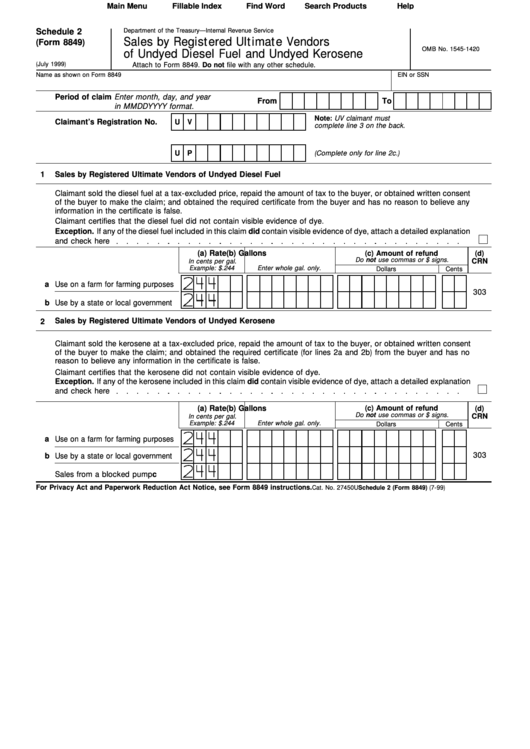

Form 8849 Schedule 2

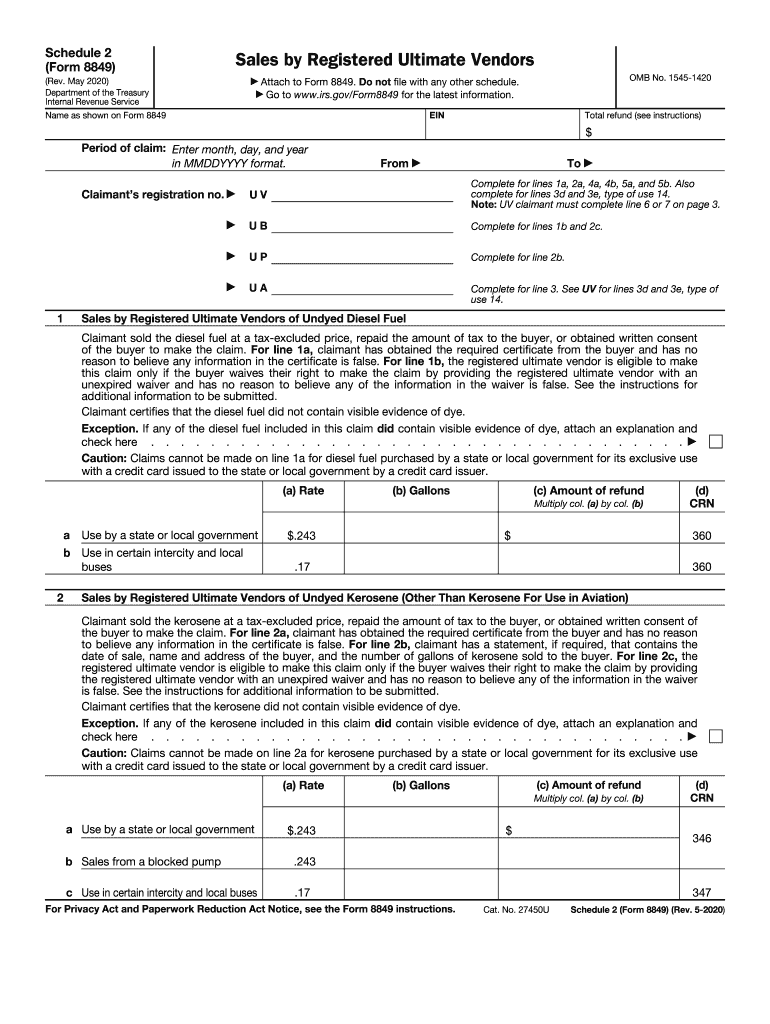

Form 8849 Schedule 2 - File each of these schedules with a separate form 8849. Start completing the fillable fields and carefully type in required information. Use the cross or check marks in the top toolbar to select your answers in the list boxes. Lines have been added for nontaxable uses of undyed kerosene (schedule 1) and sales by ultimate vendors of undyed kerosene (schedule 2). To claim refunds on nontaxable use of fuels. December 2020) department of the treasury internal revenue service. For privacy act and paperwork reduction act notice, see instructions. Other claims including the credit claim of form 2290. Web schedule 2 (form 8849) (rev. Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs.

