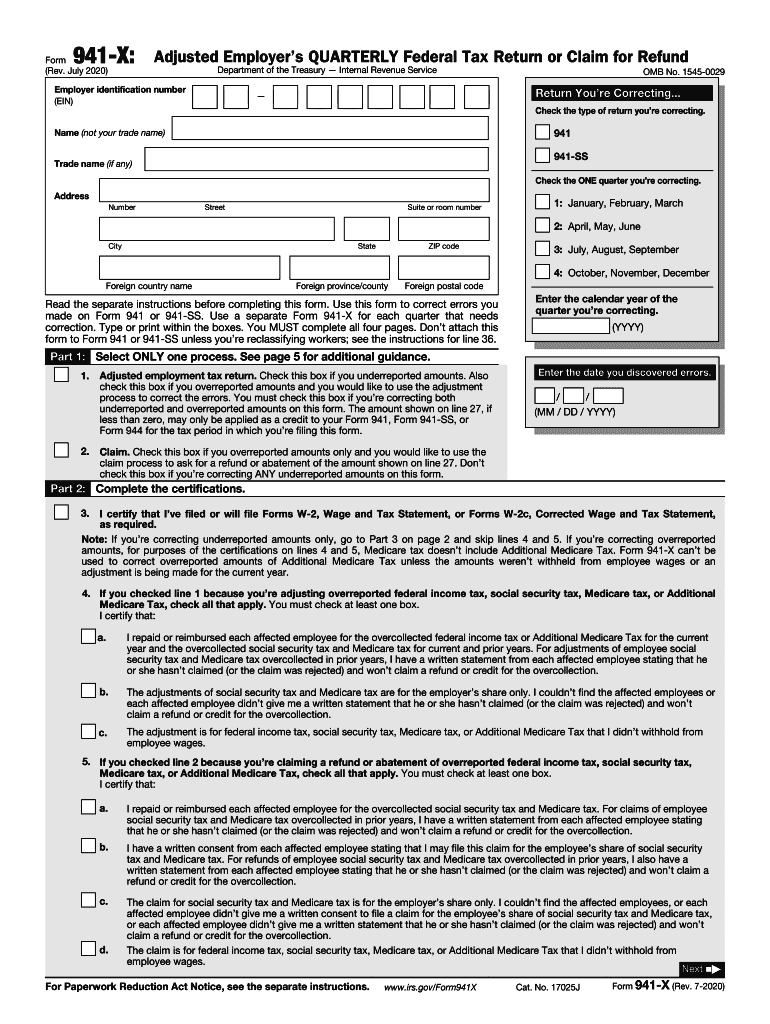

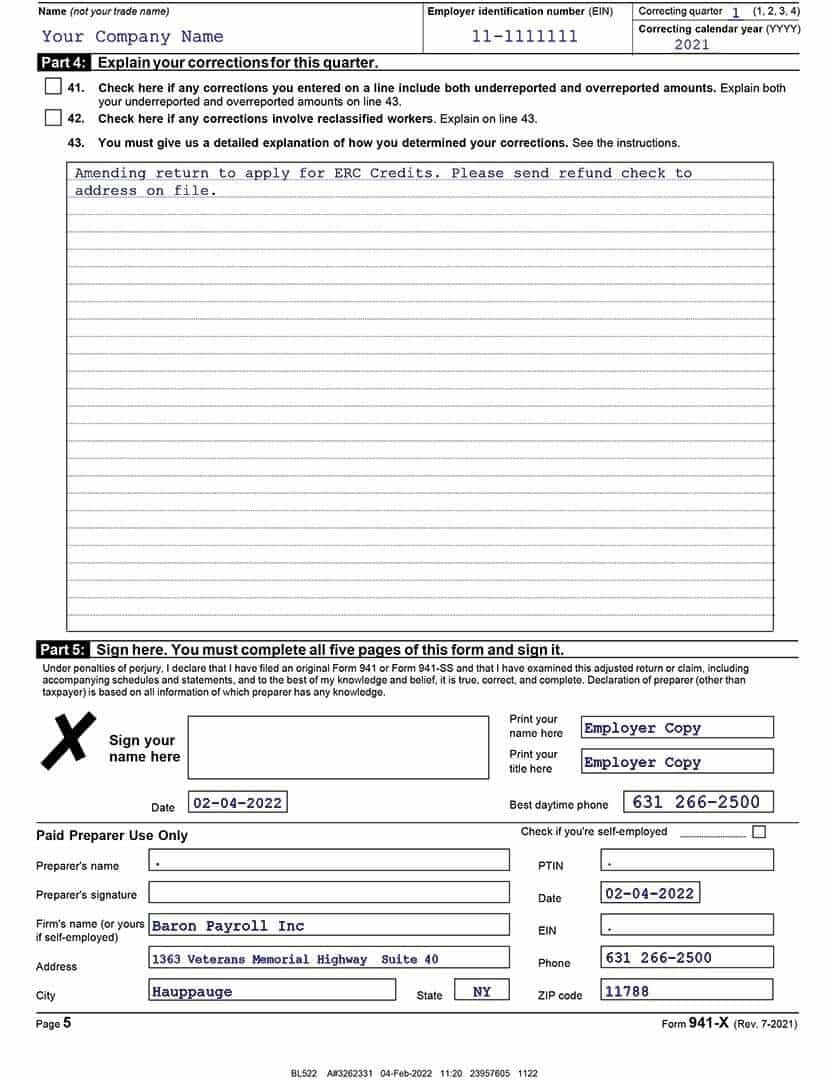

Form 941X Employee Retention Credit

Form 941X Employee Retention Credit - Qualified health plan expenses allocable to the employee retention credit are. Web what to do — the irs has knocked. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Web warning signs of an erc scam include: “the irs claims to have doubled the amount of employee. Web the american rescue plan (arp) changed the way employee retention credit should be applied within form 941. Web once the irs processes form 941x, a check is issued to the taxpayer for the credit amount, plus interest. Employers engaged in a trade or business who. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. The statute of limitations for filing amended payroll tax.

