Form 8869 Instructions

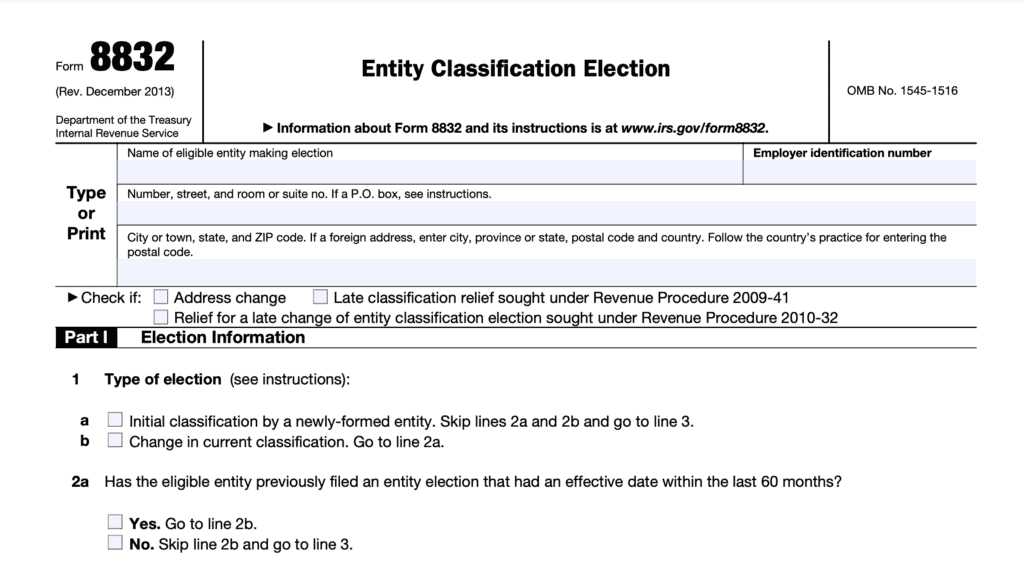

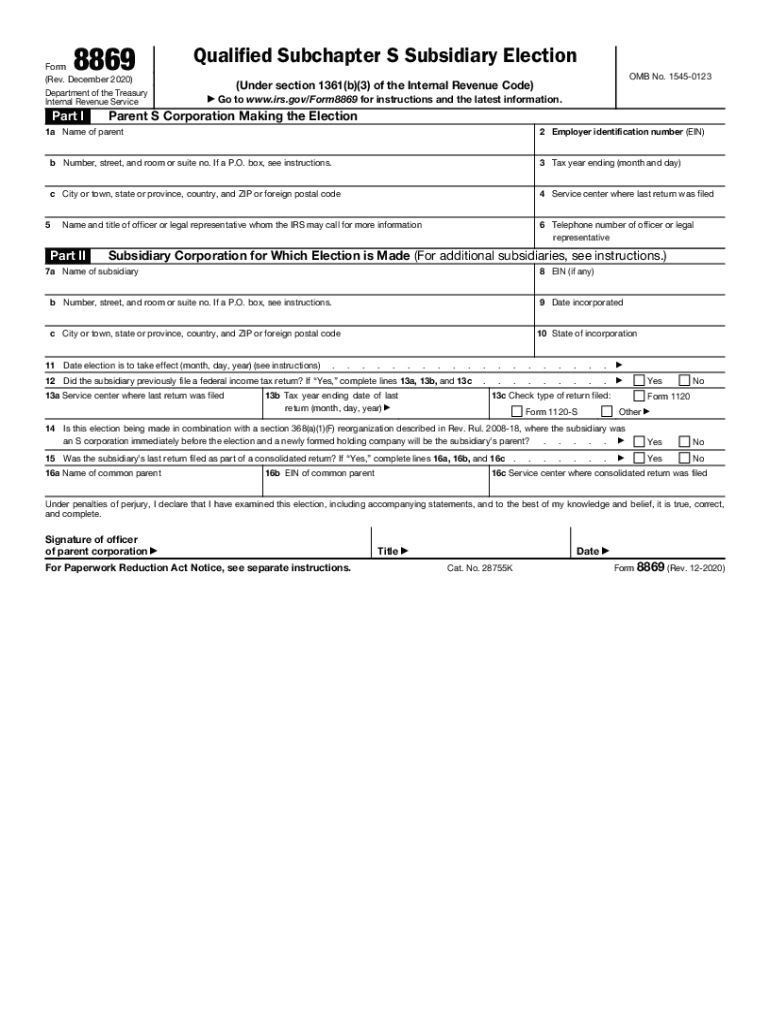

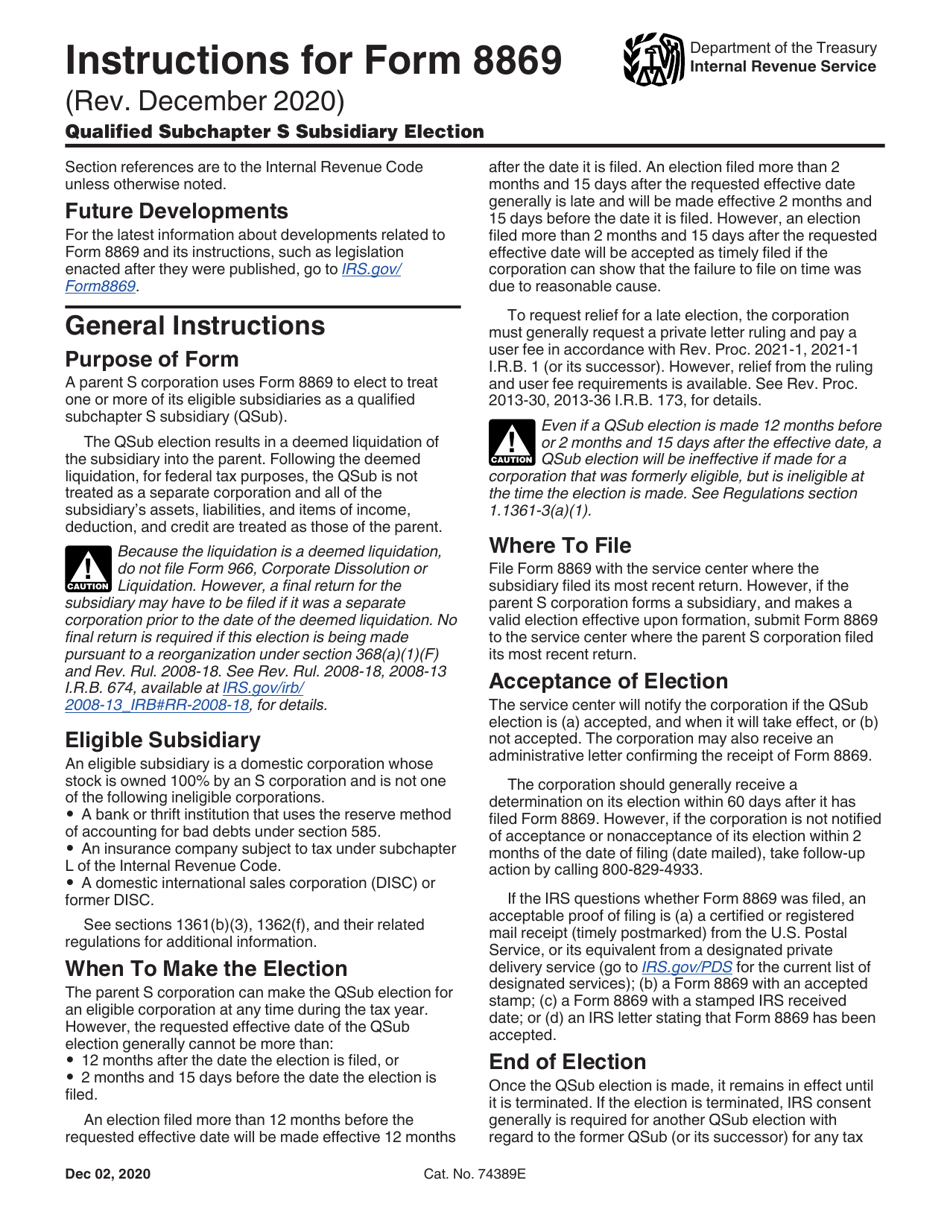

Form 8869 Instructions - Web instructions for form 8867, paid preparer's due diligence checklist 1122 12/07/2022 form 8867: General instructions purpose of form a parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and instructions on how to file. Web we last updated the qualified subchapter s subsidiary election in february 2023, so this is the latest version of form 8869, fully updated for tax year 2022. Qualified subchapter s subsidiary election. Part i parent s corporation making the election. Web upon the reorganization holdco must timely file form 8869, qualified subchapter s subsidiary election, to elect to treat the target subsidiary as a qualified subchapter s subsidiary (qsub). Web a parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. Paid preparer's due diligence checklist 1221 12/01/2021 inst 8866:

Web irs form 8869, qualified subchapter s subsidiary election (qsub election), is the tax form that a parent corporation will file with the irs to treat one of its eligible subsidiaries as a qsub. Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and instructions on how to file. Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. The qsub election results in a deemed liquidation of the subsidiary into the parent. Part i parent s corporation making the election. Annual record of federal tax liability. Income tax return for an s. Web the application prints filed pursuant to rev. General instructions purpose of form a parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). You must also enter x in the election for the subsidiary was filed late field to indicate the applicable subsidiary.

Paid preparer's due diligence checklist 1221 12/01/2021 inst 8866: Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and instructions on how to file. Annual record of federal tax liability. Part i parent s corporation making the election. Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. The qsub election results in a deemed liquidation of the subsidiary into the parent. You can print other federal tax forms here. You must also enter x in the election for the subsidiary was filed late field to indicate the applicable subsidiary. Web irs form 8869, qualified subchapter s subsidiary election (qsub election), is the tax form that a parent corporation will file with the irs to treat one of its eligible subsidiaries as a qsub. General instructions purpose of form a parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub).

