Form 8938 Threshold 2022

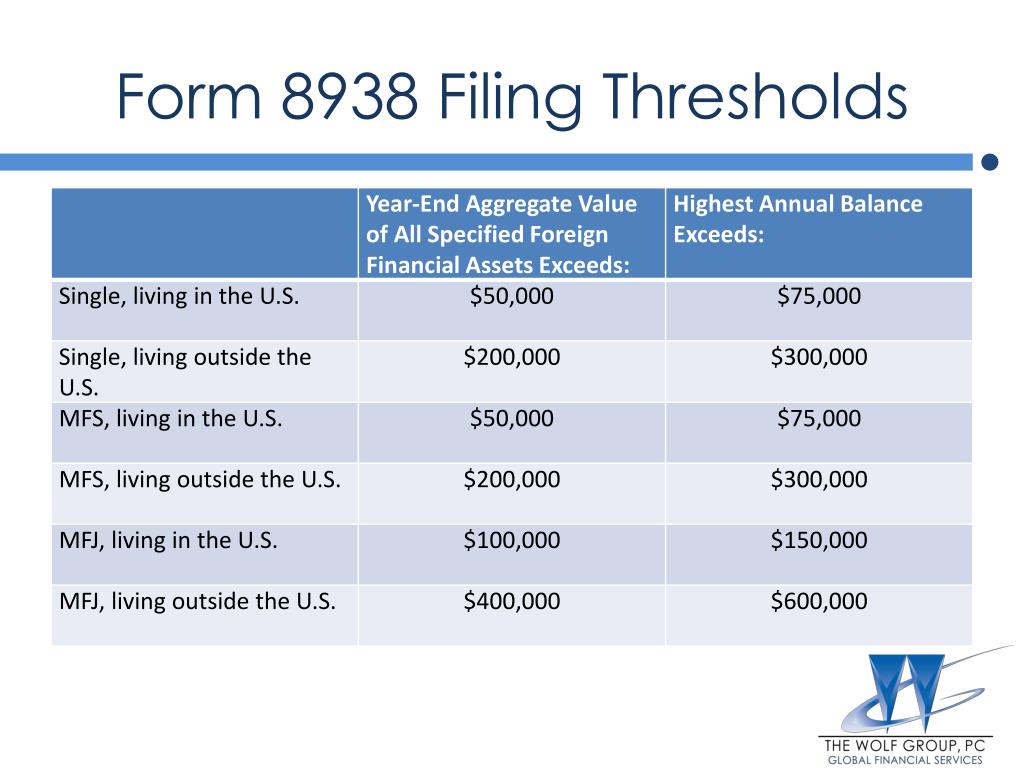

Form 8938 Threshold 2022 - Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. You can download or print. Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. Web form 8938 thresholds for 20232. Web you and your spouse do not have to file form 8938. Web fatca requires certain u.s. $200,000 on the last day of the tax year or more than. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. Web form 8938 reporting & filing requirements: For example, if a married couple filing jointly.

Web as october 15, 2022, is fast approaching, now is the time for u.s. Web we have prepared a summary explaining the basics of form 8938, who has to file, and when. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets. Web you and your spouse do not have to file form 8938. Form 8938 threshold & requirements. Taxpayers who meet the form 8938. Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen.

Web filing form 8938 is only available to those using turbotax deluxe or higher. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. You can download or print. Form 8938 threshold & requirements. Web form 8938 thresholds for 20232. Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. Taxpayers who meet the form 8938. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Single, head of household, married filing separately. $200,000 on the last day of the tax year or more than.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web you and your spouse do not have to file form 8938. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets. Even if a person meets the threshold. Taxpayers who meet the form 8938. To get to the 8938 section in turbotax, refer to the following instructions:

