Form 941 Ss

Form 941 Ss - Virgin islands, or if you have. You must fill out this form and. Check here, and if you are a seasonal employer and you do not have to file a return for. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. We need it to figure and collect the right amount of tax. July 22, 2023 5:00 a.m. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Employers use form 941 to: Web about form 941, employer's quarterly federal tax return. Web form 941 for 2023:

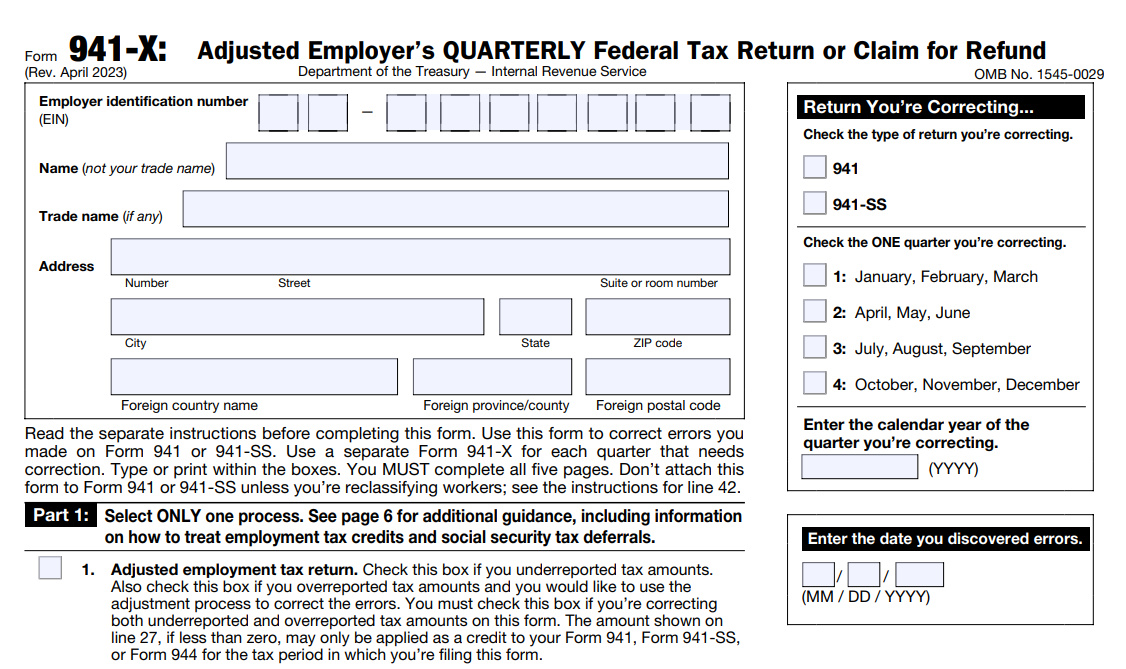

Web form 941 for 2023: Web want to file form 944 annually instead of forms 941 quarterly, check here. You must complete all five pages. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. Web about form 941, employer's quarterly federal tax return. Type or print within the boxes. Report income taxes, social security tax, or medicare tax withheld from employee's. If changes in law require additional changes to form. Exception for exempt organizations, federal, state and local government. Employers use form 941 to:

You must complete all five pages. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Exception for exempt organizations, federal, state and local government. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). We need it to figure and collect the right amount of tax. This is the final week the social security administration is sending out payments for july. Virgin islands, or if you have. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. You must fill out this form and. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

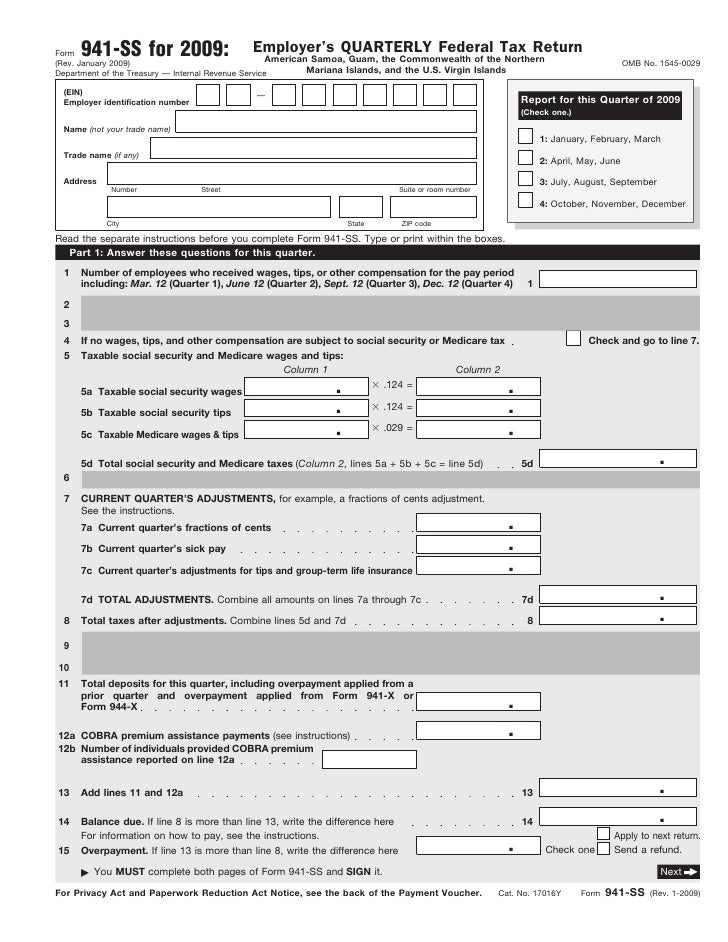

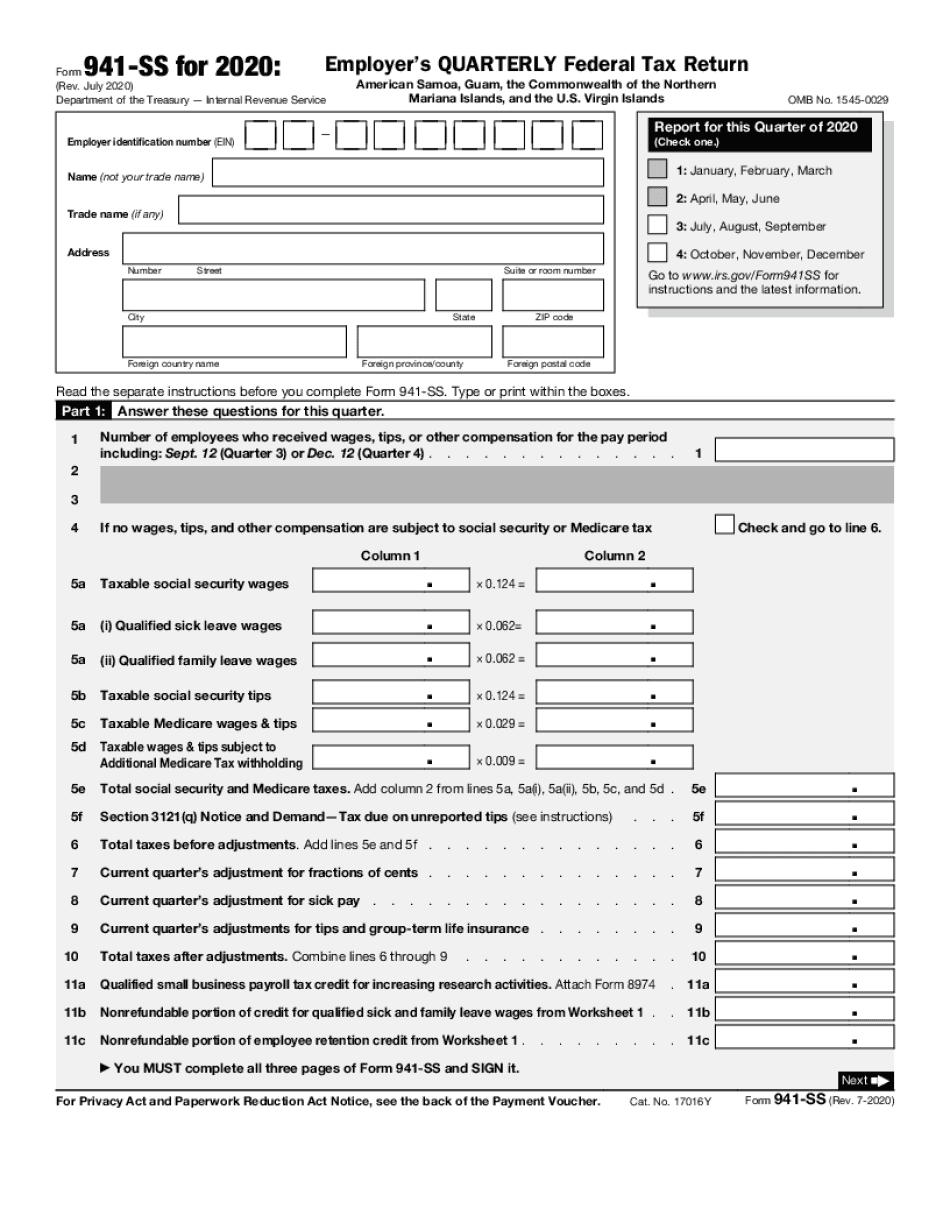

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Virgin islands, or if you have. Exception for exempt organizations, federal, state and local government. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry. Type or print within the boxes. Web want to file form 944 annually instead of forms 941 quarterly, check here.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Type or print within the boxes. This is the final week the social security administration is sending out payments for july. July 22, 2023 5:00 a.m. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web form 941.

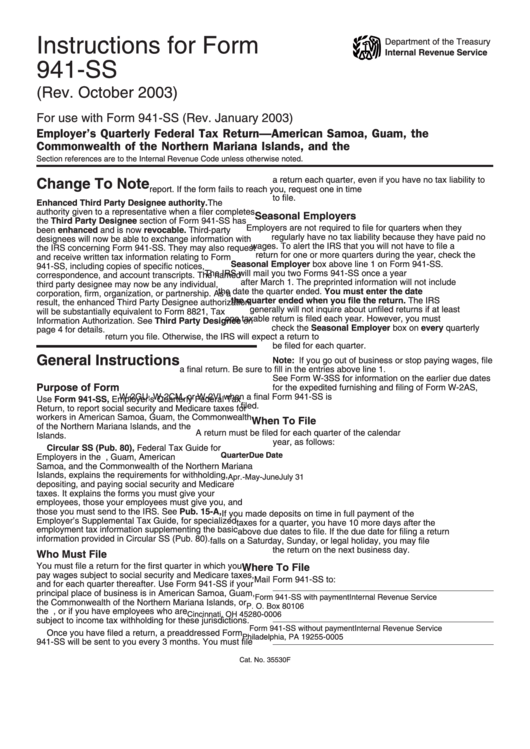

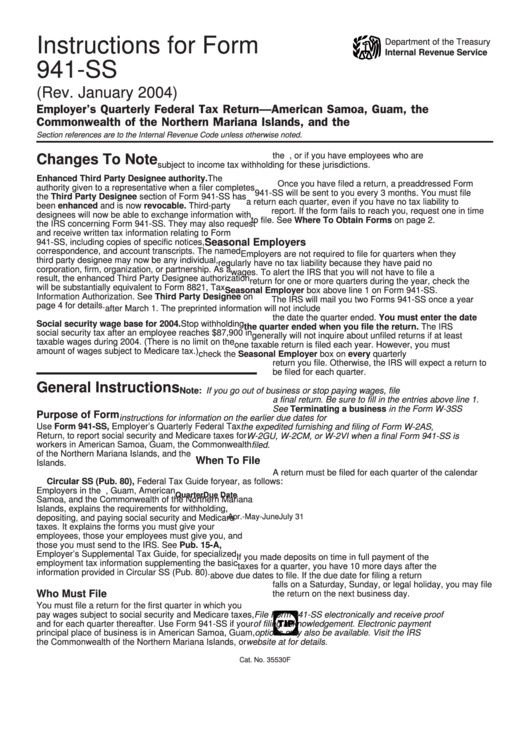

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

(your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Web want to file form 944 annually instead of forms 941 quarterly, check here. Web about form 941, employer's quarterly federal tax return. Employers use form 941 to: This is the final week the social security administration is sending out payments for july.

Form 941SS Employer's Quarterly Federal Tax Return American Samoa…

You must fill out this form and. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. You must complete all five pages. Web form 941 for 2023: Type or print within the boxes.

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

Virgin islands, or if you have. Web want to file form 944 annually instead of forms 941 quarterly, check here. We need it to figure and collect the right amount of tax. You must fill out this form and. Web about form 941, employer's quarterly federal tax return.

File 941 Online How to File 2023 Form 941 electronically

Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Report income taxes, social security tax, or medicare tax withheld from employee's. Web form 941 for 2023: Employers use form 941 to: Check here, and if you are a.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

We need it to figure and collect the right amount of tax. If changes in law require additional changes to form. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. July 22, 2023 5:00 a.m. Virgin islands, or if you have.

941SS 2022 2023 941 Forms Zrivo

We need it to figure and collect the right amount of tax. This is the final week the social security administration is sending out payments for july. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or. Web want to file form 944 annually instead of forms 941 quarterly, check here. Employers use.

941 ss 2020 Fill Online, Printable, Fillable Blank

Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). If changes in law require additional changes to form. You must complete all five pages. Report income taxes, social security tax, or medicare tax withheld from employee's. This is.

Instructions For Form 941Ss Employer'S Quarterly Federal Tax

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. July 22, 2023 5:00 a.m. Report income taxes, social security tax, or medicare tax withheld from employee's. You must complete all five pages. Web about form 941, employer's quarterly federal tax return.

Check Here, And If You Are A Seasonal Employer And You Do Not Have To File A Return For.

Web about form 941, employer's quarterly federal tax return. You must complete all five pages. If changes in law require additional changes to form. July 22, 2023 5:00 a.m.

We Need It To Figure And Collect The Right Amount Of Tax.

Virgin islands, or if you have. Web want to file form 944 annually instead of forms 941 quarterly, check here. Web form 941 for 2023: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122.

This Is The Final Week The Social Security Administration Is Sending Out Payments For July.

Employers use form 941 to: Exception for exempt organizations, federal, state and local government. Report income taxes, social security tax, or medicare tax withheld from employee's. If you haven’t received your ein by the due date of form 941, write “applied for” and the date you applied in this entry.

(Your Employment Tax Liability Generally Will Be $1,000 Or Less If You Expect To Pay $5,000 Or.

Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). You must fill out this form and. Type or print within the boxes.