Form 8814 Vs 8615

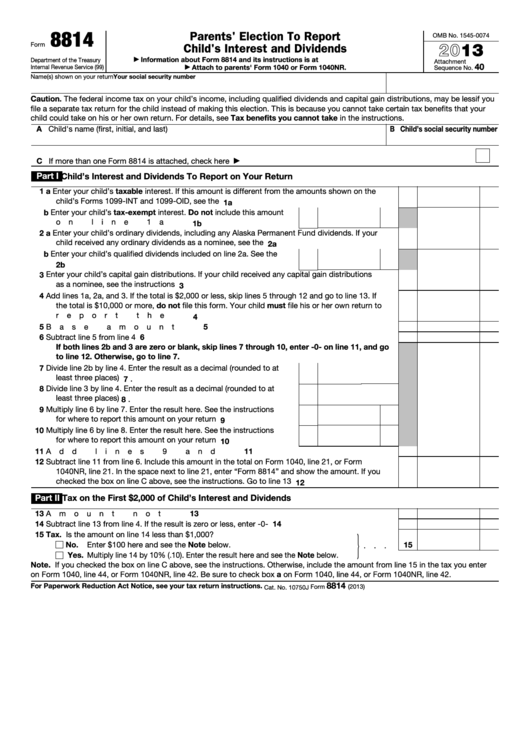

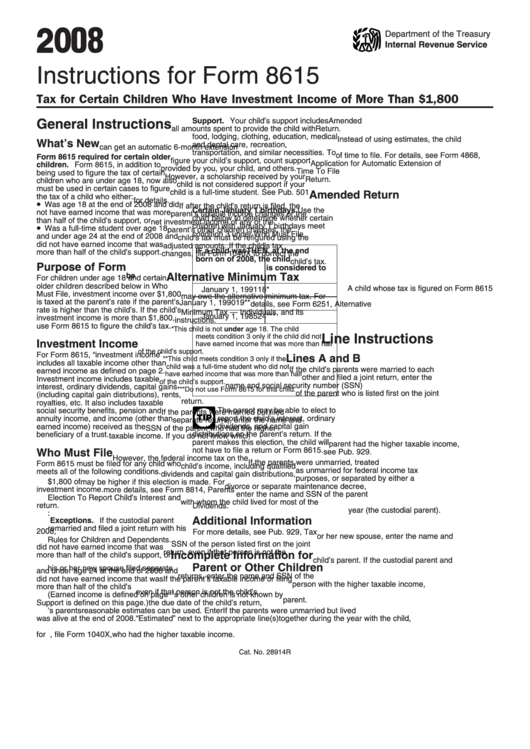

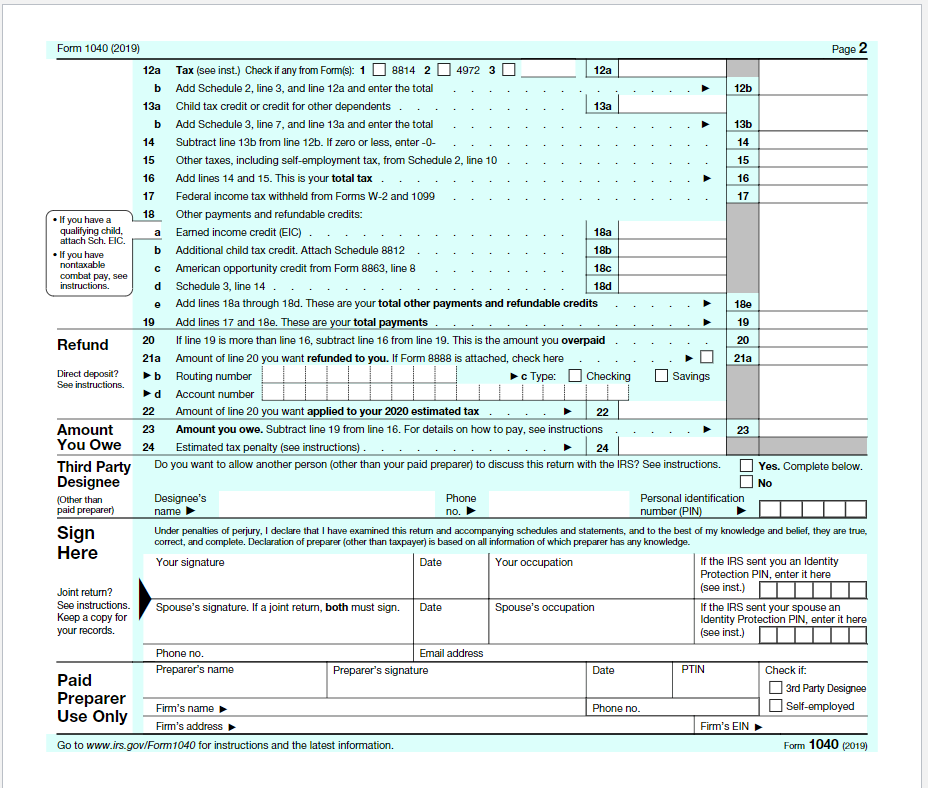

Form 8814 Vs 8615 - If the client elects to report their child's income on their return, the child won't have to file a return. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. The client can make this election if their. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. Per irs publication 929 tax rules for. If the qualified dividends and capital gain tax. 1 if you are completing the parents' return, do not enter the information for form 8615 tax for certain children who have. The child is required to file a tax return. Web unearned income unearned income is income gained from a source other than employment, work, or other business activity.

The child is required to file a tax return. Per the irs instructions, the following notes will appear at the top of printed versions of these forms: Web form 8615 must be filed for any child who meets all of the following conditions. Web unearned income unearned income is income gained from a source other than employment, work, or other business activity. Web continue with the interview process to enter your information. The parents can report it on their tax return by attaching form 8814 to their form 1040,. Web form 4972, 8814, or. Money from work, by contrast, is. Web if you are completing the parents' return, do not enter the information for form 8615 tax for certain children who have unearned income but do complete form 8814 parents’. Per irs publication 929 tax rules for.

Web who should file form 8814? Web for the child's return (form 8615), click tax on child's unearned income. If you do, your child will not have to file a return. If the client elects to report their child's income on their return, the child won't have to file a return. Web unearned income unearned income is income gained from a source other than employment, work, or other business activity. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Web there are two different ways to report your child’s unearned taxable income: Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. If the parent files form 2555, see the instructions. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web there are two different ways to report your child’s unearned taxable income: For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Money from work, by contrast, is. Web common questions about form 8615 and form 8814 below are answers to.

Fillable Form 8814 Parents' Election To Report Child'S Interest And

If the parent files form 2555, see the instructions. If the client elects to report their child's income on their return, the child won't have to file a return. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. The.

Instructions For Form 8615 Tax For Certain Children Who Have

The client can make this election if their. If the parent files form 2555, see the instructions. Or any tax from recapture of an education credit. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. If the qualified dividends and.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

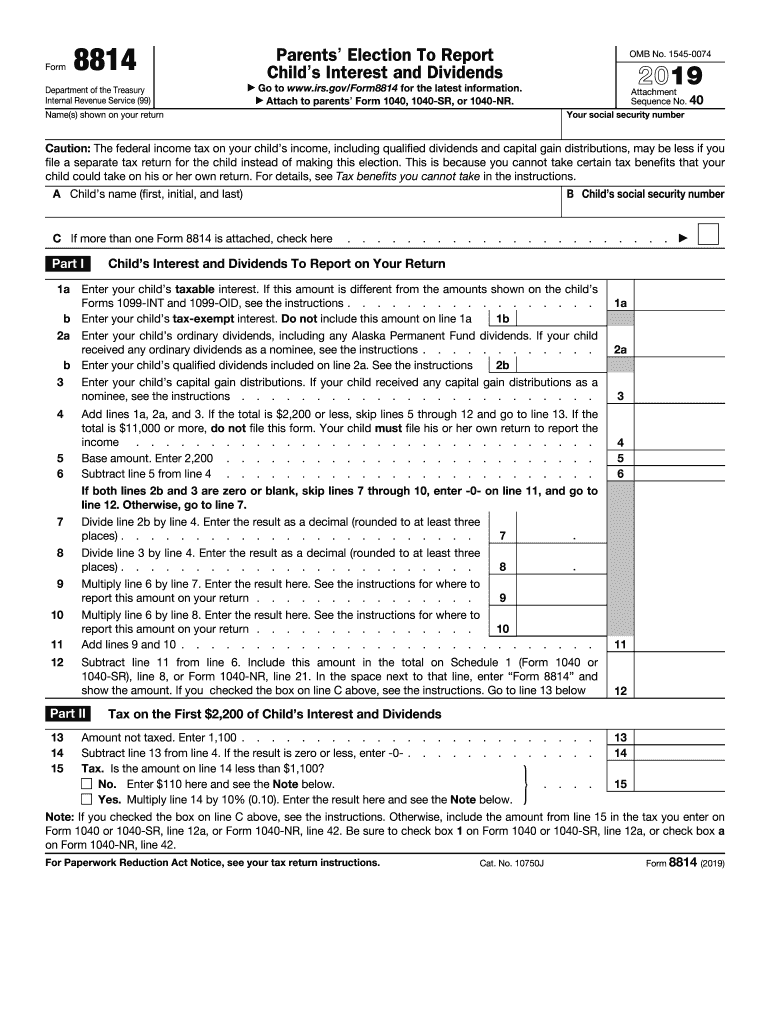

Web form 4972, 8814, or. If you do, your child will not have to file a return. Web continue with the interview process to enter your information. Web who should file form 8814? Web general instructions purpose of form use this form if you elect to report your child’s income on your return.

Fill Free fillable Form 8814 Parents’ Election To Report Child’s

Web general instructions purpose of form use this form if you elect to report your child’s income on your return. The child had more than $2,300 of unearned income. The parents can report it on their tax return by attaching form 8814 to their form 1040,. If the qualified dividends and capital gain tax. Web earning interest and dividends can.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and. 1 if you are completing the parents' return, do not enter the information for form 8615 tax for certain children who have. Per irs publication 929 tax rules for. Web.

Everything You Need to Know About Custodial Account Taxes

Web if you are completing the parents' return, do not enter the information for form 8615 tax for certain children who have unearned income but do complete form 8814 parents’. Per the irs instructions, the following notes will appear at the top of printed versions of these forms: Web who should file form 8814? If the qualified dividends and capital.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Web who should file form 8814? If the qualified dividends and capital gain tax. 1 if you are completing the parents' return, do not enter the information for form 8615 tax for certain children who have. Web general instructions purpose of form use this form if you elect to report your child’s income on your return. Web there are two.

Solved This is a taxation subject but chegg didn't give a

Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and. The child is required to file a tax return. Web for the child's return (form 8615), click tax on child's unearned income. Web who should file form 8814? Web continue.

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

Per the irs instructions, the following notes will appear at the top of printed versions of these forms: Web 14 february 2023 if you are a parent who has a child with investment income, you may need to file form 8814, parent's election to report child's interest and. The parents can report it on their tax return by attaching form.

Web If You Are Completing The Parents' Return, Do Not Enter The Information For Form 8615 Tax For Certain Children Who Have Unearned Income But Do Complete Form 8814 Parents’.

If the client elects to report their child's income on their return, the child won't have to file a return. Web who should file form 8814? If the qualified dividends and capital gain tax. Per the irs instructions, the following notes will appear at the top of printed versions of these forms:

Web For The Child's Return (Form 8615), Click Tax On Child's Unearned Income.

For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Web continue with the interview process to enter your information. If you do, your child will not have to file a return. Money from work, by contrast, is.

For The Parents' Return (Form 8814), Click Child's Interest And Dividend Income On Your Return.

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web general instructions purpose of form use this form if you elect to report your child’s income on your return. The parents can report it on their tax return by attaching form 8814 to their form 1040,. Web there are two different ways to report your child’s unearned taxable income:

1 If You Are Completing The Parents' Return, Do Not Enter The Information For Form 8615 Tax For Certain Children Who Have.

Web earning interest and dividends can result in your child needing to file a tax return for their investment income, however, and those amounts must be reported on. The child is required to file a tax return. Or any tax from recapture of an education credit. If the parent files form 2555, see the instructions.