Web form 8849 the schedules that apply. Other claims including the credit claim of form 2290. December 2020) department of the treasury internal revenue service. All other form 8849 schedules are processed within 45 days of acceptance. File each of these schedules with a separate form 8849. Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. Do not file with any other schedule. Page last reviewed or updated: For amending sales by registered ultimate vendors. Web schedules 2, 3, 5, and 8 cannot be filed with any other schedules on form 8849.

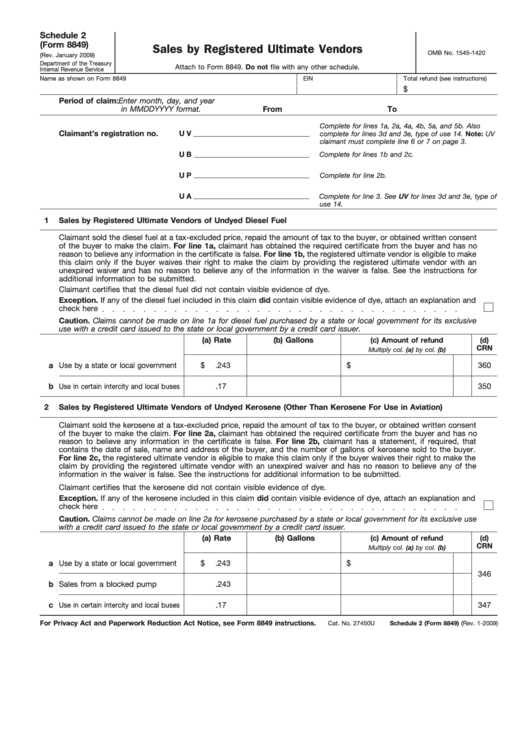

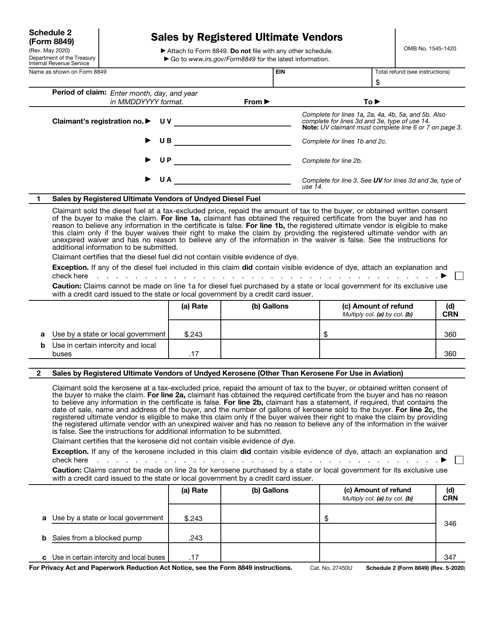

For amending sales by registered ultimate vendors. Web schedules 2, 3, 5, and 8 cannot be filed with any other schedules on form 8849. File each of these schedules with a separate form 8849. Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. To claim refunds on nontaxable use of fuels. Web form 8849 schedule 2 is used for refunds by vendors, specifically ones that sell “undyed diesel fuel, undyed kerosene, kerosene sold for use in aviation, gasoline, or aviation gasoline”, according to the irs. Other claims including the credit claim of form 2290. Start completing the fillable fields and carefully type in required information. Use the cross or check marks in the top toolbar to select your answers in the list boxes. All other form 8849 schedules are processed within 45 days of acceptance.

