Form 990 Ez 2022

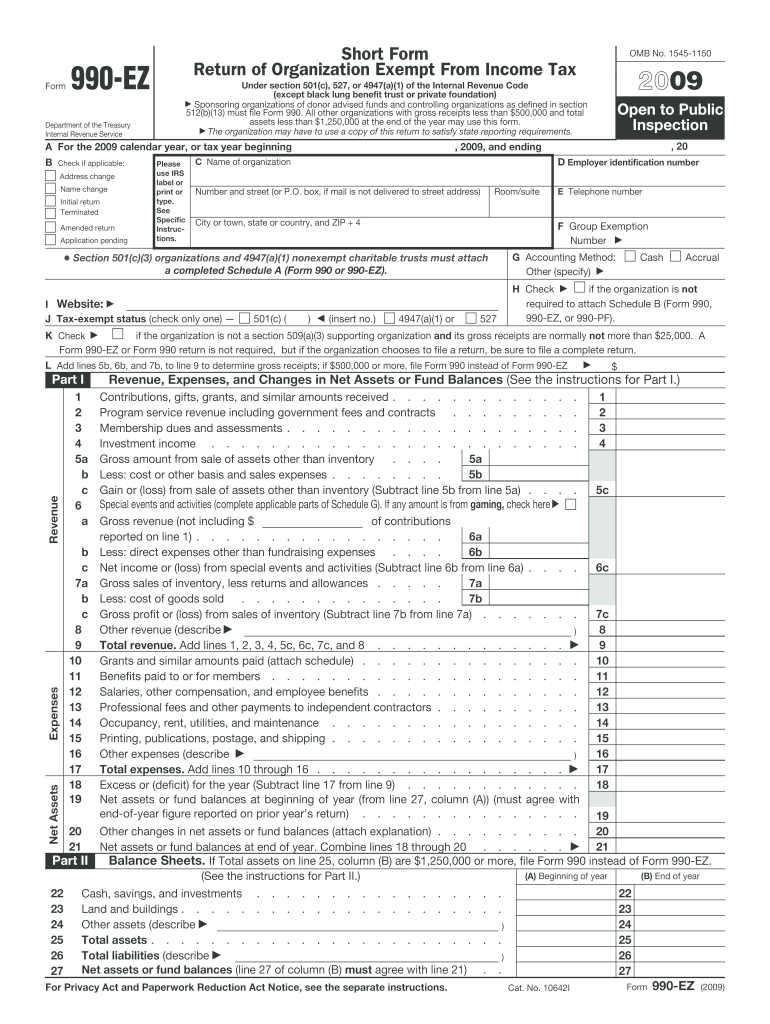

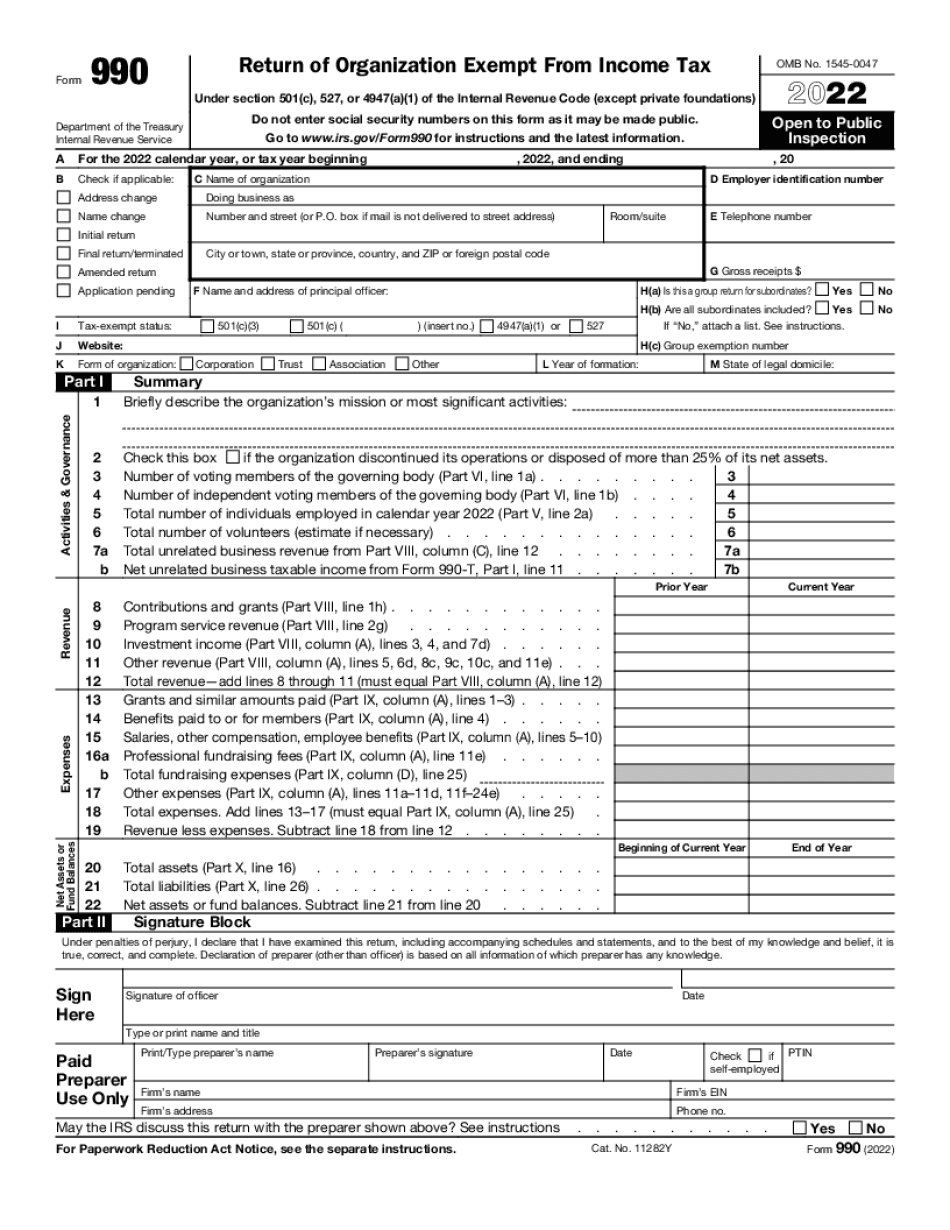

Form 990 Ez 2022 - Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. 13 carryover of disallowed deduction to 2022. Schedule a (form 990) 2022 (all organizations must complete this part.) see. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Short form return of organization exempt from income tax. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Check if applicable check any boxes in the list that apply to the pta, otherwise. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 990 (2022) page 2 check if schedule o contains a response or note to any line in this part iii briefly describe the organization's mission: Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o.

Short form return of organization exempt from income tax. 13 carryover of disallowed deduction to 2022. Complete, edit or print tax forms instantly. Check if applicable check any boxes in the list that apply to the pta, otherwise. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Upon completion of the questionnaire, please save the excel file and email it. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Basic organization information according to the irs, organizations must provide the following details: Web fiscal year the fiscal year for all local ptas and councils was july 1, 2022, through june 30, 2023.

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Basic organization information according to the irs, organizations must provide the following details: Short form return of organization exempt from income tax. Web form 990 (2022) page 2 check if schedule o contains a response or note to any line in this part iii briefly describe the organization's mission: Complete, edit or print tax forms instantly. Form 4562 (2017) (a) classification of property (e). Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Department of the treasury internal revenue service. Web fiscal year the fiscal year for all local ptas and councils was july 1, 2022, through june 30, 2023.

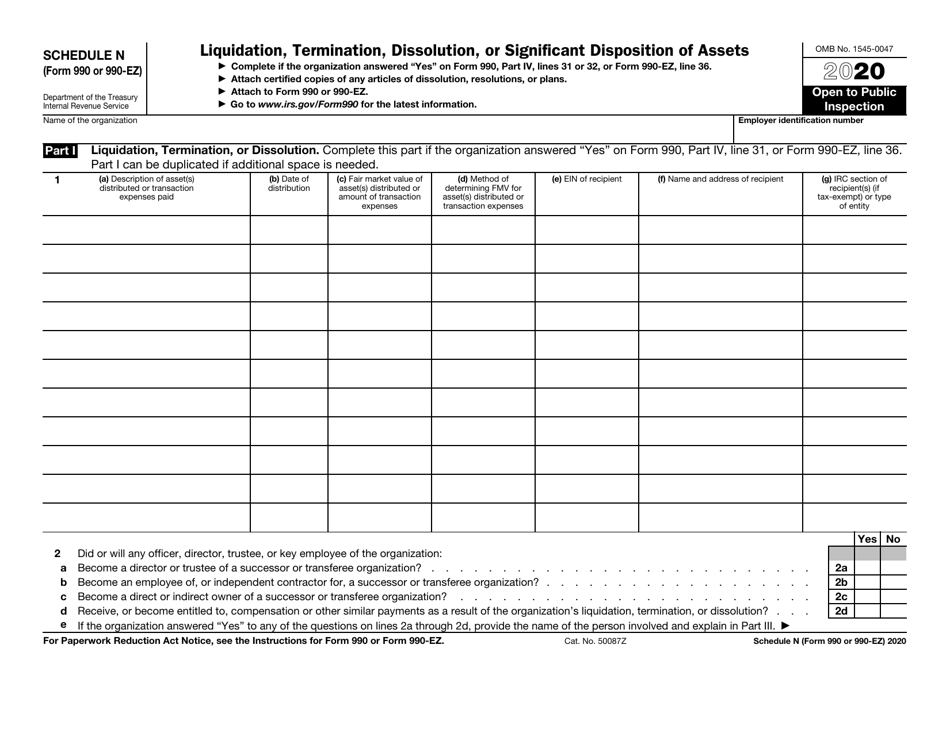

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Basic organization information according to the irs, organizations must provide the following details: Department of the treasury internal revenue service. 13 carryover of disallowed deduction to 2022. Complete, edit or print tax forms instantly. Schedule a (form 990) 2022 (all organizations must complete this part.) see.

Form 990 EZ Lions Clubs International Fill Out and Sign Printable PDF

Complete, edit or print tax forms instantly. Web fiscal year the fiscal year for all local ptas and councils was july 1, 2022, through june 30, 2023. Ad get ready for tax season deadlines by completing any required tax forms today. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web form 990 (2022) page.

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Department of the treasury internal revenue service. 13 carryover of disallowed deduction to 2022. Basic organization information according to the irs, organizations must provide the following details: Schedule a (form 990).

