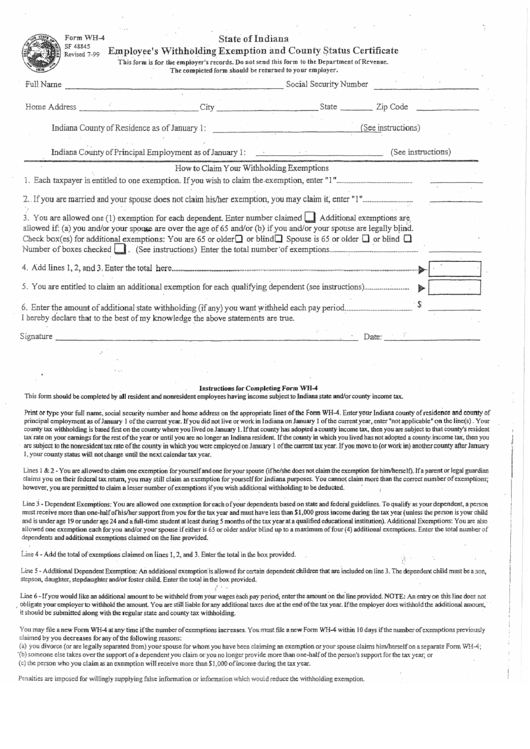

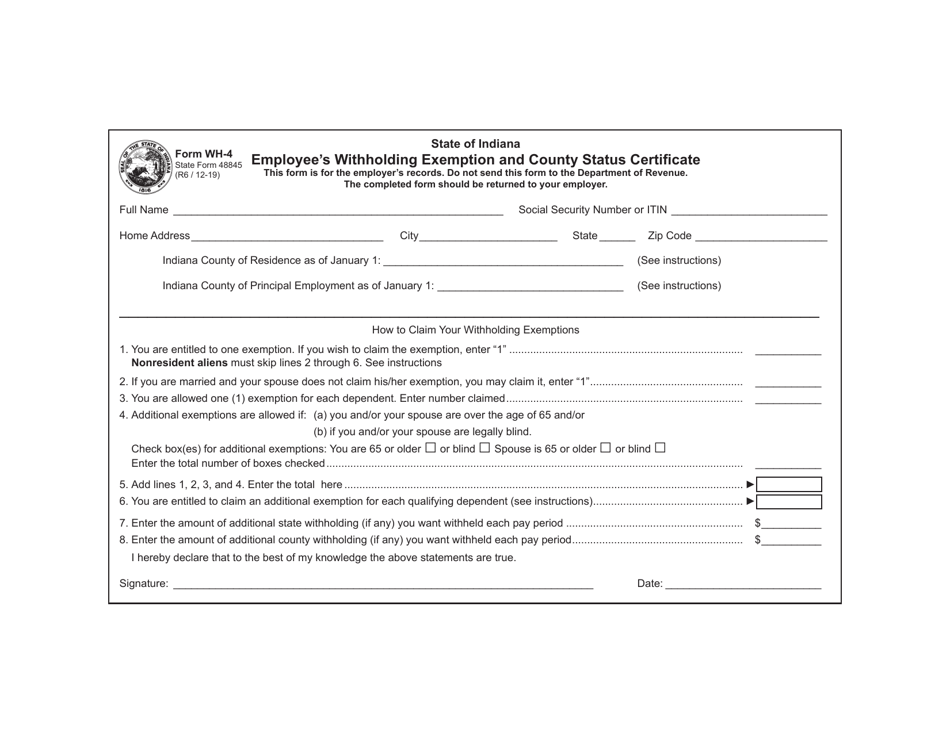

Form Wh4 Indiana

Form Wh4 Indiana - Print or type your full name, social. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. The new form no longer uses withholding allowances. If you have employees working at your business, you’ll need to collect withholding taxes. Web send wh 4 form 2019 via email, link, or fax. These are state and county taxes that. Web register and file this tax online via intime. Table b is used to figure additional dependent exemptions. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. (a) you divorce (or are legally.

Register and file this tax online via intime. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Generally, employers are required to withhold both state and county taxes from employees’ wages. Web register and file this tax online via intime. Table b is used to figure additional dependent exemptions. Employee's withholding exemption and county status certificate. These are state and county taxes that. Underpayment of indiana withholding filing. Web send wh 4 form 2019 via email, link, or fax. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction.

Web send wh 4 form 2019 via email, link, or fax. The new form no longer uses withholding allowances. Web register and file this tax online via intime. (a) you divorce (or are legally. Underpayment of indiana withholding filing. Generally, employers are required to withhold both state and county taxes from employees’ wages. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. Table b is used to figure additional dependent exemptions. These are state and county taxes that. Employee's withholding exemption and county status certificate.

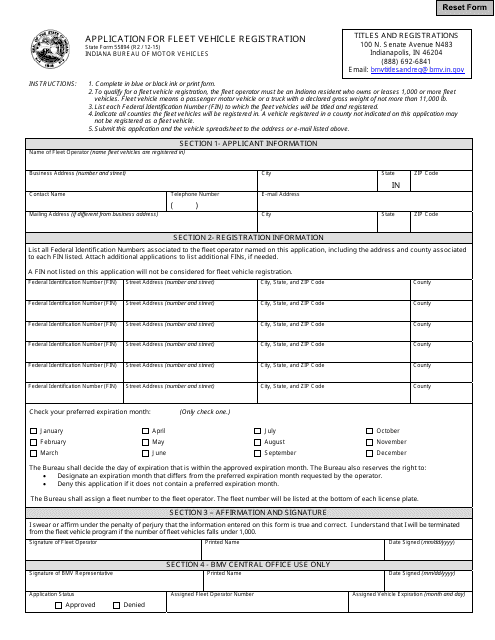

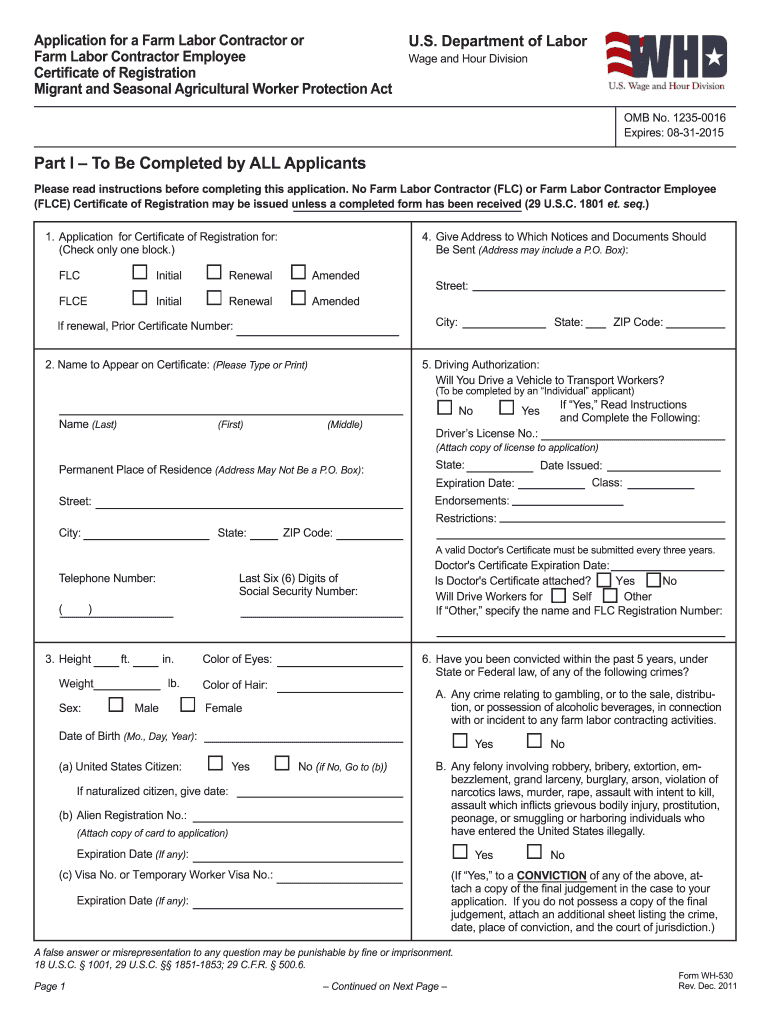

State Form 55894 Download Fillable PDF or Fill Online Application for

(a) you divorce (or are legally. Edit your 2019 indiana state withholding form online. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web register and file this tax online via intime. Print or type your full name, social.

Did the W4 Form Just Get More Complicated? GoCo.io

Instead, there is a five. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. Underpayment of indiana withholding filing. Table b is used to figure additional dependent exemptions. Web register and file this tax online via intime.

Indiana State Form 19634 Fill Online, Printable, Fillable, Blank

You can also download it, export it or print it out. Underpayment of indiana withholding filing. Edit your 2019 indiana state withholding form online. The new form no longer uses withholding allowances. Web send wh 4 form 2019 via email, link, or fax.

Indiana W4 Fill Out and Sign Printable PDF Template signNow

Edit your 2019 indiana state withholding form online. Employee's withholding exemption and county status certificate. These are state and county taxes that. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax.

Form Wh4 Employee'S Withholding Exemption And County Status

The new form no longer uses withholding allowances. Web send wh 4 form 2019 via email, link, or fax. Employee's withholding exemption and county status certificate. You can also download it, export it or print it out. If you have employees working at your business, you’ll need to collect withholding taxes.

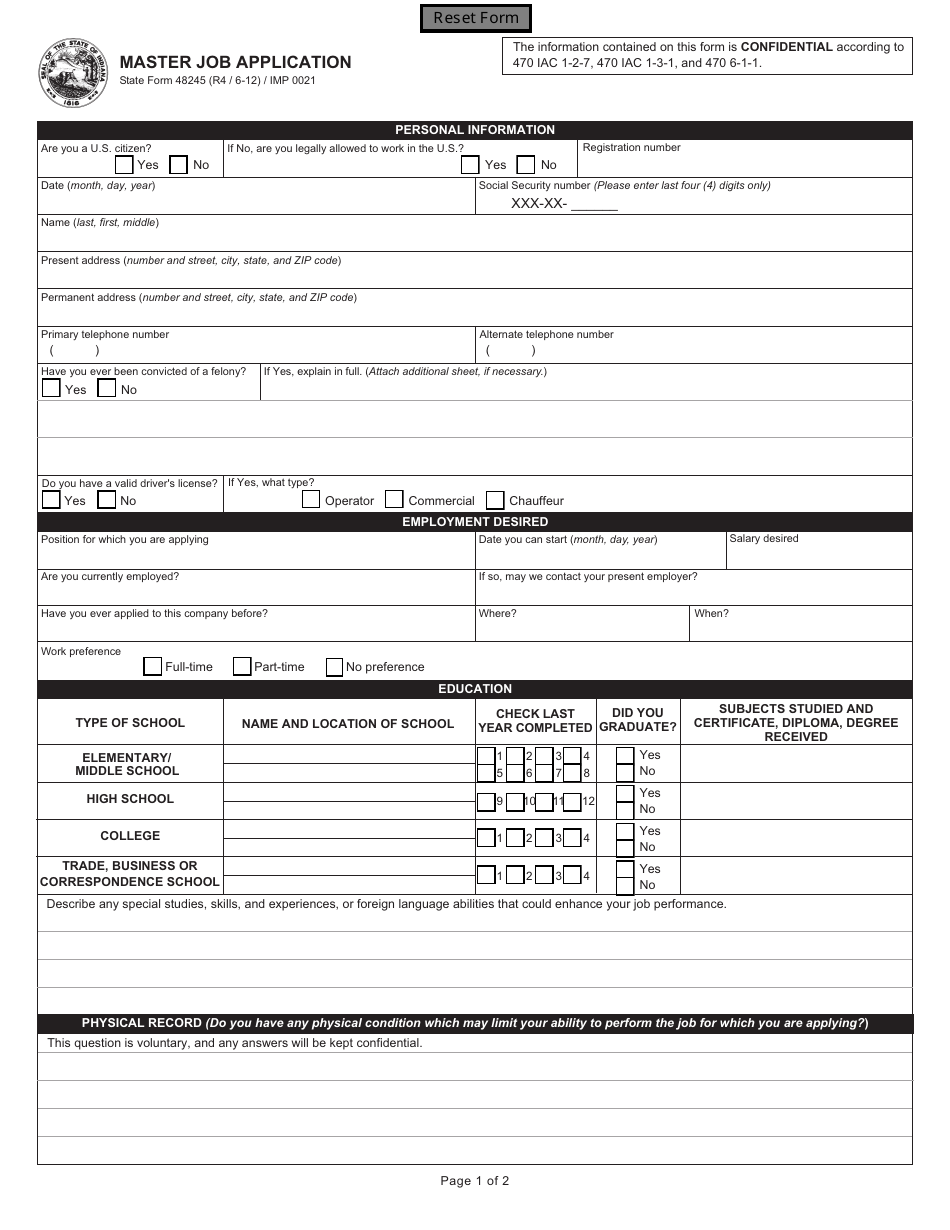

State Form 48245 Download Fillable PDF or Fill Online Master Job

Web register and file this tax online via intime. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption. If you have employees working at your business, you’ll need to collect withholding taxes. Edit your 2019 indiana state withholding form online. The new form no longer uses withholding allowances.

Wh 530 Fill Out and Sign Printable PDF Template signNow

Employee's withholding exemption and county status certificate. Web register and file this tax online via intime. The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. The new form no longer uses withholding allowances. You can also download it, export it or print it out.

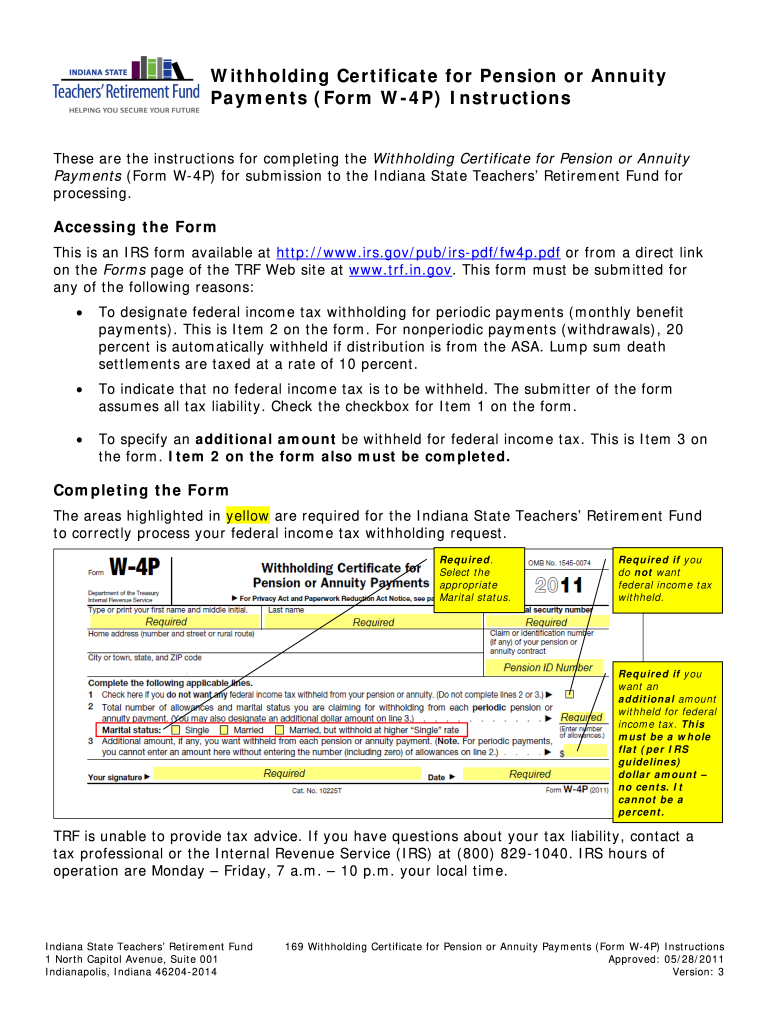

2011 Form IN SF 39530 Fill Online, Printable, Fillable, Blank pdfFiller

The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. These are state and county taxes that. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web register and file this tax online via intime. Instead, there is a five.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Print or type your full name, social. The new form no longer uses withholding allowances. Edit your 2019 indiana state withholding form online. Register and file this tax online via intime. Employee's withholding exemption and county status certificate.

20182023 Form DoL WH4 Fill Online, Printable, Fillable, Blank pdfFiller

These are state and county taxes that. You can also download it, export it or print it out. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Web register and file this tax online via intime. The new form no longer uses withholding allowances.

These Are State And County Taxes That.

(a) you divorce (or are legally. Register and file this tax online via intime. Web register and file this tax online via intime. The new form no longer uses withholding allowances.

Web Send Wh 4 Form 2019 Via Email, Link, Or Fax.

If you have employees working at your business, you’ll need to collect withholding taxes. Table b is used to figure additional dependent exemptions. Web this form should be completed by all resident and nonresident employees having income subject to indiana state and/or county income tax. Most employees are entitled to deduct $1,500 per year per qualifying dependent exemption.

Underpayment Of Indiana Withholding Filing.

The form must be forwarded to the wage and hour division (whd) office which has jurisdiction. Print or type your full name, social. Employee's withholding exemption and county status certificate. Generally, employers are required to withhold both state and county taxes from employees’ wages.

You Can Also Download It, Export It Or Print It Out.

Instead, there is a five. Edit your 2019 indiana state withholding form online.