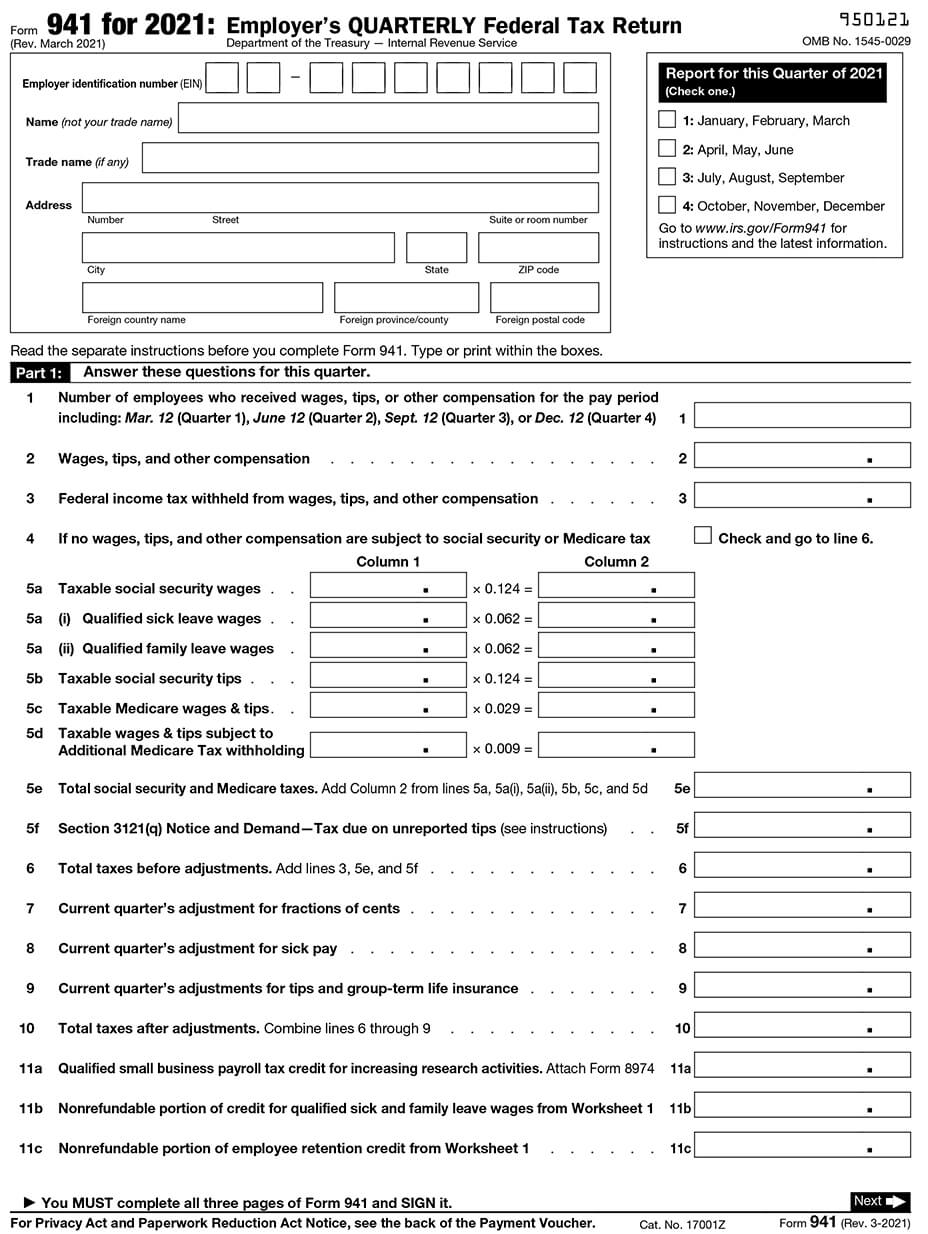

Web claim the employee retention credit on form 941, employer’s quarterly federal tax return, and receive a refund of previously paid tax deposits. The statute of limitations for filing amended payroll tax. Qualified health plan expenses allocable to the employee retention credit are. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Since the erc expired at. Many people do not know. Web employee retention credit in 2022. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web claiming the erc. Web what to do — the irs has knocked.

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Qualified health plan expenses allocable to the employee retention credit are. What is the employee retention credit (erc)? Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. Web claiming the erc. “the irs claims to have doubled the amount of employee. Today, we’re sharing how to use form 941x. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web employee retention credit in 2022.