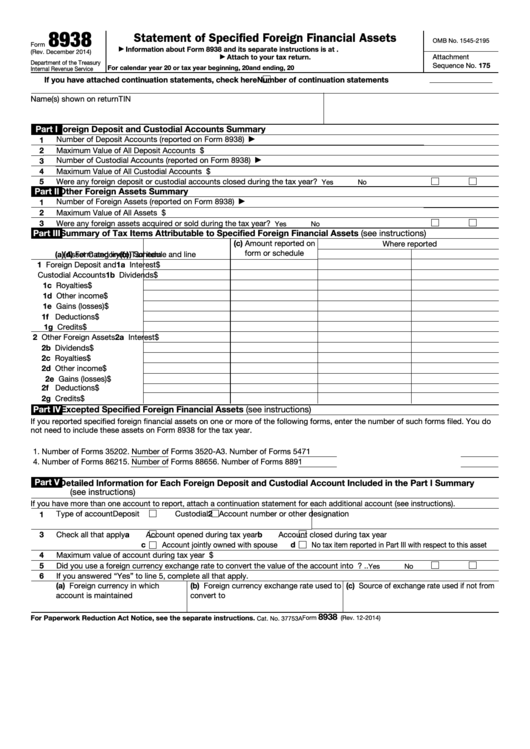

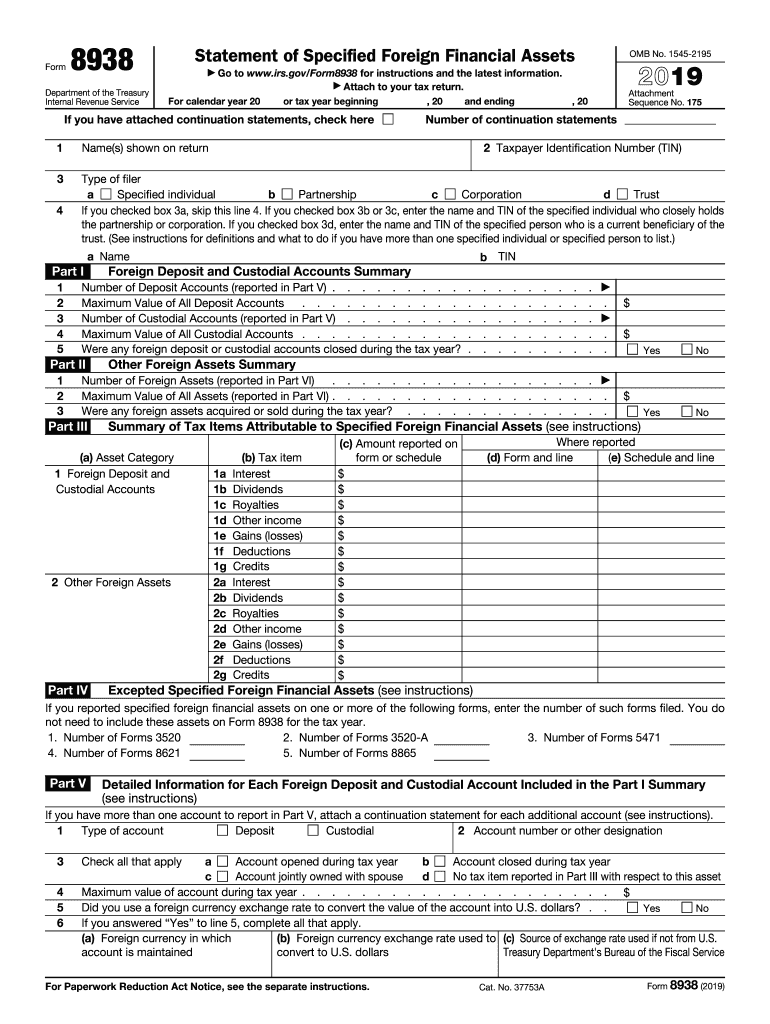

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

$200,000 on the last day of the tax year or more than. Taxpayers who own foreign financial assets to determine if they need to file irs form 8938, a. Use form 8938 to report your. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for.

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Web filing form 8938 is only available to those using turbotax deluxe or higher. Web you and your spouse do not have to file form 8938. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. You can download or print. Web.