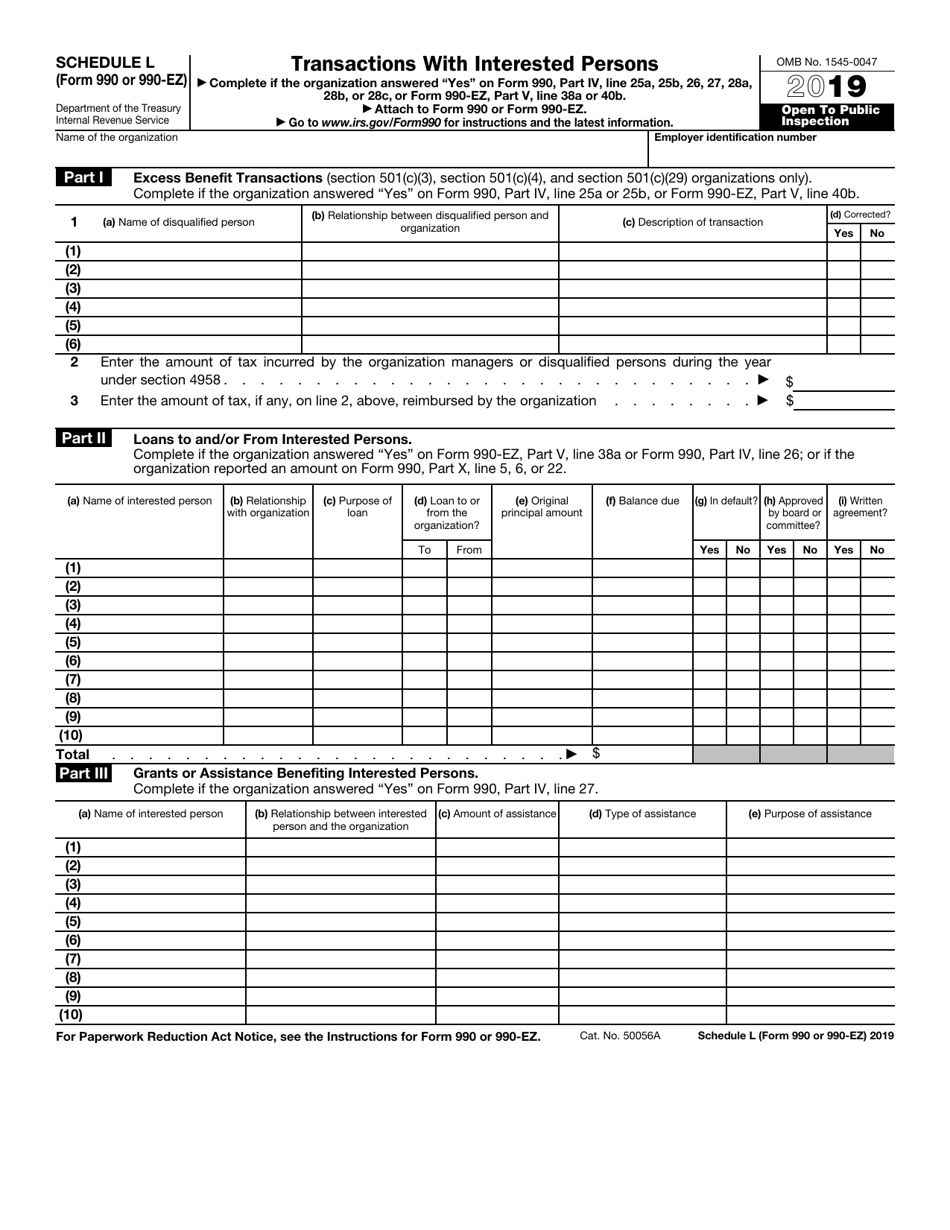

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Basic organization information according to the irs, organizations must provide the following details: Web fiscal year the fiscal year for all local ptas and councils was july 1, 2022, through june 30, 2023. Short form return of organization exempt from income tax. Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. 13 carryover of disallowed.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Web form 990 (2022) page 2 check if schedule o contains a response or note to any line in this part iii briefly describe the organization's mission: Schedule o (form 990) 2022 name of the organization lha (form 990) schedule o. Upon completion of the questionnaire, please save the excel file and email it. Check if applicable check any boxes.

Irs Form 990 ez 2023 Fill online, Printable, Fillable Blank

Basic organization information according to the irs, organizations must provide the following details: Check if applicable check any boxes in the list that apply to the pta, otherwise. Form 4562 (2017) (a) classification of property (e). Department of the treasury internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today.

2019 2020 IRS Form 990 or 990EZ Schedule L Editable Online Blank

Basic organization information according to the irs, organizations must provide the following details: Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web form 990 (2022) page 2 check if schedule o contains a response or note to any line in this part iii briefly describe the organization's mission: Form 4562 (2017) (a) classification of property (e)..

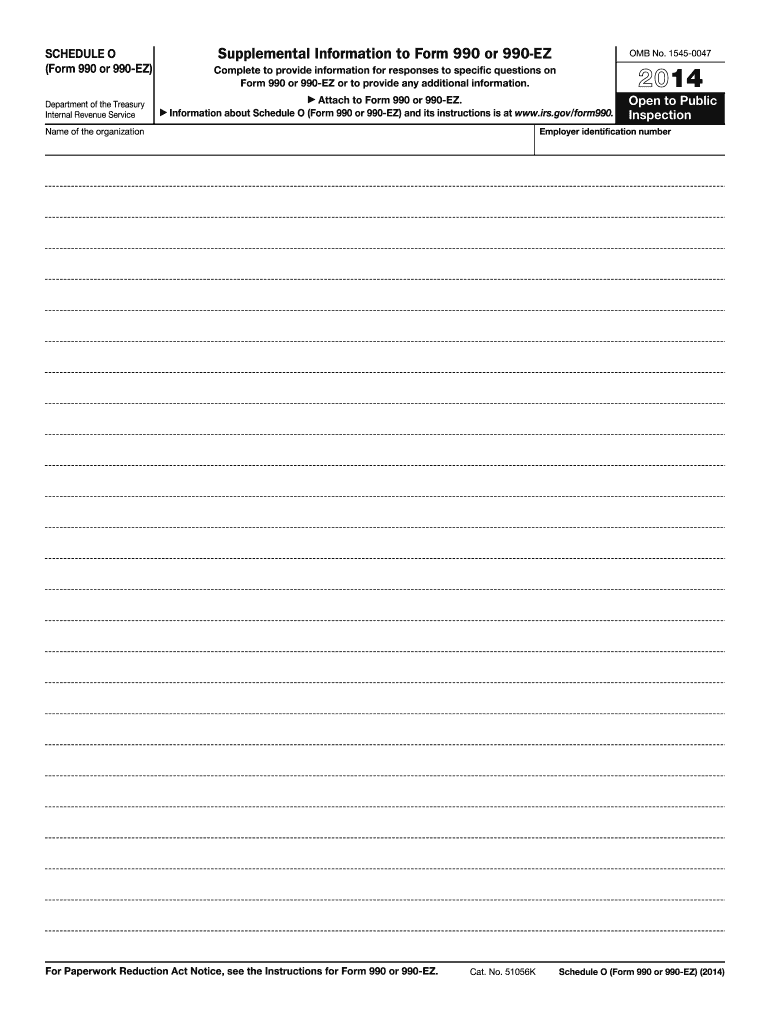

2014 Form IRS 990 Schedule O Fill Online, Printable, Fillable, Blank

Department of the treasury internal revenue service. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Check if applicable check any boxes in the list that apply to the pta, otherwise. Basic organization information according to the irs, organizations must provide the following details: Schedule a (form 990) 2022 (all organizations must complete.

