Form 8889-T December Plan Type

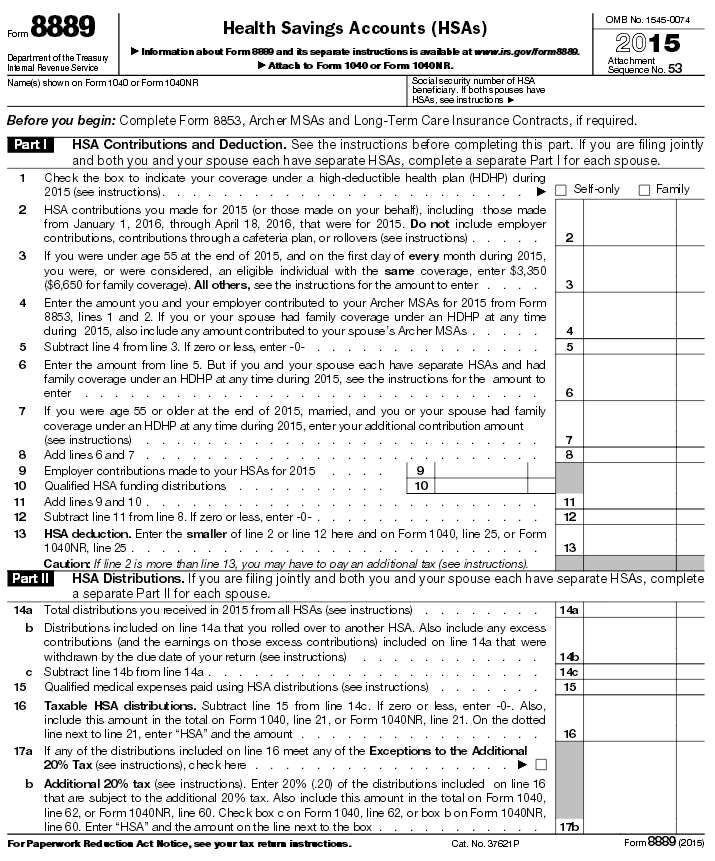

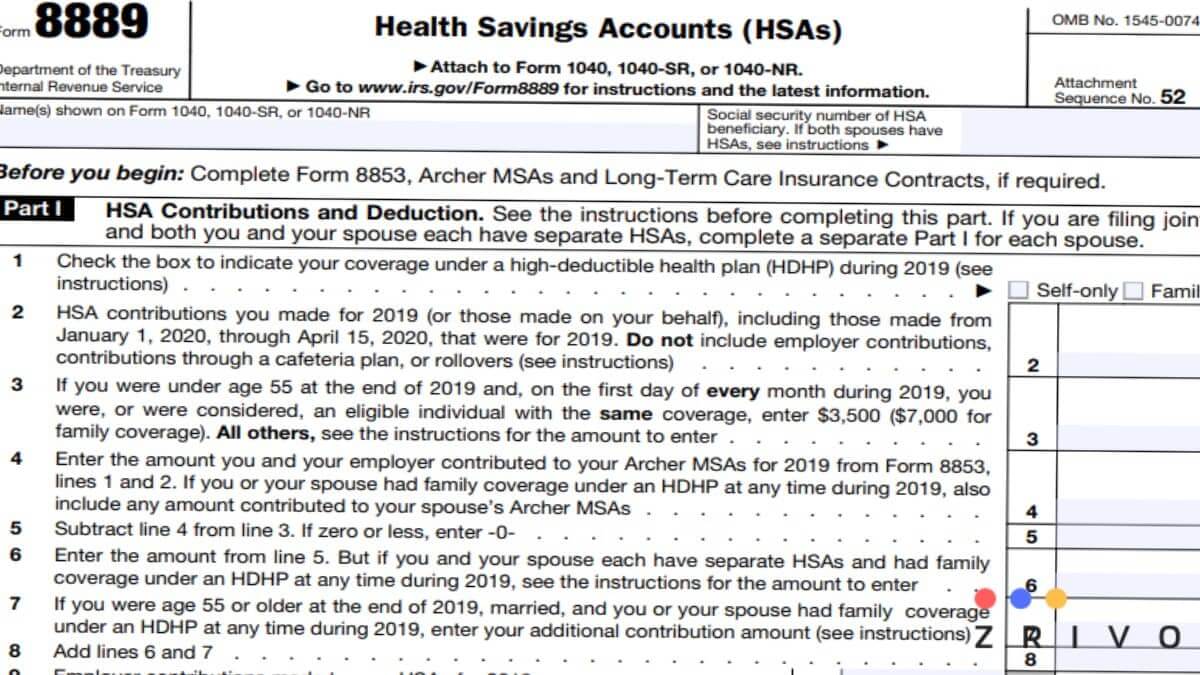

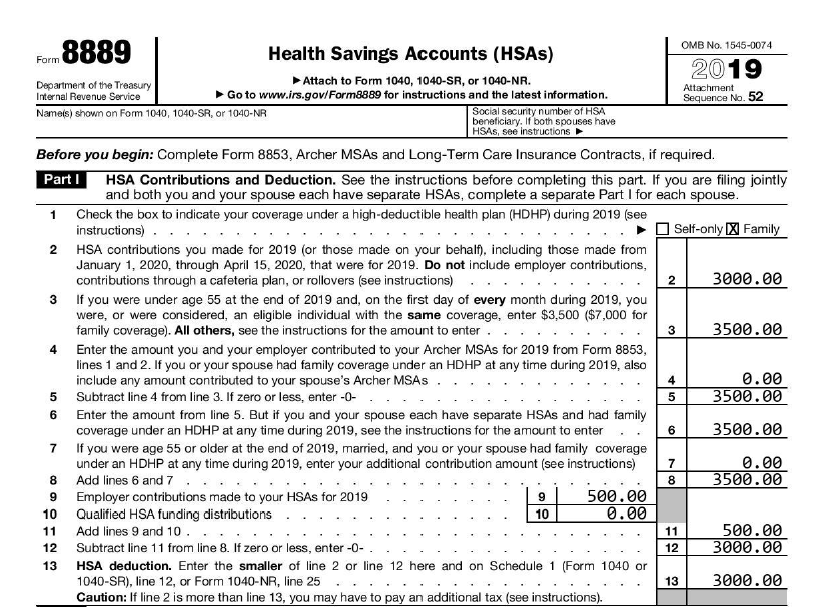

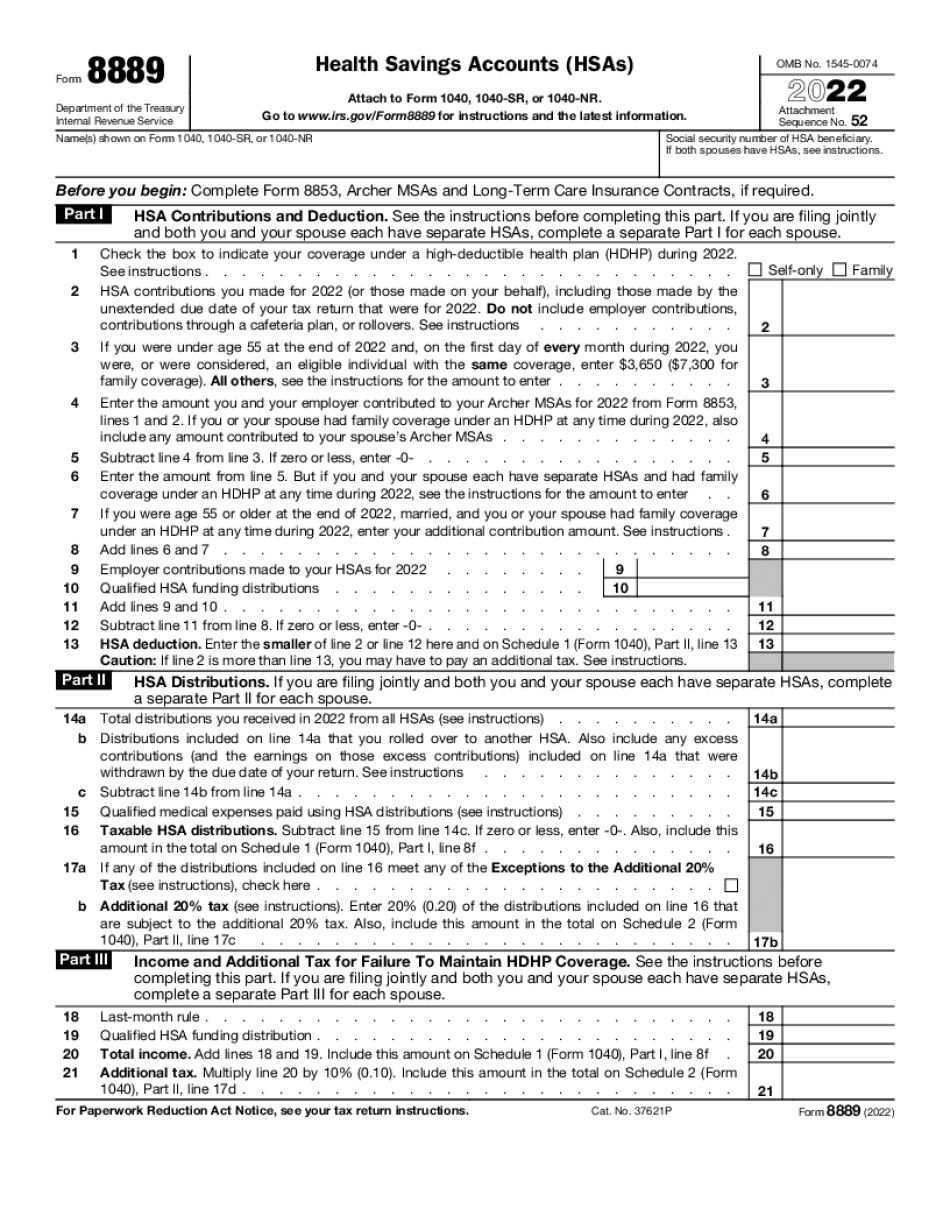

Form 8889-T December Plan Type - Web five printed sets of residential construction drawings are typically 24” x 36” documents and come with a license to construct a single residence shipped to a physical. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative. Web if you have an hsa and hdhp coverage: Web you’re required to complete and submit form 8889 if you contribute to or distribute funds from your account, if you weren’t eligible to fund your account all 12. If you fail to remain an eligible to be an. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Web when you have contributions into or take distributions from an hsa (health savings account), then the irs requires you to file form 8889. Web what is the irs form 8889? The spouse's activity would be. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview.

Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. It contains 3 bedrooms and 4 bathrooms. The spouse's activity would be. 5889 s taft ter, littleton, co is a townhome home that contains 2,755 sq ft and was built in 2012. Web if you have an hsa and hdhp coverage: Web five printed sets of residential construction drawings are typically 24” x 36” documents and come with a license to construct a single residence shipped to a physical. No entry line 1, self. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. Web you’re required to complete and submit form 8889 if you contribute to or distribute funds from your account, if you weren’t eligible to fund your account all 12.

Report health savings account (hsa) contributions (including those made on your behalf and employer. No entry line 1, self. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. The spouse's activity would be. Web about form 8889, health savings accounts (hsas) file form 8889 to: If both spouses have hsas, see instructions. Web five printed sets of residential construction drawings are typically 24” x 36” documents and come with a license to construct a single residence shipped to a physical. It contains 3 bedrooms and 4 bathrooms. Web if you have an hsa and hdhp coverage: Web what is the irs form 8889?