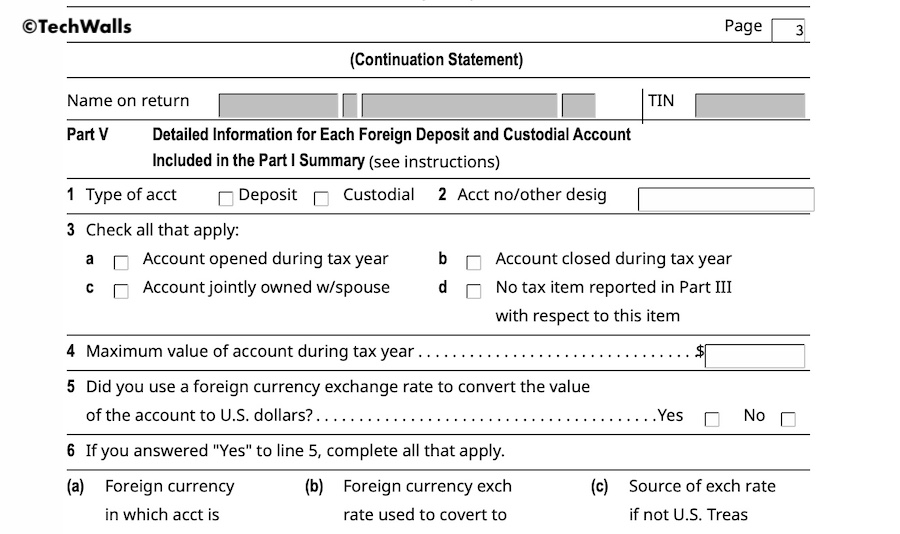

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web statement of specified foreign financial assets 3 type of filer specified individual b partnership c corporation d trust 4 if you checked box 3a, skip this line 4. Web form 8938 reporting &.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. Use form 8938 to report your. Web form 8938 reporting & filing requirements: $200,000 on the last day of the tax year or more than. Taxpayers who own foreign financial assets to.

1098 Form 2021 IRS Forms Zrivo

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Fill out the required boxes which. Even if a person meets the threshold. Web the following tips can help you complete irs 8938 easily and quickly: Internal revenue.

PPT 1818 Society Form 8938 and Other I mportant R eporting I ssues

Use form 8938 to report your. Taxpayers who own foreign financial assets to determine if they need to file irs form 8938, a. Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about. Who has to file form 8938? Web fatca requires certain u.s.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Who has to file form 8938? Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. Single, head of household, married filing separately. Web you and your spouse do not have to file form 8938. Sole proprietors & rental income recipients may.

Form 8938 IRS RJS LAW International Tax Tax Attorney San Diego

Web for an unmarried us resident, taxpayers file form 8938 in any year that the total value on the last day of the year exceeded $50,000, or if they have less than $50,000 on the last. Even if a person meets the threshold. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web fatca requires.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. Single, head of household, married filing separately. Web you and your spouse do not have to file form 8938. Who has to file form 8938? Web we last updated the statement of foreign financial assets in february 2023, so this.

Single, Head Of Household, Married Filing Separately.

Us persons, including us citizens, legal permanent residents, and foreign nationals who meet the substantial presence test —. Web as october 15, 2022, is fast approaching, now is the time for u.s. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Web form 8938 thresholds for 20232.

For Example, If A Married Couple Filing Jointly.

Web you and your spouse do not have to file form 8938. You can download or print. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the.

Taxpayers Who Meet The Form 8938.

Who has to file form 8938? Form 8938 threshold & requirements. $200,000 on the last day of the tax year or more than. Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s.

Web Filing Form 8938 Is Only Available To Those Using Turbotax Deluxe Or Higher.

Even if a person meets the threshold. Web fatca requires certain u.s. Internal revenue service form 8938 refers to statement of specified foreign financial assets filed by us persons with fatca assets. Web form 8938 reporting & filing requirements: