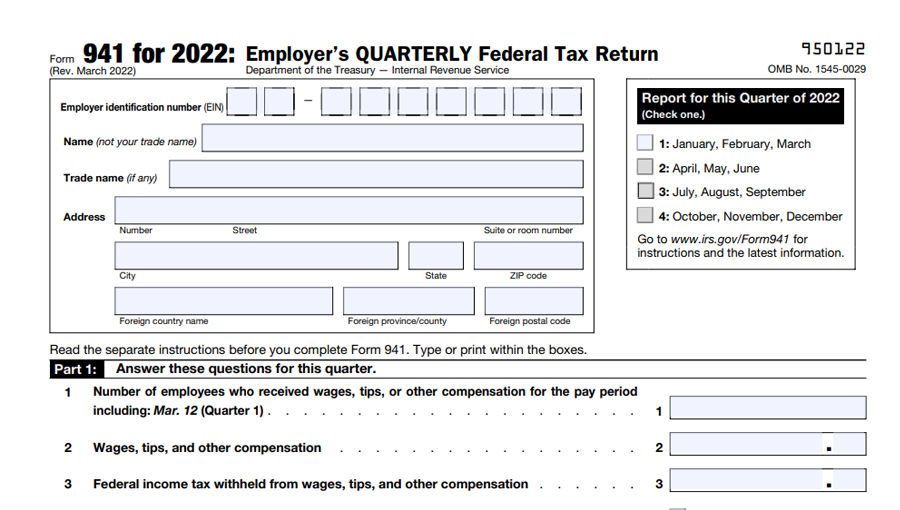

Form 941 March 2022

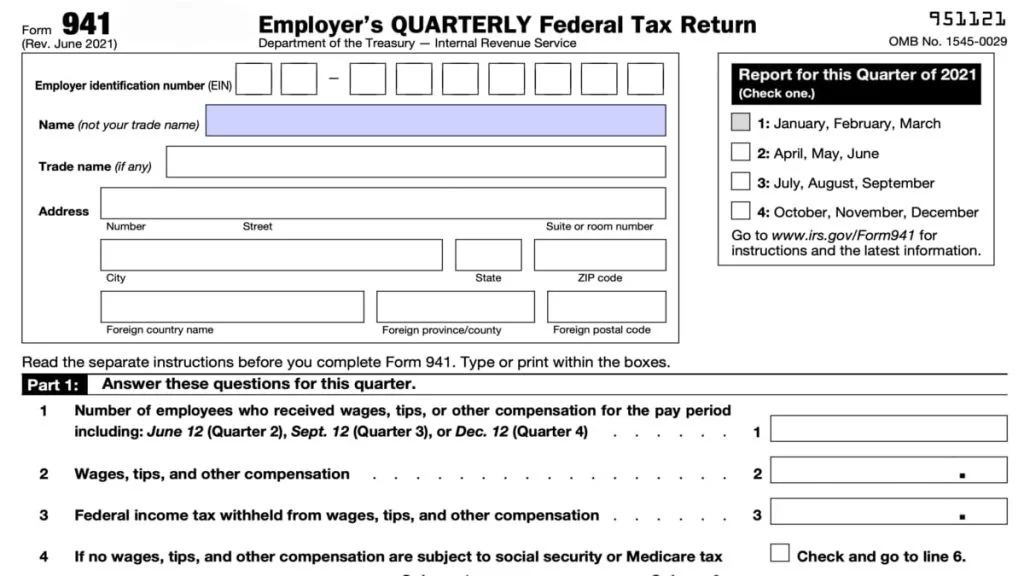

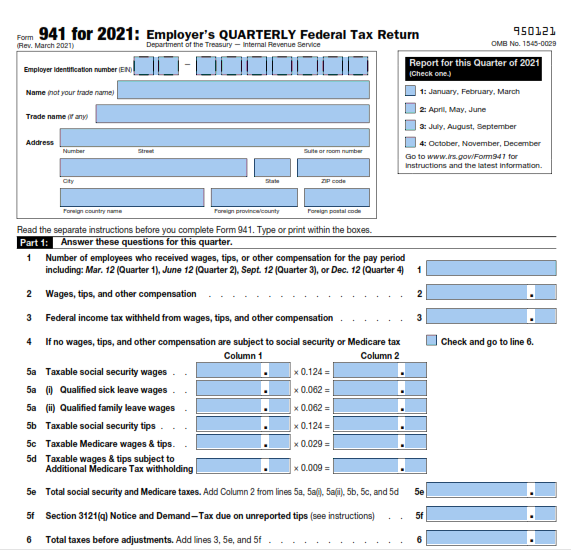

Form 941 March 2022 - Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. Web report for this quarter of 2022 (check one.) 1: Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. Revised 2022 form 941 , employer’s quarterly federal tax return, and its instructions. See the march 2022 revision of the instructions for form 941 or the 2022 instructions for form 944 for more information. April, may, june read the separate instructions before completing this form. Read the separate instructions before you complete form 941.