Form 8889T for FSA/HSA, I am SO confused. r/TurboTax

If you fail to remain an eligible to be an. The section that line 18 is in is on form 8889 in the section referring to “failure to maintain hdhp coverage”. Web what is the irs form 8889? No entry line 1, self. 5889 s taft ter, littleton, co is a townhome home that contains 2,755 sq ft and was.

Form 8889

It contains 3 bedrooms and 4 bathrooms. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. Web.

2018 Instruction 1040 Tax Tables Irs Review Home Decor

Web five printed sets of residential construction drawings are typically 24” x 36” documents and come with a license to construct a single residence shipped to a physical. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Web if you.

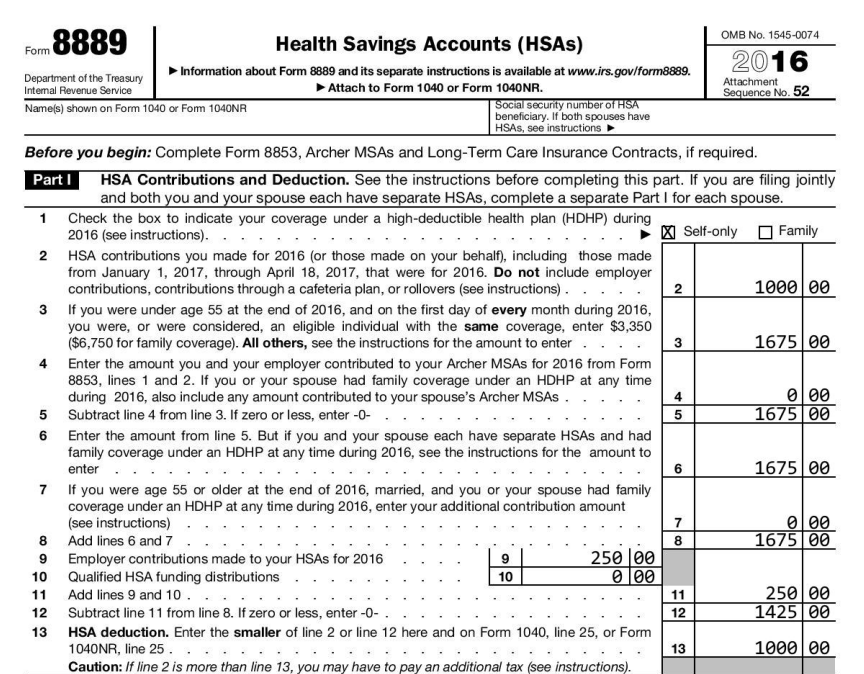

2016 HSA Form 8889 instructions and example YouTube

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. Web use form 8889 to: Report health savings account (hsa) contributions (including those made on your behalf and employer. Web what is the irs form 8889? It contains 3 bedrooms and 4 bathrooms.

8889 Form 2022 2023

If you fail to remain an eligible to be an. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. The spouse's activity would be. It contains 3 bedrooms and 4 bathrooms. Web if you have an hsa and hdhp coverage:

How to file HSA tax Form 8889 Tax forms, Filing taxes, Health savings

The section that line 18 is in is on form 8889 in the section referring to “failure to maintain hdhp coverage”. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative. Web if you have an hsa and hdhp coverage: Written by.

Top 19 919 form australia 2020 en iyi 2022

Web if you have an hsa and hdhp coverage: If you fail to remain an eligible to be an. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. Web when you have contributions into or take distributions from an hsa (health savings account), then the irs.

Form 8889 2023 Fill online, Printable, Fillable Blank

The spouse's activity would be. The section that line 18 is in is on form 8889 in the section referring to “failure to maintain hdhp coverage”. Web use form 8889 to: Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. Web when you have contributions into.

