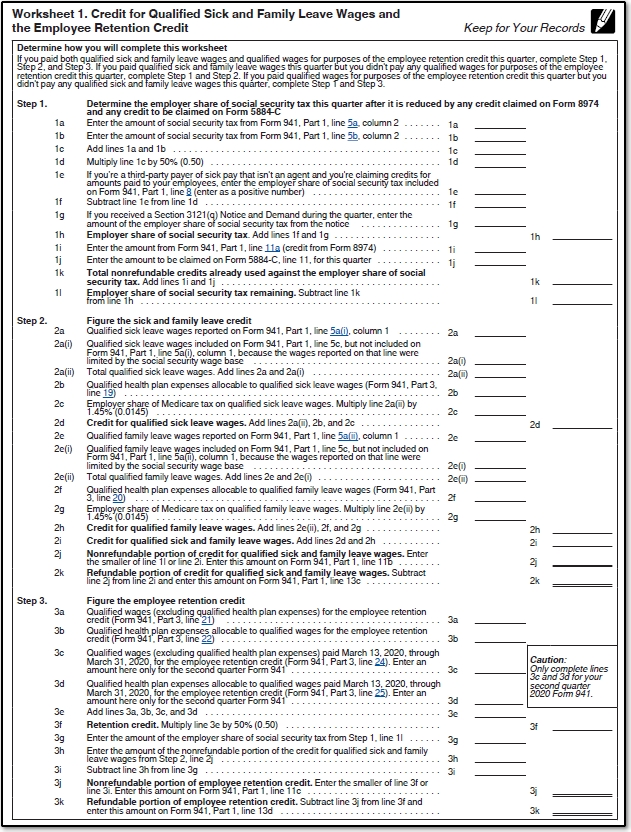

Form 941 Worksheet 1

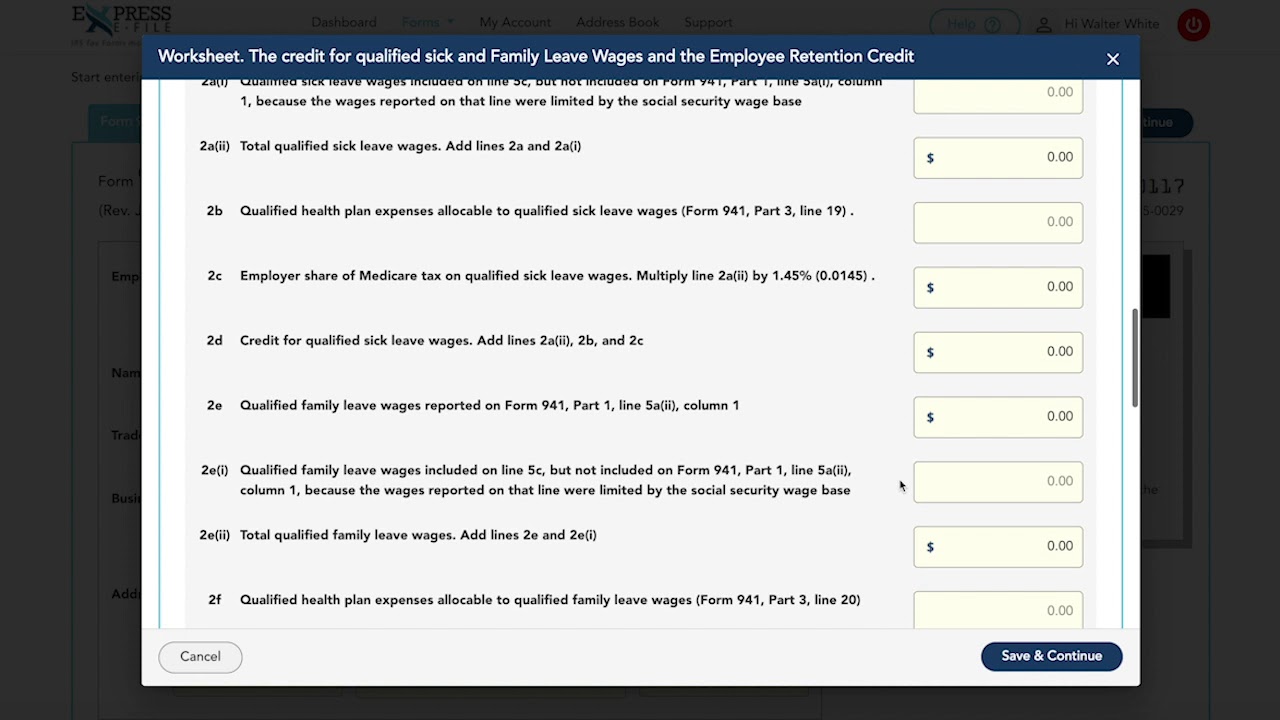

Form 941 Worksheet 1 - Section 3121 (b) definition of employment Web see the form 941 instructions and the about form 941 page for further information. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web worksheet 1 for form 941 mckenziebieker level 2 posted july 07, 2020 06:26 am last updated july 07, 2020 6:26 am worksheet 1 for form 941 i am trying to complete my 941 for quarter 2 2020 and worksheet 1 is no where to be found. Subtract line 1g from line 1f. Web an employer that owes employment taxes of $1,000 or less for the year can file form 944, employer’s annual federal tax return if given irs permission to do so. Web form 941 tax credit worksheet updated for 2021 (1) jazlyn williams reporter/editor worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation the worksheet now takes into account qualified leave wages excluded from the i.r.c. Enter the corrections for this quarter. You must complete all three pages of form 941 and sign it. Web changes to form 941 (rev.

