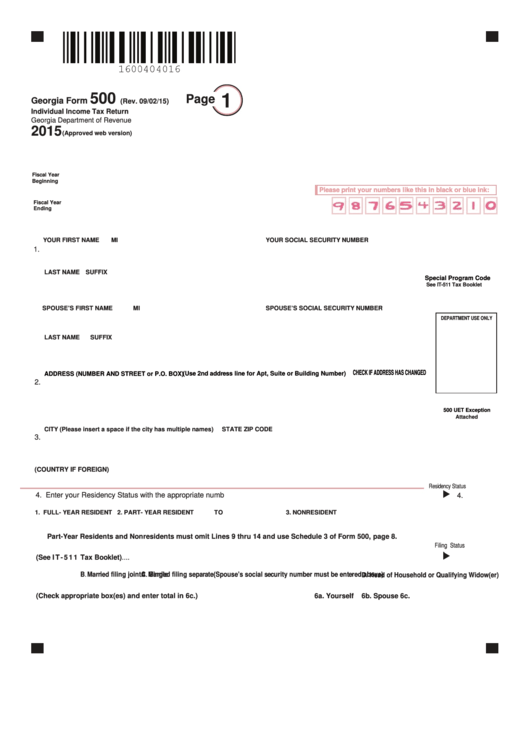

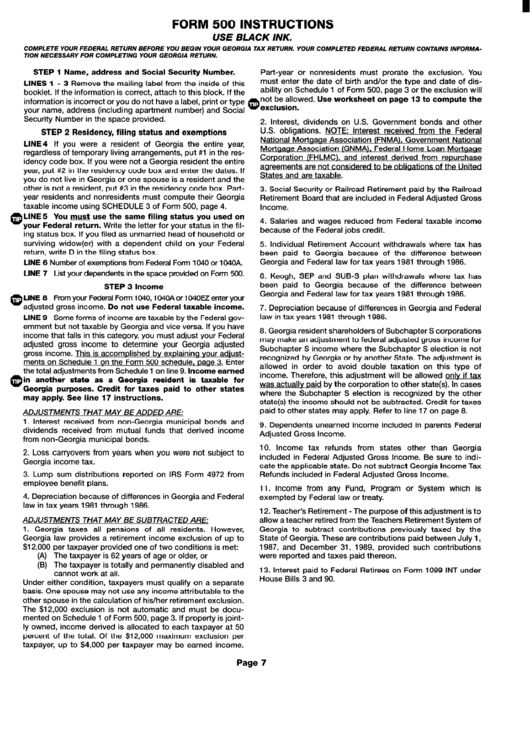

Ga Form 500 Instructions

Ga Form 500 Instructions - Web form 500 instructions (continued) line 12c: Your federal tax return contains important information that you’ll need to file your state taxes. Web the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards as payment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. Nonresident city (please insert a space if the city has multiple names) state zip code d. If state & local income taxes were limited on the federal return to $10,000 ($5,000 mfs), the following formula should be used to determine the disallowed other state income taxes: Web complete your federal tax return before beginning your state tax return. Gather what you'll need you can file state income tax electronically (through a tax vendor or directly with dor), on paper, or hire someone to file your taxes for you. If you file electronically and choose direct deposit, you can receive your refund in less than 30 days. Web georgia form 500 (rev. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements.

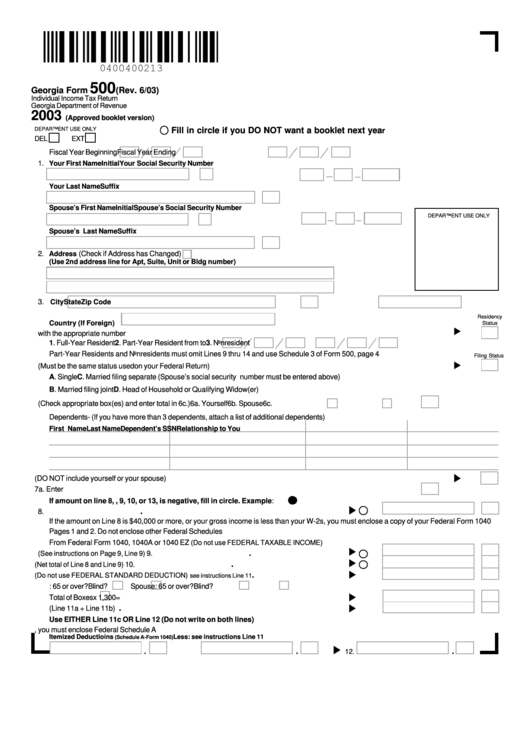

Web general instructions where do you file? Your federal return contains information that should be included on your georgia return. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Nonresident city (please insert a space if the city has multiple names) state zip code d. Complete your federal return before starting your georgia return. Web the georgia department ofenue rev accepts visa, american express, mastercard, and discover credit cards aspayment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. If you file electronically and choose direct deposit, you can receive your refund in less than 30 days. Web the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards as payment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. Your federal tax return contains important information that you’ll need to file your state taxes.