The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. The last time form 941 was updated was in june 2021 for use in the second, third, and fourth quarters of 2021. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Type or print within the boxes. 26 by the internal revenue service. Web the inflation reduction act of 2022 (the ira) increases the election amount to $500,000 for tax years beginning after december 31, 2022. Type or print within the boxes. Read the separate instructions before you complete form 941. The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including extensions). Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out.

See the march 2022 revision of the instructions for form 941 or the 2022 instructions for form 944 for more information. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in Social security and medicare tax for 2022. The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. Web report for this quarter of 2022 (check one.) 1: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web ployment tax returns for the first quarter of 2022. Type or print within the boxes. For instructions and the latest information. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out.

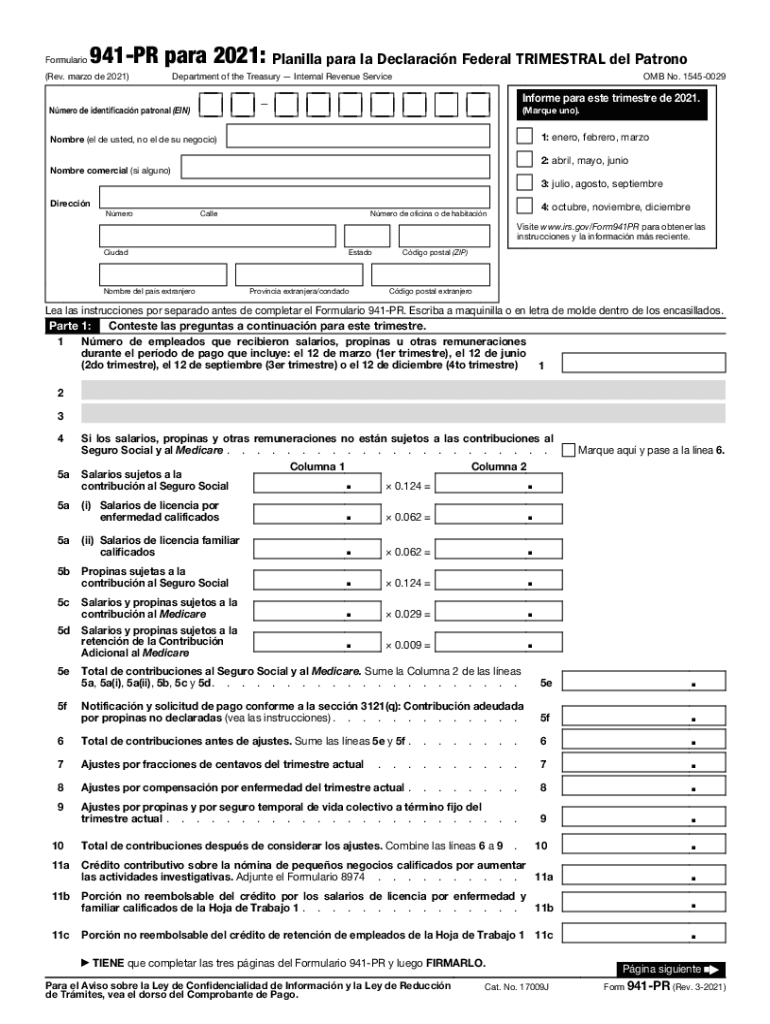

941 Pr 2021 Form Fill Out and Sign Printable PDF Template signNow

26 by the internal revenue service. Web report for this quarter of 2022 (check one.) 1: The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in April, may, june read the separate instructions before completing this form. Type or print within the boxes.

941 Form 2023

Web ployment tax returns for the first quarter of 2022. You must complete all five pages. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name.

Form 941 Fill Out and Sign Printable PDF Template signNow

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. Social security and medicare tax for 2022. Revised 2022.

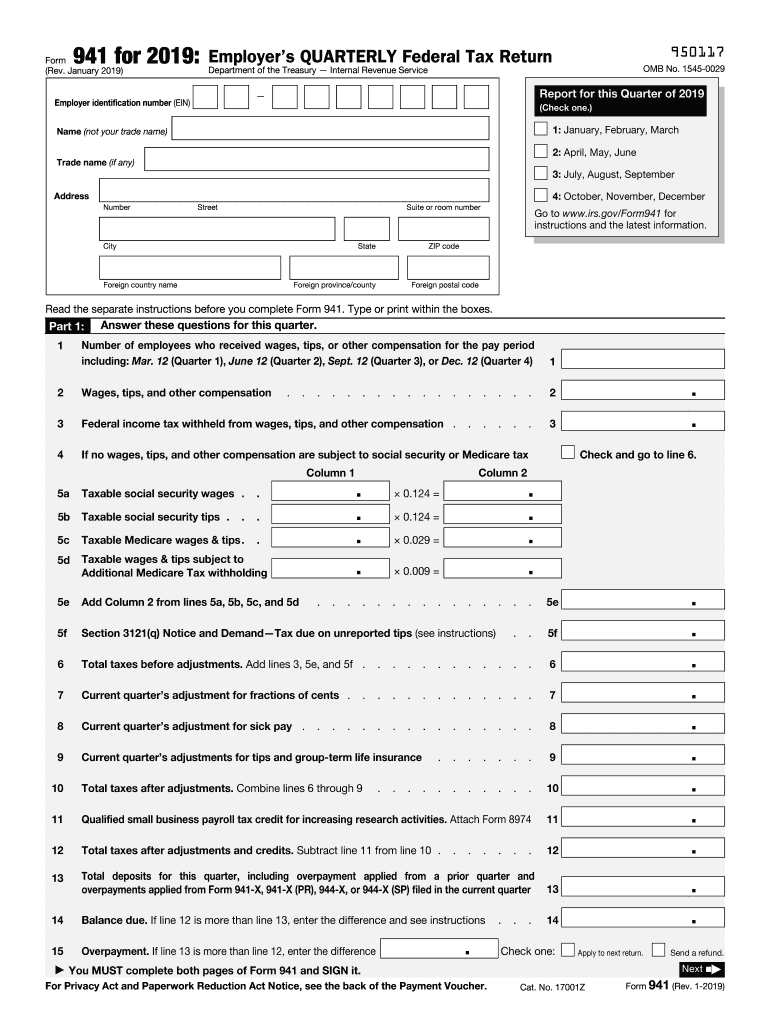

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. 26 by the internal revenue service. The instructions were updated with requirements for claiming the remaining credits in 2022. The draft form 941 , which has a march 2022 revision date, contained.

File Form 941 Online for 2023 Efile 941 at Just 5.95

Type or print within the boxes. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web the inflation reduction act of 2022 (the ira) increases the election amount to $500,000 for tax years beginning after december 31, 2022. Web ployment tax returns for the first quarter of 2022..

IRS Form 941 SS Online for 2022 Efile 941SS for 4.95

June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code. See the march 2022 revision of the instructions for form 941 or.

Update Form 941 Changes Regulatory Compliance

The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in The instructions were updated with requirements for claiming the remaining credits in 2022. The last time form 941 was updated was in june 2021 for use in the second, third, and fourth quarters of 2021. See the march 2022.

Fillable 941 Quarterly Form 2022 Printable Form, Templates and Letter

Type or print within the boxes. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. April, may, june read the separate instructions before completing this form. June 2022) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Social security and medicare tax for 2022. For instructions and the latest information. Type or print within the boxes. 26 by the internal revenue service.

Top10 US Tax Forms in 2022 Explained PDF.co

Web report for this quarter of 2022 (check one.) 1: Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out. The instructions were updated with requirements for claiming the remaining credits in 2022. Social security and medicare tax for 2022. For instructions.

Web Report For This Quarter Of 2022 (Check One.) 1:

April, may, june read the separate instructions before completing this form. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. See the march 2022 revision of the instructions for form 941 or the 2022 instructions for form 944 for more information. The instructions were updated with requirements for claiming the remaining credits in 2022.

The Last Time Form 941 Was Updated Was In June 2021 For Use In The Second, Third, And Fourth Quarters Of 2021.

For instructions and the latest information. Web the inflation reduction act of 2022 (the ira) increases the election amount to $500,000 for tax years beginning after december 31, 2022. The draft form 941 , which has a march 2022 revision date, contained several changes when compared with the version in effect for the second through fourth quarters of 2021. You must complete all five pages.

Form 941 Is Used By Employers Who Withhold Income Taxes From Wages Or Who Must Pay Social Security Or Medicare Tax.

Web ployment tax returns for the first quarter of 2022. The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including extensions). Type or print within the boxes. Social security and medicare tax for 2022.

June 2022) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) — Name (Not Your Trade Name) Trade Name (If Any) Address Number Street Suite Or Room Number City State Zip Code Foreign Country Name Foreign Province/County Foreign Postal Code.

Read the separate instructions before you complete form 941. Revised 2022 form 941 , employer’s quarterly federal tax return, and its instructions. Type or print within the boxes. 26 by the internal revenue service.