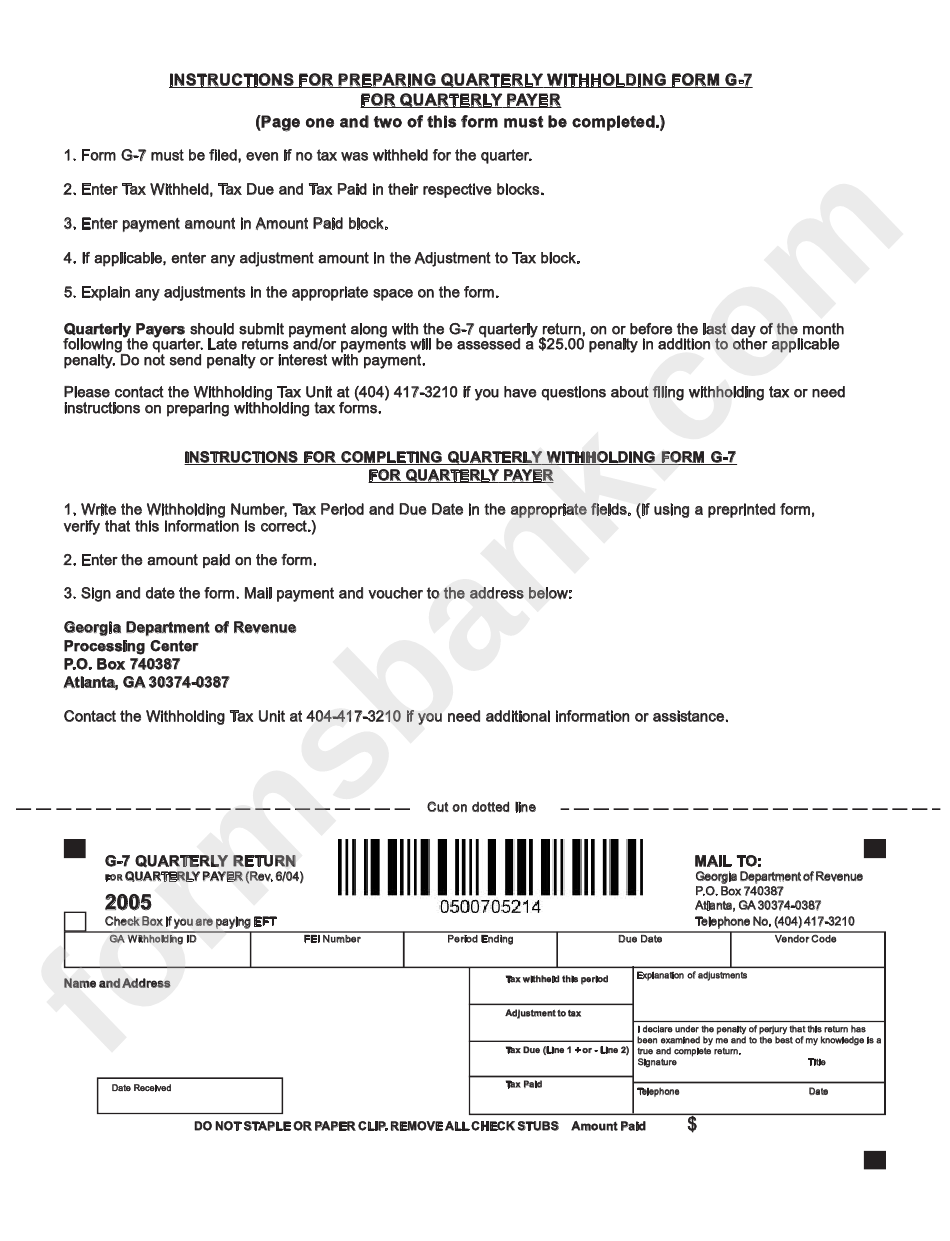

G 7 Form

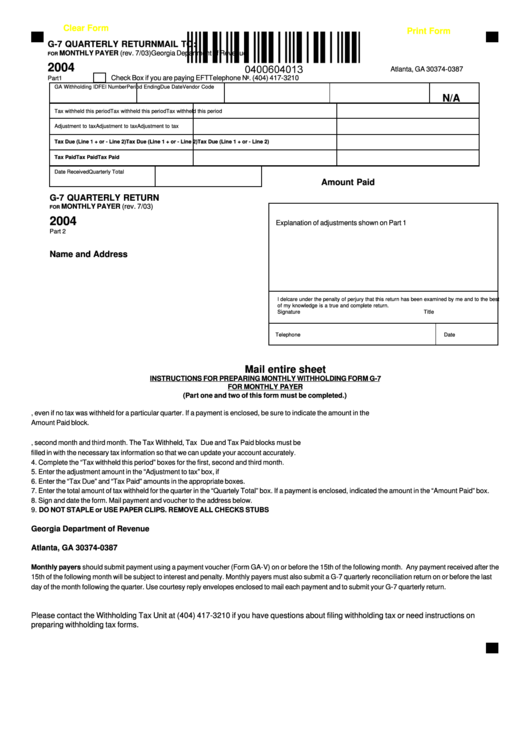

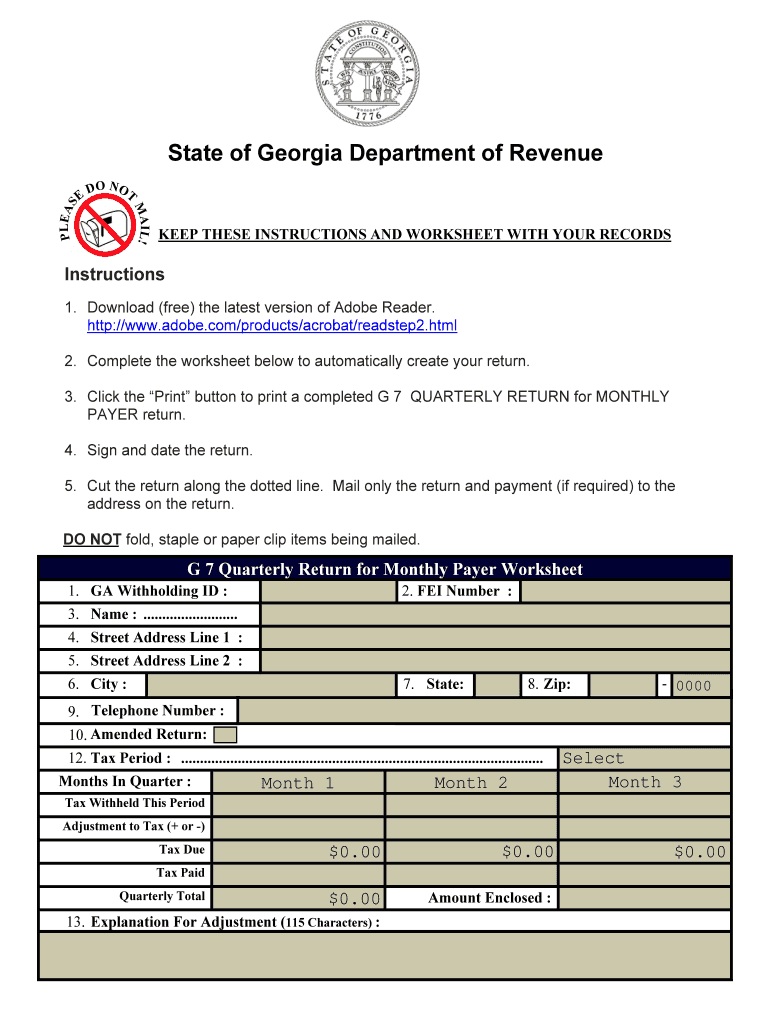

G 7 Form - Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. How to file a g7 monthly return.pdf (746.19 kb) Nonresident withholding id fei number period ending due date vendor code. If the due date falls on. For additional information about this return, please visit the department of. Go digital and save time with signnow, the best solution for. Printing and scanning is no longer the best way to manage documents. The form is used to calculate and report your state income. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability.

E n te r th e ta x. Web handy tips for filling out g 7 form online. Printing and scanning is no longer the best way to manage documents. Nonresident withholding id fei number period ending due date vendor code. Web log into gtc, click on the withholding payroll number, select the return period and import the template. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. This instructional document explains how to file a g7 monthly return. Go digital and save time with signnow, the best solution for. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year.

For additional information about this return, please visit the department of. The form is used to calculate and report your state income. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. E n te r th e ta x. If the due date falls on. Web log into gtc, click on the withholding payroll number, select the return period and import the template. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web handy tips for filling out g 7 form online. How to file a g7 monthly return.pdf (746.19 kb) Use get form or simply click on the template preview to open it in the editor.

What's the G7, what countries are members, what does the group do and

Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web handy tips for filling out g 7 form online. Printing and scanning is no longer the best way to manage documents. Web log into gtc, click on the withholding payroll number, select the return.