If state & local income taxes were limited on the federal return to $10,000 ($5,000 mfs), the following formula should be used to determine the disallowed other state income taxes: Complete your federal return before starting your georgia return. Other state income taxes divided Your federal tax return contains important information that you’ll need to file your state taxes. Web georgia form 500 (rev. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web the georgia department ofenue rev accepts visa, american express, mastercard, and discover credit cards aspayment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. Web complete your federal tax return before beginning your state tax return. Nonresident city (please insert a space if the city has multiple names) state zip code d. If you file electronically and choose direct deposit, you can receive your refund in less than 30 days.

Estimated Tax Payments 2021 Fill Online, Printable, Fillable

Gather what you'll need you can file state income tax electronically (through a tax vendor or directly with dor), on paper, or hire someone to file your taxes for you. Web the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards as payment for current year individual income tax due on original forms 500, 500ez, and.

How To Check The Status Of My Ga Tax Refund TAXW

Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Web georgia form 500 (rev. Web form 500 instructions (continued) line 12c: Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. If you file electronically and.

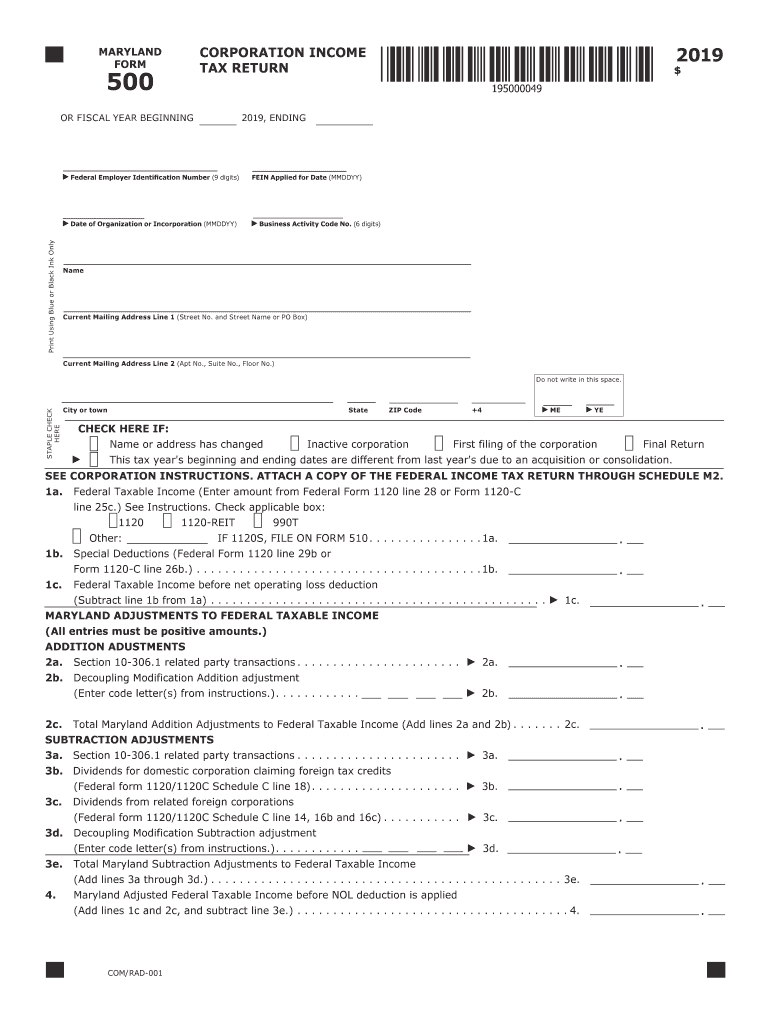

Form 500 Instructions 2019 lwtaylorartanddesign

Your federal tax return contains important information that you’ll need to file your state taxes. Nonresident city (please insert a space if the city has multiple names) state zip code d. Web georgia form 500 (rev. If state & local income taxes were limited on the federal return to $10,000 ($5,000 mfs), the following formula should be used to determine.