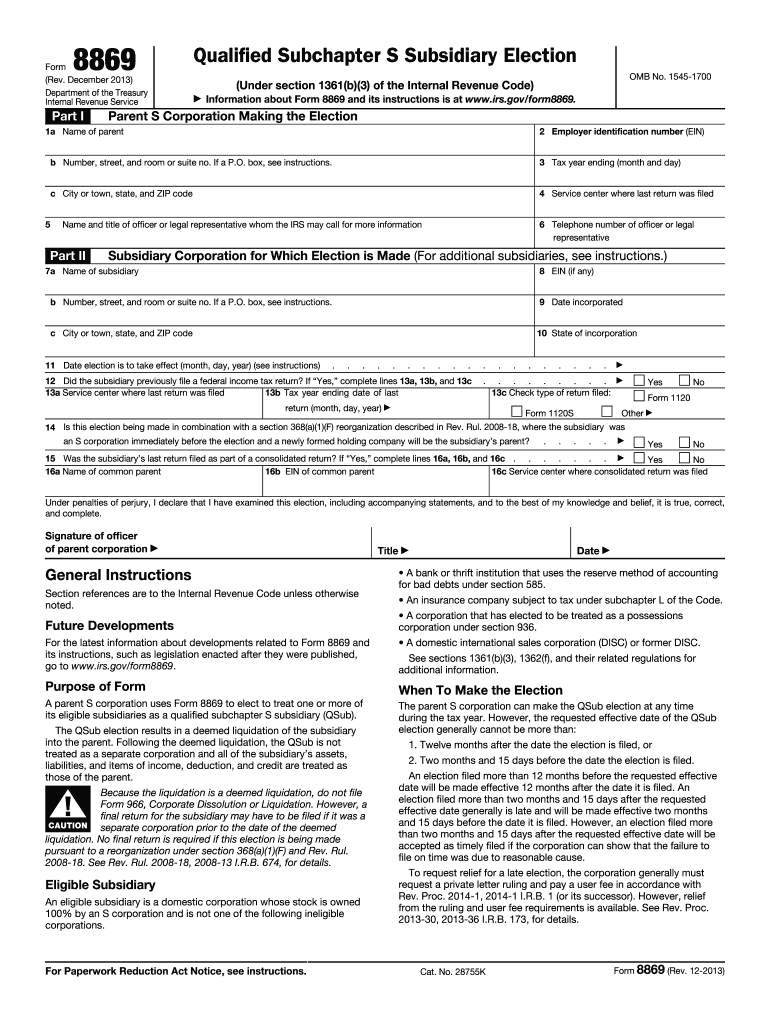

Form 8869 Qualified Subchapter S Subsidiary Election (2014) Free Download

Part i parent s corporation making the election. Annual record of federal tax liability. Income tax return for an s. Web upon the reorganization holdco must timely file form 8869, qualified subchapter s subsidiary election, to elect to treat the target subsidiary as a qualified subchapter s subsidiary (qsub). Web instructions for form 8867, paid preparer's due diligence checklist 1122.

Fill Free fillable Form 8869 Qualified Subchapter S Subsidiary

Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. A parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). Annual record of federal tax liability. Qualified subchapter s subsidiary election. You must also enter x in.

Qualified subhapter s subsidiaries form 8869 2013 Fill out & sign

Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. The qsub election results in a deemed liquidation of the subsidiary into the parent. Paid preparer's due diligence checklist 1221 12/01/2021 inst 8866: Web instructions for form 8867, paid preparer's due diligence checklist 1122 12/07/2022 form 8867: Web a parent s corporation.

