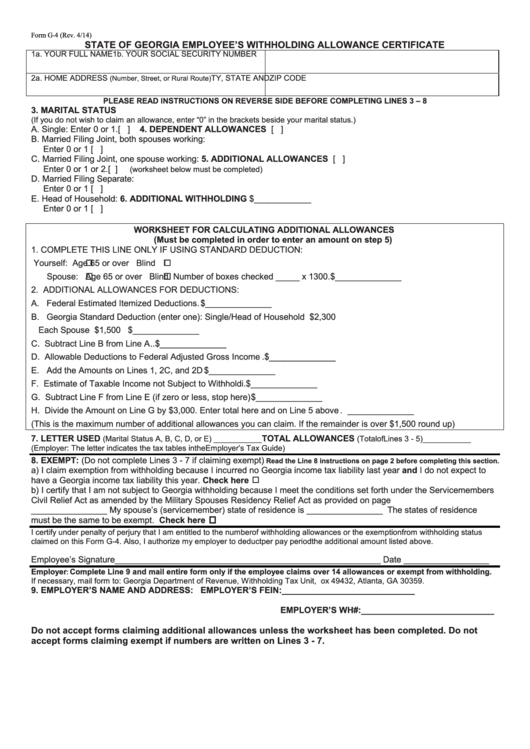

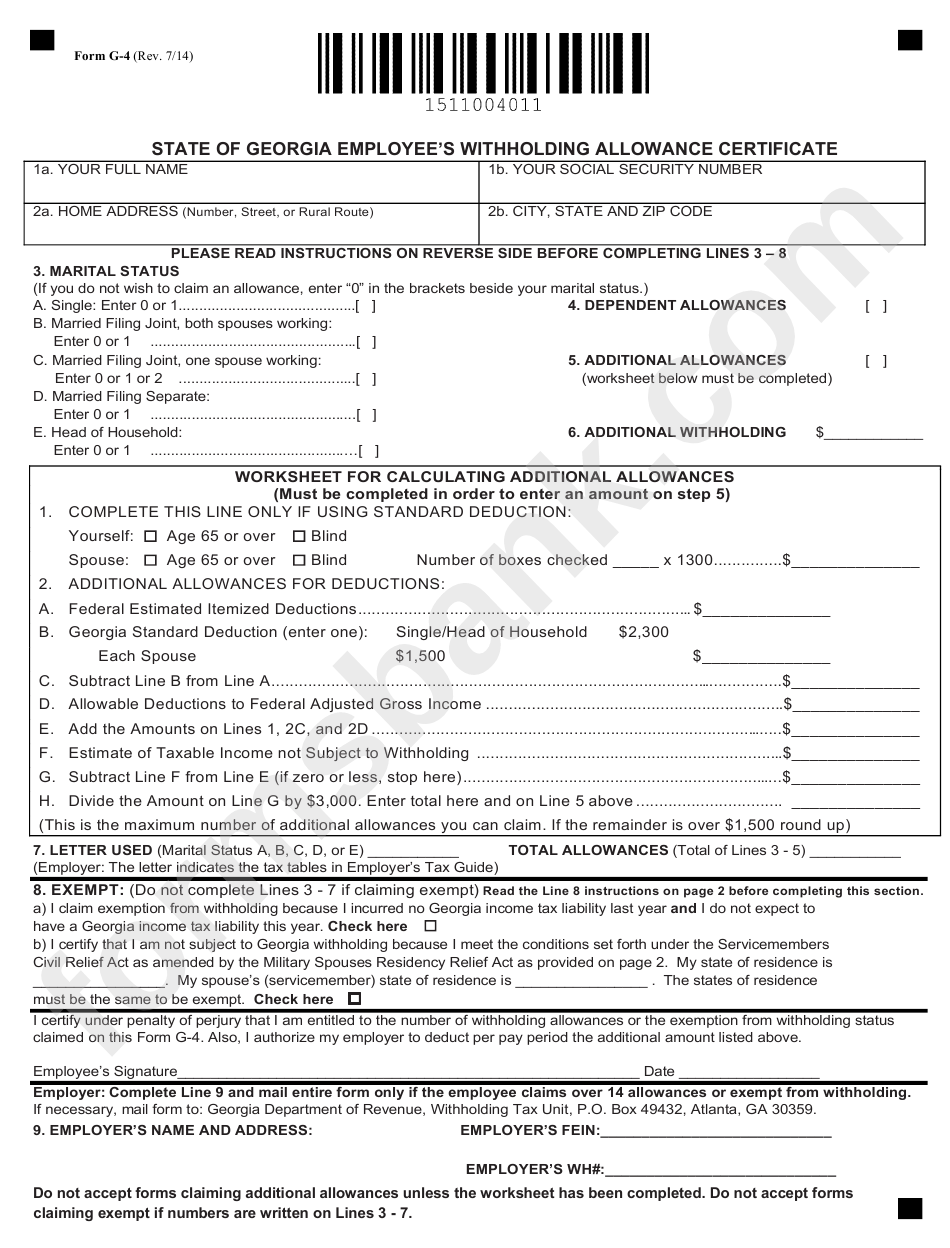

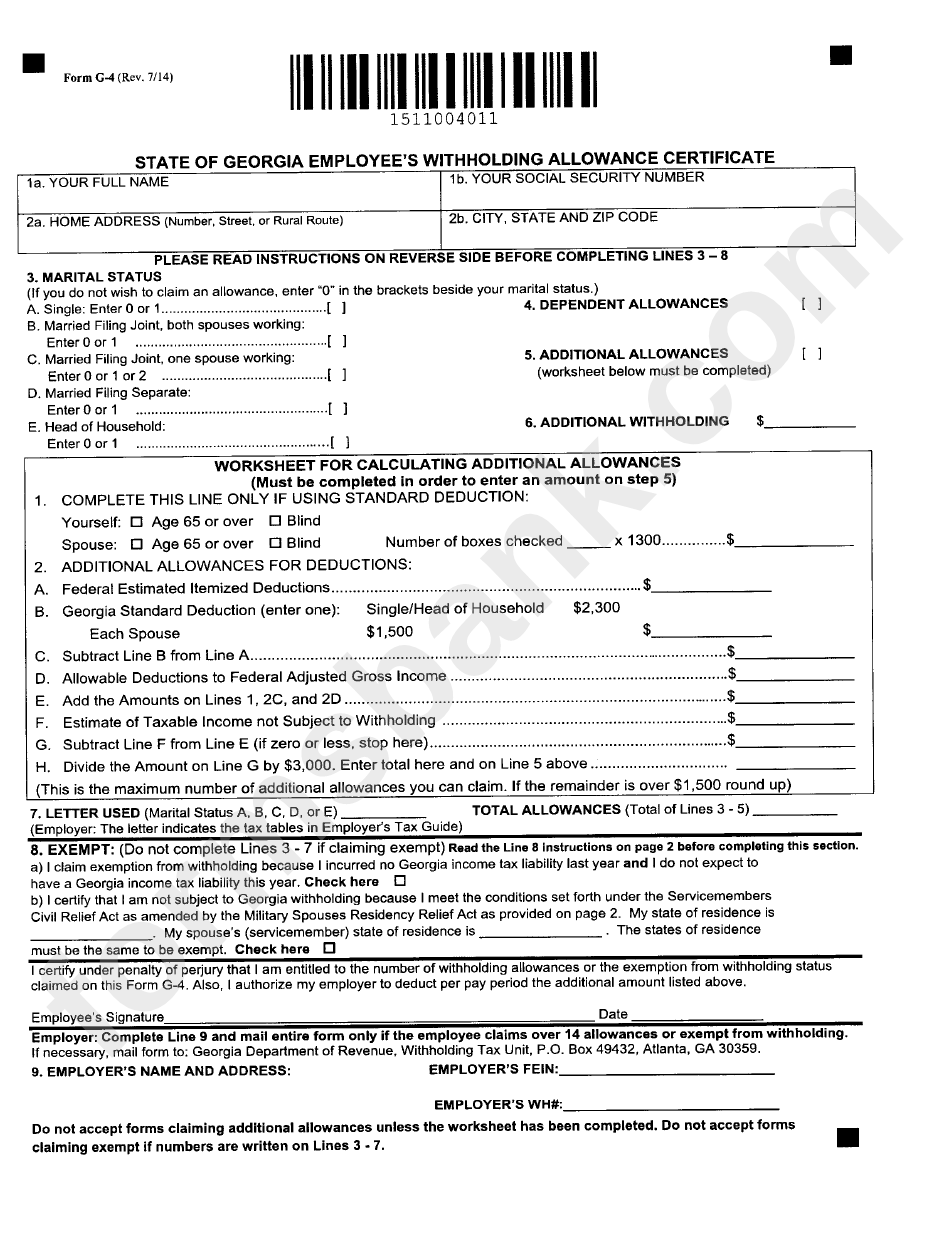

Form G 4 Georgia

Form G 4 Georgia - 12/09) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. If you do not provide. You can download or print current or past. Your tax liability is the amount on line 4 (or line 16); For recipients of income from annuities, pensions, and certain other deferred compensation plans. Therefore, you do not qualify to claim exempt. Its purpose is to inform a. Easily fill out pdf blank, edit, and sign them. State of georgia employees form is 2 pages long and contains: For the first time since july 2014, the georgia department of revenue recently released.

Web up to 5% cash back georgia tax return this year and will not have a tax liability. The forms will be effective with the first paycheck. For recipients of income from annuities, pensions, and certain other deferred compensation plans. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as required. 7/14) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. For the first time since july 2014, the georgia department of revenue recently released. Your tax liability is the amount on. Therefore, you do not qualify to claim exempt. Use this form to tell. Your tax liability is the amount on line 4 (or line 16);

12/09) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. Web up to 5% cash back georgia tax return this year and will not have a tax liability. Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100. You can download or print current or past. Web your employer withheld $500 of georgia income tax from your wages. Access the fillable pdf document with a click. For recipients of income from annuities, pensions, and certain other deferred compensation plans. Start filling out the template. Its purpose is to inform a. The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero).

Ga Employee Withholding Form 2022 2023

The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). Easily fill out pdf blank, edit, and sign them. If you do not provide. Therefore, you do not qualify to claim exempt. For recipients of income from annuities, pensions, and certain other deferred compensation plans.

Form Type Archives Page 1847 of 2481 PDFSimpli

You can not claim exempt if you did not file a georgia income tax return for the previous tax year. Your tax liability is the amount on line 4 (or line 16); State of georgia employees form is 2 pages long and contains: Save or instantly send your ready documents. Do not withhold georgia state income tax from my.

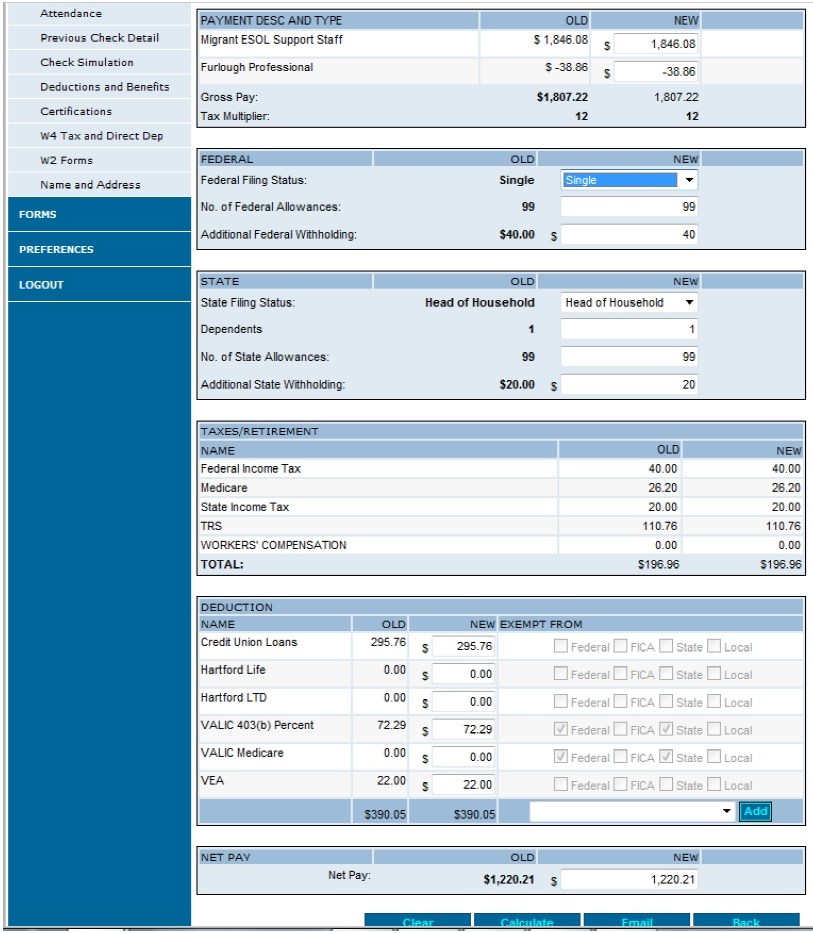

WFR State Fixes 2022 Resourcing Edge

The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). Easily fill out pdf blank, edit, and sign them. Web up to 5% cash back georgia tax return this year and will not have a tax liability. State of georgia employees form is 2 pages long and contains: Use this form to tell.

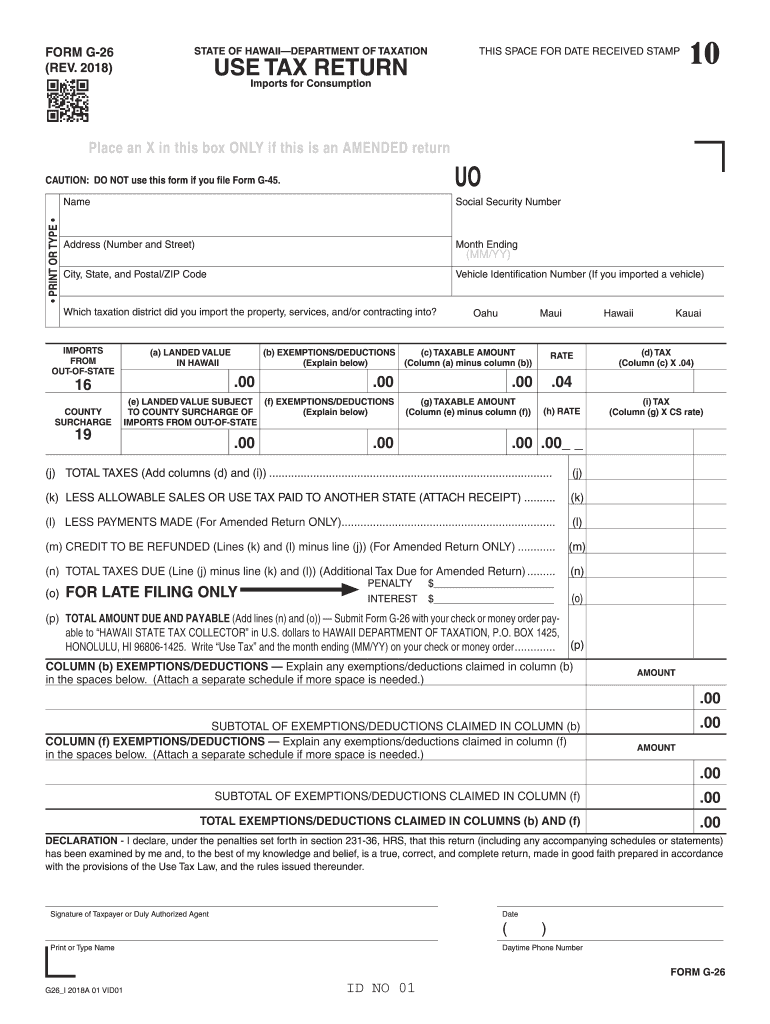

2018 Form HI G26 Fill Online, Printable, Fillable, Blank pdfFiller

Start filling out the template. This form is for income earned in tax year 2022, with tax returns due in april. Web up to 5% cash back georgia tax return this year and will not have a tax liability. Its purpose is to inform a. State of georgia employees form is 2 pages long and contains:

Fillable Form G4 State Of Employee'S Withholding Allowance

Access the fillable pdf document with a click. Therefore, you do not qualify to claim exempt. You can download or print current or past. Easily fill out pdf blank, edit, and sign them. Its purpose is to inform a.

Form G Form G Locking Pins, Index Plungers Standard Parts Brauer

Access the fillable pdf document with a click. If you do not provide. Your tax liability is the amount on line 4 (or line 16); For recipients of income from annuities, pensions, and certain other deferred compensation plans. Start filling out the template.

Form G4 State Of Employee'S Withholding Allowance

Do not withhold georgia state income tax from my. Use this form to tell. You can not claim exempt if you did not file a georgia income tax return for the previous tax year. Web your employer withheld $500 of georgia income tax from your wages. Web up to 5% cash back georgia tax return this year and will not.

Free Form G PDF 194KB 2 Page(s)

Your tax liability is the amount on. Your tax liability is the amount on line 4 (or line 16); Do not withhold georgia state income tax from my. The forms will be effective with the first paycheck. You can download or print current or past.

VCS Employee Portal Valdosta City Schools

Your tax liability is the amount on line 4 (or line 16); Use this form to tell. Your tax liability is the amount on. This form is for income earned in tax year 2022, with tax returns due in april. For recipients of income from annuities, pensions, and certain other deferred compensation plans.

Form G4 State Of Employee'S Withholding Allowance

Therefore, you do not qualify to claim exempt. Easily fill out pdf blank, edit, and sign them. Use this form to tell. Web up to 5% cash back georgia tax return this year and will not have a tax liability. Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100.

12/09) State Of Georgia Employee’s Withholding Allowance Certificate Please Read Instructions On Reverse Side Before.

For recipients of income from annuities, pensions, and certain other deferred compensation plans. The forms will be effective with the first paycheck. Your tax liability is the amount on. This form is for income earned in tax year 2022, with tax returns due in april.

Do Not Withhold Georgia State Income Tax From My.

State of georgia employees form is 2 pages long and contains: Web up to 5% cash back georgia tax return this year and will not have a tax liability. You can not claim exempt if you did not file a georgia income tax return for the previous tax year. Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100.

Access The Fillable Pdf Document With A Click.

Your tax liability is the amount on line 4 (or line 16); Its purpose is to inform a. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Start Filling Out The Template.

If you do not provide. For the first time since july 2014, the georgia department of revenue recently released. Web your employer withheld $500 of georgia income tax from your wages. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as required.