State Tax Form 500ez bestkup

Nonresident city (please insert a space if the city has multiple names) state zip code d. Gather what you'll need you can file state income tax electronically (through a tax vendor or directly with dor), on paper, or hire someone to file your taxes for you. Web the georgia department of revenue accepts visa, american express, mastercard, and discover credit.

Fillable Form 500 Indvidual Tax Form

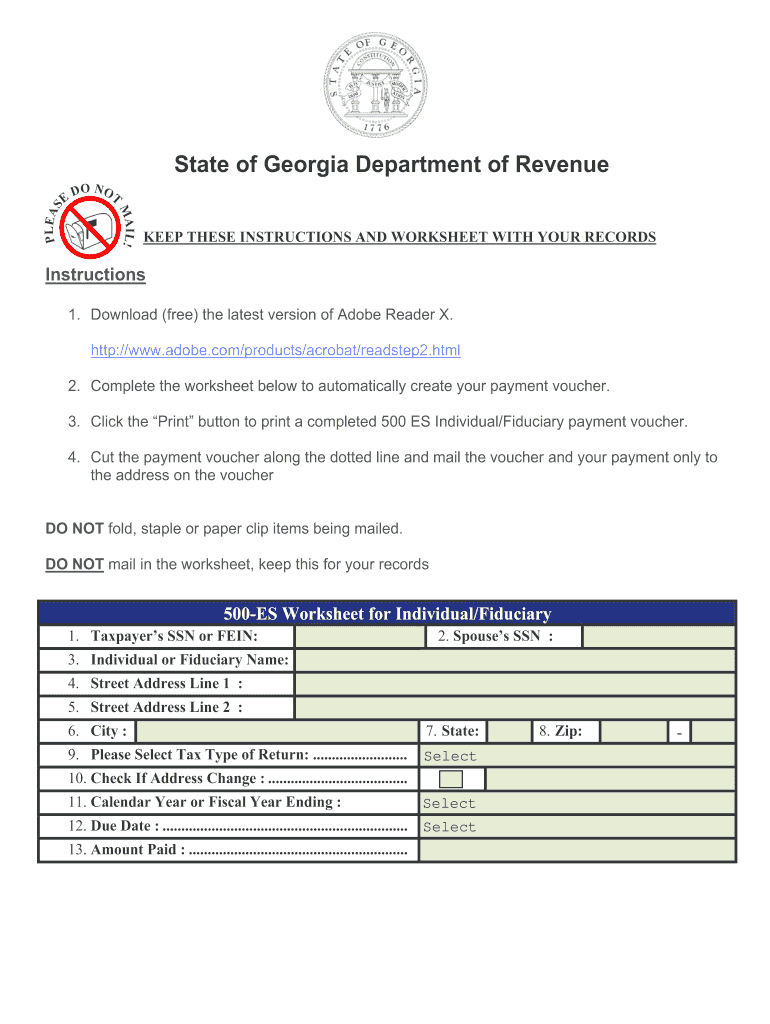

To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web complete your federal tax return before beginning your state tax return. Web the georgia department ofenue rev accepts visa, american express, mastercard, and discover credit cards aspayment for current year individual income tax due on original forms 500, 500ez, and 500es, as.

Form 500 Instructions printable pdf download

Complete your federal return before starting your georgia return. Nonresident city (please insert a space if the city has multiple names) state zip code d. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web georgia form 500 (rev. Your federal tax return contains important information that you’ll need to file your.

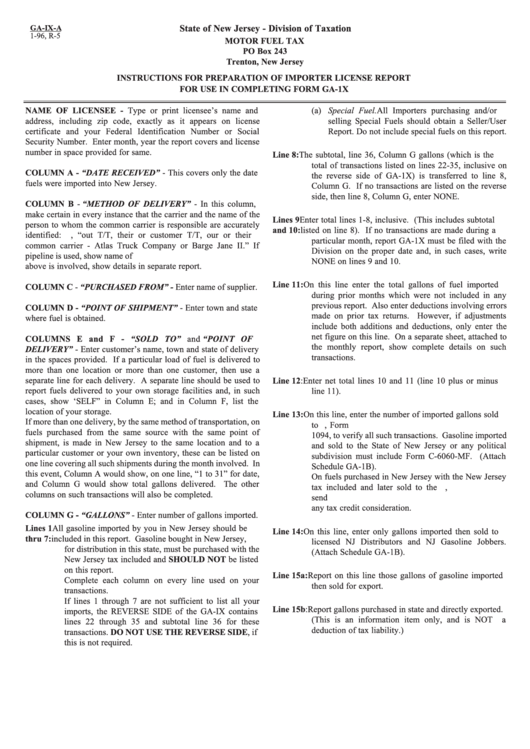

Instructions For Preparation Of Importer License Report For Use In

To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web form 500 instructions include all completed schedules with your georgia return. Gather what you'll need you can file state income tax electronically (through a tax vendor or directly with dor), on paper, or hire someone to file your taxes for you. Web.