Subtract line 1g from line 1f. Web the following are the changes: Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. So, from quarter 2, 2020,. Because this is a quarterly tax return, the business must complete it at the end of every quarter. Web track income & expenses. For privacy act and paperwork reduction act notice, see the back of the payment voucher. Sign in / sign up. Web the form 941 for the quarter for which the credit is being claimed has been filed. About form 941 worksheet 2

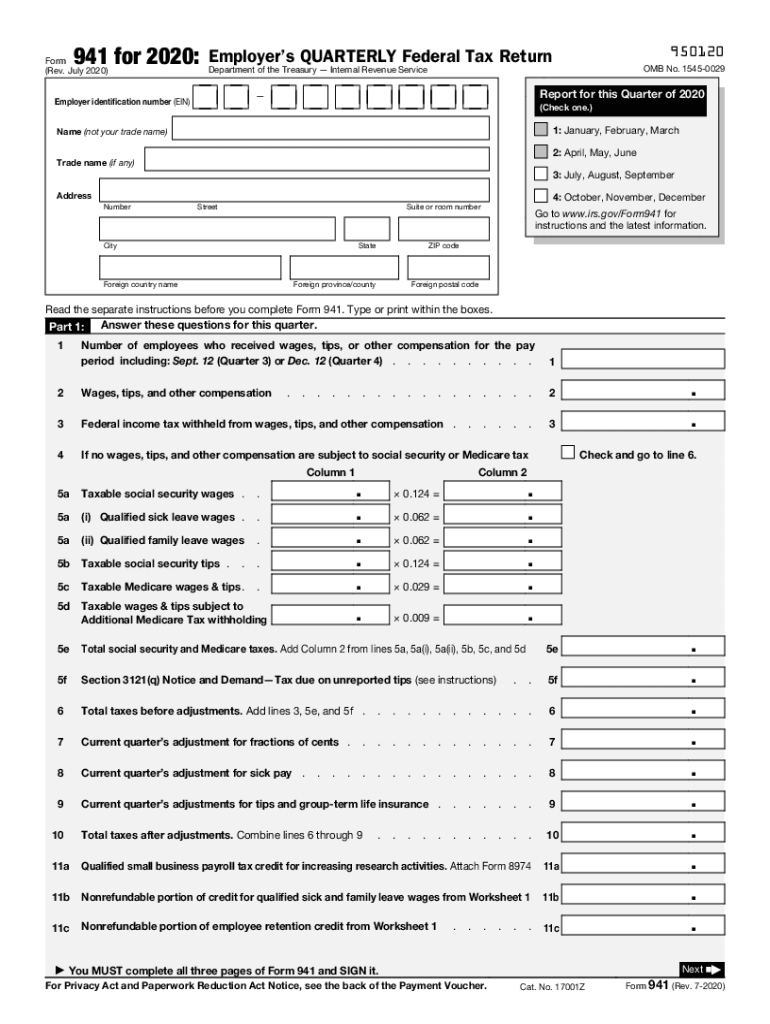

Web the following are the changes: Web changes to form 941 (rev. Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. A second version of the worksheet in das 2020 was released to calculate the credit for quarters 3 and 4. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. Web nonrefundable portion of employee retention credit from worksheet 1. Web see the form 941 instructions and the about form 941 page for further information. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020.

Worksheet 1 941x

To generate this form, you'll have to update your payroll tax table to the latest release to get our latest tax form enhancements. The irs initially revised form 941 for quarter 2, 2020, to accommodate the relief measures announced by the government to overcome the pandemic. This worksheet is for your records and to assist you in completing the new.

Form 941 3Q 2020

Web nonrefundable portion of employee retention credit from worksheet 1. Web changes to form 941 (rev. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. It reports information related to certain withholdings: About form 941 worksheet 2

941 Worksheet 1 Credit for Qualified Sick and Family Leave Wages and

Because this is a quarterly tax return, the business must complete it at the end of every quarter. Enter the corrections for this quarter. This worksheet is for your records and to assist you in completing the new data fields of form 941. Section 3121 (b) definition of employment Thus, any employer who files the quarterly employment tax form to.

Irs Forms 2020 Printable Fill Out and Sign Printable PDF Template

Because this is a quarterly tax return, the business must complete it at the end of every quarter. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. To generate this form, you'll have to update your payroll tax table to the latest release to get our latest tax.

How to Complete Form 941 Worksheet 1 YouTube

Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Web nonrefundable portion of employee retention credit from worksheet 1. Web worksheet 1 is not an official attachment to.

How to fill out IRS Form 941 2019 PDF Expert

Explain your corrections for this quarter. Enter the corrections for this quarter. Web worksheet 1 for form 941 mckenziebieker level 2 posted july 07, 2020 06:26 am last updated july 07, 2020 6:26 am worksheet 1 for form 941 i am trying to complete my 941 for quarter 2 2020 and worksheet 1 is no where to be found. Web.

941x Worksheet 1 Excel

Section 3121 (b) definition of employment Web form 941 tax credit worksheet updated for 2021 (1) jazlyn williams reporter/editor worksheet 1 was updated to incorporate a new payroll tax credit and a revised employee retention credit calculation the worksheet now takes into account qualified leave wages excluded from the i.r.c. A second version of the worksheet in das 2020 was.

20++ 941 Worksheet 1 Worksheets Decoomo

Web changes to form 941 (rev. It reports information related to certain withholdings: After that, make sure that you qualify and claim a. Form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on a quarterly basis. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on.

941x Worksheet 1 Excel

Web the following are the changes: For privacy act and paperwork reduction act notice, see the back of the payment voucher. So, from quarter 2, 2020,. What's new social security and medicare tax for 2023. Because this is a quarterly tax return, the business must complete it at the end of every quarter.

941x Worksheet 2 Excel

Web worksheet 1 for form 941 mckenziebieker level 2 posted july 07, 2020 06:26 am last updated july 07, 2020 6:26 am worksheet 1 for form 941 i am trying to complete my 941 for quarter 2 2020 and worksheet 1 is no where to be found. Sign in / sign up. March 2023) employer’s quarterly federal tax return department.

Sign In / Sign Up.

Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Web the following are the changes: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Web Worksheet 1 Is Not An Official Attachment To Form 941, Therefore You Won’t Have To Worry About Submitting It To The Irs.

Web changes to form 941 (rev. Section 3121 (b) definition of employment What's new social security and medicare tax for 2023. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits.

Beginning With The Second Quarter 2020 Form 941, The Form Has Been Updated To Include Worksheet 1 (On Page 5) That Is Used To Calculate The Credits.

Form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on a quarterly basis. Web track income & expenses. In das 2021, a different version of the worksheet is specific to quarter 2021. A second version of the worksheet in das 2020 was released to calculate the credit for quarters 3 and 4.

Subtract Line 1G From Line 1F.

Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Enter the corrections for this quarter. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Web worksheet 1 for form 941 mckenziebieker level 2 posted july 07, 2020 06:26 am last updated july 07, 2020 6:26 am worksheet 1 for form 941 i am trying to complete my 941 for quarter 2 2020 and worksheet 1 is no where to be found.

.jpg)