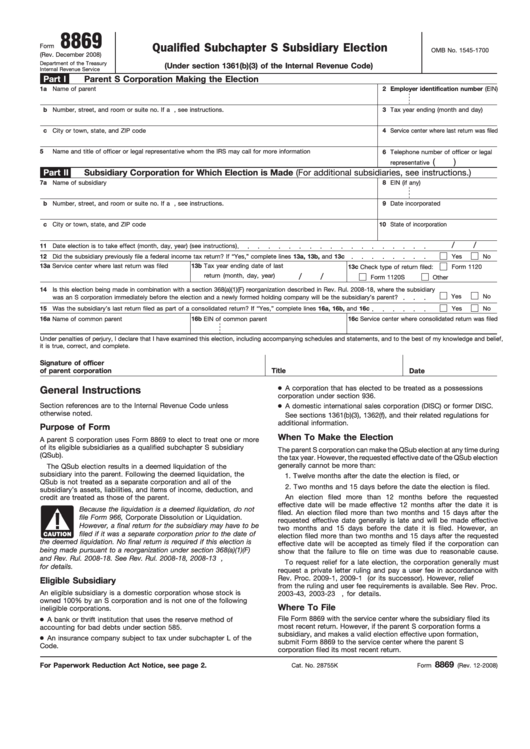

Fillable Form 8869 2008 Qualified Subchapter S Subsidiary Election

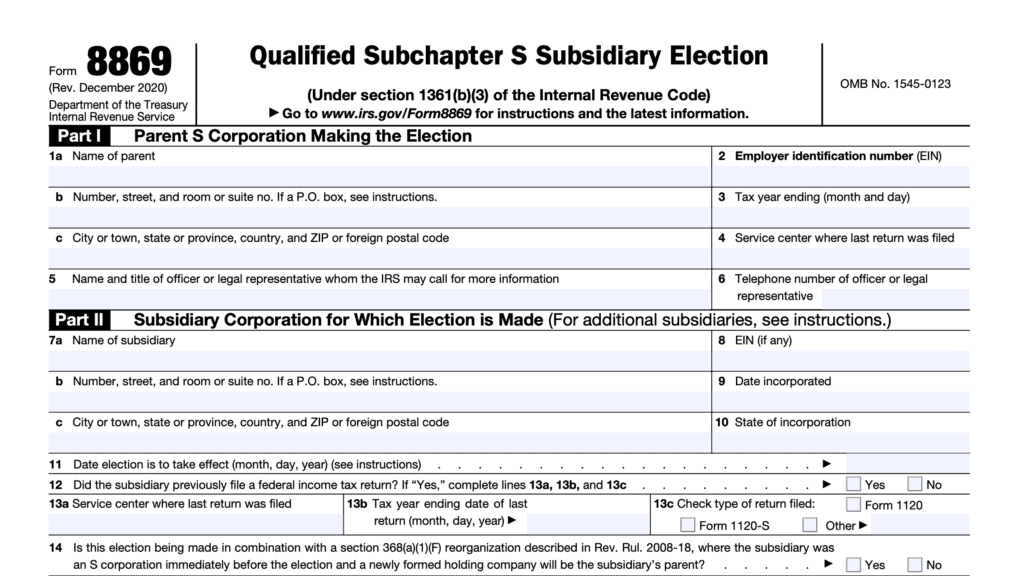

December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal revenue code) go to www.irs.gov/form8869 for instructions and the latest information. Annual record of federal tax liability. The qsub election results in a deemed liquidation of the subsidiary corporation into the parent. Qualified subchapter s subsidiary election. You must also.

IRS Form 2553 Instructions Electing S Corporation Status

Web we last updated the qualified subchapter s subsidiary election in february 2023, so this is the latest version of form 8869, fully updated for tax year 2022. Income tax return for an s. Web upon the reorganization holdco must timely file form 8869, qualified subchapter s subsidiary election, to elect to treat the target subsidiary as a qualified subchapter.

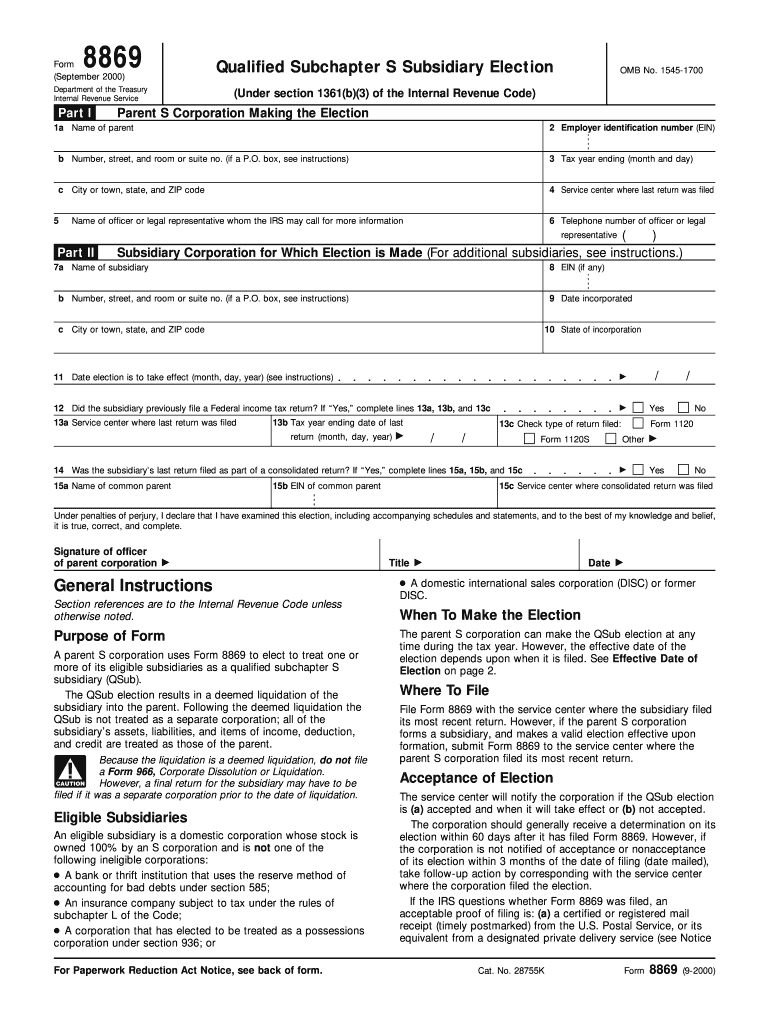

Form 8869 Rev September , Fill in Version Fill Out and Sign Printable

Web upon the reorganization holdco must timely file form 8869, qualified subchapter s subsidiary election, to elect to treat the target subsidiary as a qualified subchapter s subsidiary (qsub). Sales by registered ultimate vendors. Web we last updated the qualified subchapter s subsidiary election in february 2023, so this is the latest version of form 8869, fully updated for tax.

IRS Form 2553 Instructions Electing S Corporation Status

A parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal revenue code) go to www.irs.gov/form8869 for instructions and the latest information. Paid preparer's due diligence.

8869 Fill Out and Sign Printable PDF Template signNow

Annual record of federal tax liability. Web irs form 8869, qualified subchapter s subsidiary election (qsub election), is the tax form that a parent corporation will file with the irs to treat one of its eligible subsidiaries as a qsub. Qualified subchapter s subsidiary election. You must also enter x in the election for the subsidiary was filed late field.

Fill Free fillable Qualified Subchapter S Subsidiary Election 2017

Web we last updated the qualified subchapter s subsidiary election in february 2023, so this is the latest version of form 8869, fully updated for tax year 2022. The qsub election results in a deemed liquidation of Instructions for form 8975 and schedule a (form 8975), country. Instructions for form 8869, qualified subchapter s subsidiary election. Qualified subchapter s subsidiary.

Download Instructions for IRS Form 8869 Qualified Subchapter S

Income tax return for an s. A parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal revenue code) go to www.irs.gov/form8869 for instructions and the.

You Must Also Enter X In The Election For The Subsidiary Was Filed Late Field To Indicate The Applicable Subsidiary.

December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal revenue code) go to www.irs.gov/form8869 for instructions and the latest information. Paid preparer's due diligence checklist 1221 12/01/2021 inst 8866: Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and instructions on how to file. The qsub election results in a deemed liquidation of the subsidiary into the parent.

Instructions For Form 8869, Qualified Subchapter S Subsidiary Election.

Web irs form 8869, qualified subchapter s subsidiary election (qsub election), is the tax form that a parent corporation will file with the irs to treat one of its eligible subsidiaries as a qsub. Web upon the reorganization holdco must timely file form 8869, qualified subchapter s subsidiary election, to elect to treat the target subsidiary as a qualified subchapter s subsidiary (qsub). A parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). The qsub election results in a deemed liquidation of the subsidiary corporation into the parent.

Web Form 8869 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/ Form8869.

Web we last updated the qualified subchapter s subsidiary election in february 2023, so this is the latest version of form 8869, fully updated for tax year 2022. The qsub election results in a deemed liquidation of You can print other federal tax forms here. Sales by registered ultimate vendors.

Annual Record Of Federal Tax Liability.

Qualified subchapter s subsidiary election. Web instructions for form 8867, paid preparer's due diligence checklist 1122 12/07/2022 form 8867: Web the application prints filed pursuant to rev. Instructions for form 8975 and schedule a (form 8975), country.