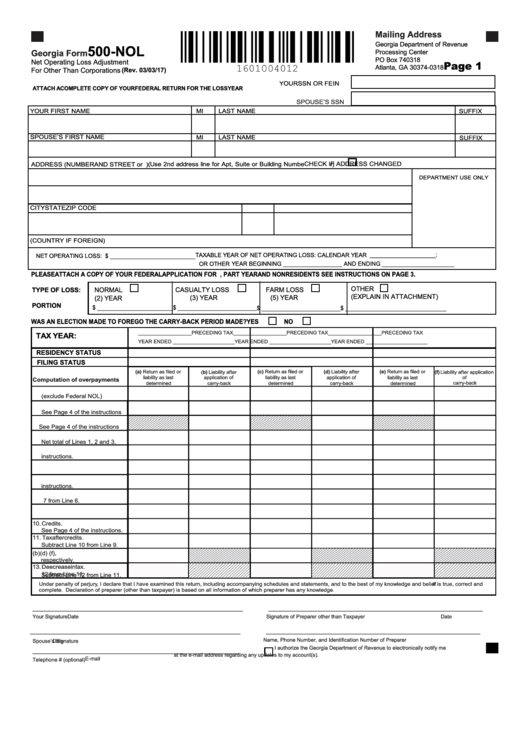

Fillable Form 500Nol Net Operating Loss Adjustment For Other

Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web form 500 instructions include all completed schedules with your georgia return. If state & local income taxes were limited on the federal return to $10,000 ($5,000 mfs), the following formula should be used to determine the disallowed other state income taxes:.

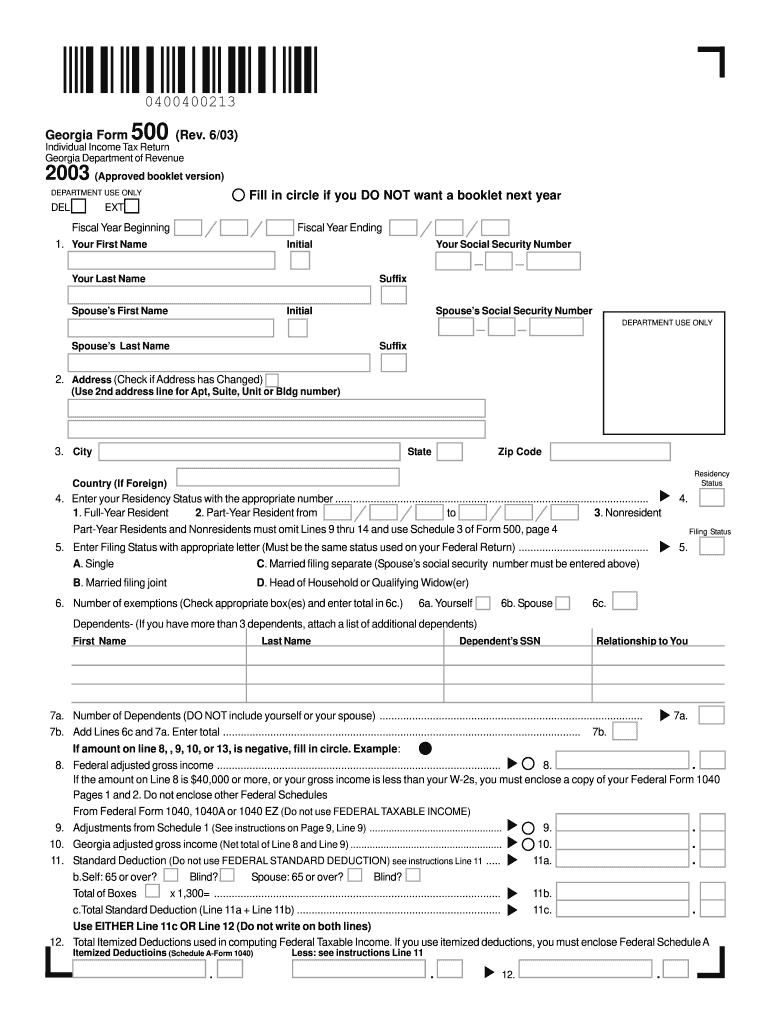

2003 Form GA DoR 500 Fill Online, Printable, Fillable, Blank pdfFiller

Web complete your federal tax return before beginning your state tax return. Web form 500 instructions (continued) line 12c: If state & local income taxes were limited on the federal return to $10,000 ($5,000 mfs), the following formula should be used to determine the disallowed other state income taxes: Complete your federal return before starting your georgia return. Web form.