Fillable Schedule 2 (Form 8849) Sales By Registered Ultimate Vendors

Web schedule 2 (form 8849) (rev. Use get form or simply click on the template preview to open it in the editor. Other claims including the credit claim of form 2290. Do not file with any other schedule. For amending sales by registered ultimate vendors.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. Claimants are now allowed to file a claim for nontaxable use of fuels (schedule 1) for any quarter of their income tax year. Web form 8849 the schedules that apply. To claim refunds on nontaxable use.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. Use get form or simply click on the template preview to open it in the editor. Web quick steps to complete and design schedule 2 8849 online: Web schedules 2, 3, 5, and 8 cannot be.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Do not file with any other schedule. Total refund (see instructions) $ Lines have been added for nontaxable uses of undyed kerosene (schedule 1) and sales by ultimate vendors of undyed kerosene (schedule 2). Page last reviewed or updated: December 2020) department of the treasury internal revenue service.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

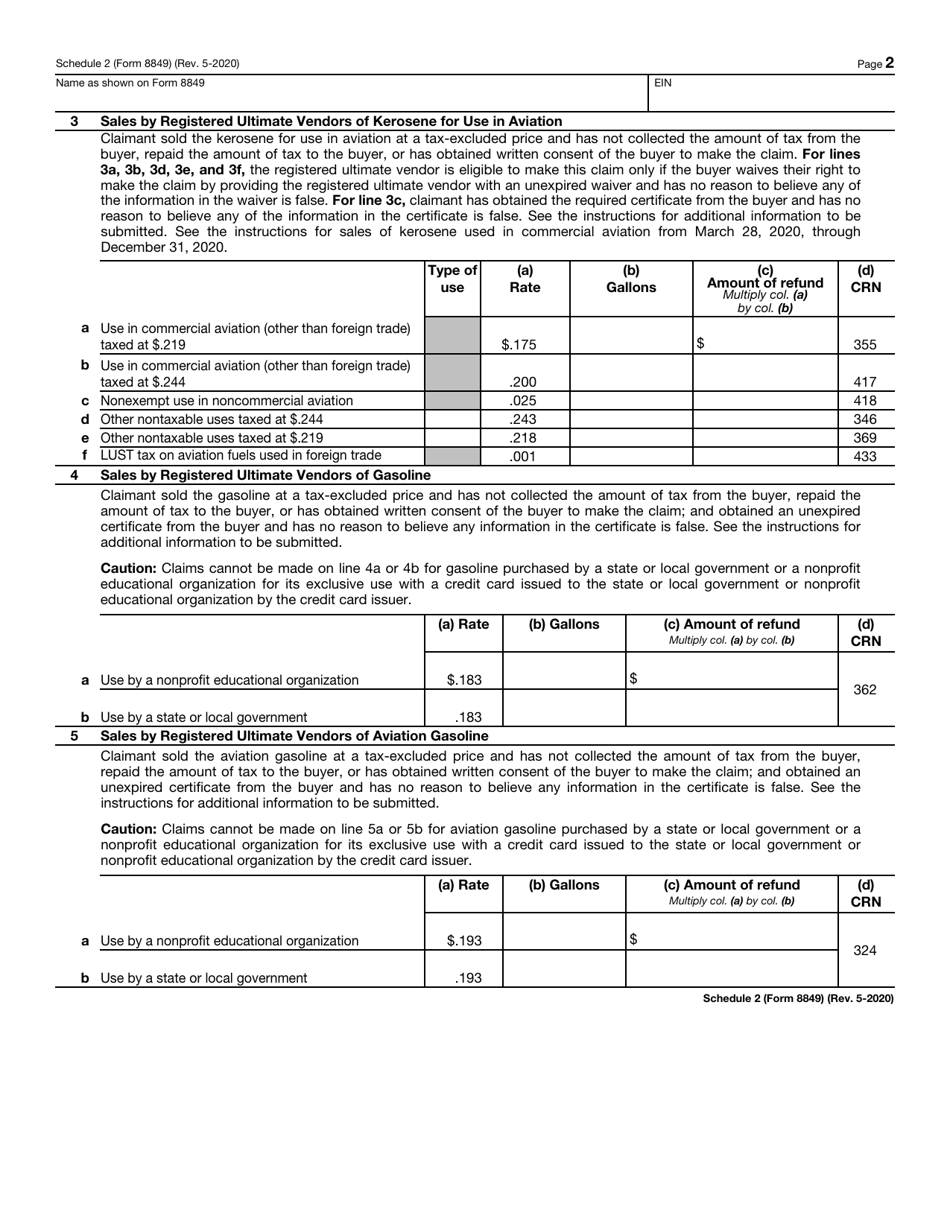

All other form 8849 schedules are processed within 45 days of acceptance. Web schedule 2 (form 8849) (rev. File each of these schedules with a separate form 8849. Web schedules 2, 3, 5, and 8 cannot be filed with any other schedules on form 8849. Web 3 what’s new tax holiday for kerosene used in commercial aviation.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

Use get form or simply click on the template preview to open it in the editor. Web schedule 2 (form 8849) (rev. December 2020) department of the treasury internal revenue service. Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. Other claims including the credit.

Fillable Schedule 2 (Form 8849) Sales By Registered Ultimate Vendors

Use get form or simply click on the template preview to open it in the editor. To claim refunds on nontaxable use of fuels. For claiming alternative fuel credits. Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. Page last reviewed or updated:

Fill Free fillable Form 8849 2014 Claim for Refund of Excise Taxes

File each of these schedules with a separate form 8849. Web 3 what’s new tax holiday for kerosene used in commercial aviation. For privacy act and paperwork reduction act notice, see instructions. Web form 8849 the schedules that apply. Sales by registered ultimate vendors.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Kerosene used in commercial aviation from march 28, 2020, through december 31, 2020 (tax holiday) is treated as a nontaxable use. Web form 8849 schedule 2 is used for refunds by vendors, specifically ones that sell “undyed diesel fuel, undyed kerosene, kerosene sold for use in aviation, gasoline, or aviation gasoline”, according to the irs. For claiming alternative fuel credits..

8849 Schedule 2 Form Fill Out and Sign Printable PDF Template signNow

Sales by registered ultimate vendors. Web quick steps to complete and design schedule 2 8849 online: December 2020) department of the treasury internal revenue service. Kerosene used in commercial aviation from march 28, 2020, through december 31, 2020 (tax holiday) is treated as a nontaxable use. Use the cross or check marks in the top toolbar to select your answers.

Kerosene Used In Commercial Aviation From March 28, 2020, Through December 31, 2020 (Tax Holiday) Is Treated As A Nontaxable Use.

Refunds for an electronically filed form 8849, with schedule 2, 3 or 8, will be processed within 20 days of acceptance by the irs. For claiming alternative fuel credits. Sales by registered ultimate vendors. December 2020) department of the treasury internal revenue service.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

For amending sales by registered ultimate vendors. Web 3 what’s new tax holiday for kerosene used in commercial aviation. File each of these schedules with a separate form 8849. Other claims including the credit claim of form 2290.

Lines Have Been Added For Nontaxable Uses Of Undyed Kerosene (Schedule 1) And Sales By Ultimate Vendors Of Undyed Kerosene (Schedule 2).

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web schedules 2, 3, 5, and 8 cannot be filed with any other schedules on form 8849. Web quick steps to complete and design schedule 2 8849 online: Total refund (see instructions) $

For Privacy Act And Paperwork Reduction Act Notice, See Instructions.

Web schedule 2 (form 8849) (rev. Claimants are now allowed to file a claim for nontaxable use of fuels (schedule 1) for any quarter of their income tax year. Do not file with any other schedule. Start completing the fillable fields and carefully type in required information.