Form 8833 Turbotax

Form 8833 Turbotax - The form must also be used by dual. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Complete, edit or print tax forms instantly. Web instructions, and pubs is at irs.gov/forms. Ad get ready for tax season deadlines by completing any required tax forms today. Web the payee must file a u.s. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web what is irs form 8833? You can print the form and mail it with your.

Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. To enter a description and an amount for line 8 of schedule 1 (form 1040) to reduce the taxable wage amount from form 1040 u.s. The form must also be used by dual. Note that this is not an exhaustive list of all positions that are reportable on a form 8833. For example, the form 1040 page is at. Web the payee must file a u.s. Web instructions, and pubs is at irs.gov/forms.

Tax return and form 8833 if claiming the following treaty benefits: To enter a description and an amount for line 8 of schedule 1 (form 1040) to reduce the taxable wage amount from form 1040 u.s. Ad get ready for tax season deadlines by completing any required tax forms today. Web the payee must file a u.s. Complete, edit or print tax forms instantly. For example, the form 1040 page is at. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. Web what is irs form 8833? Web instructions, and pubs is at irs.gov/forms. The form must also be used by dual.

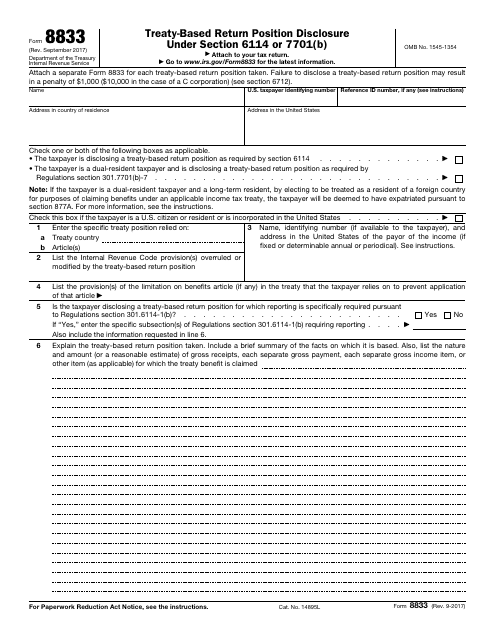

Form 8833 TreatyBased Return Position Disclosure

The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Tax return and form 8833 if claiming the following treaty benefits: Note that this is not an exhaustive list of all positions that are reportable on a form 8833. Web what is irs form.

投票:RA claim 5000中美treaty是否必须附上8833 税务 美卡论坛

A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Complete, edit or print tax forms instantly. Tax return and form 8833 if claiming the following treaty benefits: The form must also be used by dual. Web what is irs form 8833?

IRS Form 8833 Download Fillable PDF or Fill Online TreatyBased Return

Web instructions, and pubs is at irs.gov/forms. The form must also be used by dual. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Note that this is not an exhaustive list of all positions that are reportable on a form 8833. Web.

Form 8833 How to Claim Tax Treaty Benefits

The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. You can print the form and mail it with your. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Almost every form and publication has a.

U.S. Tax Form 8833 Guidelines Expat US Tax

You can print the form and mail it with your. Note that this is not an exhaustive list of all positions that are reportable on a form 8833. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. Almost every form and publication has a page on irs.gov with a friendly shortcut. To.

Tax Treaty Benefits & Form 8833 What You Need to Know (From a CPA!)

Web the payee must file a u.s. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. To enter.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

Web what is irs form 8833? The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. The form must also be used by dual. To enter a description and an amount for line 8 of schedule 1 (form 1040) to reduce the taxable wage.

Form 8833 Turbotax Fill online, Printable, Fillable Blank

The form must also be used by dual. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. Tax return and form 8833 if claiming the following treaty benefits: Note that this is not an exhaustive list of all positions that are reportable on a.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

For example, the form 1040 page is at. Web the payee must file a u.s. Web what is irs form 8833? The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Ad get ready for tax season deadlines by completing any required tax forms.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

You can print the form and mail it with your. The form must also be used by dual. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Tax return and form 8833 if claiming the following treaty benefits: A reduction or modification in.

You Can Print The Form And Mail It With Your.

Web the payee must file a u.s. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. A reduction or modification in the taxation of gain or loss from the disposition of a u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return.

Note That This Is Not An Exhaustive List Of All Positions That Are Reportable On A Form 8833.

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Tax return and form 8833 if claiming the following treaty benefits: The form must also be used by dual.

Web What Is Irs Form 8833?

Almost every form and publication has a page on irs.gov with a friendly shortcut. Web instructions, and pubs is at irs.gov/forms. For example, the form 1040 page is at. To enter a description and an amount for line 8 of schedule 1 (form 1040) to reduce the taxable wage amount from form 1040 u.s.