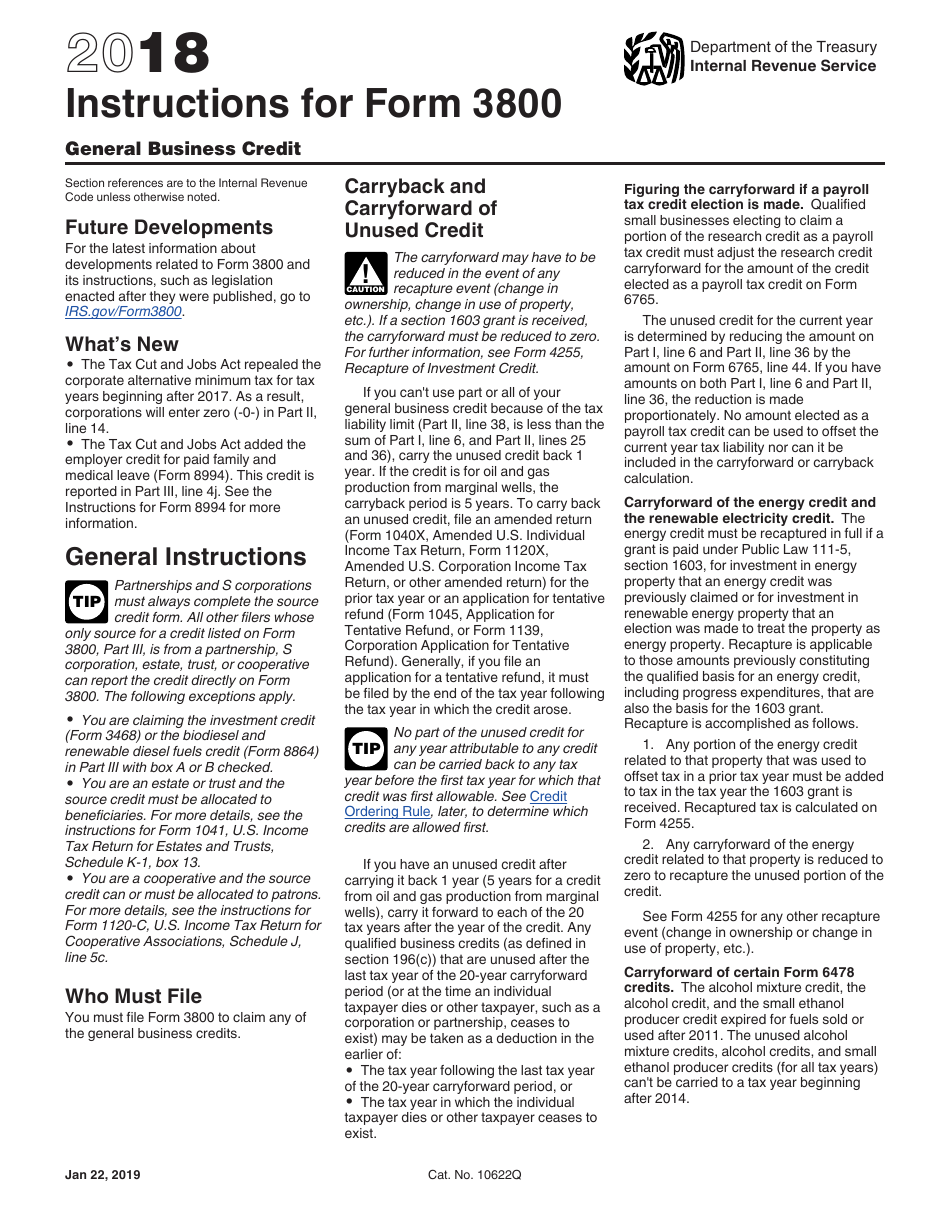

Form 3800 Instructions How to Fill out the General Business Credit

Web must be removed before printing. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. The credit.

