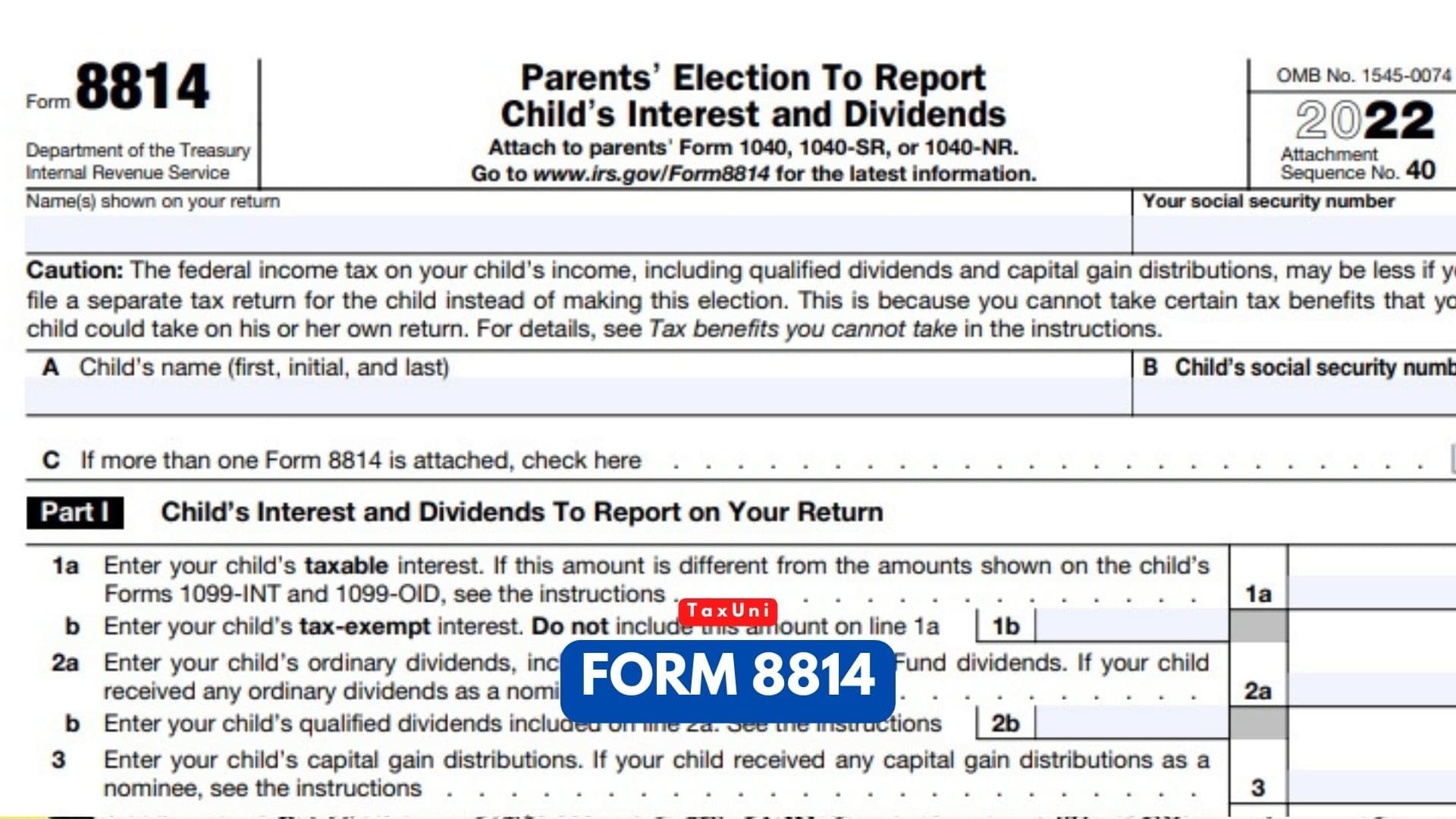

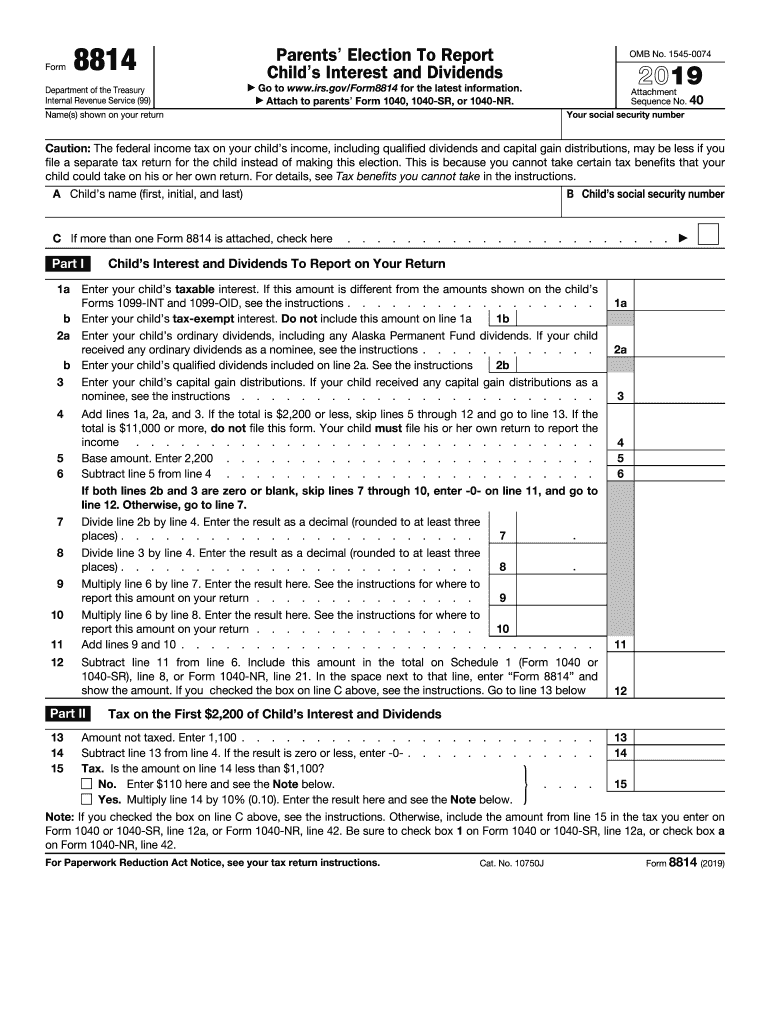

Form 8814 Capital Gains

Form 8814 Capital Gains - Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child ’s. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web the child’s only income was from interest and dividends, including capital gain. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web it means that if your child has unearned income more than $2,200, some of it will be. Web information about form 8814, parent's election to report child's interest. Include this amount in the total on form 1040, line 21, or. Web form 8814, parent's election to report child's interest and dividends who. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. If you make this election, you still get the.

Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web the child's only income was from interest and dividends, including capital. If you make this election, you still get the. Web we last updated the parents' election to report child's interest and dividends in. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web information about form 8814, parent's election to report child's interest. Web to report a child's income, the child must meet all of the following. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web subtract line 11 from line 6.

Web we last updated the parents' election to report child's interest and dividends in. Web to report a child's income, the child must meet all of the following. Web subtract line 11 from line 6. Web if your child's only income is interest and dividend income (including capital gain. Web it means that if your child has unearned income more than $2,200, some of it will be. Web form 8814, parent's election to report child's interest and dividends who. Include this amount in the total on form 1040, line 21, or. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child ’s. Web information about form 8814, parent's election to report child's interest.

Form 8814 Instructions 2010

Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web to report a child's income, the child must meet all of the following. Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web subtract line 11 from line 6. Web form 8814 will be used if you elect to report.

Fill Free fillable Form 8814 Parents’ Election To Report Child’s

Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web form 8814, parent's election to report child's interest and dividends who. Web the child’s only income was from interest and dividends, including capital gain. Web if your child's only income is interest and dividend income.

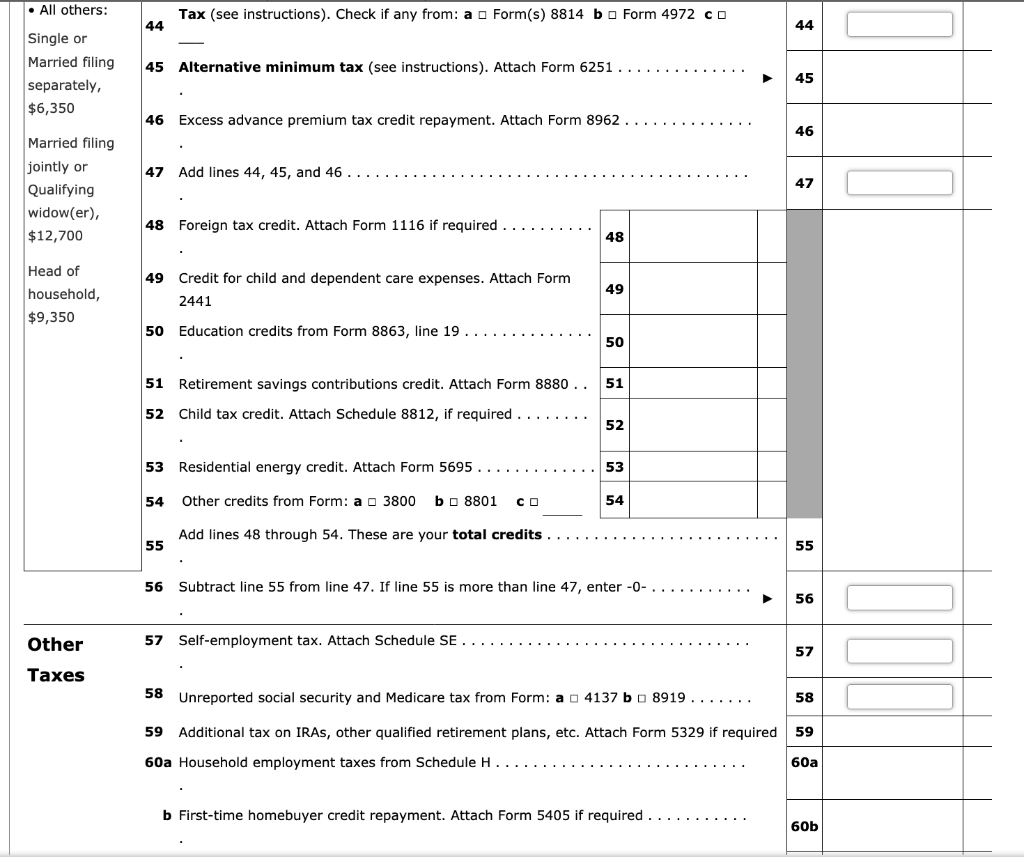

Tax Return Tax Return Qualified Dividends

Web the child’s only income was from interest and dividends, including capital gain. Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web the child's only income was from interest and dividends, including capital. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web subtract line 11 from line 6.

Form 8814 Instructions 2010

Web if your child's only income is interest and dividend income (including capital gain. Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web subtract line 11 from line 6. Web form 8814, parent's election to report child's interest and dividends who. Web information about form 8814, parent's election to report child's.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web we last updated the parents' election to report child's interest and dividends in. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web it means that if your child has unearned income more than $2,200, some of it will be. Web the child's.

8814 Form 2023

Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child ’s. Web subtract line 11 from line 6. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web the child’s only income was from interest and.

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web form 8814 department of the treasury internal revenue service (99) parents’ election. Web it means that if your child has unearned income more than $2,200, some of it will be. Web form 8814, parent's election to report child's interest and dividends who..

Note This Problem Is For The 2017 Tax Year. Janic...

Web it means that if your child has unearned income more than $2,200, some of it will be. Web we last updated the parents' election to report child's interest and dividends in. Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web the child's only income was from interest and dividends, including capital. Web to make the election,.

Form 2438 Undistributed Capital Gains Tax Return (2013) Free Download

Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web if your child's only income is interest and dividend income (including capital gain. Web subtract line 11 from line 6. Web the child's only income was from interest and dividends, including capital. Web up to $7 cash back form 8814 is a.

Form 1120 (Schedule D) Capital Gains and Losses (2014) Free Download

If you make this election, you still get the. Web information about form 8814, parent's election to report child's interest. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web to make the election, complete and attach form(s) 8814 to your tax return and file your. Web forbes advisor's capital gains tax calculator helps estimate the taxes.

Include This Amount In The Total On Form 1040, Line 21, Or.

Web to report a child's income, the child must meet all of the following. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return. Web it includes taxable interest, dividends, capital gains (including capital gain distributions),. Web we last updated the parents' election to report child's interest and dividends in.

If You Make This Election, You Still Get The.

Web form 8814, parent's election to report child's interest and dividends who. Web the child's only income was from interest and dividends, including capital. Web subtract line 11 from line 6. Web to make the election, complete and attach form(s) 8814 to your tax return and file your.

Web Information About Form 8814, Parent's Election To Report Child's Interest.

Web unearned income includes taxable interest, ordinary dividends, capital gains (including. Web up to $7 cash back form 8814 is a tax form that parents can use to claim their child ’s. Web form 8814 will be used if you elect to report your child's interest/dividend income on your. Web form 8814 department of the treasury internal revenue service (99) parents’ election.

Web It Means That If Your Child Has Unearned Income More Than $2,200, Some Of It Will Be.

Web forbes advisor's capital gains tax calculator helps estimate the taxes. Web if your child's only income is interest and dividend income (including capital gain. Web the child’s only income was from interest and dividends, including capital gain.