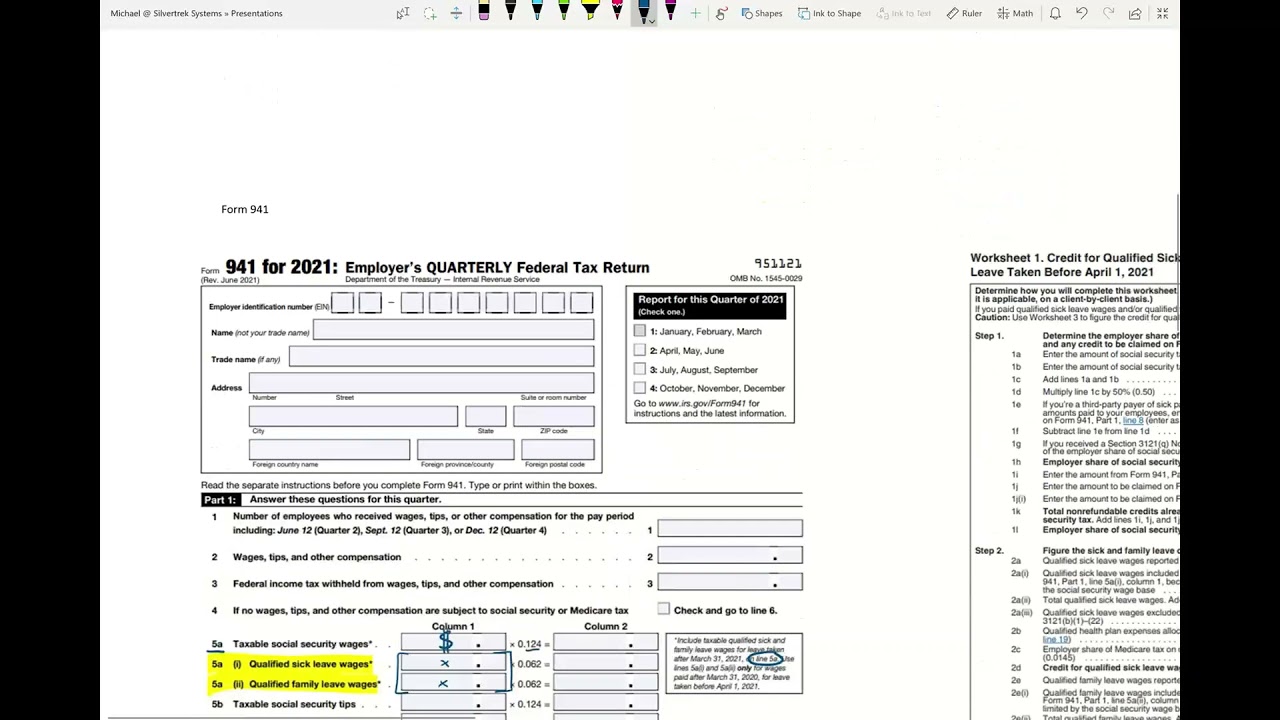

How To Fill Out Form 941 X For Employee Retention Credit In 2020

Web the american rescue plan (arp) changed the way employee retention credit should be applied within form 941. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Today, we’re sharing how to use form 941x. Employers engaged in a trade or business who. Web once the irs processes form 941x, a check is.