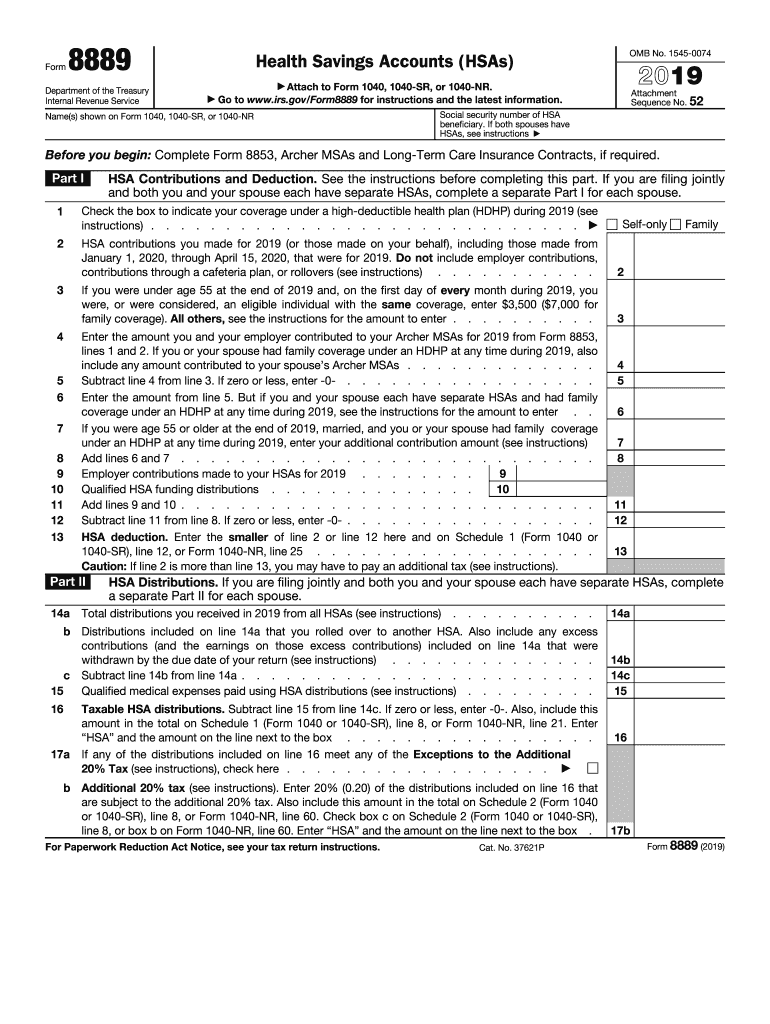

2019 Form IRS 8889 Fill Online, Printable, Fillable, Blank pdfFiller

If you fail to remain an eligible to be an. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Web use form 8889 to: Web when you have contributions into or take distributions from an hsa (health savings account), then.

2016 HSA Form 8889 Instructions and Example HSA Edge

Web use form 8889 to: 5889 s taft ter, littleton, co is a townhome home that contains 2,755 sq ft and was built in 2012. If both spouses have hsas, see instructions. Web about form 8889, health savings accounts (hsas) file form 8889 to: If you fail to remain an eligible to be an.

Web Use Form 8889 To:

If you fail to remain an eligible to be an. Report health savings account (hsa) contributions (including those made on your behalf and employer. Web about form 8889, health savings accounts (hsas) file form 8889 to: The spouse's activity would be.

The Section That Line 18 Is In Is On Form 8889 In The Section Referring To “Failure To Maintain Hdhp Coverage”.

Web you’re required to complete and submit form 8889 if you contribute to or distribute funds from your account, if you weren’t eligible to fund your account all 12. It contains 3 bedrooms and 4 bathrooms. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. No entry line 1, self.

If Both Spouses Have Hsas, See Instructions.

Web when you have contributions into or take distributions from an hsa (health savings account), then the irs requires you to file form 8889. 5889 s taft ter, littleton, co is a townhome home that contains 2,755 sq ft and was built in 2012. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Web if you have an hsa and hdhp coverage:

Web What Is The Irs Form 8889?

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:09 am overview. Web five printed sets of residential construction drawings are typically 24” x 36” documents and come with a license to construct a single residence shipped to a physical. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative.