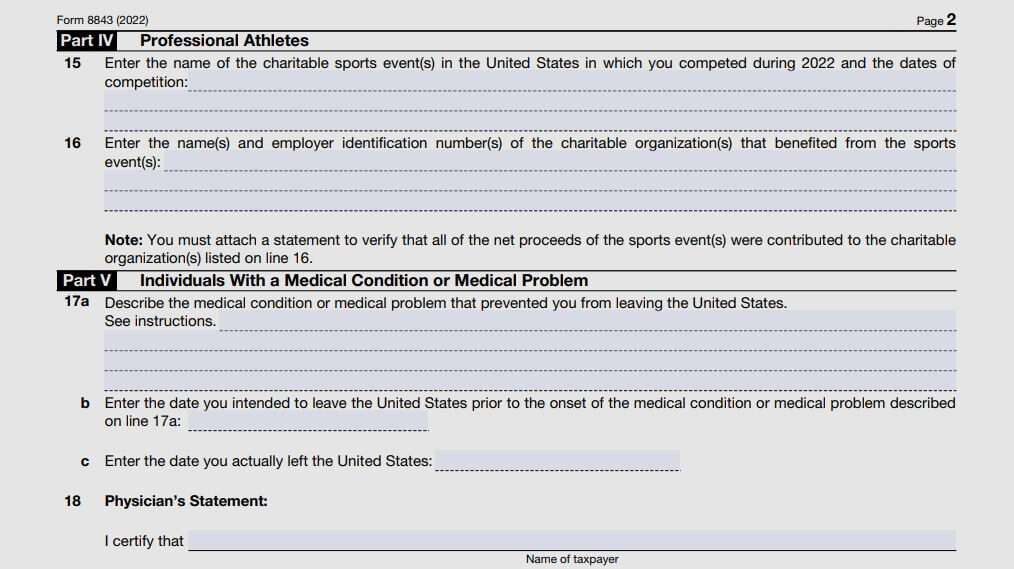

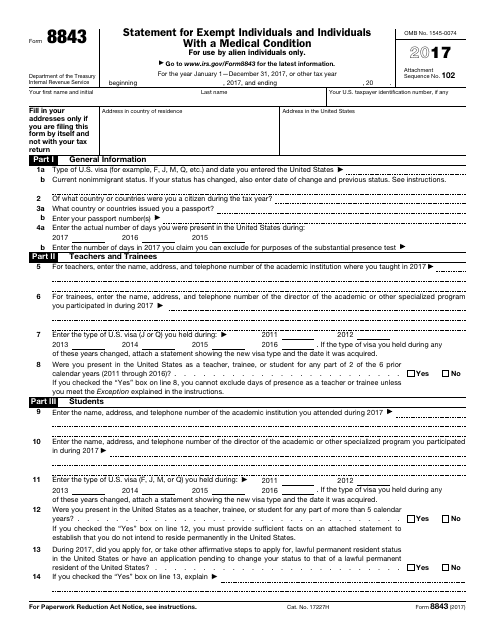

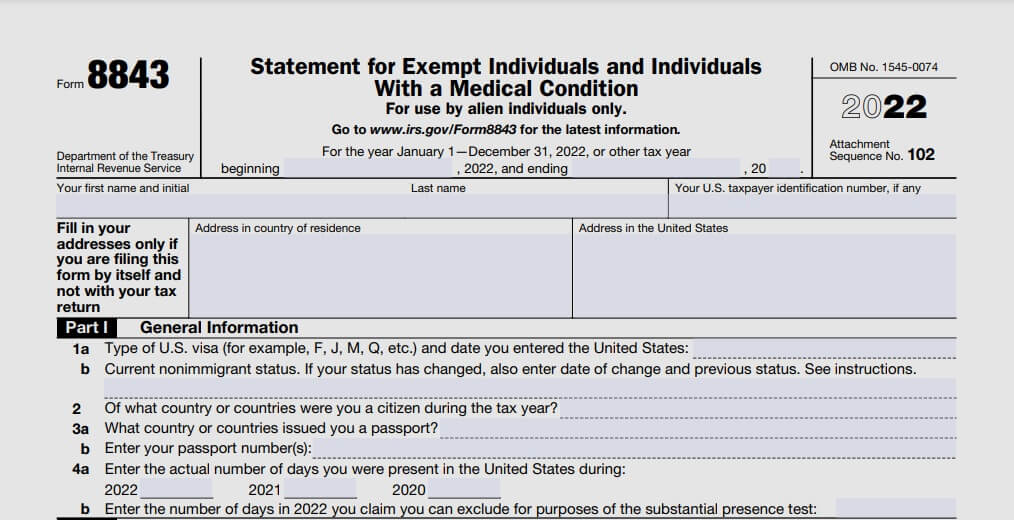

Form 8843 Instructions

Form 8843 Instructions - You were present in the us in the previous tax year; For any day during 2021. Government that you are eligible for nonresident alien status for tax purposes and therefore exempt from being taxed on income you may have from outside the u.s. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. For foreign nationals who had no u.s. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Access to a free online form completion wizard is available. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Current form 8843 and supporting documents must be mailed by june 15th. Web you must file a form 8843 if:

Web form 8843 must be filed if an individual is: In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Alien individuals use form 8843 to explain excluded days of presence in the u.s. You were present in the us in the previous tax year; Web you must file a form 8843 if: • present in the u.s. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. Access to a free online form completion wizard is available.

Current form 8843 and supporting documents must be mailed by june 15th. • present in the u.s. In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. You can not file this form electronically, you must mail the paper form. Web instructions for form 8843. Access to a free online form completion wizard is available. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Web mail your completed form 8843 to: For the prior calendar year is april 15th of the current year.”

IRS Form 8843 Editable and Printable Statement to Fill out

Current form 8843 and supporting documents must be mailed by june 15th. Access to a free online form completion wizard is available. In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. Web form 8843 must be filed if an individual is: • present in the u.s.

Form 8843 Instructions How to fill out 8843 form online & file it

Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. For foreign nationals who had no u.s. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. And help determine tax responsibility. The deadline for mailing your 8843:

LEGO 8843 ForkLift Truck Set Parts Inventory and Instructions LEGO

Alien individuals use form 8843 to explain excluded days of presence in the u.s. For any day during 2021. For foreign nationals who had no u.s. Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. Web mail your completed form 8843 to:

IRS Form 8843 Download Fillable PDF or Fill Online Statement for Exempt

They do not need to be received by that date. • a nonresident alien (an individual who has not passed the green card test or the substantial presence test.) • present in the u.s. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. Web irs form 8843 is a tax.

Form 8843 Instructions How to fill out 8843 form online & file it

You were present in the us in the previous tax year; You are a nonresident alien; Access to a free online form completion wizard is available. For any day during 2021. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s.

What is Form 8843 and How Do I File it? Sprintax Blog

Access to a free online form completion wizard is available. If you are claiming the rev. They do not need to be received by that date. Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Mail your tax return by the due date (including extensions) to.

Form 8843 Statement for Exempt Individuals and Individuals with a

The deadline for mailing your 8843: And help determine tax responsibility. You can not file this form electronically, you must mail the paper form. Access to a free online form completion wizard is available. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file.

Form 8843 Statement for Exempt Individuals and Individuals with a

You can not file this form electronically, you must mail the paper form. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s..

Tax how to file form 8843 (1)

Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Web form 8843 must be filed if an individual is: For the prior calendar year is april 15th of the current year.” In 2021, whether they worked and earned money or not, are required to complete and.

form 8843 example Fill Online, Printable, Fillable Blank

And help determine tax responsibility. For the substantial presence test. For any day during 2021. Mail your tax return by the due date (including extensions) to the address shown in your tax return instructions. For foreign nationals who had no u.s.

Government That You Are Eligible For Nonresident Alien Status For Tax Purposes And Therefore Exempt From Being Taxed On Income You May Have From Outside The U.s.

Web mail form 8843 and supporting documents in an envelope to the following address: Web you must file a form 8843 if: Web irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to file.

For The Prior Calendar Year Is April 15Th Of The Current Year.”

The deadline for mailing your 8843: Web instructions for form 8843. Current form 8843 and supporting documents must be mailed by june 15th. Access to a free online form completion wizard is available.

• A Nonresident Alien (An Individual Who Has Not Passed The Green Card Test Or The Substantial Presence Test.) • Present In The U.s.

They do not need to be received by that date. For the substantial presence test. You were present in the us in the previous tax year; You can not file this form electronically, you must mail the paper form.

And Help Determine Tax Responsibility.

Source income* during 2016 (or less than $4050) the purpose of form 8843 is to demonstrate to the u.s. Even if you don’t need to file an income tax return, you should file the form 8843 if the above criteria apply. In 2021, whether they worked and earned money or not, are required to complete and send in the 8843 form. For foreign nationals who had no u.s.