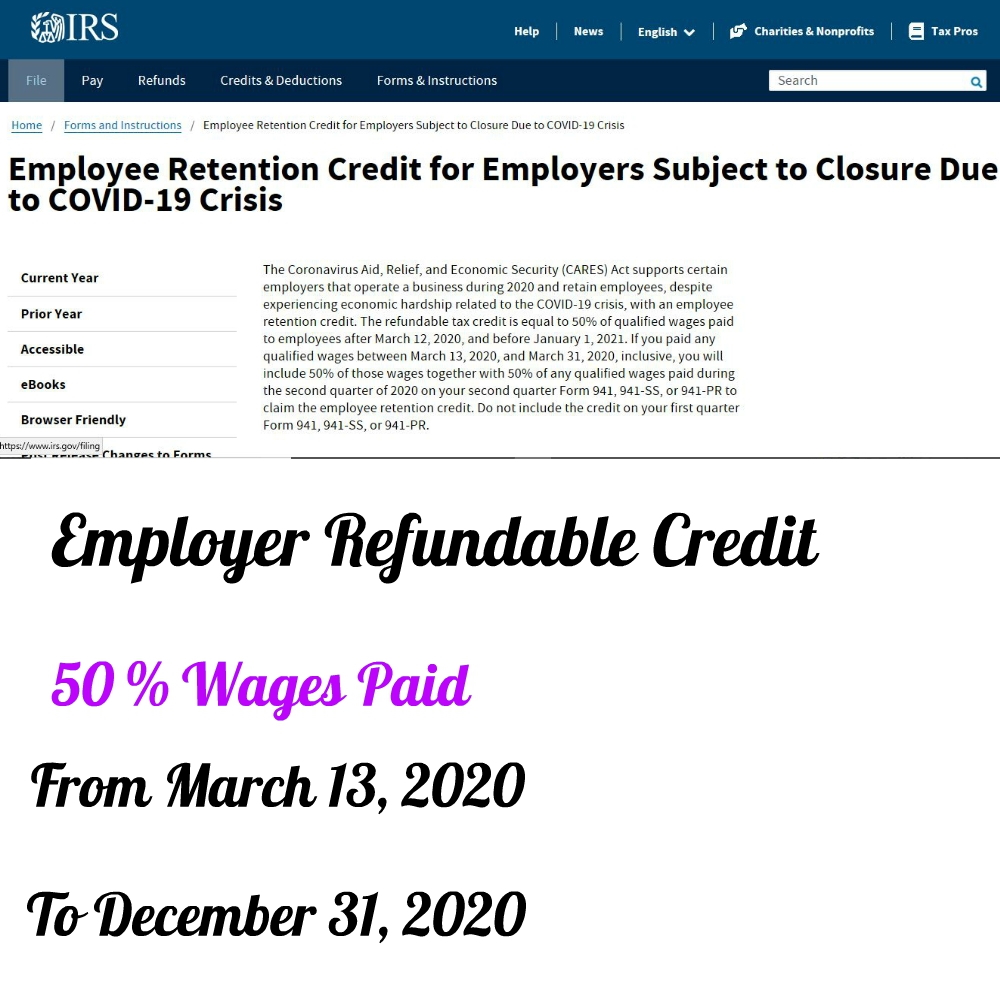

2020 Form 941 Employee Retention Credit for Employers subject to

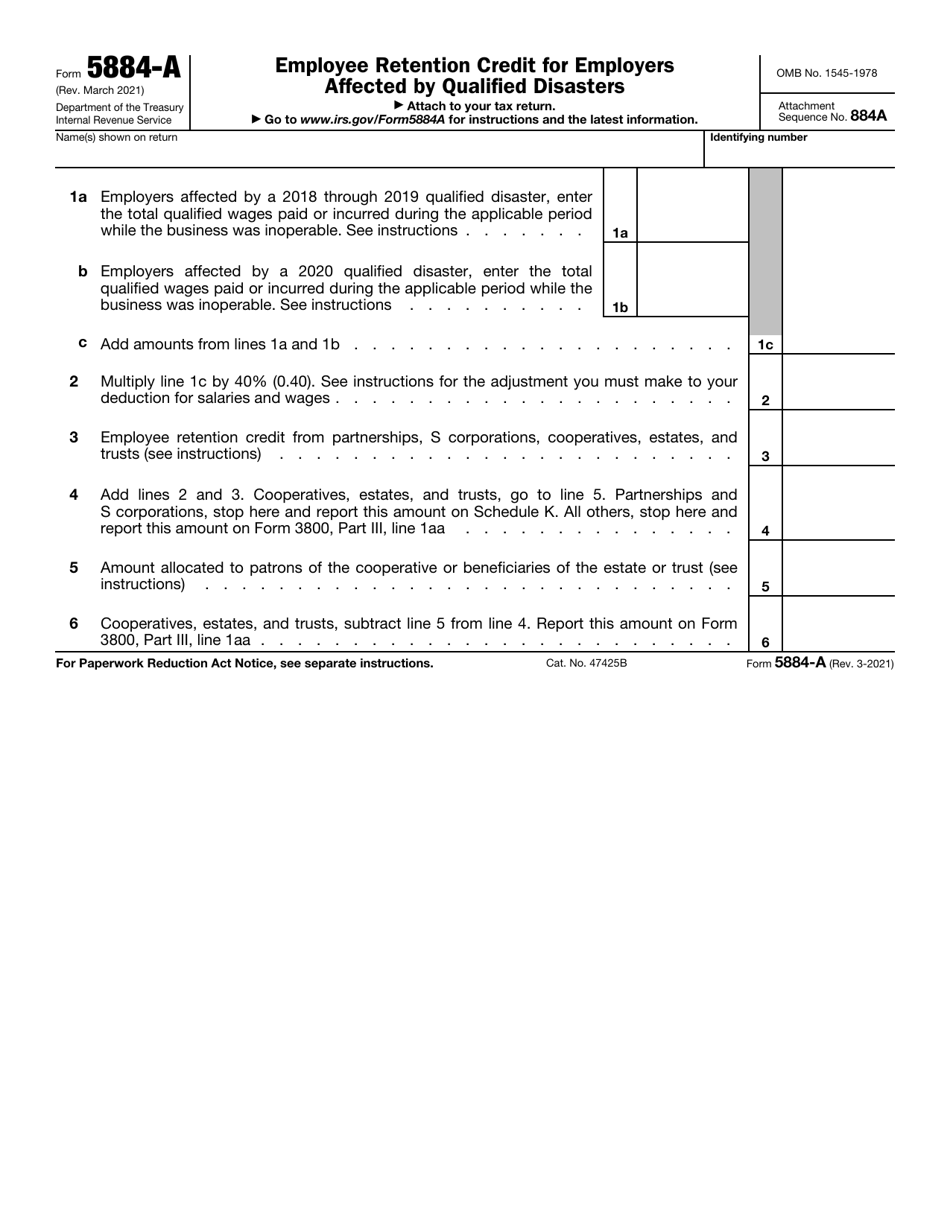

Web how do i file form 941 with taxbandits? Employee's withholding certificate form 941; What is the employee retention credit (erc)? Web employee retention credit in 2022. Many people do not know.

941 X Form Fill Out and Sign Printable PDF Template signNow

Web claim the employee retention credit on form 941, employer’s quarterly federal tax return, and receive a refund of previously paid tax deposits. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. What is the employee retention credit (erc)? Web 2 days agothe employee retention credit, or erc,. Web the american.

Worksheet 2 Adjusted Employee Retention Credit

If your business is eligible for the employee. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. Today, we’re sharing how to use form 941x. Web 2 days agothe employee retention credit, or erc,. Many people do not know.

EFile 941, 2290, 941x, W2 & 1099 Forms ExpressEfile

What is the employee retention credit (erc)? Web warning signs of an erc scam include: Web how do i file form 941 with taxbandits? April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Many people do not know.

erc form download romanholidayvannuys