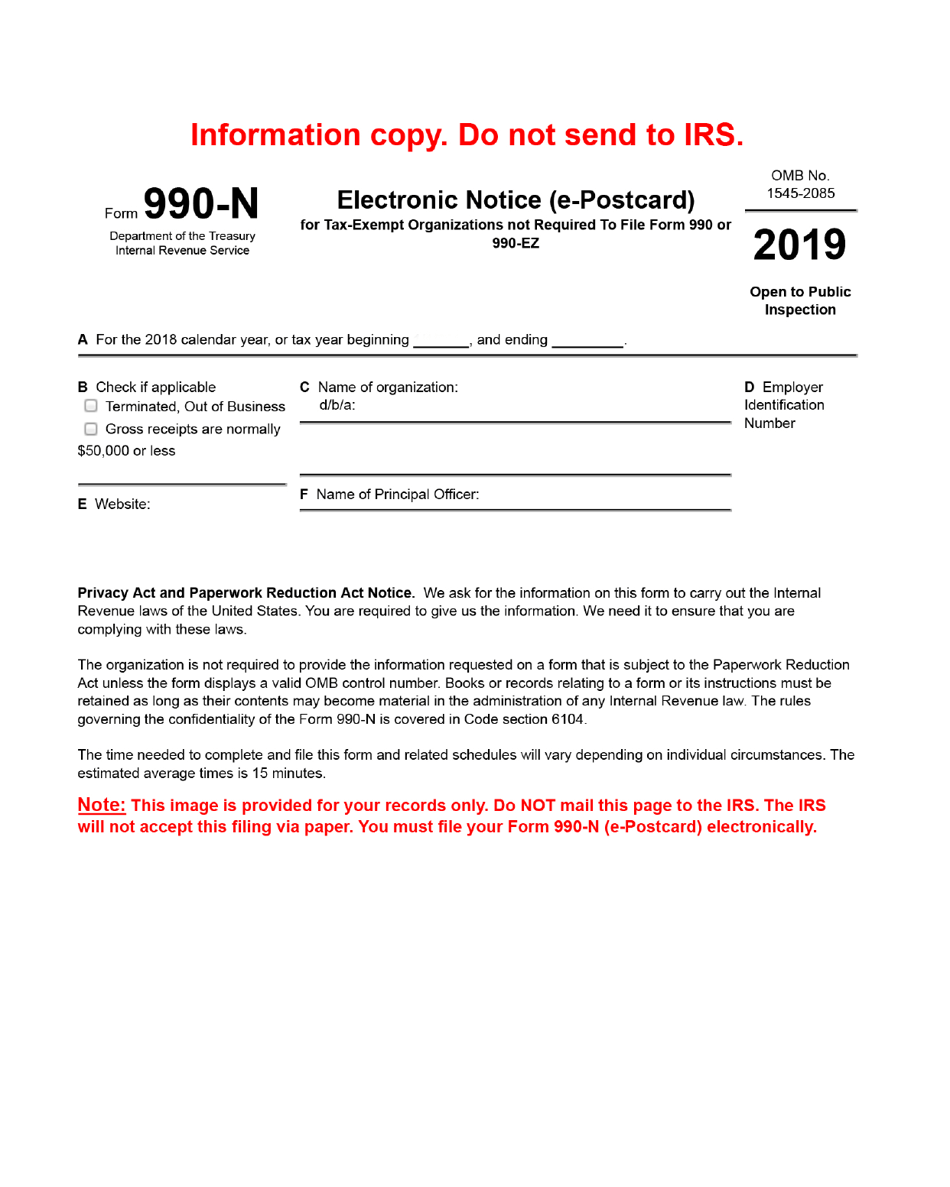

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Check if applicable check any boxes in the list that apply to the pta, otherwise..

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Ad get ready for tax season deadlines by completing any required tax forms today. Upon completion of the questionnaire, please save the excel file and email it. Web form 990 (2022) page 2 check if schedule o contains a response or note to any line in this part iii briefly describe the organization's mission: 13 carryover of disallowed deduction to.

Schedule O (Form 990) 2022 Name Of The Organization Lha (Form 990) Schedule O.

13 carryover of disallowed deduction to 2022. Web form 990 (2022) page 2 check if schedule o contains a response or note to any line in this part iii briefly describe the organization's mission: Ad get ready for tax season deadlines by completing any required tax forms today. Upon completion of the questionnaire, please save the excel file and email it.

Complete, Edit Or Print Tax Forms Instantly.

Department of the treasury internal revenue service. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Short form return of organization exempt from income tax. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w.

A Supporting Organization Described In Section 509 (A) (3) Is Required To File Form 990 (Or.

Check if applicable check any boxes in the list that apply to the pta, otherwise. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web fiscal year the fiscal year for all local ptas and councils was july 1, 2022, through june 30, 2023. Basic organization information according to the irs, organizations must provide the following details: