Form 990 Preparation

Form 990 Preparation - Tax 990 supports filing for the current and previous tax year. Get ready for tax season deadlines by completing any required tax forms today. Verification routines ensure your return is accurate and complete. Web at wegner cpas, we will make sure your form 990 puts your best foot forward. Web organizations that must file form 990. The long form and short forms provide the irs with information about the organization’s. Download or email irs 990sa & more fillable forms, register and subscribe now! Web choose tax year and form. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. Complete, edit or print tax forms instantly.

There is no paper form. Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. As anyone who has had to compile information for the form 990 knows, what the irs is requesting is exceptionally time consuming to put. Web at wegner cpas, we will make sure your form 990 puts your best foot forward. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. The download files are organized by month. Web distinguish where the filing organization’s financial information is to be properly reported on parts viii, ix, x, xi, and xii of the 990 core form. Get ready for tax season deadlines by completing any required tax forms today. The long form and short forms provide the irs with information about the organization’s.

Web the irs form 990 series are informational tax forms that most nonprofits must file annually. Choose the tax year for which you are required to file, select the applicable form and. Get ready for tax season deadlines by completing any required tax forms today. As anyone who has had to compile information for the form 990 knows, what the irs is requesting is exceptionally time consuming to put. Complete, edit or print tax forms instantly. Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Download or email irs 990sa & more fillable forms, register and subscribe now! Web 21 rows required filing (form 990 series) see the form 990 filing thresholds page to. Web at wegner cpas, we will make sure your form 990 puts your best foot forward. Web choose tax year and form.

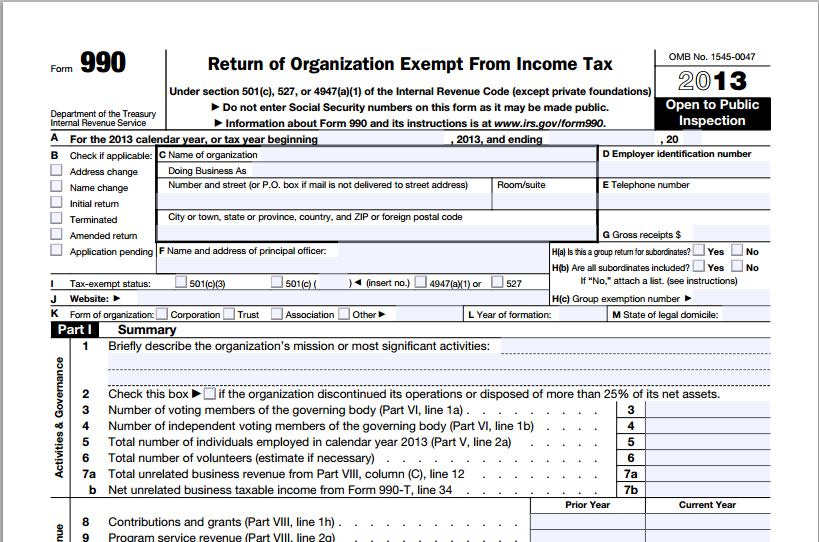

What is IRS Form 990?

Web choose tax year and form. Tax 990 supports filing for the current and previous tax year. On this page you may download the 990 series filings on record for 2021. Download or email irs 990sa & more fillable forms, register and subscribe now! Was the organization controlled directly or indirectly at any time during the tax year by one.

2009 Form 990 by Camfed International Issuu

Tax 990 supports filing for the current and previous tax year. Get ready for tax season deadlines by completing any required tax forms today. Web choose tax year and form. Web at wegner cpas, we will make sure your form 990 puts your best foot forward. Web organizations that must file form 990.

IRS Form 990 Preparation and Assessment Blackman & Sloop Nonprofit

Tax 990 supports filing for the current and previous tax year. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Download or email irs 990sa & more fillable forms, register and subscribe now! Recognize the importance of.

What Is A 990 N E Postcard hassuttelia

Recognize the importance of making. Download or email irs 990sa & more fillable forms, register and subscribe now! Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. On this page you may download the 990 series filings on record.

Form 990 Preparation Form 990, 990EZ, 990N Preparation, Form, Irs

Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. As anyone who has had to compile information for the form 990 knows, what the irs is requesting is exceptionally time consuming to put. On this page you may download.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

As anyone who has had to compile information for the form 990 knows, what the irs is requesting is exceptionally time consuming to put. Download or email irs 990sa & more fillable forms, register and subscribe now! Tax 990 supports filing for the current and previous tax year. There is no paper form. Recognize the importance of making.

Form 990 Preparation NonProfit Accountant Wegner CPAs

Web organizations that must file form 990. Web choose tax year and form. Web at wegner cpas, we will make sure your form 990 puts your best foot forward. Choose the tax year for which you are required to file, select the applicable form and. Complete, edit or print tax forms instantly.

Affordable IRS Form 990 Preparation Services Labyrinth, Inc.

On this page you may download the 990 series filings on record for 2021. As anyone who has had to compile information for the form 990 knows, what the irs is requesting is exceptionally time consuming to put. Tax 990 supports filing for the current and previous tax year. Recognize the importance of making. Download or email irs 990sa &.

Form 990 Preparation

The download files are organized by month. Web choose tax year and form. Choose the tax year for which you are required to file, select the applicable form and. Complete, edit or print tax forms instantly. The long form and short forms provide the irs with information about the organization’s.

Form 990 IRS NonProfit Tax Returns & Tax Form 990 Community Tax

Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Web organizations that must file form 990. Choose the tax year for which you are required to file, select the applicable form and. Recognize the importance of making. The long form and short forms provide the irs with information about the.

Web Organizations That Must File Form 990.

Complete, edit or print tax forms instantly. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web distinguish where the filing organization’s financial information is to be properly reported on parts viii, ix, x, xi, and xii of the 990 core form. Web the irs requires all u.s.

There Is No Paper Form.

Web choose tax year and form. Complete, edit or print tax forms instantly. Web the irs form 990 series are informational tax forms that most nonprofits must file annually. As anyone who has had to compile information for the form 990 knows, what the irs is requesting is exceptionally time consuming to put.

Web Schedule C (Form 990) 2022 Page Check If The Filing Organization Belongs To An Affiliated Group (And List In Part Iv Each Affiliated Group Member’s Name, Address, Ein, Expenses,.

Download or email irs 990sa & more fillable forms, register and subscribe now! Web at wegner cpas, we will make sure your form 990 puts your best foot forward. Tax 990 supports filing for the current and previous tax year. The long form and short forms provide the irs with information about the organization’s.

Recognize The Importance Of Making.

Choose the tax year for which you are required to file, select the applicable form and. Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Get ready for tax season deadlines by completing any required tax forms today. The download files are organized by month.