Fillable Form G7 Quarterly Return 2004 printable pdf download

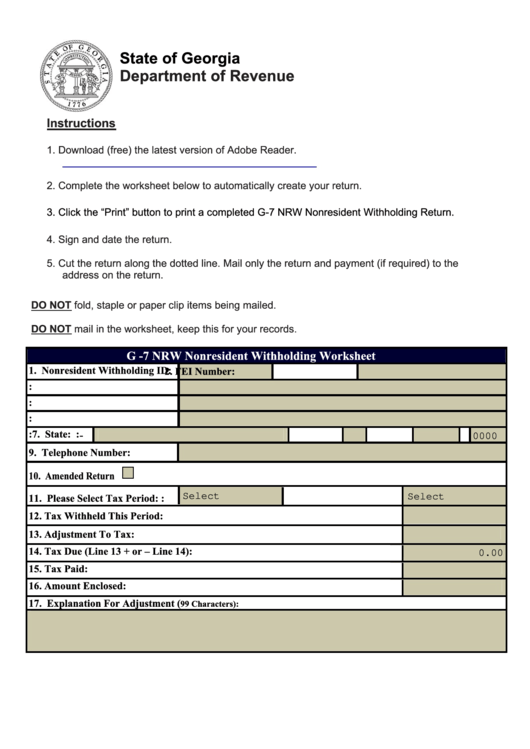

Nonresident withholding id fei number period ending due date vendor code. Web log into gtc, click on the withholding payroll number, select the return period and import the template. For additional information about this return, please visit the department of. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who.

GForm Elite Short Liner Reviews

How to file a g7 monthly return.pdf (746.19 kb) Go digital and save time with signnow, the best solution for. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. If the due date falls on. Use get form or simply click on the template.

G 7

Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. This instructional document explains how to file a g7 monthly.

Fillable Form G7 Nrw Nonresident Withholding Return

Use get form or simply click on the template preview to open it in the editor. This instructional document explains how to file a g7 monthly return. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. Web the georgia form g 7 is a state tax form that.

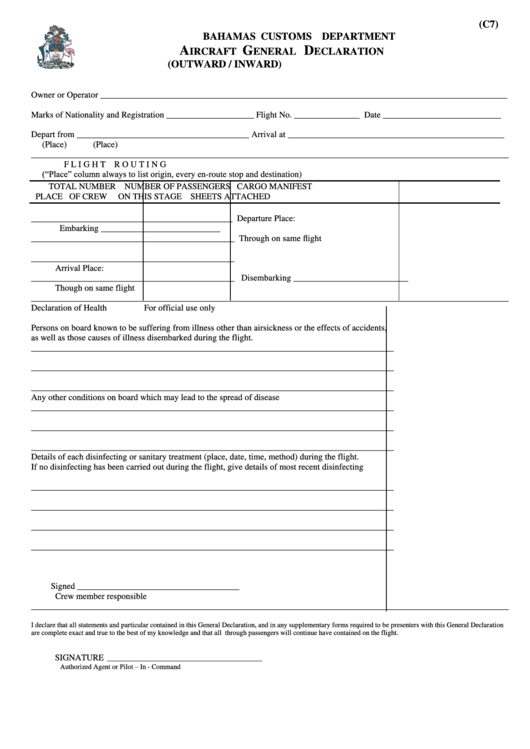

Form C7 Bahamas printable pdf download

Nonresident withholding id fei number period ending due date vendor code. This instructional document explains how to file a g7 monthly return. Printing and scanning is no longer the best way to manage documents. Go digital and save time with signnow, the best solution for. The form is used to calculate and report your state income.

P&G (7) AM Photography

Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. If a payment is enclosed, be sure to indicate the amount in the amount paid block. The form is used to calculate and report your state income. Go digital and save time with signnow, the best solution for. For.

mseb app download howtogrownailsfasterinadaytips

Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web handy tips for filling out g 7 form online. This instructional document explains how to file a g7 monthly return. For additional information about this return, please visit the department of. Go digital and.

2015 Form GA DoR G7 Fill Online, Printable, Fillable, Blank pdfFiller

Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. The form is used to calculate and report your state income. If the due date falls on. Web log into gtc, click on the withholding payroll number, select the return period and import the template. Use get form or.

Form G7 Quarterly Withholding For Quarterly Payer 2004 printable

If the due date falls on. How to file a g7 monthly return.pdf (746.19 kb) Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. Web handy tips for filling out g 7 form online. Web log into gtc, click on the withholding payroll number, select the return period.

The Form Is Used To Calculate And Report Your State Income.

Web handy tips for filling out g 7 form online. For additional information about this return, please visit the department of. Nonresident withholding id fei number period ending due date vendor code. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability.

Go Digital And Save Time With Signnow, The Best Solution For.

Web log into gtc, click on the withholding payroll number, select the return period and import the template. Printing and scanning is no longer the best way to manage documents. This instructional document explains how to file a g7 monthly return. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year.

If A Payment Is Enclosed, Be Sure To Indicate The Amount In The Amount Paid Block.

If the due date falls on. E n te r th e ta x. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. The form is used to calculate and report your state income.

How To File A G7 Monthly Return.pdf (746.19 Kb)

Use get form or simply click on the template preview to open it in the editor.