Web employee retention credit in 2022. “the irs claims to have doubled the amount of employee. What is the employee retention credit (erc)? Today, we’re sharing how to use form 941x. Web how do i file form 941 with taxbandits?

941x Worksheet 1 Excel

Today, we’re sharing how to use form 941x. Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Web what to do — the irs has knocked. What is the employee retention credit (erc)? If your business is eligible for the employee.

Updated 941 and Employee Retention Credit in Vista YouTube

Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. The statute of limitations for filing amended payroll tax. Web 2 days agothe employee retention credit, or erc,. Web what to do — the irs has knocked. Web claim the employee retention credit on form 941, employer’s quarterly federal tax return, and receive a.

How To Fill Out Form 941X For Employee Retention Credit Businesses Go

Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. Qualified health plan expenses allocable to the employee retention credit are. Web what to do — the irs has knocked. What is the employee retention credit (erc)? Web once the irs processes form 941x, a check is issued to the taxpayer for.

COVID19 Relief Legislation Expands Employee Retention Credit

If your business is eligible for the employee. “the irs claims to have doubled the amount of employee. Employers engaged in a trade or business who. Many people do not know. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee.

Web Warning Signs Of An Erc Scam Include:

Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Employee's withholding certificate form 941; “the irs claims to have doubled the amount of employee. Qualified health plan expenses allocable to the employee retention credit are.

Since The Erc Expired At.

Unsolicited calls or advertisements mentioning an easy application process. statements that the promoter or company can. Web 2 days agothe employee retention credit, or erc,. Web claim the employee retention credit on form 941, employer’s quarterly federal tax return, and receive a refund of previously paid tax deposits. Today, we’re sharing how to use form 941x.

Web What To Do — The Irs Has Knocked.

Web employee retention credit in 2022. Washington — with the internal revenue service making substantial progress in the ongoing effort related to the employee. What is the employee retention credit (erc)? Employers engaged in a trade or business who.

Web How Do I File Form 941 With Taxbandits?

The statute of limitations for filing amended payroll tax. Web the american rescue plan (arp) changed the way employee retention credit should be applied within form 941. Qualified health plan expenses allocable to the employee retention credit are. If your business is eligible for the employee.