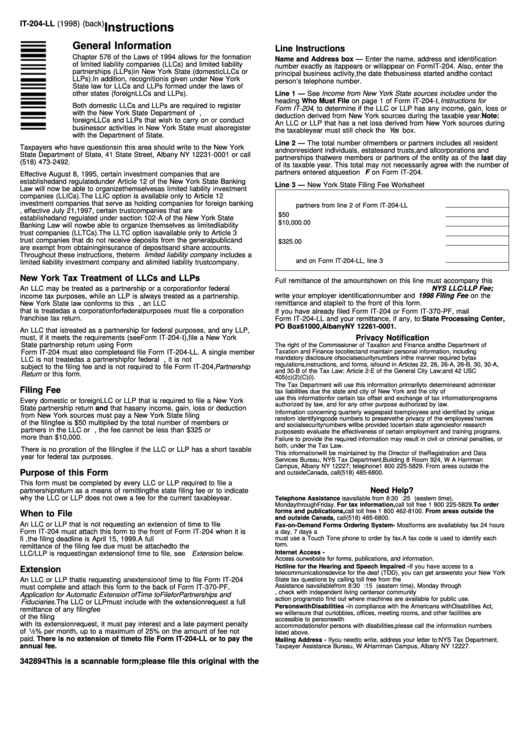

Form It-204-Ll Instructions

Form It-204-Ll Instructions - That has income, gain, loss, or deduction from new york sources in the current taxable year; Web on average this form takes 10 minutes to complete. Web ein and 2019 filing fee on the remittance and submit it with this form. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or And had new york source gross income for the preceding tax year of. Used to report income, deductions, gains, losses and credits from the operation of a partnership. February 18, 2022 department of taxation and finance For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): Submit full remittance of any filing fee due with the form. Go to general > electronic filing.

Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web on average this form takes 10 minutes to complete. That has income, gain, loss, or deduction from new york sources in the current taxable year; Web ein and 2019 filing fee on the remittance and submit it with this form. Submit full remittance of any filing fee due with the form. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or Go to general > electronic filing. And had new york source gross income for the preceding tax year of. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): February 18, 2022 department of taxation and finance

And had new york source gross income for the preceding tax year of. Web on average this form takes 10 minutes to complete. Submit full remittance of any filing fee due with the form. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or February 18, 2022 department of taxation and finance Go to general > electronic filing. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): That has income, gain, loss, or deduction from new york sources in the current taxable year; Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web ein and 2019 filing fee on the remittance and submit it with this form.

Instructions For Form It204Ll Limited Liability Company/limited

For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or Web on average this form takes 10 minutes to complete. And had new york source gross income for the preceding tax year.

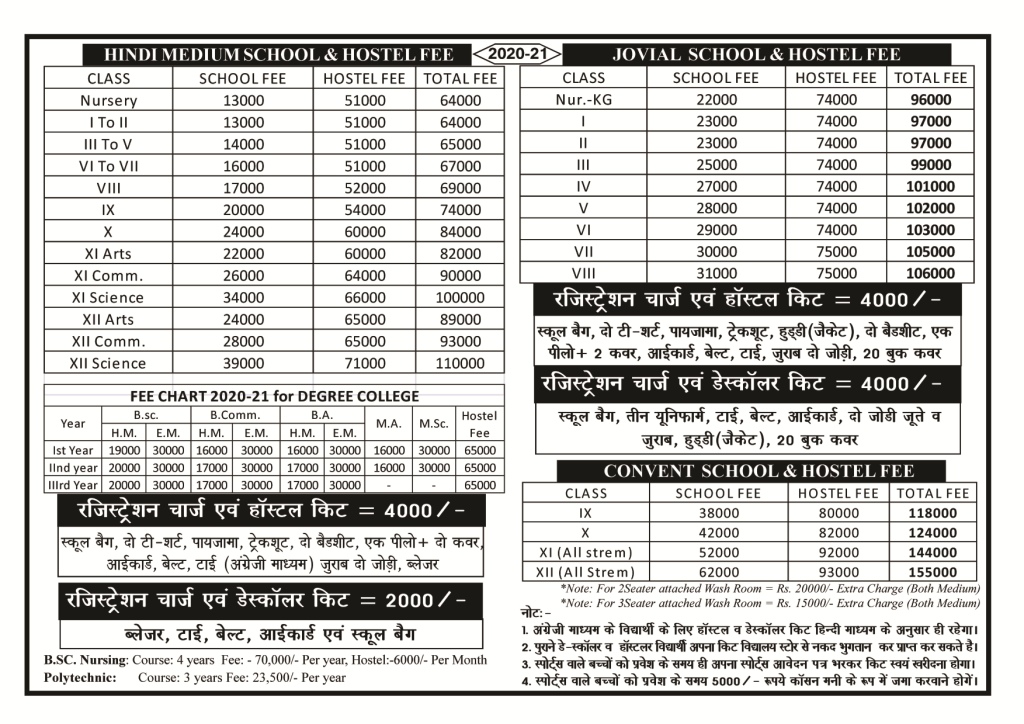

Fee Details

Web on average this form takes 10 minutes to complete. And had new york source gross income for the preceding tax year of. Submit full remittance of any filing fee due with the form. That has income, gain, loss, or deduction from new york sources in the current taxable year; Used to report income, deductions, gains, losses and credits from.

Listening Section Tryout Smk Pertama Tahun 2022 keyrole

Web ein and 2019 filing fee on the remittance and submit it with this form. Used to report income, deductions, gains, losses and credits from the operation of a partnership. Submit full remittance of any filing fee due with the form. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income,.

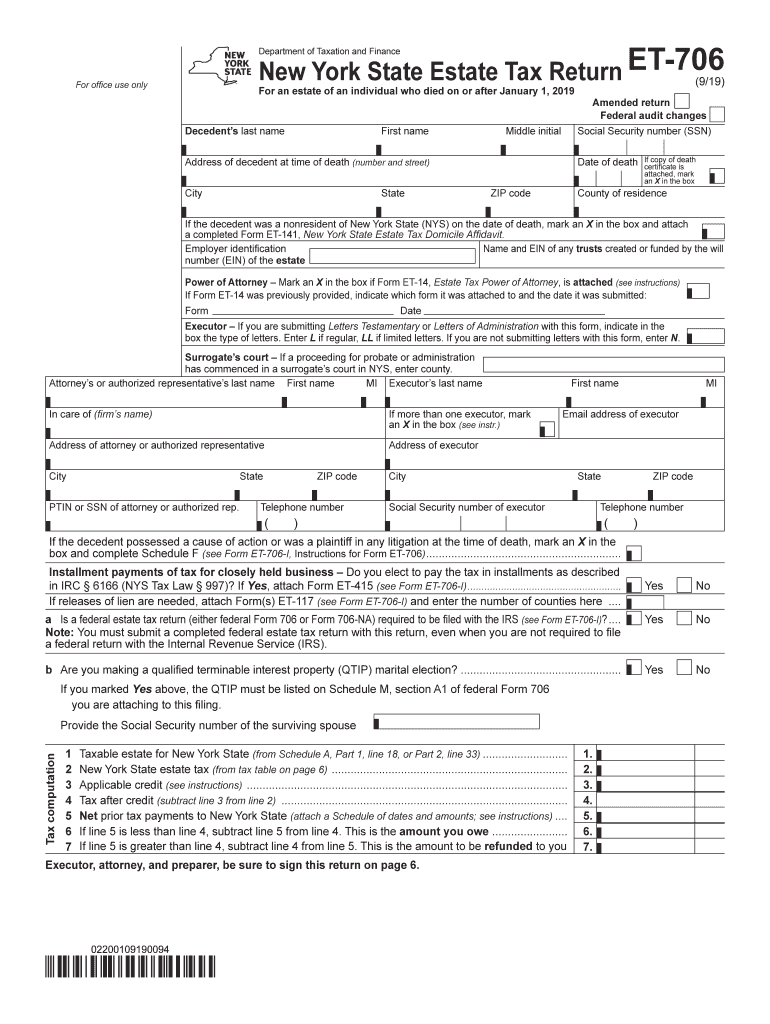

NY DTF ET706 20192021 Fill out Tax Template Online US Legal Forms

Submit full remittance of any filing fee due with the form. Web ein and 2019 filing fee on the remittance and submit it with this form. Web on average this form takes 10 minutes to complete. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): Go to general > electronic filing.

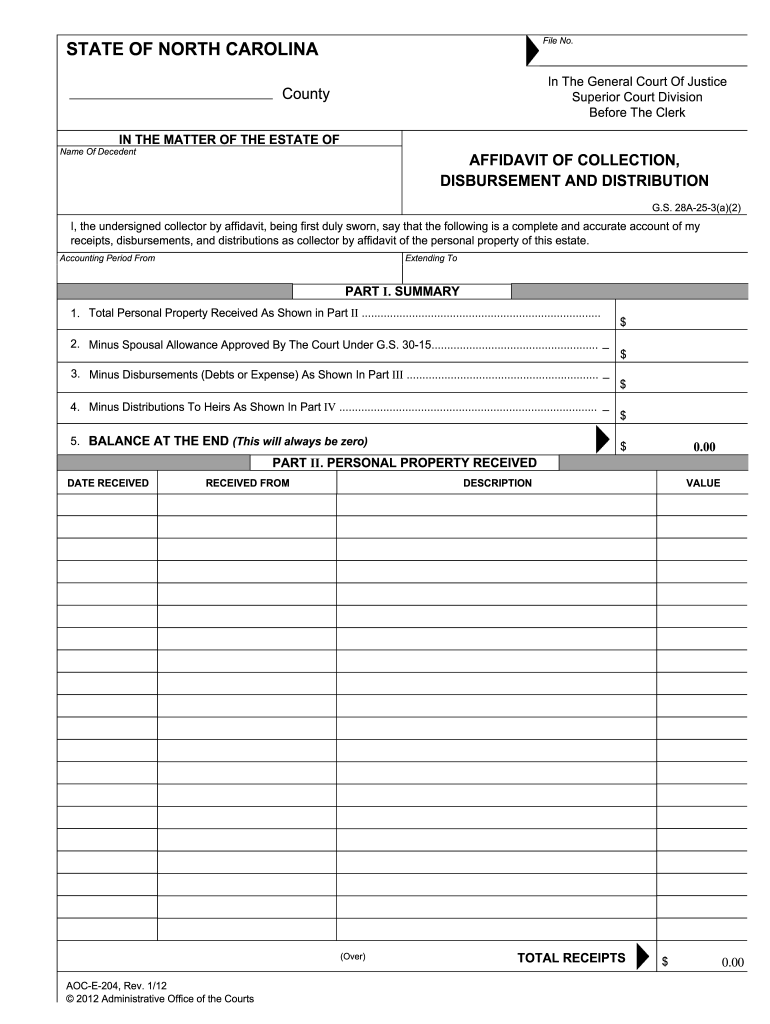

Nc Form Aoc E 204 Instructions Fill Out and Sign Printable PDF

That has income, gain, loss, or deduction from new york sources in the current taxable year; For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): Submit full remittance of any filing fee due with the form. Web ein and 2019 filing fee on the remittance and submit it with this form. Used to.

2021 NY Form IT204LLI Fill Online, Printable, Fillable, Blank

• a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or Go to general > electronic filing. Used to report income, deductions, gains, losses and credits from the operation of a partnership. And had new york source gross income for the preceding tax year of. Submit full remittance of.

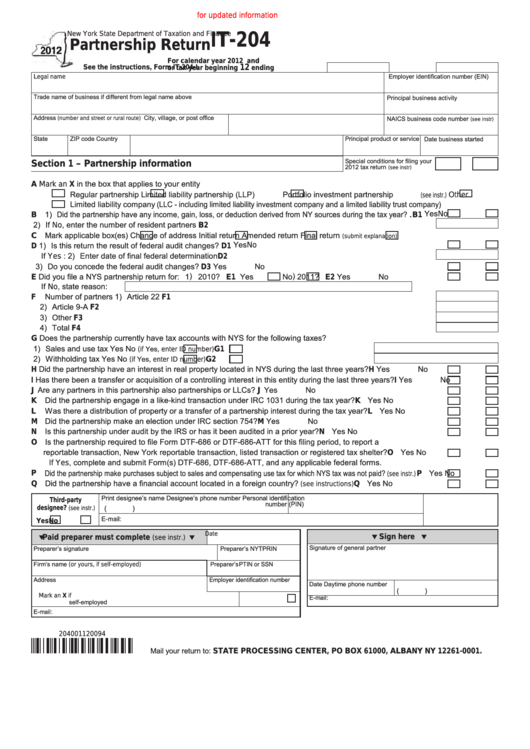

Fillable Form It204 Partnership Return 2012 printable pdf download

Web on average this form takes 10 minutes to complete. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or Used to report income, deductions, gains, losses and credits from the operation of a partnership. Web ein and 2019 filing fee on the remittance and submit it with.

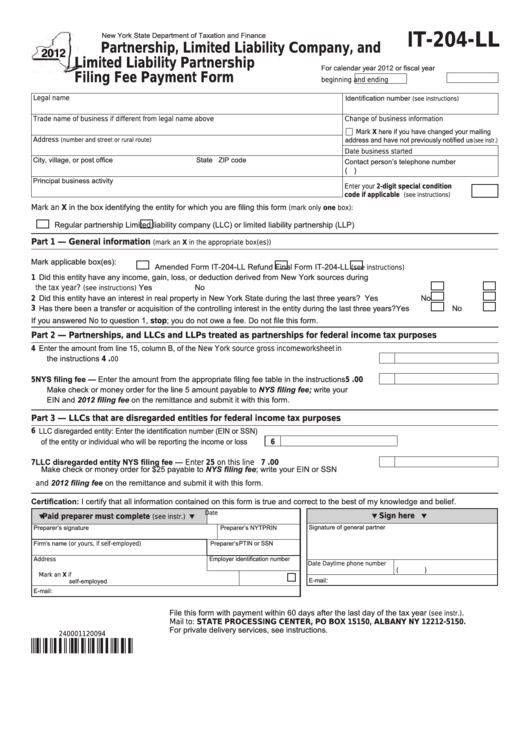

Fillable Form It204Ll Partnership, Limited Liability Company, And

Go to general > electronic filing. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): Web on average this form takes 10 minutes to complete. February 18, 2022 department of taxation and finance That has income, gain, loss, or deduction from new york sources in the current taxable year;

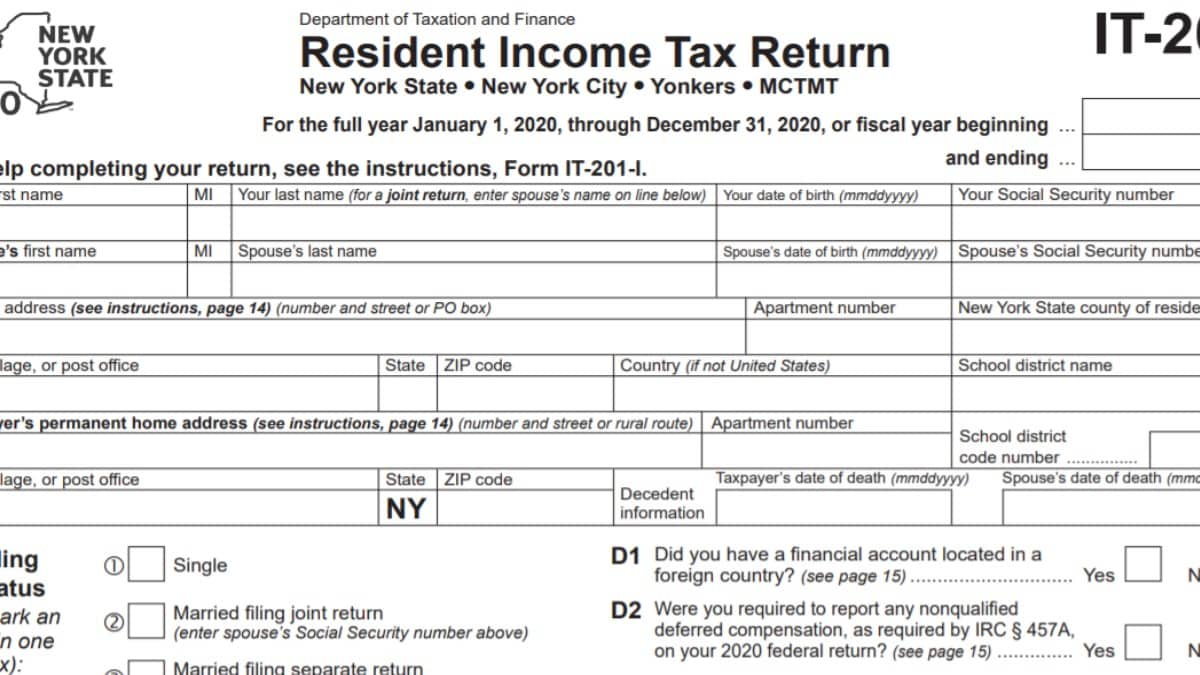

IT201 Instructions 2022 2023 State Taxes TaxUni

Web ein and 2019 filing fee on the remittance and submit it with this form. And had new york source gross income for the preceding tax year of. • a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or For calendar year 2019 or tax year beginning 19 and.

20182021 Form NY DTF IT204LL Fill Online, Printable, Fillable, Blank

Web ein and 2019 filing fee on the remittance and submit it with this form. Used to report income, deductions, gains, losses and credits from the operation of a partnership. February 18, 2022 department of taxation and finance For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): And had new york source gross.

Used To Report Income, Deductions, Gains, Losses And Credits From The Operation Of A Partnership.

And had new york source gross income for the preceding tax year of. For calendar year 2019 or tax year beginning 19 and ending mark applicable box(es) (see instructions): February 18, 2022 department of taxation and finance Web ein and 2019 filing fee on the remittance and submit it with this form.

That Has Income, Gain, Loss, Or Deduction From New York Sources In The Current Taxable Year;

• a limited liability company (llc) that is a disregarded entity for federal income tax purposes that has income, gain, loss, or Go to general > electronic filing. Submit full remittance of any filing fee due with the form. Web on average this form takes 10 minutes to complete.