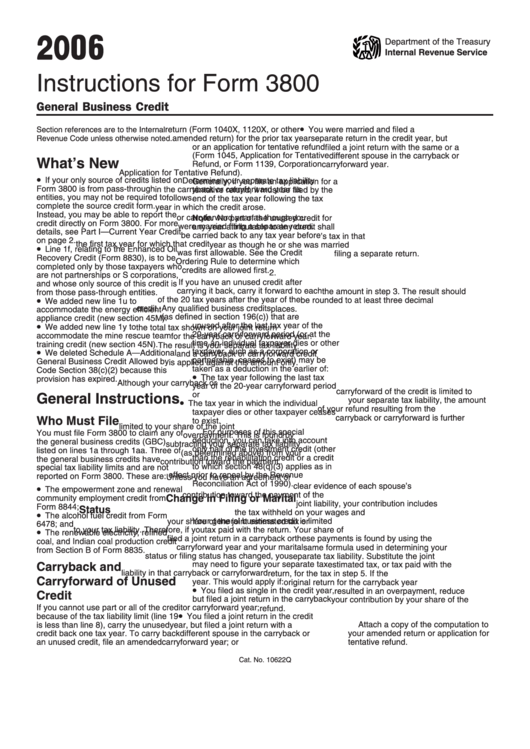

Download Instructions for IRS Form 3800 General Business Credit PDF

Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Web you must file form 3800 to claim any of the general business credits. Future developments for the latest information. For businesses who rely on credit, capital one® spark business cards.

Instructions For Form 3800 General Business Credit Internal Revenue

Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Web file form 3800 to claim any of the general business credits. Web you must file form 3800 if you have business tax credits to claim. Web anyone claiming general business credits must file form 3800..

General Business Credit Eligible Businesses, Form 3800 & How to Claim

For businesses who rely on credit, capital one® spark business cards keep it simple. Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web anyone claiming general business credits must file form 3800. The form has two main.

Form 3800 General Business Credit (2014) Free Download

Web the general business credit (form 3800) is made up of many other credits, like: You must attach all pages of form 3800, pages 1, 2, and 3, to your tax. Web instructions for form 3800 general business credit section references are to the internal revenue code unless otherwise noted. Web form 3800 is used to summarize the credits that.

How to File General Business Credit Form 3800 for Tax Credits

Select the links below to see solutions for frequently asked questions concerning form 3800 in a fiduciary return. Web anyone claiming general business credits must file form 3800. Future developments for the latest information. Carryback and carryforward of unused credit Web the general business credit (form 3800) is made up of many other credits, like:

Form 3800General Business Credit

#didyouknow you can use tax credits. In this guide, we’ll show. In addition, it’s worth noting that the irs requires partnerships and s corporations to always. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return. Web if you’re claiming more than one business tax credit, you’ll need to fill out.

Instructions For Form 3800 General Business Credit Internal Revenue

For businesses who rely on credit, capital one® spark business cards keep it simple. The credit claimed is subject to a limitation based on your tax liability that is figured on the form used to compute that. Web solved • by intuit • 1 • updated july 14, 2022. Web if you’re claiming more than one business tax credit, you’ll.

Web If You’re Claiming More Than One Business Tax Credit, You’ll Need To Fill Out Form 3800, Also Called The General Business Credit Form.

Web if you’re claiming more than one business tax credit, you’ll need to fill out form 3800, also called the general business credit form. Form 3800, “general business credit,” is an irs form used to record tax credits for businesses. Web anyone claiming general business credits must file form 3800. Web must be removed before printing.

You Must Attach All Pages Of Form 3800, Pages 1, 2, And 3, To Your Tax.

Ad compare cash back, travel rewards and no annual fee business credit cards. Web what is form 3800? Web solved • by intuit • 1 • updated july 14, 2022. In this guide, we’ll show.

Carryback And Carryforward Of Unused Credit

Web general business credit go to www.irs.gov/form3800 for instructions and the latest information. Web file form 3800 to claim any of the general business credits. #didyouknow you can use tax credits. If you claim multiple business credits, then our program will draft form 3800, general business credits, onto your return.

In Addition, It’s Worth Noting That The Irs Requires Partnerships And S Corporations To Always.

From general business credits no longer covered on form 3800 due to, and not limited to, expiration of a tax provision. In this guide, we’ll show. The form has two main. For businesses who rely on credit, capital one® spark business cards keep it simple.