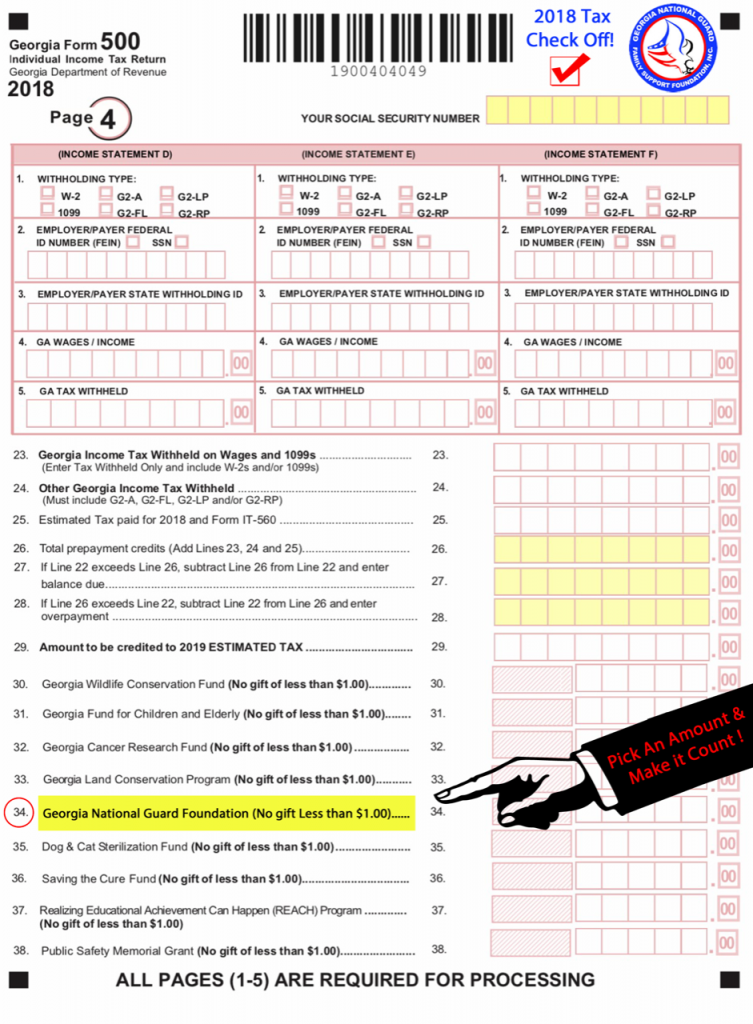

Pick an Amount & Make it Count on GA Form 500 Individual Tax Return

Web the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards as payment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. If state & local income taxes were limited on the federal return to $10,000.

Web Form 500 Instructions (Continued) Line 12C:

Your federal return contains information that should be included on your georgia return. Complete your federal return before starting your georgia return. Gather what you'll need you can file state income tax electronically (through a tax vendor or directly with dor), on paper, or hire someone to file your taxes for you. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements.

If State & Local Income Taxes Were Limited On The Federal Return To $10,000 ($5,000 Mfs), The Following Formula Should Be Used To Determine The Disallowed Other State Income Taxes:

Subtract line 12b from line 12a, enter total. Web general instructions where do you file? Web complete your federal tax return before beginning your state tax return. Nonresident city (please insert a space if the city has multiple names) state zip code d.

To Successfully Complete The Form, You Must Download And Use The Current Version Of Adobe Acrobat Reader.

Your federal tax return contains important information that you’ll need to file your state taxes. Web the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards as payment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. If you file electronically and choose direct deposit, you can receive your refund in less than 30 days. Web form 500 instructions include all completed schedules with your georgia return.

Web Georgia Form 500 (Rev.

Web the georgia department ofenue rev accepts visa, american express, mastercard, and discover credit cards aspayment for current year individual income tax due on original forms 500, 500ez, and 500es, as well as for liabilities presented to taxpayers via georgia department of revenue assessment notices. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Other state income taxes divided